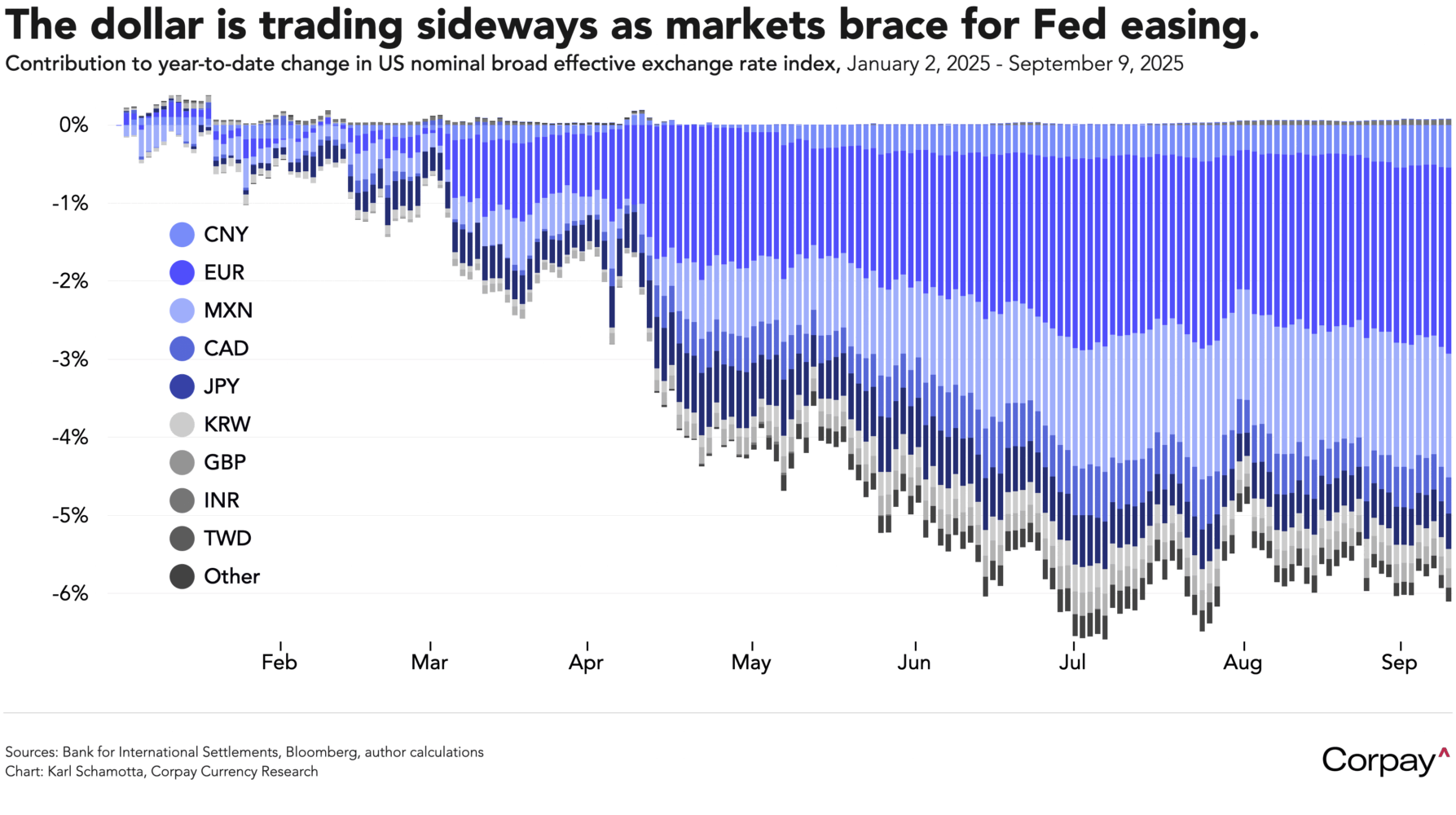

A sense of optimism is percolating across global financial markets this morning, underpinned by hopes for a drawn-out monetary easing campaign from the Federal Reserve. Long-term bond yields are coming down across most advanced economies, equity indices are advancing, and currency markets are displaying risk-on characteristics, with the dollar retreating against all of its major peers.

The Bureau of Labor Statistics will publish its latest set of benchmark revisions at 10:00 this morning, potentially providing evidence of a slowdown in job creation long before Donald Trump’s tariffs sent measures of policy uncertainty soaring. The estimate, based on the Quarterly Census of Employment and Wages, is seen subtracting somewhere between 400,000 and 1.1 million jobs in the twelve months ended in March as the “birth-death” model—the agency’s method for guessing how many businesses were created and destroyed over the period—is recalibrated. This could generate renewed political attacks on American statistical agencies and might trigger a short-lived reaction in markets, but is part of a normal (and increasingly accurate) procedure, and shouldn’t have significant monetary policy implications.

Instead, Thursday’s US inflation report looks to be the next major volatility catalyst for markets. Bets on a rate cut at next week’s Fed meeting look well-nigh unshakeable at this point, but an elevated consumer price index reading could weaken confidence in a series of sequential moves in the months to come.

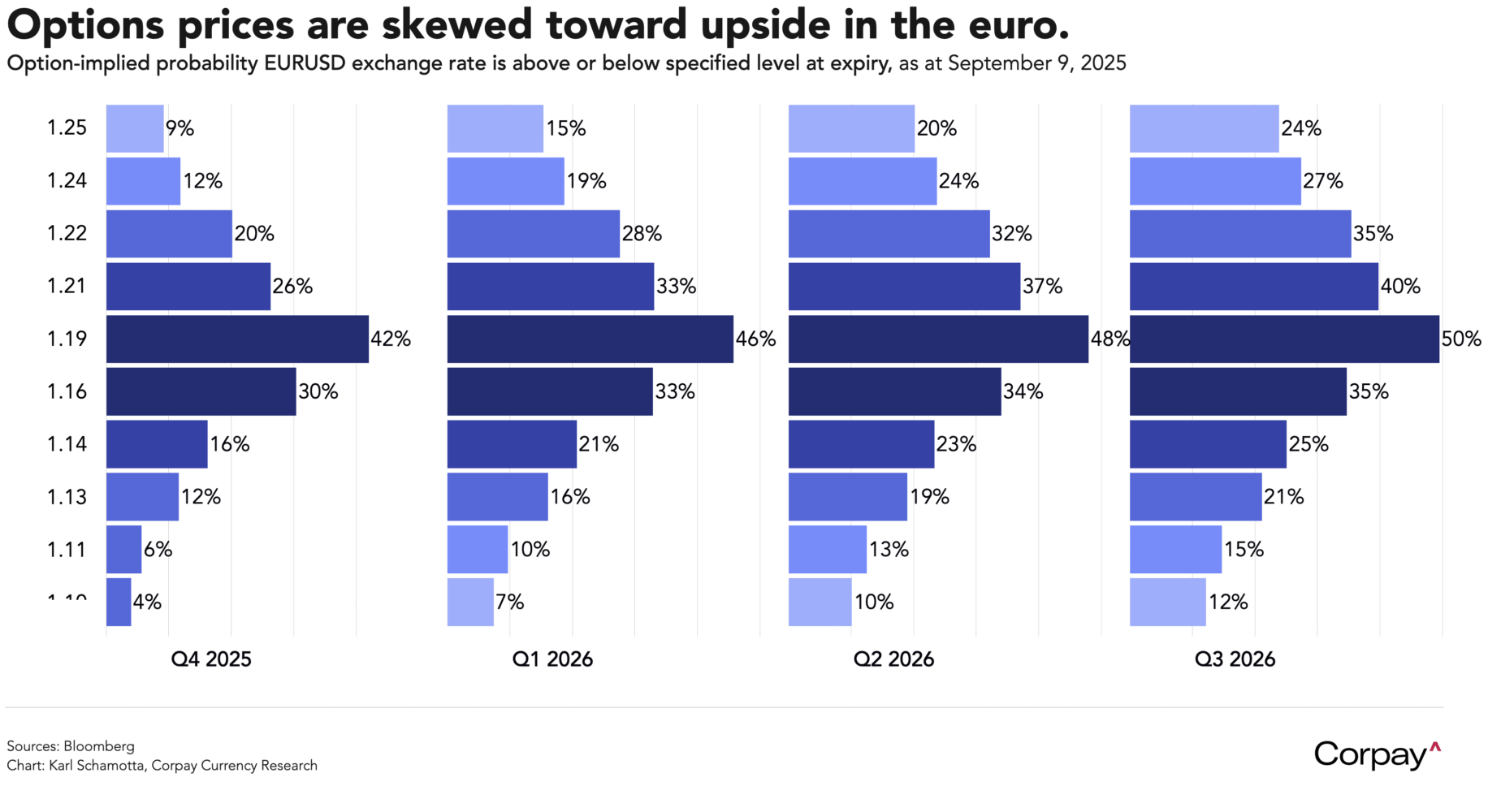

As had been widely expected, French Prime Minister François Bayrou lost a confidence vote yesterday, toppling the government and scuttling plans to reduce fiscal deficits over time. Although President Macron is expected to appoint a replacement within days, few expect a candidate to emerge who can unite an incredibly-fragmented National Assembly around the combination of spending cuts and tax increases needed to put the country’s finances on a more sustainable footing. A steady rise in the “risk premium” embedded in French assets is likely to play out in the weeks and months to come, especially in the event that one of the major ratings agencies decides to downgrade its view on the outlook. Traders are nonetheless optimistic on the euro itself, with options pricing firmly skewed to the upside over the year ahead as policy rate differentials between the Federal Reserve and European Central Bank converge.

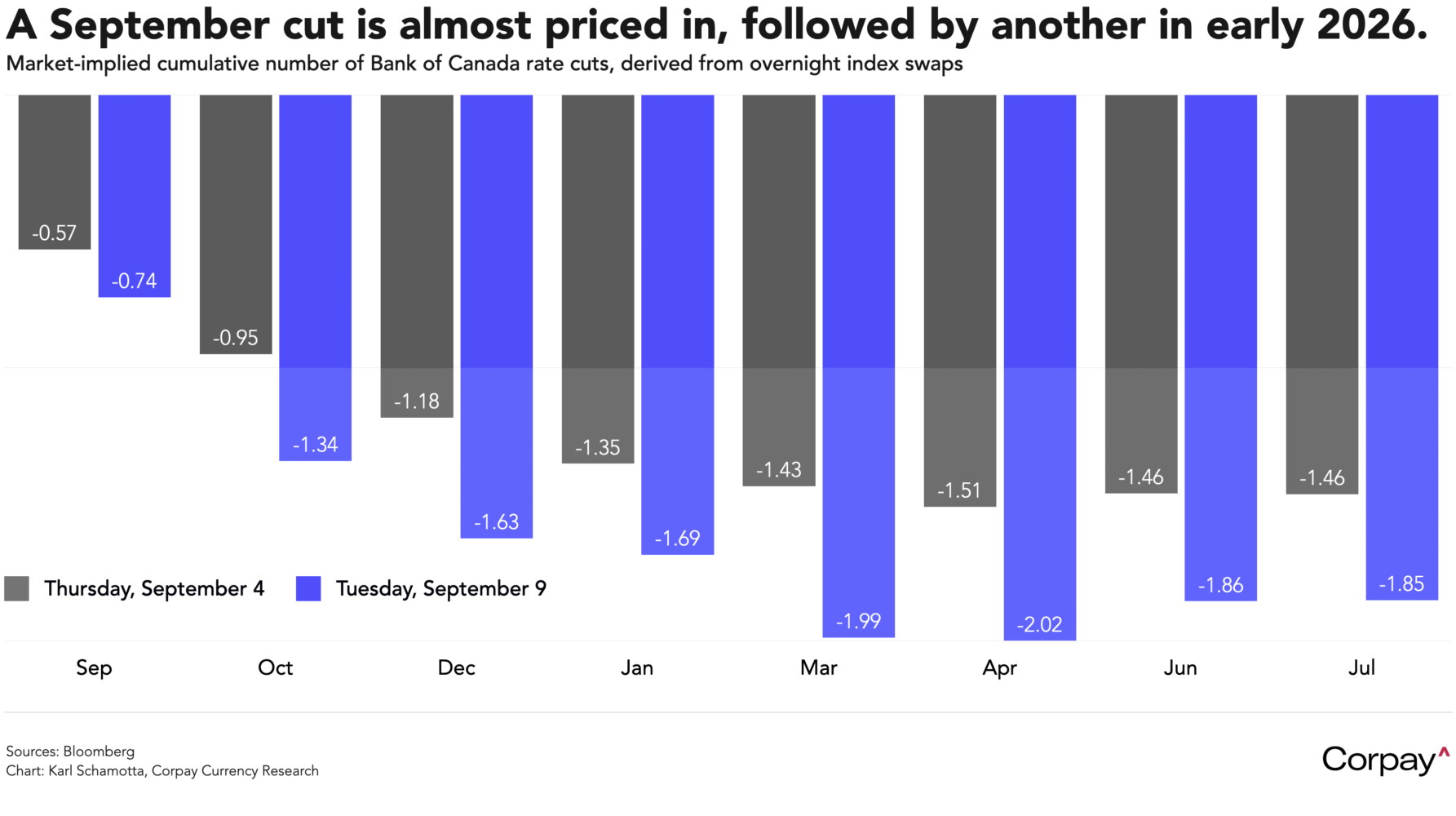

Here in Canada, the repercussions of Friday’s disappointing jobs number are still rippling across markets. Although Tuesday’s August inflation report could change the picture, we are inclined to think policymakers at the Bank of Canada will deliver a cut at next week’s meeting, and again in October as they respond to weakening labour markets and signs of a slowing in exogenous demand, while looking through supply-side price increases. That may sound contrarian, but isn’t far off market pricing: traders are putting 75-percent odds on a September cut, and the next is priced in for the early new year. The Canadian dollar could therefore nudge lower in the near term, yet isn’t likely to lurch into the frigid wastelands above 1.40 without a more meaningful catalyst.

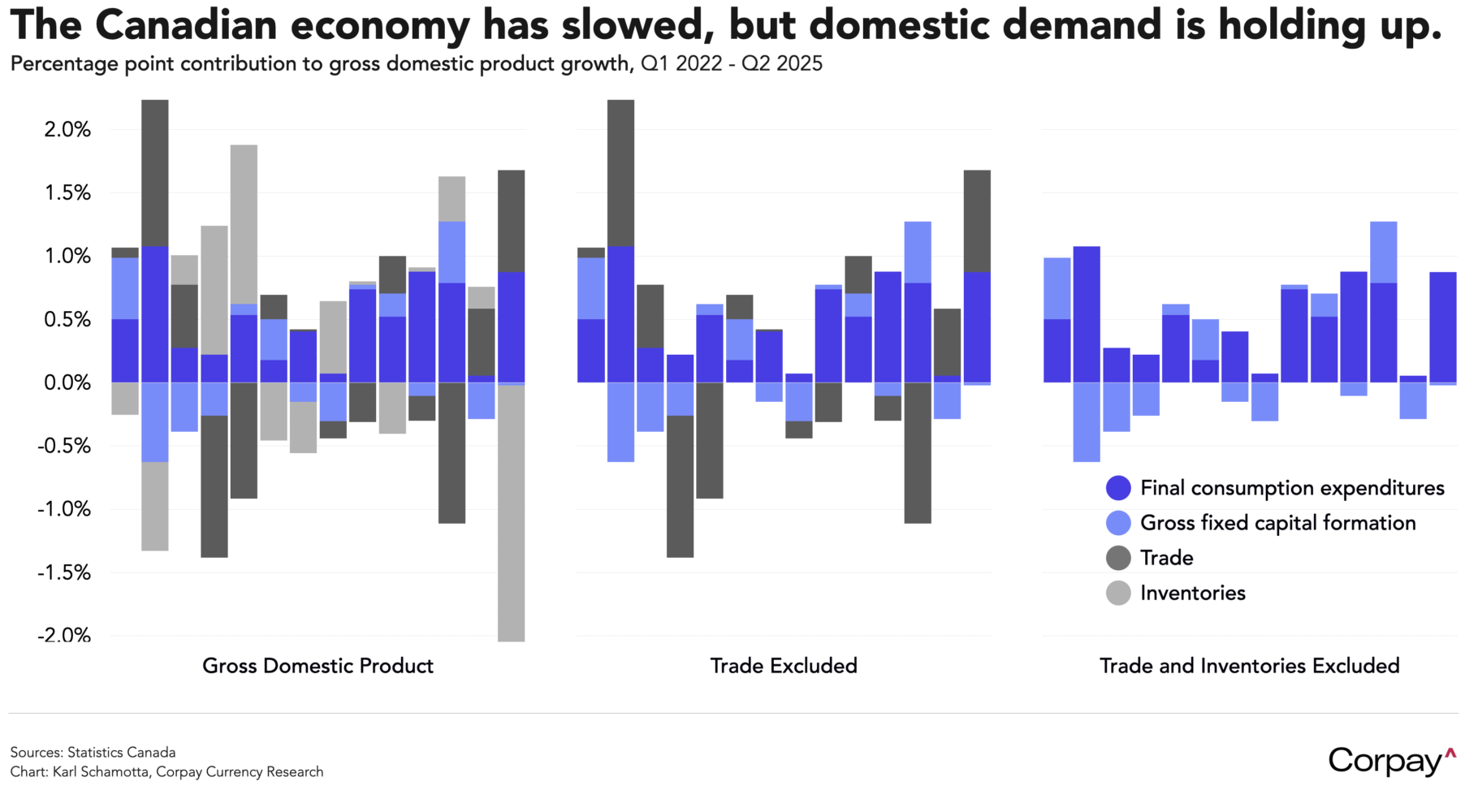

It’s important to note however, that ‘bullwhip effects’ are still playing out across the economy. Just as in the US, massive fluctuations in trade and inventory volumes have obscured any meaningful view of the fundamentals this year, and there are signs that the household spending and real estate-driven areas of the economy could prove more resilient than market participants expect. Final domestic demand—often considered a cleaner read of underlying momentum—has held up surprisingly well on a year-to-date basis, and could surprise all of us in continuing to do so. it may not be a satisfying outlook from a hedging standpoint, but to paraphrase HL Mencken: for every question on the Canadian economy’s path forward, there is an answer that is clear, simple, and wrong.