• Political news. Political developments in South Korea & ongoing issues in France dominated the international news flow the past 24hrs.

• Calm markets. However, market spillovers were limited. European equities rose. USD held steady, as did AUD. NZD eased slightly.

• AU growth. Q3 GDP released today. Partial data points to a pick up in activity. A ‘soft landing’ looks to be intact. RBA set to lag its global peers.

News-wise there has been a lot going on but the geopolitical developments had limited spillover across markets overnight. In South Korea, after months of political deadlock President Yoon stunned the nation by suddenly declaring martial law. Lawmakers quickly voted to lift the martial law, and the President rescinded his order, however the ructions weighed on Korean assets with the KRW initially tumbling ~3% before partially reversing course after the central bank pledged to provide “unlimited liquidity” if required. In France, the wrangling over the budget is ongoing and a no-confidence vote against the current government could be held tonight.

In terms of the numbers global equities shrugged these issues off and continued to push higher. Gains in yesterday’s Asian session flowed through to Europe (EuroStoxx600 +0.4%) with US indices consolidating at record highs. Bond yields were mixed with UK and German rates ticking up ~2-4bps across respective curves. In the US, the benchmark 10yr yield increased ~4bps (now ~4.23%) while the 2yr yield held steady (now ~4.18%). In FX, the USD index tread water with EUR hovering just above ~$1.05. GBP is at ~$1.2670 and USD/JPY nudged up to ~149.50. And while the NZD slipped back slightly (now ~$0.5878, ~1.4% from its 2024 lows), the AUD has been range bound (now ~$0.6482) despite firmer equity markets and uptick in base metal (copper +1.4%, iron ore +0.6%) and energy prices (WTI crude oil +3% to US$70/brl). The latter was supported by news the US has imposed more sanctions targeting Iranian supply and signs OPEC+ was making progress on a deal to limit output. Reports China is holding its Central Economic Work Conference next week and may hint at more stimulus measures has underpinned industrial commodities.

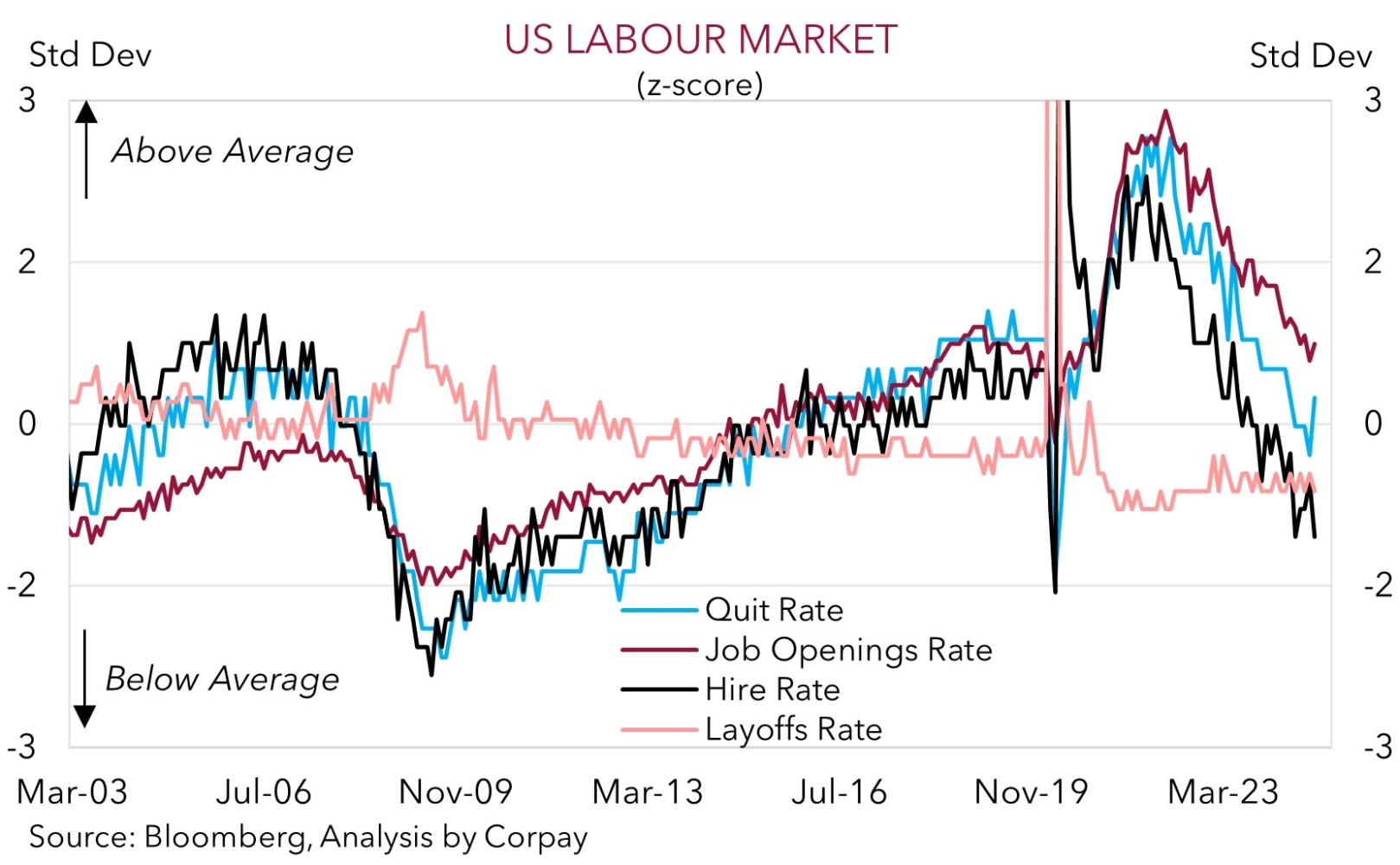

On the data front, US JOLTS, a leading indicator for the labour market, was released. It had mixed messages. While the level of job openings rebounded in October after being weather disrupted last month (implying stronger labour demand) the hiring rate slowed. Yet as our chart illustrates the ‘layoff’ rate remains below average. In our mind these signals net off to show that US jobs growth is cooling but there aren’t strong indications a sharp jump in unemployment is looming. Tonight, US ADP employment (12:15am AEDT) and ISM services gauge (2am AEDT) are due with Fed Chair Powell also set to speak (5:45am AEDT). Another US Fed interest rate cut in December is ~70% factored in with ~3 moves priced in by end-2025. In our view, a continuation of the solid US economic data and/or ‘cautious’ comments by Chair Powell regarding the speed/size of future moves may support the USD which is also likely to benefit from European political jitters and the factoring in of US President-elect Trump’s platform (see Market Musings: Trump 2.0 & the AUD).

AUD Corner

The AUD has tracked in a relatively narrow range centered on ~$0.6480 over the past 24hrs with the various macro and geopolitical cross-currents also seeing the USD tread water (see above). That said, the AUD has perked up a bit on a few of the crosses. The uptick in global equities and base metal prices has helped the AUD edge up ~0.2% versus the NZD, CAD, and CNH. AUD/JPY is also a touch firmer, although at ~96.90 it remains more than 5% from its early-November peak. AUD/EUR (now ~0.6170) is also just ~1.4% from its 2024 highs.

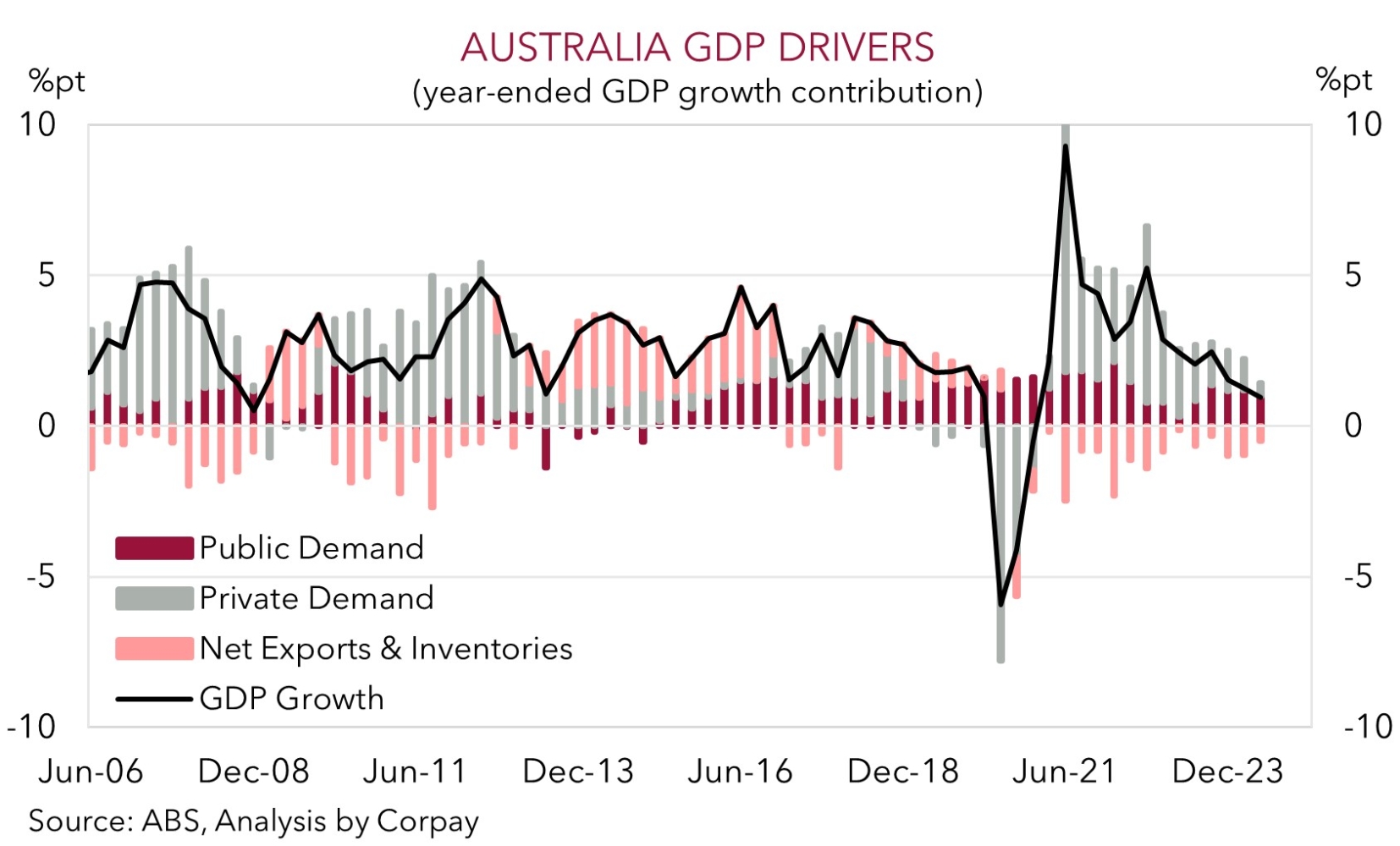

Locally, the focus today will be on Q3 GDP. While they look dated the national accounts do provide insights into the underlying health of the economy and specific sectors, as well as other things like productivity and price pressures which the RBA is lasering in on. Based on the partial inputs that have been released we think GDP growth risks coming in above analysts predictions (mkt 0.5%qoq, 1.1%pa). This is due to another positive contribution from government spending and a pick up in household consumption. An acceleration in activity in Q3 would suggest that the RBA’s attempt to achieve a ‘soft landing’ is intact and would effectively rule out the chances of a near-term interest rate cut. As we have outlined before, we think the still high level of activity across the private and public sectors, coupled with the resilience in the labour market and elevated core/services inflation means that a slow/limited RBA easing cycle is likely to kick off around May 2025.

All up, although we think the enacting of the Trump policy agenda of trade tariffs, greater fiscal spending, and steps to curb US immigration will be USD supportive and this in turn should keep the AUD in the mid-$0.60s over coming quarters (see Market Musings: Trump 2.0 & the AUD), we don’t foresee the AUD sustainably falling too far from current levels. A fair amount of negativity already looks factored in with the AUD trading at a ~3-4 cent discount to our ‘fair value’ estimates. Added to that, over the past decade the AUD has not traded much below where it is (it has only been sub-$0.65 6% of the time since 2015) because of Australia’s high terms of trade and improved trade position. These dynamics remain in place. And we also believe that the diverging fundamentals between Australia and others should be AUD supportive against currencies like the EUR, NZD, CAD, GBP, and CNH. From our perspective recent moves on several AUD crosses appears overdone and a solid Q3 Australian GDP report could give the AUD a helping hand.