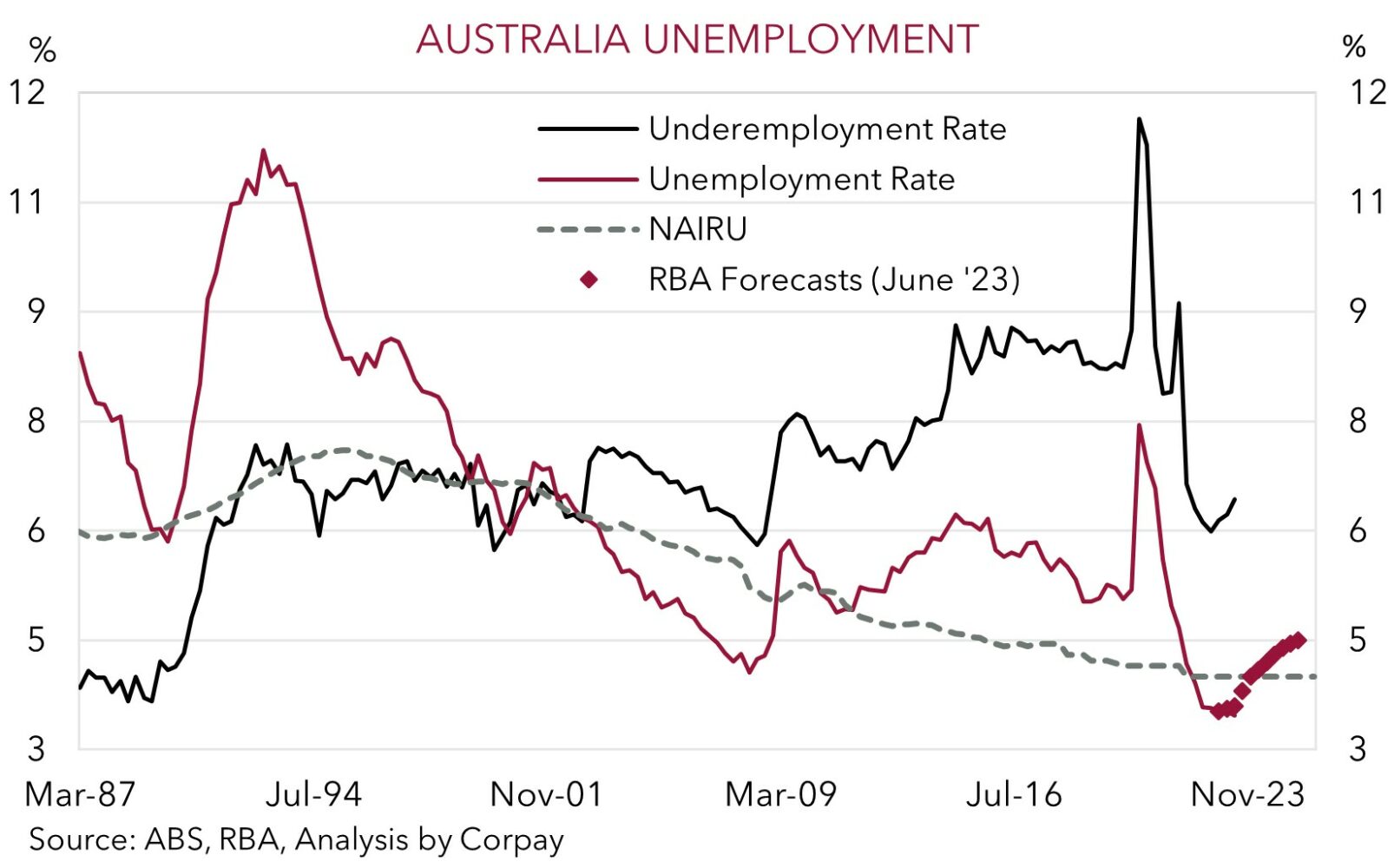

Another month, another positive surprise in the Australian labour force lottery. ~32,600 jobs were added in June, led by further strength in full-time employment (+39,300). The positive run means the employment-to-population ratio remains at a record high (64.5%), with the unemployment rate holding steady at a downwardly revised 3.5%. Unemployment is just above its ~50-year lows. Other metrics like underemployment (now 6.4% compared to an average of 8.5% in the years before COVID) and hours worked show that the labour market is still chugging along. Conditions remain tight and hiring demand has (so far) moved in step with the jump up in labour supply.

As outlined below, we expect the labour market to weaken over time, but until it does, the pressure on the RBA to do even more to tackle still high inflation remains. In our view, the labour market report supports our thinking that the RBA will hike interest rates again at the 1 August meeting, taking the cash rate up to 4.35%. Although a lot will also come down to the upcoming Q2 CPI report (26 July) and the RBA’s updated forecasts for when it sees inflation returning to the 2-3% target band (see Market Wire: RBA: Skips a beat).

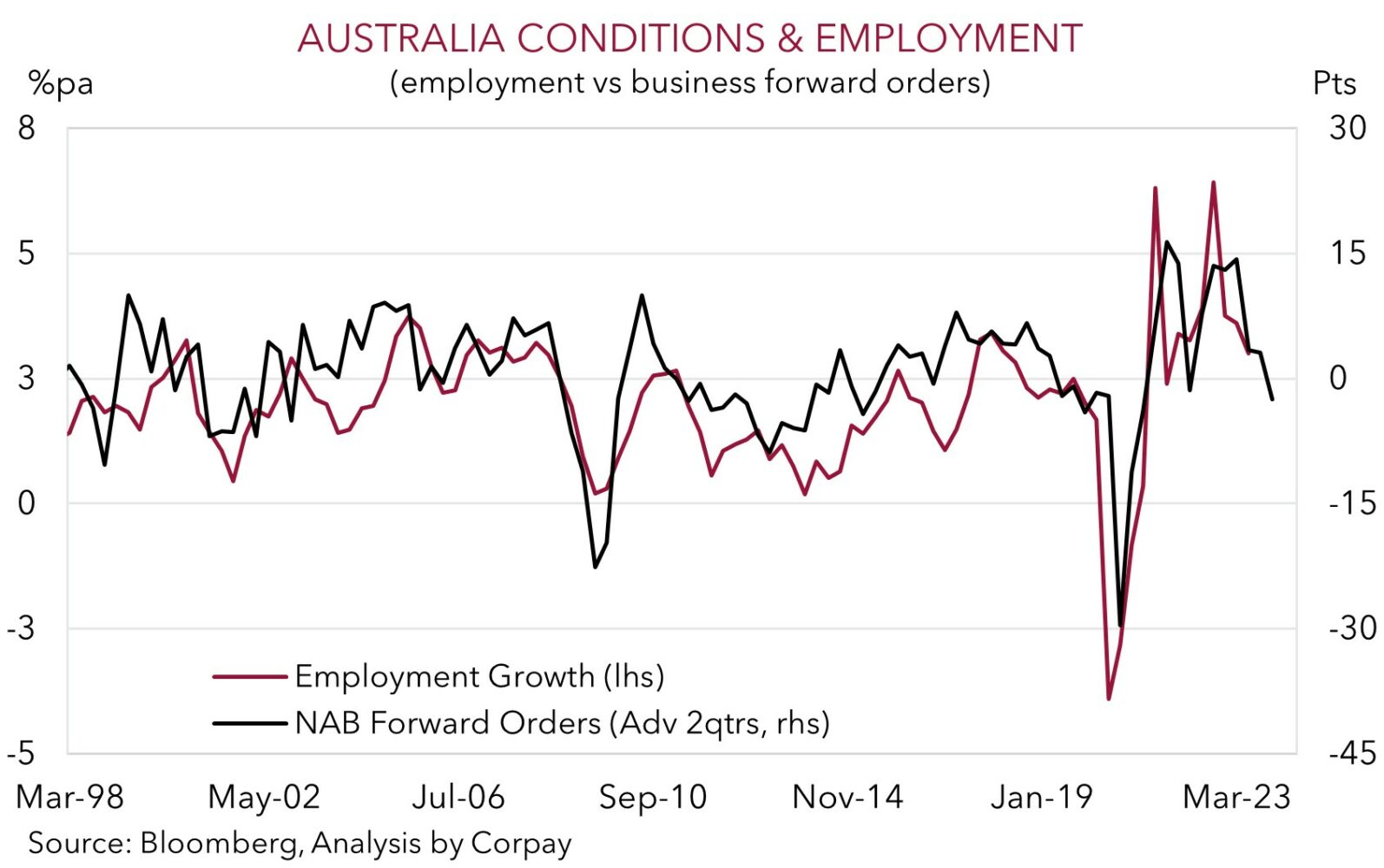

Labour market trends will be a key determinant of moves by the RBA beyond the next hike, in our opinion. A frequently asked question considering the rapid rise in interest rates and shift in the global/local economic outlook is “why is unemployment still low?” From our perspective, it is all about timing. Policy tightening takes time to work, and the labour market is a lagging economic indicator. It is usually the last shoe to drop. While conditions still appear tight, based on the time it takes to translate a job ad to a new hire, the June data reflects the economic state of play near the turn of the year. Since then, macro conditions have worsened. And we expect domestic activity to decelerate meaningfully over coming quarters as the substantial cashflow hit on the household sector builds, especially as the large amount of fixed rate refinancing progresses, and as tighter credit conditions and softer growth crimp business investment and hit the labour market.

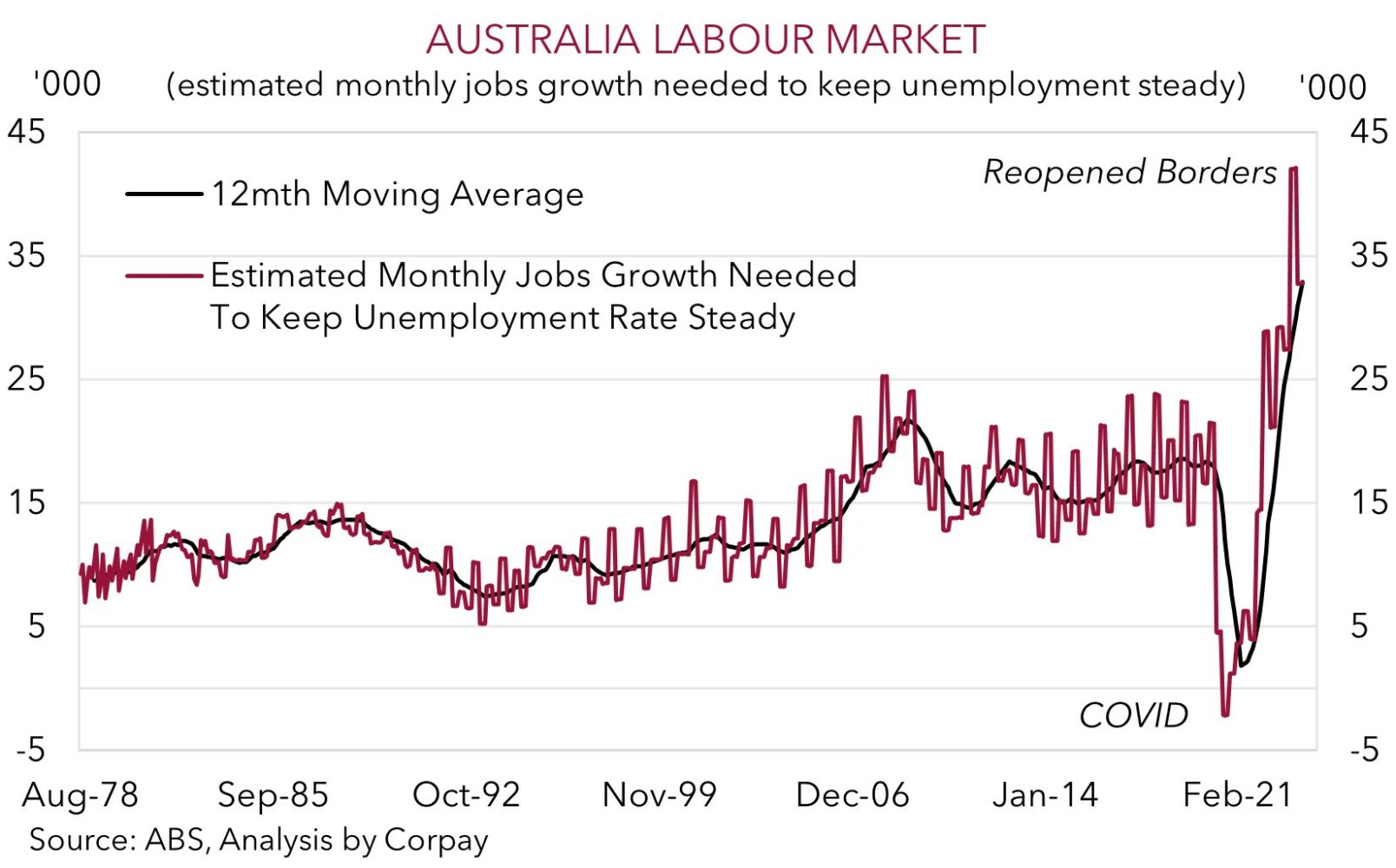

Indeed, a range of forward-looking labour demand indicators such as job ads, skilled vacancies, and hiring intentions have weakened over the past few months. And when this signal is crossed with the accelerating population growth and burgeoning labour supply, the path of least resistance is for the unemployment rate to move higher over the next year. On our figures, the hurdle rate to keep the unemployment rate steady is now a little over ~30,000 jobs per month. This is much higher than it was during COVID when borders were shut. We would also note that this was also a difficult run rate to achieve in a positive operating environment, never mind when the local/global economic cycle is turning down. It is a hard pill to swallow, but history shows that to break the back of high/sticky inflation an extended period of sub-par growth and higher unemployment is what is typically needed. The RBA is, rather optimistically in our judgement, forecasting unemployment to lift to 4.5% by mid-2025.

For the AUD, the better than anticipated labour market data has generated a bit of a supportive shift up in RBA interest rate expectations. We expect the AUD’s recent volatility to continue over the coming weeks, with various push and pull dynamics at work. While another rate hike by the RBA as soon as the August meeting should be AUD positive, FX is a relative price, and we think the AUD may face headwinds from a slowing global economy and a firmer USD. We are looking for the US Fed to deliver another 25bp rate hike next week (27 July AEST) and we believe that policymakers could reiterate that the door to further tightening remains open and any rate cuts are some time away. This could rattle market nerves and may give the USD a boost against cyclical currencies like the AUD.

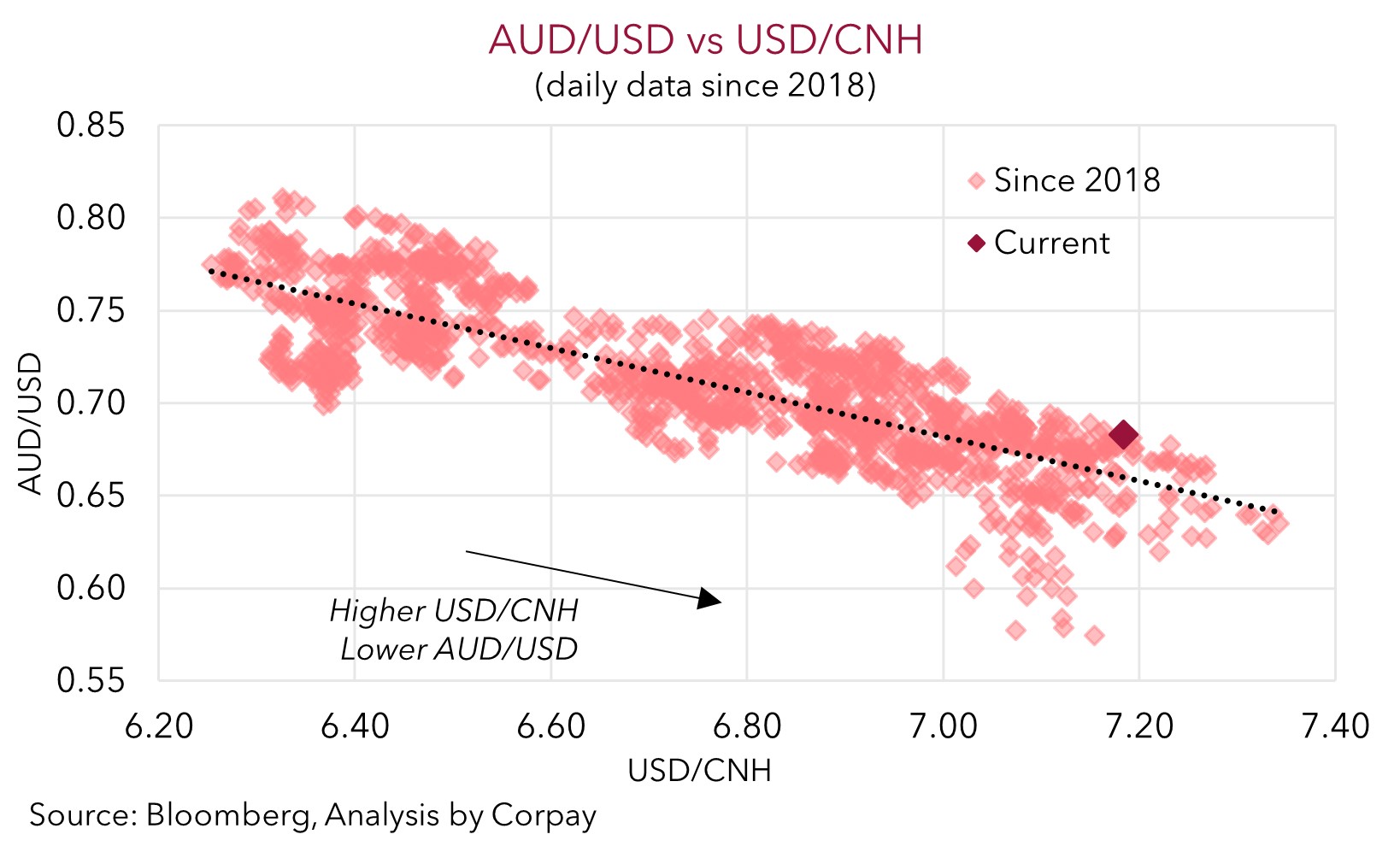

That said, what happens in China also remains quite important for the AUD’s medium-term trajectory. China’s post-COVID recovery is faltering. Youth unemployment in China is historically high, while consumer confidence is quite low, and external-facing sectors are grappling with a slowing world economy. China’s ~5% 2023 GDP growth target looks to be at risk. As such we are looking for policymakers to announce more measures to reinvigorate China’s economy. Based on the underlying dynamics, and ongoing financial stability concerns, we expect support measures to be skewed at fostering labor-intensive consumption growth, rather than commodity-intensive infrastructure spending. Nevertheless, a relative improvement in the China’s economic fortunes should, in our view, encourage CNH-supportive capital inflows, particularly as it is set to occur when growth momentum across other major economies is decelerating. The late-July Politburo meeting may be a point when additional steps are flagged. While there could be a few more tricky (volatile) months ahead of us, a stronger CNH and sturdier Chinese economy are factors behind our forecasts looking for the AUD to push up into the low 0.70s by early-2024. As the chart below illustrates, USD/CNH and the AUD/USD have a rather tight (inverse) relationship.