• Mixed markets. Equities push higher while French political issues weighed on the EUR. This supported the USD. AUD & NZD lost ground.

• US data. ISM manufacturing better than expected. US job openings due tonight. Non-farm payrolls released on Friday night.

• AU events. October retail sales stronger than anticipated. A promising sign for Q4. Q3 GDP released on Wednesday. RBA meets next week.

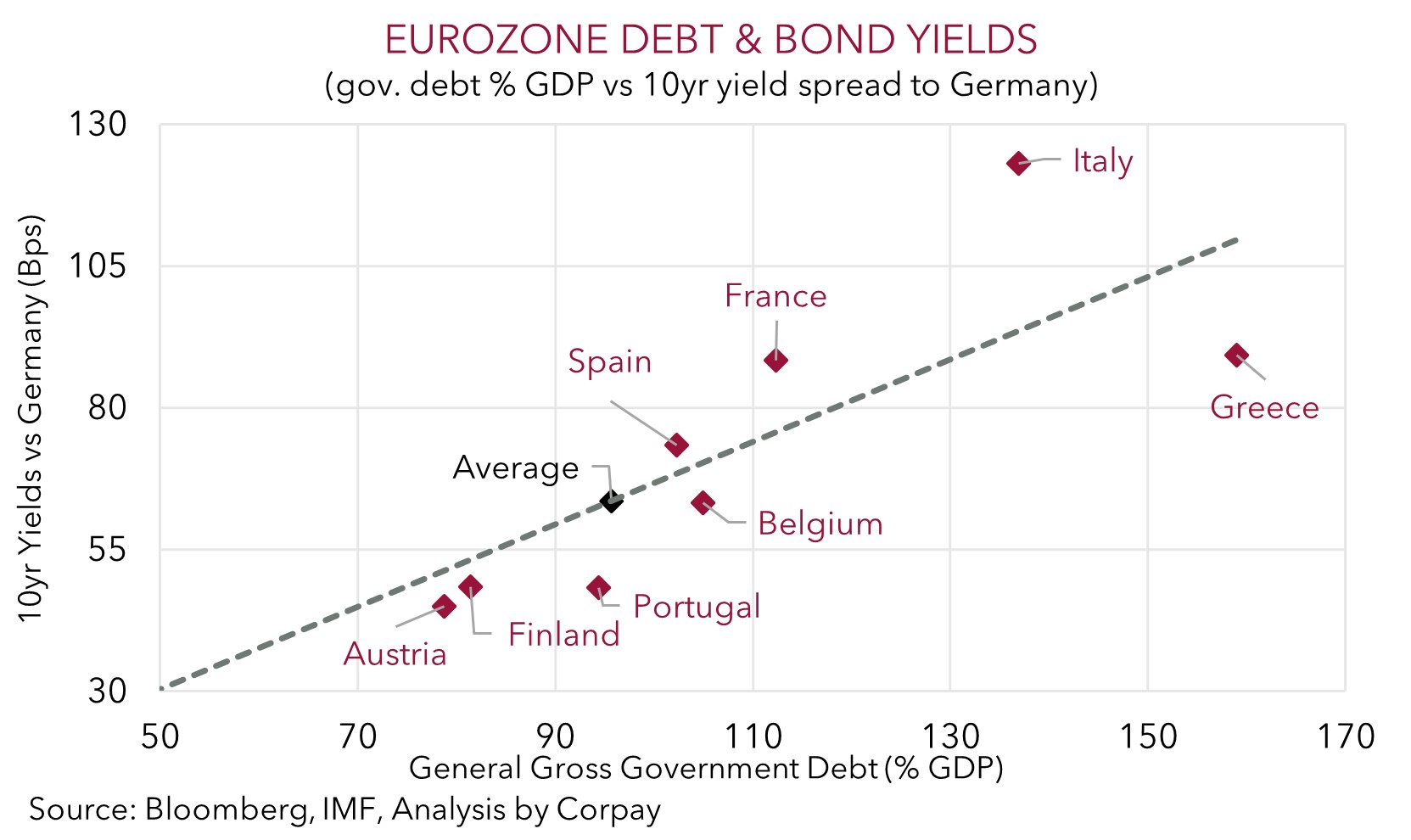

There has been a mixed performance across asset markets and regions at the start of the new month. Equities have continued to power along with strength in the tech-sector underpinning the broader US market which hit another record high (NASDAQ +1%, S&P500 +0.3%). European stocks also rose (EuroStoxx600 +0.7%), although there was a noticeable underperformance in France. This was also visible in bonds with long end French yields ticking up (10yr +2bps to 2.91%) compared to falls in Germany (-6bps to 2.03%) and other major Eurozone economies.

The trigger has been heightened political uncertainty. Budget issues have been bubbling away in France for a little while, but things look to have reached a crucial point yesterday. French Prime Minister Barnier used special constitutional powers to force part of the Budget through Parliament. This saw left- and right-wing parties express support for a no-confidence motion that can be tabled within 48hrs. If successful this would lead to the collapse of the French Government and a caretaker taking charge. The French driven Eurozone risk premium also flowed through to FX with EUR coming under downward pressure over the past 24hrs (now ~$1.05). Given it is the major alternative the EUR weakness supported the USD. GBP (now $1.2667), the NZD (now ~$0.5893) and AUD (now ~$0.6483) have lost ground. However, USD/JPY continues to buck the trend with the JPY continuing to outperform on the back of the pockets of global geopolitical nervousness and diverging policy expectations between the Bank of Japan (2 rate hikes are factored in by next October) and other major central banks where more easing is anticipated.

Also helping the USD was ongoing US economic outperformance. The US ISM manufacturing gauge increased more than predicted with improvement in new orders and employment intentions the drivers. In contrast to the steady stream of additional rate cuts anticipated by the ECB over the next year as the region grapples with its growth challenges (markets are pricing in ~160bps worth of easing by October 2025) markets are assuming the US Fed will be more measured. Another US Fed rate reduction in December is ~75% priced in, with heavyweight policymaker Waller noting he is “leaning” that way, but only ~3 moves are discounted over the next year. US JOLTS job openings (a guide for labour demand and job market churn) are released tonight (2am AEDT) and there are several other US data points due over the next few days. In our view, a rebound in US jobs growth after temporary disruptions last month could see markets trim their US rate cut bets. If realised, this may support the USD which is also likely to benefit from European political jitters and the pricing in of US President-elect Trump’s platform (see Market Musings: Trump 2.0 & the AUD).

AUD Corner

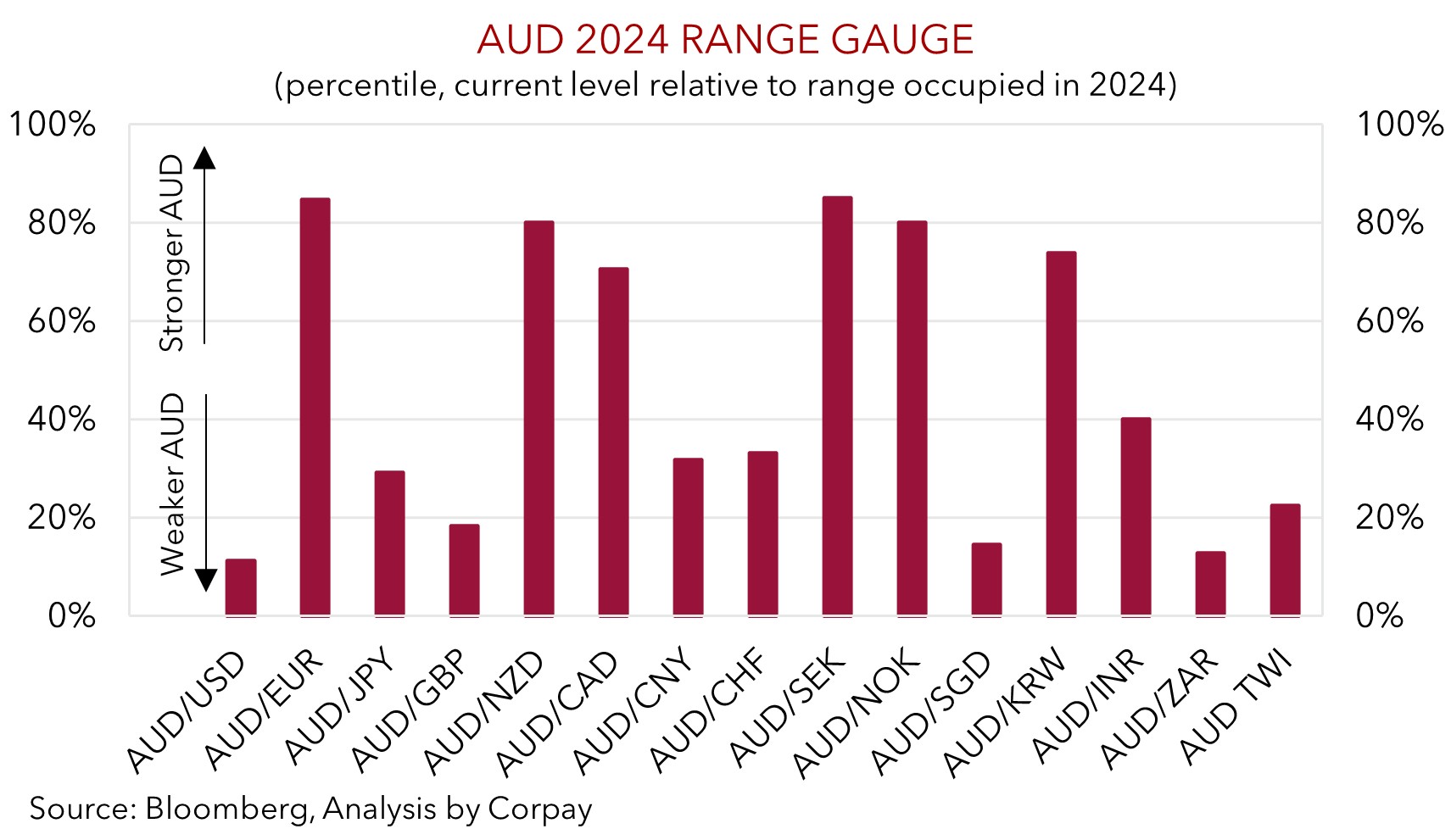

The firmer USD stemming from the French-led European political concerns and ongoing US economic outperformance has pushed the AUD a bit lower at the start of the new week (see above). The factors mentioned have more than offset the upswing in equities and stronger base metal prices with the AUD back down near ~$0.6480. The AUD’s mixed performance on the crosses has continued with the AUD ticking up against the EUR (now ~0.6168), and slipping back ~0.1-0.2% versus NZD, CAD, and CNH. The pull-back in AUD/JPY has extended with the JPY supportive backdrop seeing it touch levels traded in September (now ~96.77, ~5.5% from its recent peak).

Locally, while a bigger than expected inventory drawdown is likely to detract from Q3 GDP growth, it may be counterbalanced by a larger positive contribution from net exports (data due today 11:30am AEDT). More encouragingly retail sales for October were stronger than predicted with spending rising by 0.6% in the month. This is a promising sign for Q4 as the October strength came before the usual jump in activity related to ‘Black Friday’ sales. From our perspective, the still high level of activity should mean that the RBA isn’t in a rush to lower interest rates given the ongoing resilience in the labour market and elevated core/services inflation. We think a slow and limited RBA rate cutting cycle will kick off around May 2025, which is where markets and economists are also gravitating towards.

As outlined before, we believe the enacting of the Trump policy agenda of trade tariffs, greater fiscal spending, and steps to curb US immigration will be USD supportive and this in turn should keep the AUD in the mid-$0.60s over the next few quarters (see Market Musings: Trump 2.0 & the AUD). A solid US jobs report (Friday night AEDT) and European political concerns might create added near-term AUD headwinds. However, we don’t foresee the AUD falling too far from current low levels. A fair degree of ‘bad news’ already looks baked in with the AUD trading at a ~3-4 cent discount to our ‘fair value’ estimates. Furthermore, over the past decade the AUD has not sustainably traded much below where it is (it has only been sub-$0.65 6% of the time since 2015) because of Australia’s high terms of trade and improved trade position. We also believe that diverging fundamentals between Australia and other nations should be AUD supportive against currencies like the EUR, NZD, CAD, GBP, and CNH. From our perspective recent moves on several AUD crosses appears overdone.