Risk-sensitive assets are looking buoyant this morning as perceived tail risks recede and investors turn more optimistic on the direction of global growth. The US dollar is up slightly, Treasury yields are inching higher, and major American stock indices are climbing ahead of the North American open after series of strong corporate earnings releases in recent days, coupled with a drumbeat of trade deal reports, helped allay fears of a more severe downturn in the US and world economies.

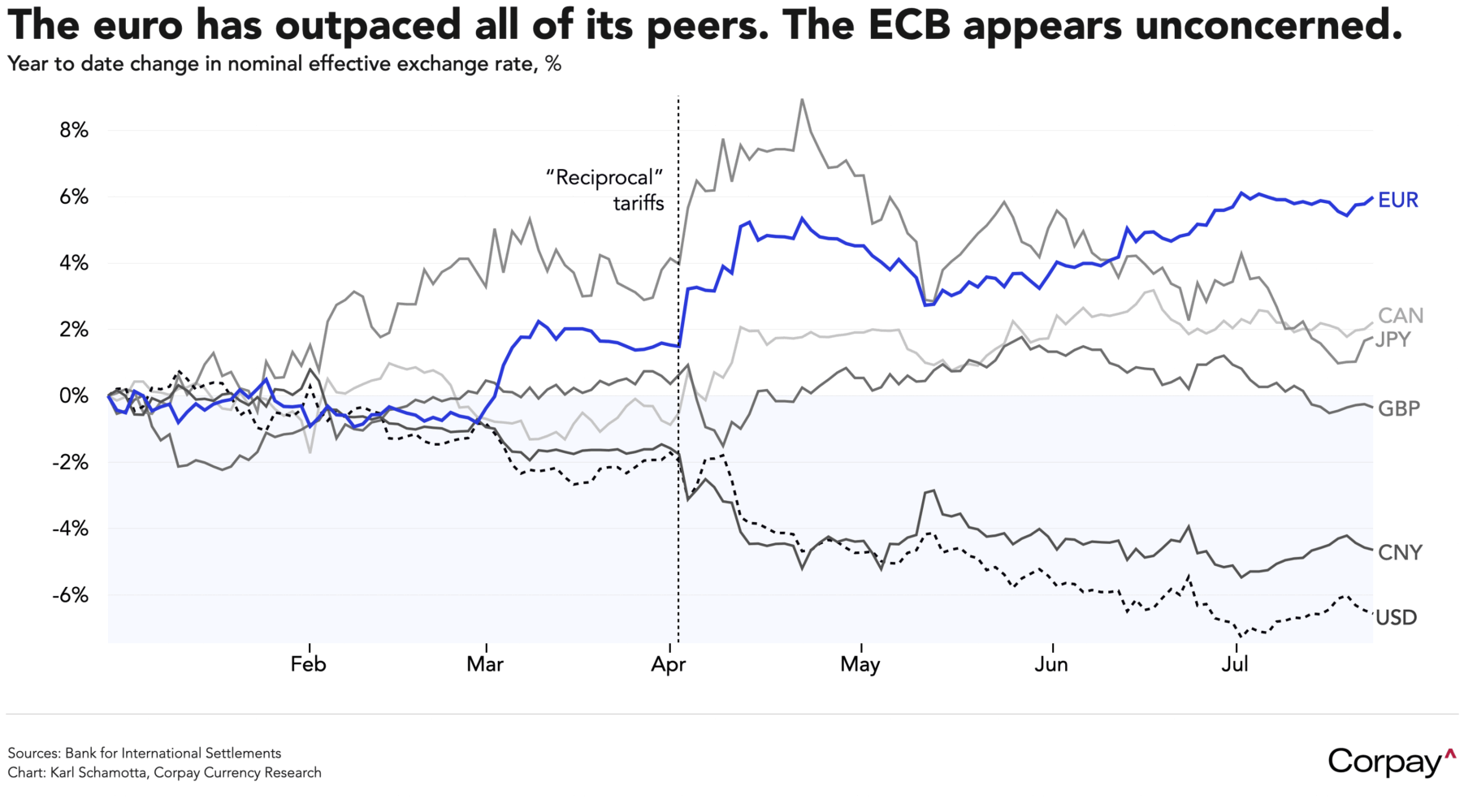

The euro is holding firm after the European Central Bank left rates unchanged and avoided telegraphing its next moves, leaving market expectations broadly unchanged. There was no evidence of concern over the euro’s appreciation this year—it is up roughly 6.5 percent on a trade-weighted basis— and policymakers justifiably played their cards close to the chest, stopping short of providing anything resembling forward guidance, choosing instead to keep their options open ahead of the next meeting in September. Thus far, the economy appears to be evolving in alignment with the Bank’s early June forecasts, but there are major unknowns around the impact that the global trade war might have on growth and inflation in the months and years ahead. At the moment, traders have 22 basis points in easing priced in by year end, essentially unchanged from levels seen ahead of the release.

The Financial Times yesterday reported that the EU and US are nearing a trade deal that would resemble Wednesday’s accord with Japan. According to the newspaper’s sources, the bloc is expecting tariff rates to land at 15 percent, up slightly from the status quo on most goods—4.8 percent plus 10 percent—but down from the 27.5-percent tax currently levied on autos. This would represent a long-term headwind for European exports, but could reduce downside risks for many of the bloc’s most trade-sensitive economies and provide a modicum of stability for shell-shocked market participants.

Here in Canada, the loonie is up slightly after Statistics Canada said consumer demand rebounded in June, suggesting that an improvement in sentiment is beginning to translate into more purchasing activity. According to this morning’s update, Canadian retail sales tumbled 1.1 percent in May—in line with the advance estimate—as auto sales fell after several months of tariff front-running efforts ran their course, but then jumped 1.6 percent last month. After an early-year surge in rate cut expectations, odds on a move at next week’s Bank of Canada meeting are practically non-existent, and traders have just 13 basis points in easing priced in for year end.

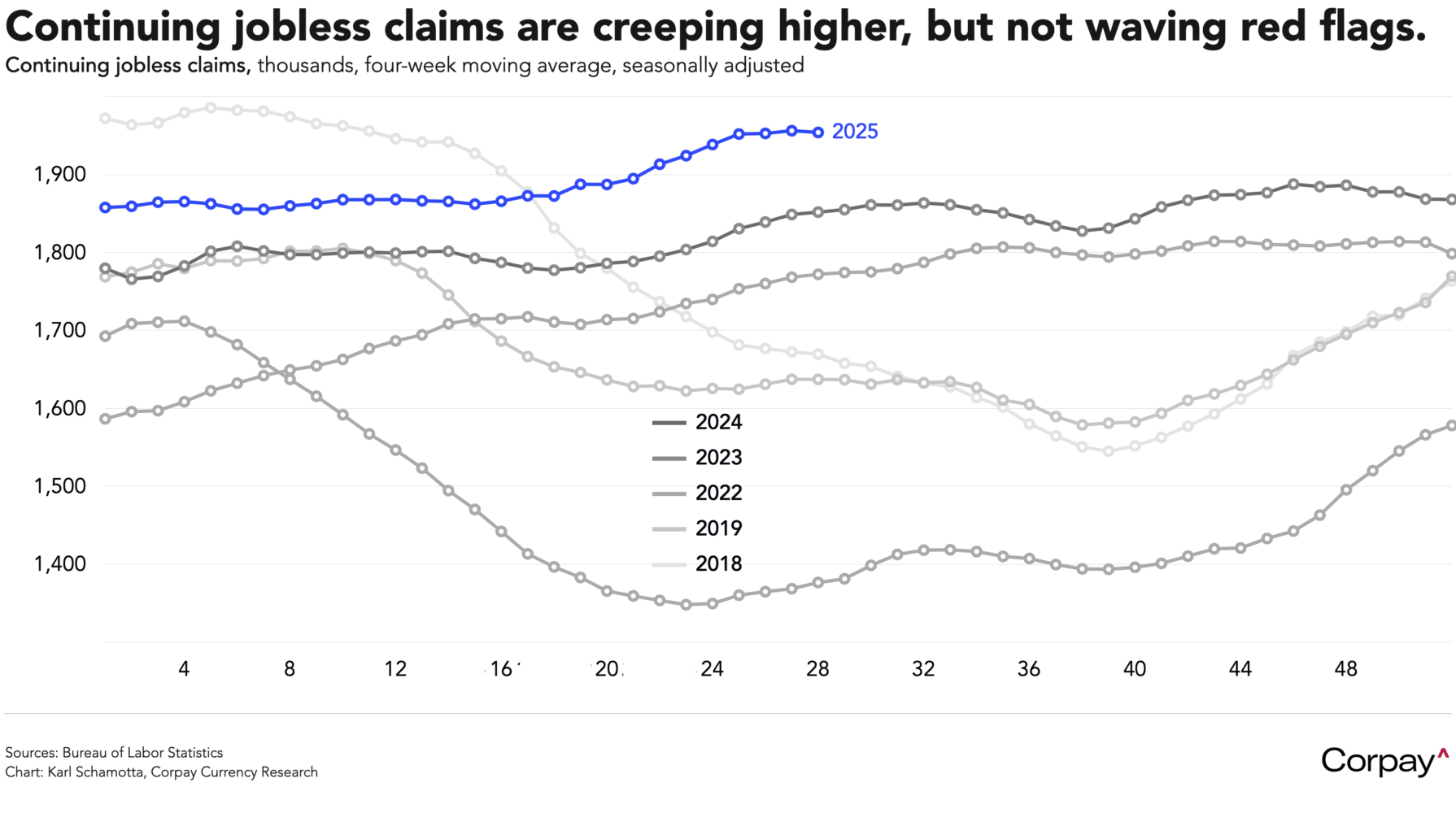

US job markets continue to exhibit surprising strength. According to this morning’s update, the number of Americans filing new claims for unemployment fell for a sixth consecutive time to 217,000 in the week ended July 19. In the prior week, continuing claims held at 1.96 million, putting the four-week average on an only slightly-elevated track relative to seasonal patterns and the size of the overall labour force. Economists are nonetheless convinced that a period of softness is coming, with early consensus expectations for next week’s July non-farm payrolls report pointing to a slowdown in the pace of hiring—to 115,000 from June’s 147,000—and a rise in the unemployment rate to 4.2 percent from 4.1 percent previously.

Today’s data calendar looks quiet beyond this morning’s purchasing manager indices, but we are wary of headline risks arising from President Trump’s visit to the Federal Reserve this afternoon. According to the White House, Trump is set to join a tour of the central bank’s renovation project, which has provided a focal point for accusations of cost overruns and—in the eyes of some—could give the president grounds to remove Chair Powell before his term ends early next year. Fed officials have taken steps to outline the factors that have raised the construction budget from an estimated $1.7 billion in 2017 up to $2.5 billion today, and Powell has pushed back on specific claims made by his critics, telling the Senate Banking Committee in June “There’s no new marble. There’s no special elevators. They’re old elevators that have been there. There are no new water features. There’s no beehives and there’s no roof garden terraces,” but the attacks have continued, and Trump could step up his rhetorical assault during today’s appearance.

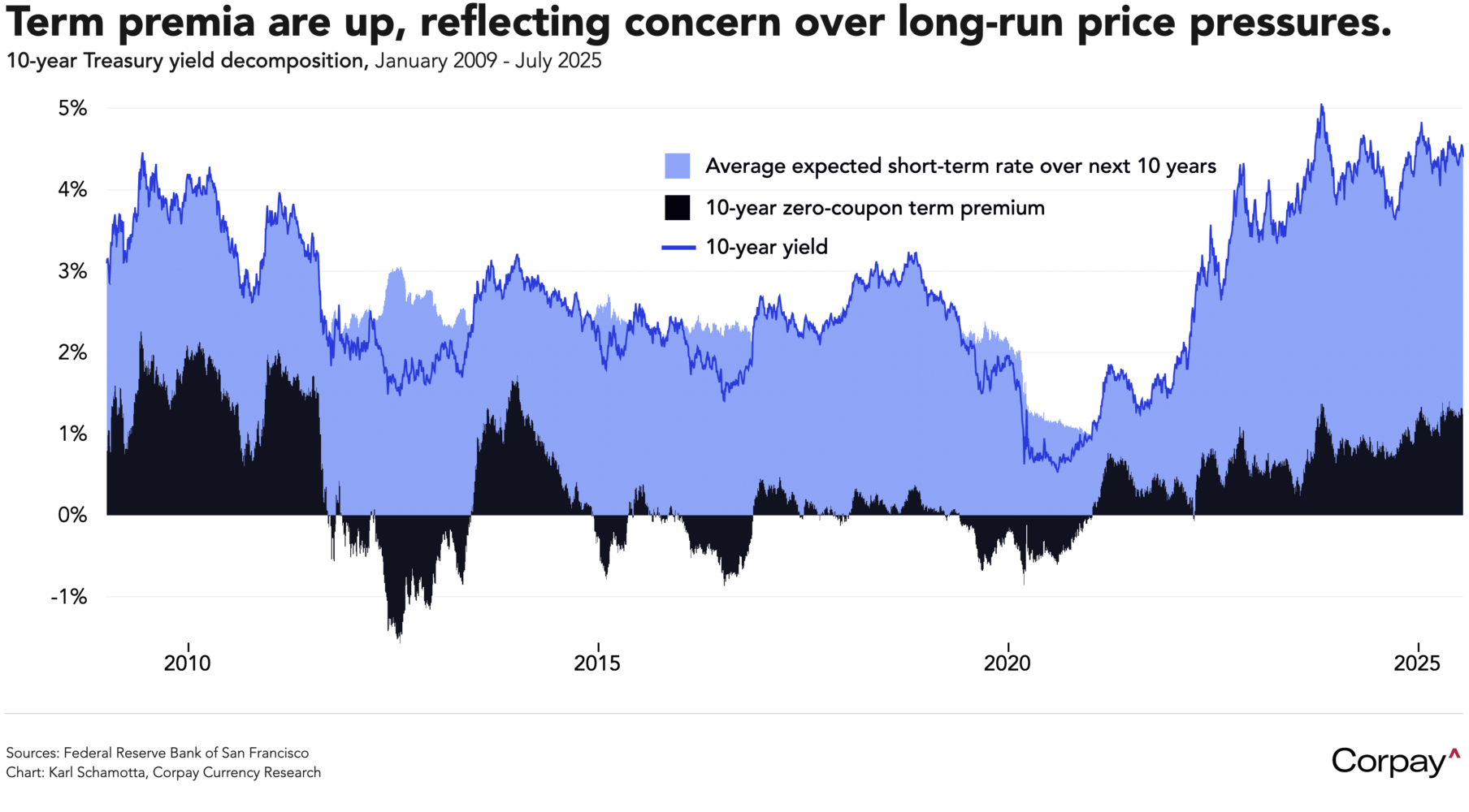

Markets are increasingly convinced that the Fed’s independence is set to erode. The “term premium”—the extra yield that investors expect to receive for holding longer-term bonds compared to rolling over shorter-term bonds over the same period—embedded in interest rates on US debt has risen to its highest levels in over a decade, up almost 1.6 percent from a cyclical low near minus-0.33 percent. A more dovish-leaning Fed might be expected to push short-term borrowing costs lower than would otherwise be justified, contributing to higher inflation over the long run and raising long-dated rates, which could steepen the yield curve. If investors were to add to this view, the dollar could take another leg down. We wouldn’t want to cut into anyone’s happy hour, but it might be worth keeping an eye on markets between 4 and 5 this afternoon.

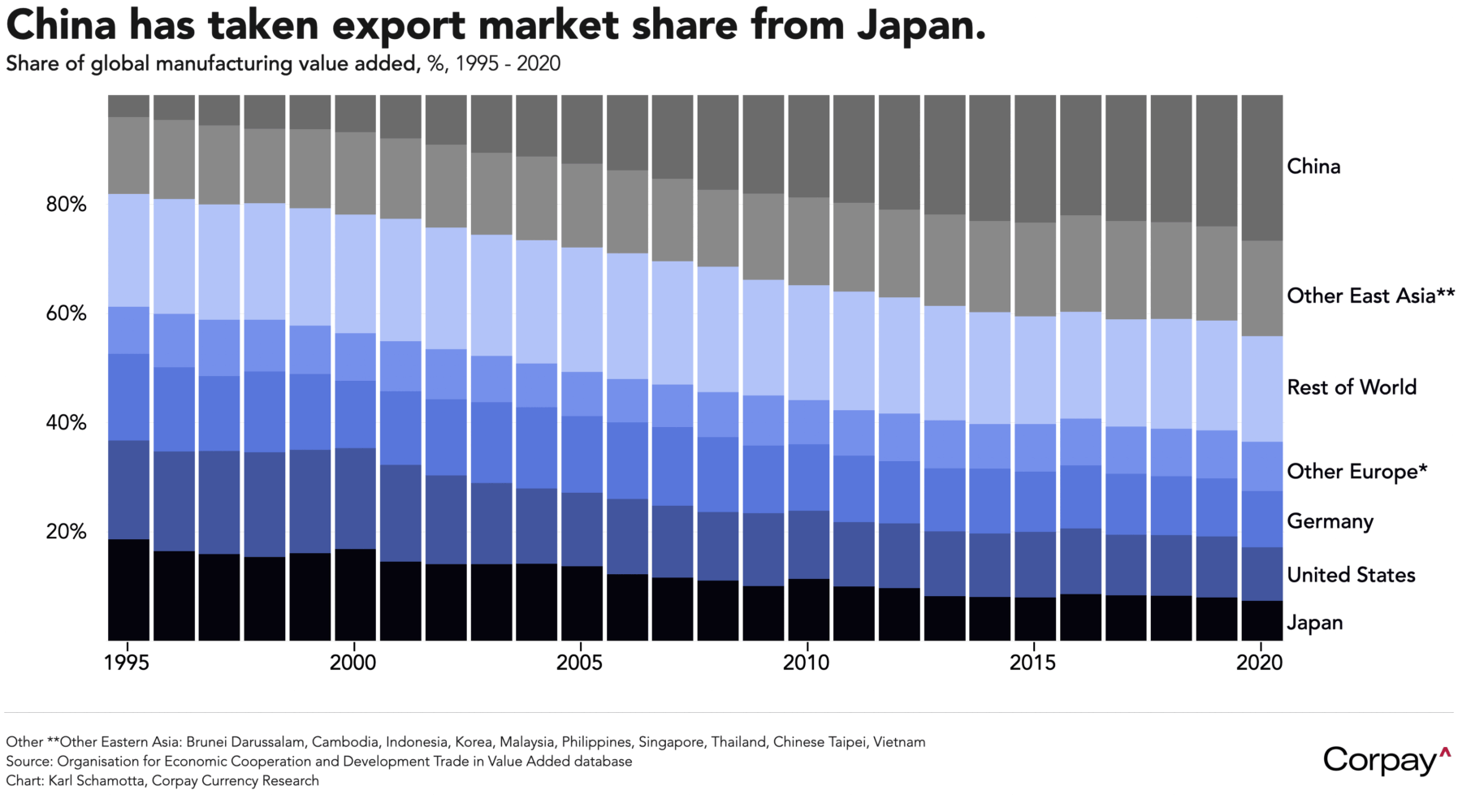

And in a follow-up to yesterday’s missive, here’s a chart illustrating the change in global manufacturing value-added exports since 1995. This illustrates the extent to which China has taken market share from Japan more than the US and Germany over time—a trend that could fall apart over the years ahead if other countries join the US in raising tariffs against Beijing.