Currency markets are back in consolidation mode as investors consider the implications of Donald Trump’s latest cabinet picks and position ahead of this morning’s inflation update. The dollar is inching lower amid month-end flows, Treasury yields are down, equity futures are slipping, and oil prices are weakening after Israel and Hezbollah reached a cease-fire agreement late yesterday, reducing the likelihood of a widening conflict that could pull in other regional powers.

Unease over the extent to which protectionist policies might be deployed by the US remains elevated after the president-elect tapped Robert Lighthizer’s former chief of staff to lead trade negotiations. Jamieson Greer is an avowed China hawk, having previously argued for a “strategic decoupling” and a revoking of the country’s “permanent normal trade relations” status, and has spoken frequently of the need to prevent transshipment of manufactured products through third countries. This comes after Trump’s Monday evening threats to levy large tariffs on Canada, Mexico, and China left investors concerned about downside risks in pairs with heavy trade exposures to the US.

The latest update to the Federal Reserve’s preferred inflation measure will land at an unusual time this morning, hitting markets at 10:00 instead of the typical 8:30. Estimates derived from previously-released consumer and producer price data suggest that the core personal consumption expenditures index rose 0.27 percent in October, up 2.8 percent on a year over year basis from 2.7 percent in the prior month. This is likely a touch too hot for the central bank, and will add to concerns about “sticky” inflation, but is nonetheless unlikely to derail a rate cut in December.

Fed officials now favour moving “gradually” to ease policy in the coming months, according to a record of early November’s get-together. Minutes taken during the post-election meeting, released yesterday afternoon, were consistent with higher levels of confidence among policymakers, with participants noting that the inflation outlook was “little changed,” that downside risks had “decreased somewhat,” and that there was “no sign” of deterioration in labour markets. “In discussing the positioning of monetary policy in response to potential changes in the balance of risks,” the minutes said, “some participants noted that the committee could pause its easing of the policy rate and hold it at a restrictive level if inflation remained elevated, and some remarked that policy easing could be accelerated if the labor market turned down or economic activity faltered”.

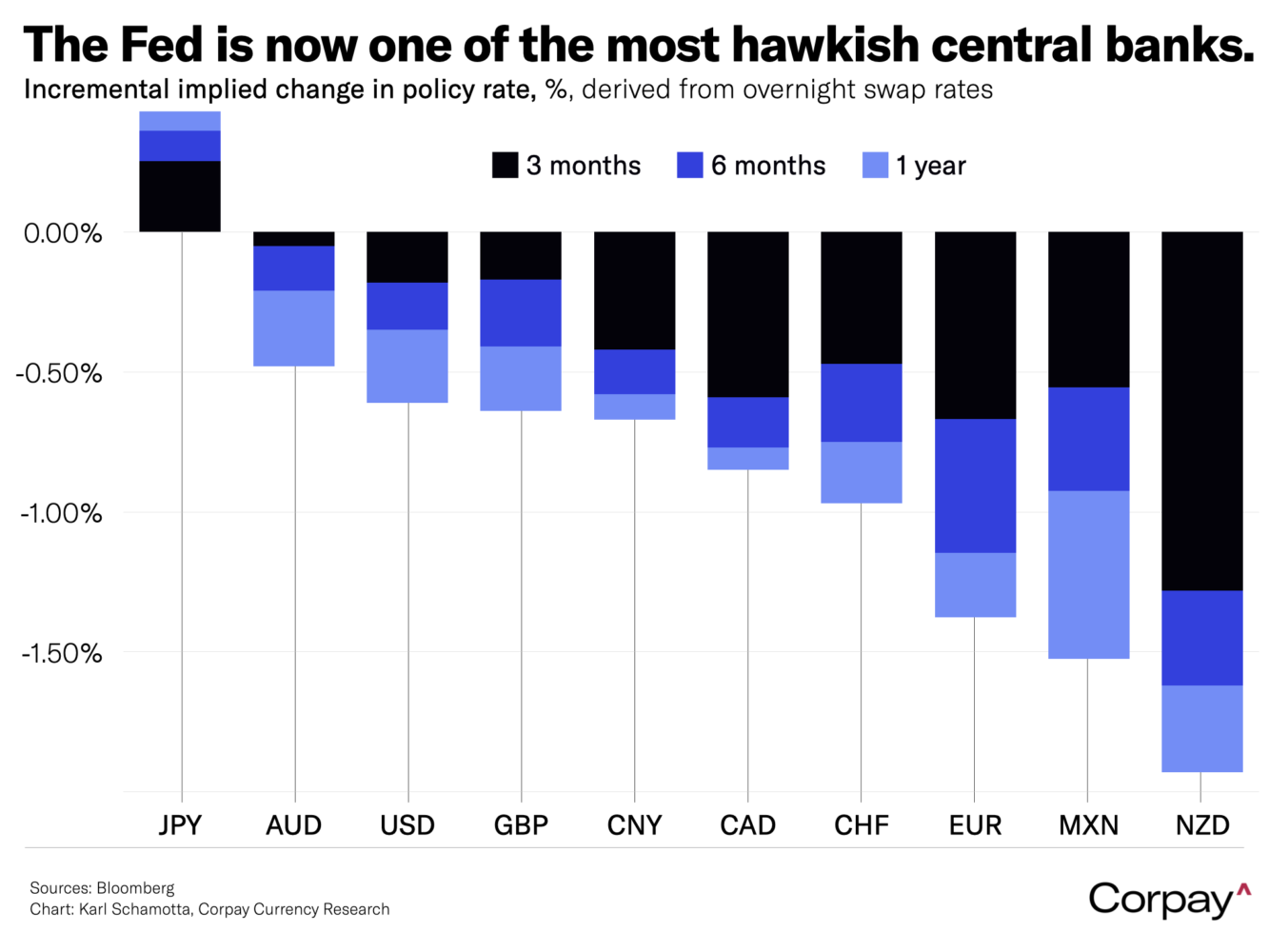

Markets are putting two-in-three odds on a quarter point cut in December, and now expect just three moves by the end of next year. This outlook makes the Fed one of the advanced world’s most hawkish central banks, and is enough to keep both real and nominal interest rates dramatically tilted in the dollar’s favour.

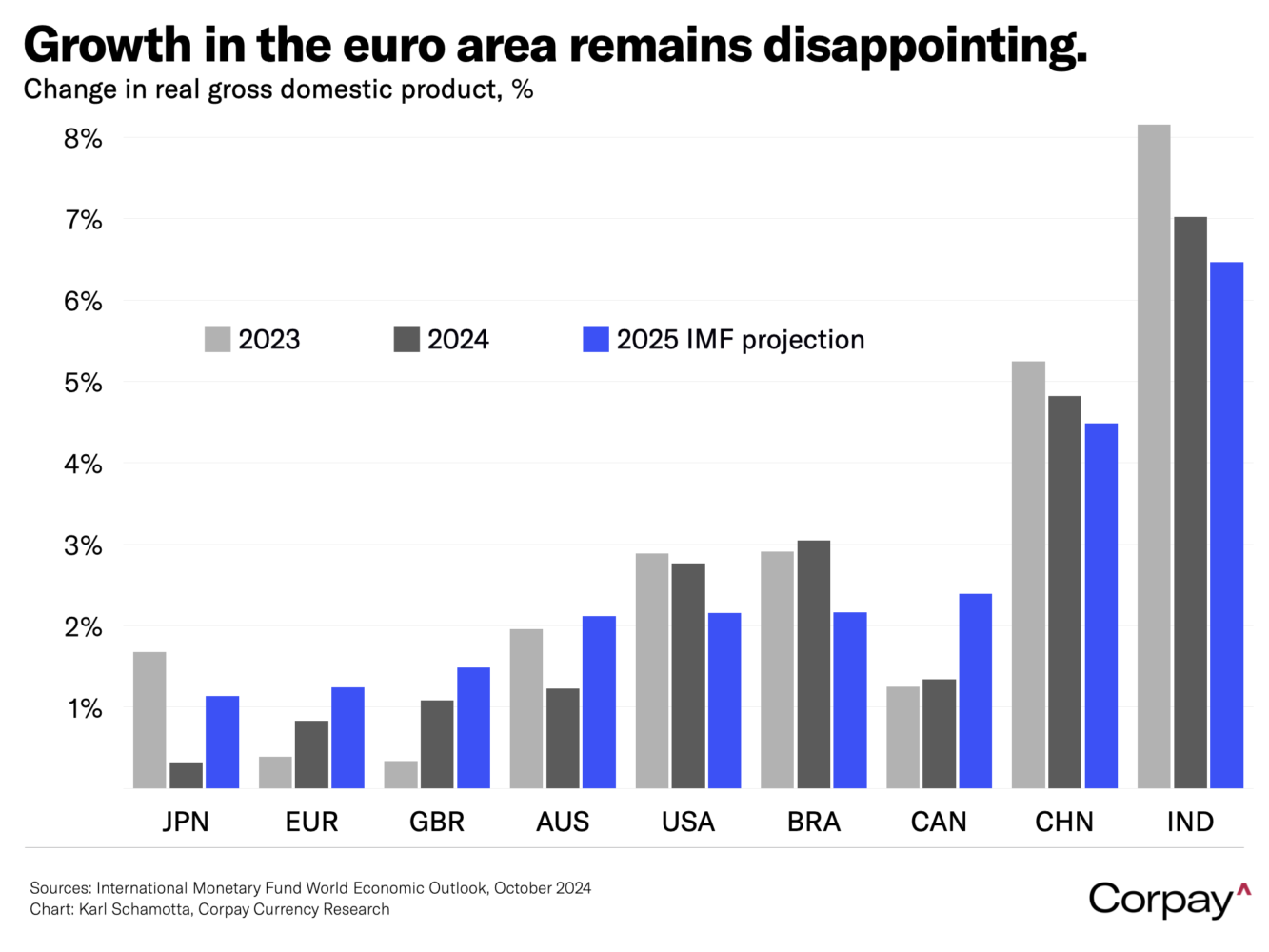

The euro looks set to end the month with its worst loss since 2022, weighed down by weak growth differentials, domestic political dysfunction, and the prospect of trade action from the incoming Trump presidency. Data released this morning showed German consumer confidence sinking to the worst levels since May, and the International Monetary Fund expects the common currency bloc to grow just 1.2 percent next year – in stark contrast with a 2.2 percent expansion in the US, and near the bottom of the global league tables – as an industrial downturn continues in the core manufacturing countries, business investment remains soft, and governments shift into fiscal consolidation mode.

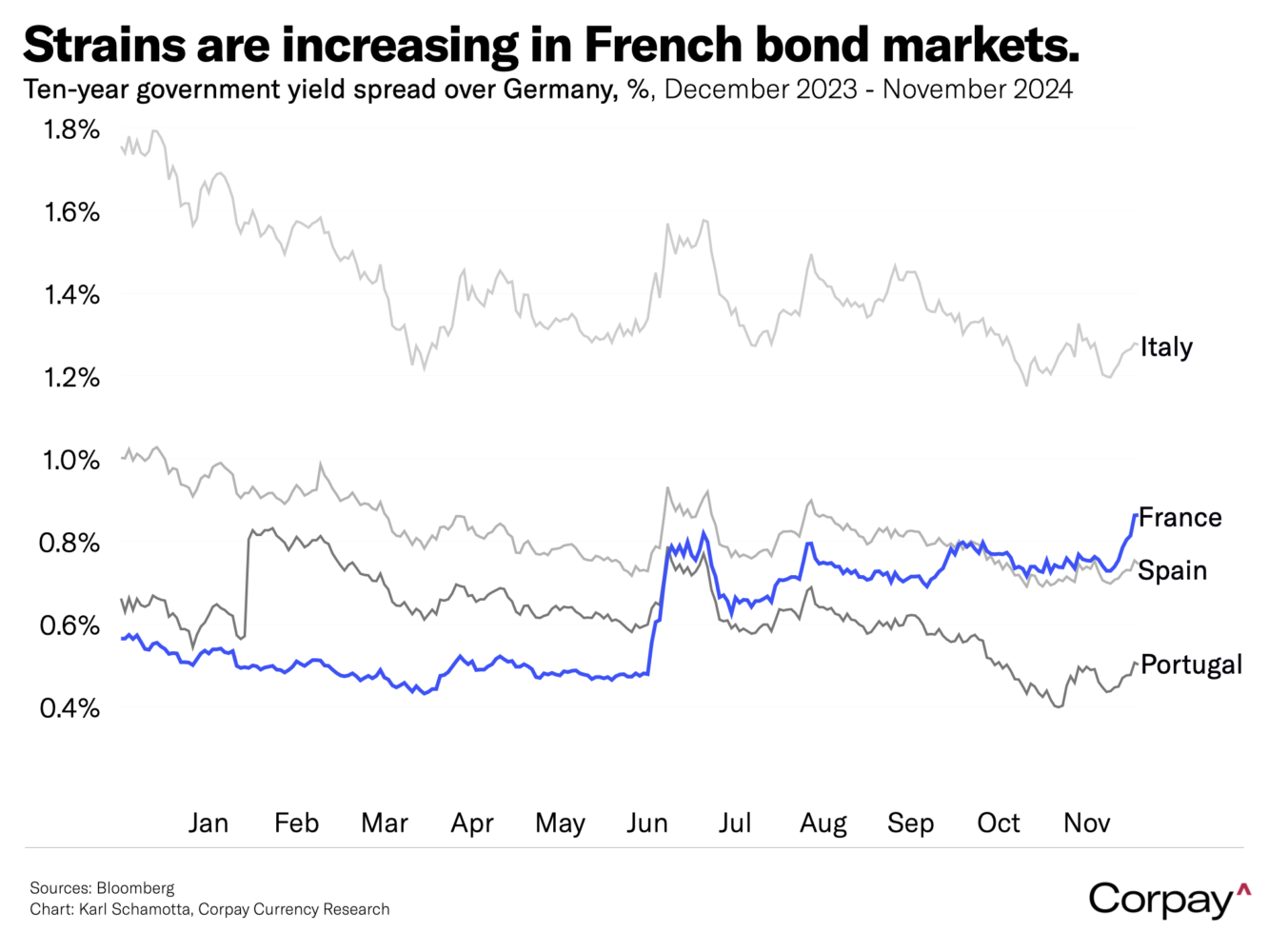

The premium investors demand for holding French government bonds over their German equivalents rose to the highest levels since 2012 this morning. Prime Minister Michel Barnier is facing difficulty in passing a credible budget, and markets are growing increasingly convinced that an alliance of opposition parties will bring down the minority government with a no-confidence motion in the coming weeks, keeping the fiscal trajectory on a worsening trajectory while weakening the economy’s underpinnings. Ratings agencies are growing more sceptical, with S&P Global Ratings likely to follow its peers in downgrading the country’s outlook this Friday.

Incoming president Trump hasn’t yet singled Europe out in his post-election tariff threats, but we have little doubt something is in the offing. The bloc’s large trade surplus, dependence on the US security umbrella, and persistent underspending on defence seem likely to put it in the rhetorical crossfire at some point, and further downside in the euro is highly probable when that happens.

We nonetheless expect a modest recovery at some point as European political leaders respond to exogenous threats with a stronger stimulus effort, and as investors begin to take a more balanced view on the US economy’s prospects. Both the long-dollar and short-euro trades look overcrowded at the moment, helping set off our contrarian alarm bells.