• Positive tone. US equities, bond yields, & the USD rose at the end of last week. US data remains positive. Markets also positioning for Trump 2.0.

• US policy. Pres. Trump will be in the drivers seat. Will he announce a range of measures after coming into power or is too much expected?

• Event Radar. US Pres. Inauguration (Tues), NZ CPI (Weds), BoJ & MAS meetings (Fri), & global PMIs (Fri) in focus this week.

Global Trends

Global equities ended last week on a positive note ahead of today’s US holiday and the US Presidential Inauguration (Tues 4am AEDT). A positive China data batch which showed a pickup in growth momentum over Q4 2024 on the back of improvement in areas such as industrial activity as stimulus measures gained traction, and reports of a “very good” call between President’s Trump and Xi underpinned sentiment. Also helpful were further signs the US economy is in a healthy state with housing starts, building permits, and industrial production all exceeding expectations.

In terms of the numbers US equities rose with the NASDAQ (+1.5%) outperforming the broader S&P500 (+1%). As a result, the S&P500 recorded its best weekly performance (+2.9%) since early November. US bond yields also edged up with a relatively bigger lift at the front-end (US 2yr +5bps to 4.28%) flattening the curve a bit (US 10yr +2bps to 4.63%). That said, after being inverted from mid-2022 to Q3 2024, the US 2s10s yield curve has steepened sharply over recent months (now +34bps). A larger sell-off at the long-end has been the driving force as a ‘higher for longer’ interest rate backdrop and re-emerging inflation challenges are discounted.

In FX, the USD was a little volatile during Friday’s trade, but on net it pushed higher to be tracking where it was earlier in the week. EUR continues to struggle (now ~$1.0287), with GBP’s underperformance also continuing (now ~$1.2168, the bottom-end of its multi-quarter range). Ahead of this Friday’s Bank of Japan meeting, where we believe another rate hike is a strong chance due to Japan’s underlying inflation trends and with policy still in ‘accommodative’ territory USD/JPY rebounded a little (now ~156.26). Elsewhere, NZD remains near its cyclical lows (now ~$0.5588) with Q4 NZ CPI (Weds AEDT) looming, and the AUD oscillated around ~$0.62.

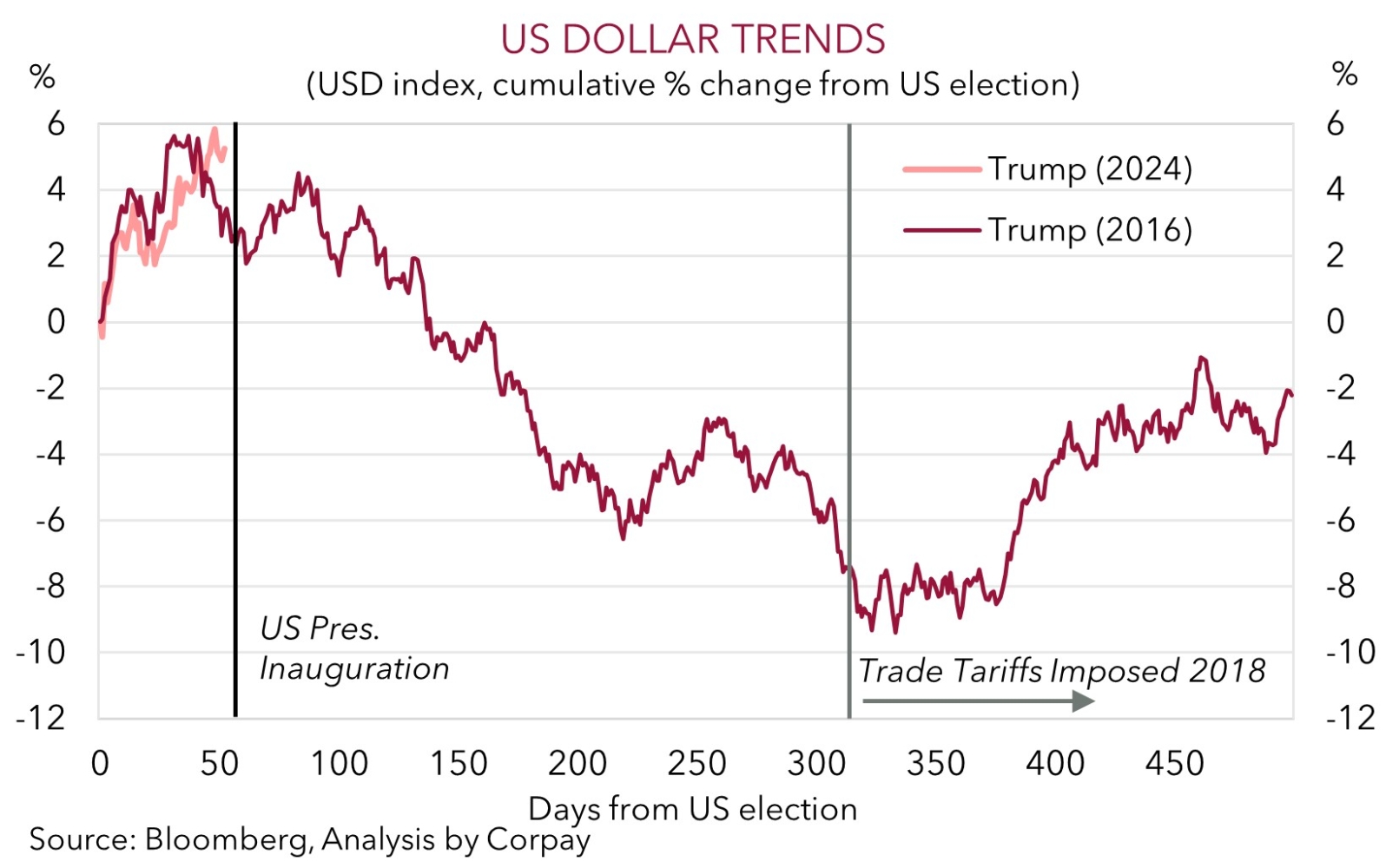

US President Trump formerly comes to power once again tomorrow, and he has repeatedly stressed he will hit the ground running, especially when it comes to tariffs and immigration. Markets will no doubt be braced for a potential raft of Executive Orders from the White House in the hours after the inauguration (Tues 4am AEDT). We believe there is potential for renewed bouts of volatility over the near-term based on what does or doesn’t happen. A forceful start to Trump’s new term could rattle nerves and give the USD more support. By contrast, based on what already looks baked in we think a more measured approach may ease fears and see the USD lose ground (as it did after Trump took charge in 2017).

Trans-Tasman Zone

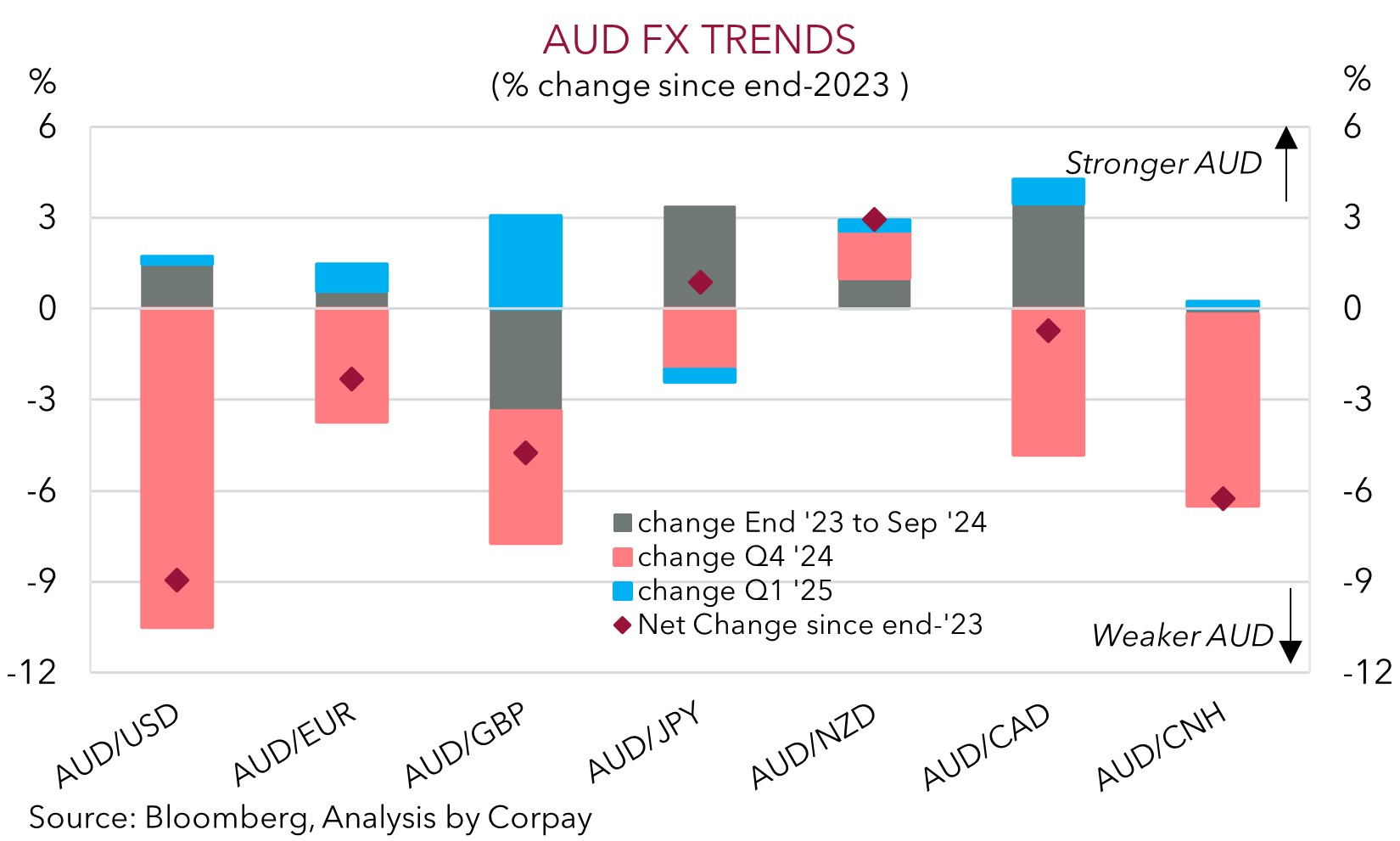

The uptick in the USD at the end of last week exerted a little renewed downward pressure on the AUD (now ~$0.6197) and kept the NZD on the backfoot (now ~$0.5590). That said, the AUD has held up well on the crosses. Outside of a dip against CNH (-0.4%), which was buoyed by reports of a productive call between President’s Trump and Xi the AUD has generally ticked up with gains of ~0.1-0.4% recorded against the JPY, GBP, NZD and CAD. AUD/EUR consolidated just above ~0.60. As our chart shows, outside of the JPY the AUD has actually been performed better against the other major currencies so far in 2025.

It is a quiet week in Australia with no major data or RBA events scheduled. The next major AU-centric release is Q4 CPI inflation (29 January). This will be a major input into whether the RBA kicks off its interest rate cutting cycle on 18 February. Markets are assigning it a ~67% chance it does. We aren’t as sure on the timing given the ongoing resilience in the labour market, though we do expect some easing to occur by May. Near-term, what happens in the hours and days after the US Presidential Inauguration (Tues 4am AEDT) will influence the AUD. As discussed above, markets are likely to be sensitive to what is (or isn’t) announced by President Trump. If Trump delivers on its pledges to act decisively on areas like trade tariffs and immigration, we expect any resultant market volatility to be USD supportive, which in turn might weigh on the AUD. By contrast, more drawn out and less forceful steps may see the USD soften helping the AUD (which are models are suggesting is currently ~3-4 cents undervalued) claw back lost ground.

Across the Tasman we think downside NZD risks remain. In addition to the events in the US, Q4 NZ CPI is also due (Weds). Various leading indicators point to a further moderation in NZ inflation pressures. If realised, this coupled with the weakness in NZ economic activity and widening cracks in the NZ labour market could reinforce the case for the RBNZ to deliver another 50bp rate cut when it meets on 19 February. The downshift in NZ interest rates over 2025 should be a lingering NZD headwind, in our view, with the relative economic and policy trends projected to help AUD/NZD edge higher over coming months.