• Risk wobbles. Concerns about a US-China trade war remain. US equities slipped back & the USD lost ground. AUD & NZD pushed higher.

• Tariff impacts. US’ effective tariff rate is still very high. Downside US growth risks remain. This & reduced investor confidence are USD negatives.

• Volatility. More headline driven volatility should be anticipated over the period ahead. There’s still a lot of water to go under the tariff bridge.

Global Trends

Financial markets remain lively with the chopping and changing in US trade policy still firmly in the driver’s seat. Yesterday’s positive jolt from the announced ‘pause’ in higher reciprocal tariffs carried through to Asia and European trade with equities posting strong gains, however that wasn’t sustained in the US session overnight with stocks once again hitting the skids. The S&P500 fell ~3.5% and the tech-focused NASDAQ declined ~4.3%, meaning a bit less than half of yesterday’s euphoric rebound was unwound. Concerns about the US-China trade war are front-of-mind with US officials clarifying that the tariff on imports from China had risen to 145% not 125% as President Trump had stated. Worries China might unveil fresh countermeasures in response is making markets nervous.

Interestingly, there was also a renewed steepening in the US yield curve. A softer than predicted March US CPI print (core inflation decelerated to 2.8%pa) and lingering growth concerns weighed on the 2yr rate (-5bps to ~3.86%), while the long-end of the curve rose with investors still clearly not convinced about the US Administrations ability to implement effective policy. The US 30yr yield increased ~13bps to 4.87%, with ~5% a key threshold to watch as a brief move above this level looks to have been one of the triggers behind the announced tariff modifications. In FX, the USD has been under downward pressure, another sign global investors aren’t enamored with what is going on in terms of the US policy. EUR (the major USD alternative) has appreciated to ~$1.12, a high since last-September, while USD/JPY (the second most traded currency pair) dipped to ~144.55, the bottom of its multi-month range. Elsewhere, GBP strengthened (now ~$1.2970), USD/SGD dropped towards ~1.33, the NZD moved above its 1-month average (now ~$0.5740), and the AUD clawed back more lost ground (now ~$0.6225).

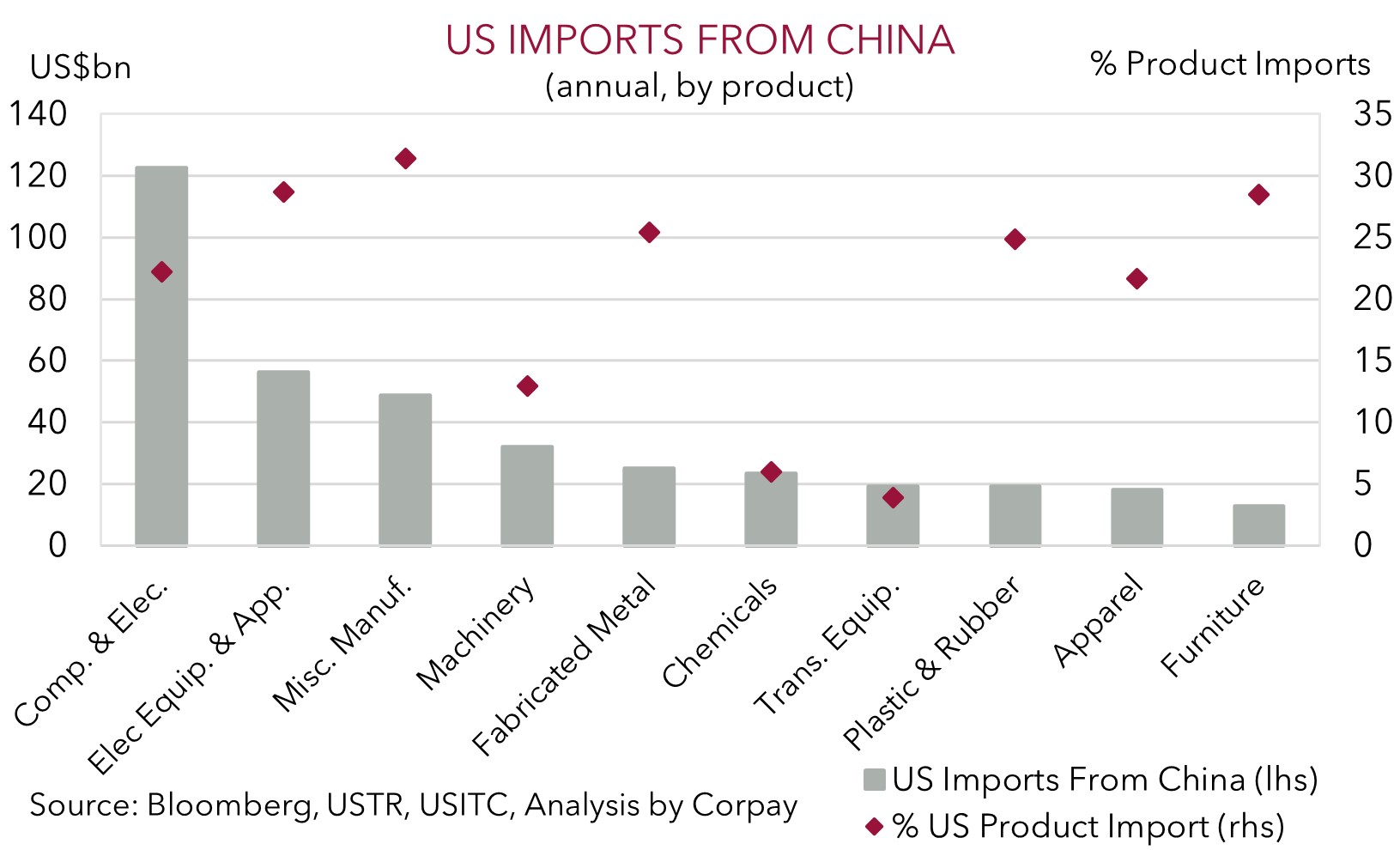

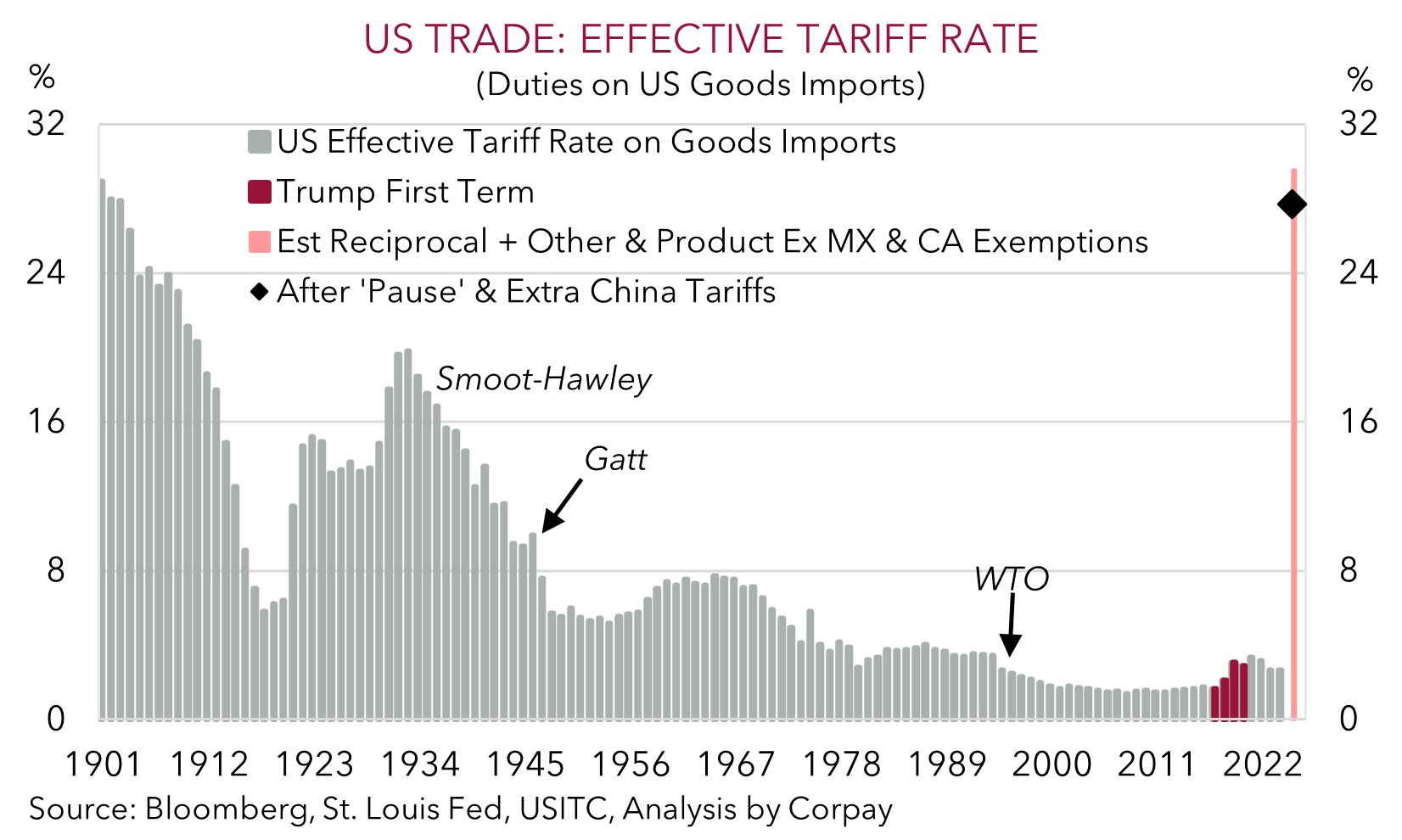

There are several moving parts to the US’ tariff adjustments. On balance, the large increase in tariffs on goods from China largely offsets the ‘temporary’ moderation in duties imposed on products from other nations. The US’ effective tariff rate (i.e. its weighted average levy) is still historically high (chart 1), though this is heavily concentrated on China. In our opinion, the levies imposed on US imports and higher costs faced by US consumer/businesses means downside US growth risks remain. Importantly, a deeper dive finds that a high share of US consumer goods and machinery imports come from China (chart 2). These may be difficult to substitutes for, at least in the short-term. We believe US growth headwinds and prospect of higher unemployment down the track, coupled with shaken investor confidence, should see the USD trend lower over the medium-term.

Trans-Tasman Zone

Despite renewed wobbles in US equities and pull-back in commodities such as WTI oil (-4.4%) and copper (-1.1%), the AUD has extended its recovery. The softer USD stemming from ongoing US growth concerns, and a perceived reduction in investor confidence in the US Administrations ability to effectively implement policy, has been the overriding force that has helped the AUD climb up to ~$0.6225. This is just under its year-to-date average and ~5.3% above Wednesday’s cyclical low. That said, it hasn’t all been one-way. The AUD has slipped back against the EUR (-1.1% to ~0.5558), JPY (-0.9% to ~90), and NZD (-0.5% to ~1.0845), with gains recorded against the CAD (+0.4%) and CNH (+0.7%). The sharp rebound in AUD/CNH (now ~4.5527) has pushed it into positive territory for the year.

RBA Governor Bullock spoke overnight and she provided some measured comments about the policy outlook. According to the Governor “a key focus for us is how all this uncertainty is affecting decisions made by households and businesses in Australia”, and as policymakers are “mindful of not adding to the uncertainty” it is “too early for us to determine what the path will be for interest rates”. We believe that the RBA will deliver more interest rate relief at its 20 May meeting in the form of another 25bp reduction. This has been our long-standing view, and Governor Bullocks comments don’t suggest larger emergency style steps are as high as some might have thought. We continue to think that the RBA is on a slightly different path to its peers, just as it was during the rate hiking phase, with the stickiness in Australian inflation and resilient labour market pointing to a drawnout and limited easing cycle.

Further bursts of volatility should be anticipated over the near-term given the fast-moving backdrop, but on net, even after the recent recovery, we think there is more upside potential for the AUD over the medium-term. In addition to the outlook for a weaker USD, domestic economic fundamentals in Australia look on sturdier footing. On top of that, as discussed before, Australia’s direct trade exposure with the US is limited (only ~4% of exports are sent to the US) and any pain in China’s export sector is likely to be counteracted by steps to stimulate domestic activity. This is where Australia’s key exports are plugged into. The AUD also still has valuation support with it tracking a few cents below the average of our suite of ‘fair value’ models.