• Holiday markets. Limited moves with the US closed for Thanksgiving. Eurozone equities rose & yields dipped. USD tread water.

• AUD holding. AUD little changed. RBA Governor Bullock spoke & noted that “underlying” inflation is too high to consider a near-term rate cut.

• Data flow. EZ CPI due tonight. China PMIs tomorrow. Next week AU GDP is released, Fed Chair Powell speaks, & the US jobs report is out.

With the US closed for the Thanksgiving holiday it was a quiet night on markets. Across in Europe, equities rose with the EuroStoxx600 ~0.5% higher, while bond yields declined. Bond yields in Germany slipped back by ~3bps across the curve with similar sized moves occurring in the UK. Members of the ECB continue to debate the policy outlook. In contrast to the more ‘hawkish’ rhetoric from the ECB’s Schnabel a day ago, policymaker Villeroy was more ‘dovish’ overnight. In Villeroy’s view with inflation heading sustainably back to the ECB’s target and Eurozone growth sluggish there aren’t reasons to keep policy settings ‘restrictive’.

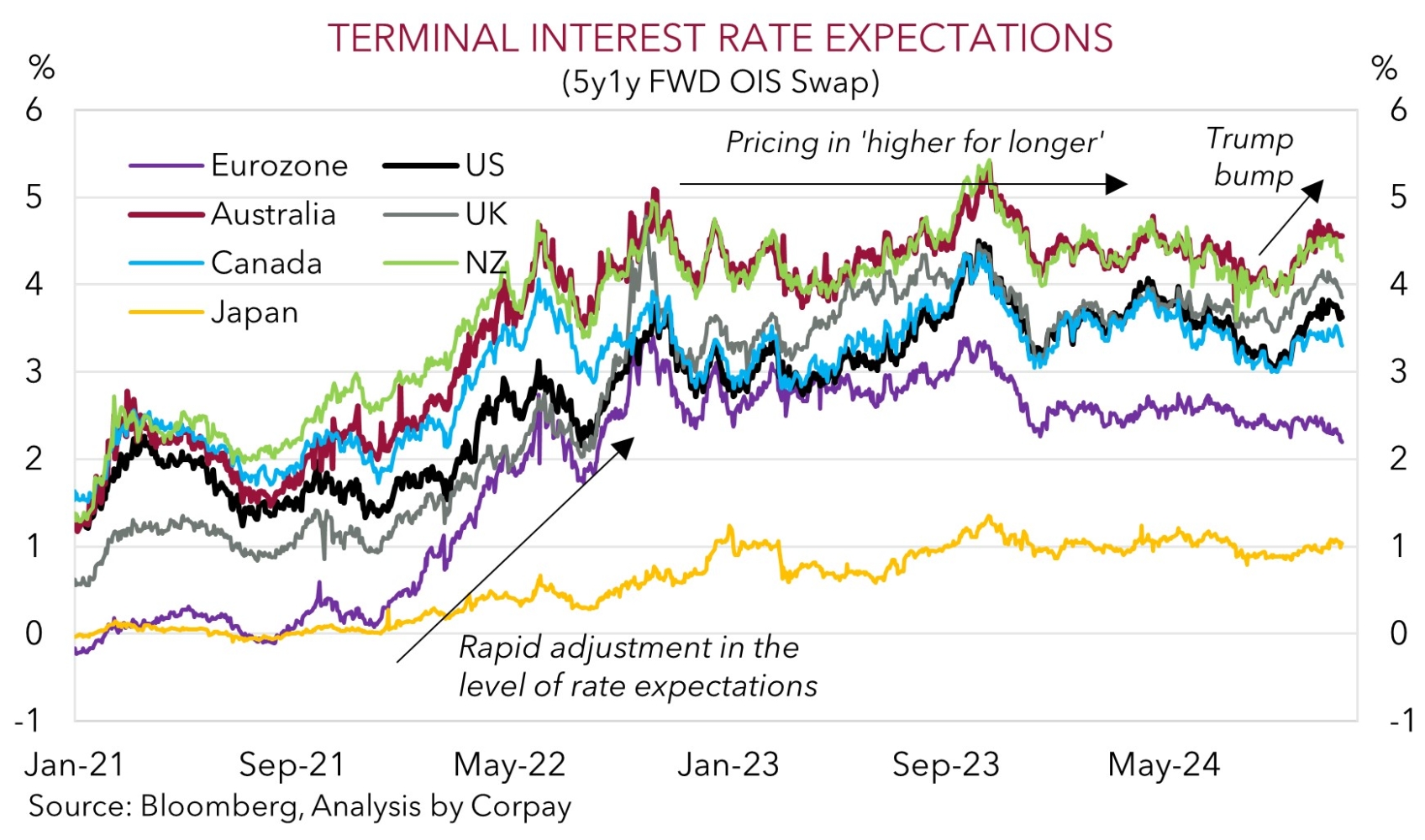

These comments were backed up by the data with German CPI inflation undershooting analysts’ predictions and holding steady at 2.4%pa. Eurozone CPI inflation is released tonight (9pm AEDT). Odds of the ECB delivering an outsized 50bp cut in December have been pared back recently, however ~30bps of easing is still discounted with almost 150bps worth of rate reductions factored in by next October. This contrasts to the US Fed with another rate cut in mid-December assigned a ~60% probability and less than 3 more moves priced in by October.

In FX, there has been little net movement, unsurprising given the lack of news flow and economic releases, and with US participants on a break. The USD tread water. EUR is hovering near ~$1.0555, GBP is around ~$1.2690, and USD/JPY has nudged up to ~151.50. USD/SGD is a fraction higher (now ~1.3424), while the NZD (now ~$0.5892) and AUD (now ~$0.6501) consolidated.

US markets are only open for part of tonight’s session, so barring an exogenous shock market volatility should remain rather depressed into the end of the week. Looking ahead, the November US jobs report is due at the end of next week and this could make or break the case for the US Fed delivering another 25bp rate cut later in the month. Overall, we think the USD should remain firm over the period ahead given our expectations that the US economy continues to outperform its peers, with relative interest rate expectations set to remain in the US’ favour (particularly compared to the Eurozone), and as the policy platform of US President-elect Trump (which is focused on trade-tariffs, greater fiscal spending, and steps to curb immigration) is enacted (see Market Musings: Trump 2.0 & the AUD).

AUD Corner

The AUD has held steady over the past 24hrs with the limited market moves during the US holiday period keeping it close to ~$0.65 (see above). There has been a bit more movement on some of the AUD crosses, though the swings only partially unwound some of the recent moves. AUD/EUR ticked a little higher (+0.2% to ~0.6160), as did AUD/JPY (+0.3% to ~98.50). AUD/NZD (now ~1.1035) and AUD/CNH (now ~4.7132) also edged up modestly.

RBA Governor Bullock spoke overnight. Her comments were broadly in line with recent rhetoric, which in our mind shows that the RBA remains on a different path to its counterparts. According to Governor Bullock policy is less restrictive in Australia even after rate cuts offshore are factored in. This reflects the RBA’s decision to not raise rates as high in an effort to preserve as many COVID-era jobs as possible. Moreover, when it comes to prices, Governor Bullock outlined that “underlying inflation is still too high to be considering lowering the cash rate target in the near term” and that it will take “a little longer for inflation to settle at target in Australia” given the “tightness” in the jobs market and RBA’s “assessment that the level of demand still exceeds supply in the broader economy”. We continue to believe that the RBA will lag other central banks with the start of a gradual and limited rate cutting cycle a story for late-H1 2025.

As outlined above, we feel the pricing in and enacting of the Trump policy agenda should be USD supportive. And this will keep the AUD in the mid-$0.60s over the next few quarters (see Market Musings: Trump 2.0 & the AUD). But we don’t foresee further falls in the AUD from already low levels to be fundamentally sustained. In our opinion, a lot ‘bad news’ already looks discounted with the AUD trading at a ~4 cent discount to our suite of ‘fair value’ models. Additionally, over the past decade the AUD has not traded much below where it is (it has only been sub-$0.65 6% of the time since 2015) because of Australia’s terms of trade and improvement in its trade/current account position. We doubt these dynamics will meaningfully change given Australia’s export basket is rather tariff-insulated and probability authorities in China attempt to offset US tariff-induced export pain via steps to bolster commodity-intensive infrastructure investment. We also think that diverging economic fundamentals and monetary policy trends between Australia and others should see the AUD outperform currencies like the EUR, NZD, CAD, GBP, and CNH over the medium-term (see Market Musings: AUD/NZD: RBNZ stuck in reverse).