And it’s back. The dollar is extending its post-election rally this morning, gaining against all of its major counterparts – excepting the safe-haven Swiss franc – as markets continue to adjust to a future in which US policymakers maintain expansionary fiscal policies, raise barriers to trade, and fold the security umbrella that has underpinned global growth since the Second World War. A series of nomination announcements in the last two days – including former Fox News personality Pete Hegseth as Defense Secretary, NATO-sceptic Tulsi Gabbard as director of National Intelligence, and firebrand congressman Matt Gaetz as Attorney General – have sent shockwaves across the political landscape, while sending a clear message to market participants that Donald Trump intends to follow through on the “America First” policy proposals that got him reelected. Equity futures are slightly weaker and the benchmark ten-year Treasury yield is holding at 4.47 percent, near its highest levels since July.

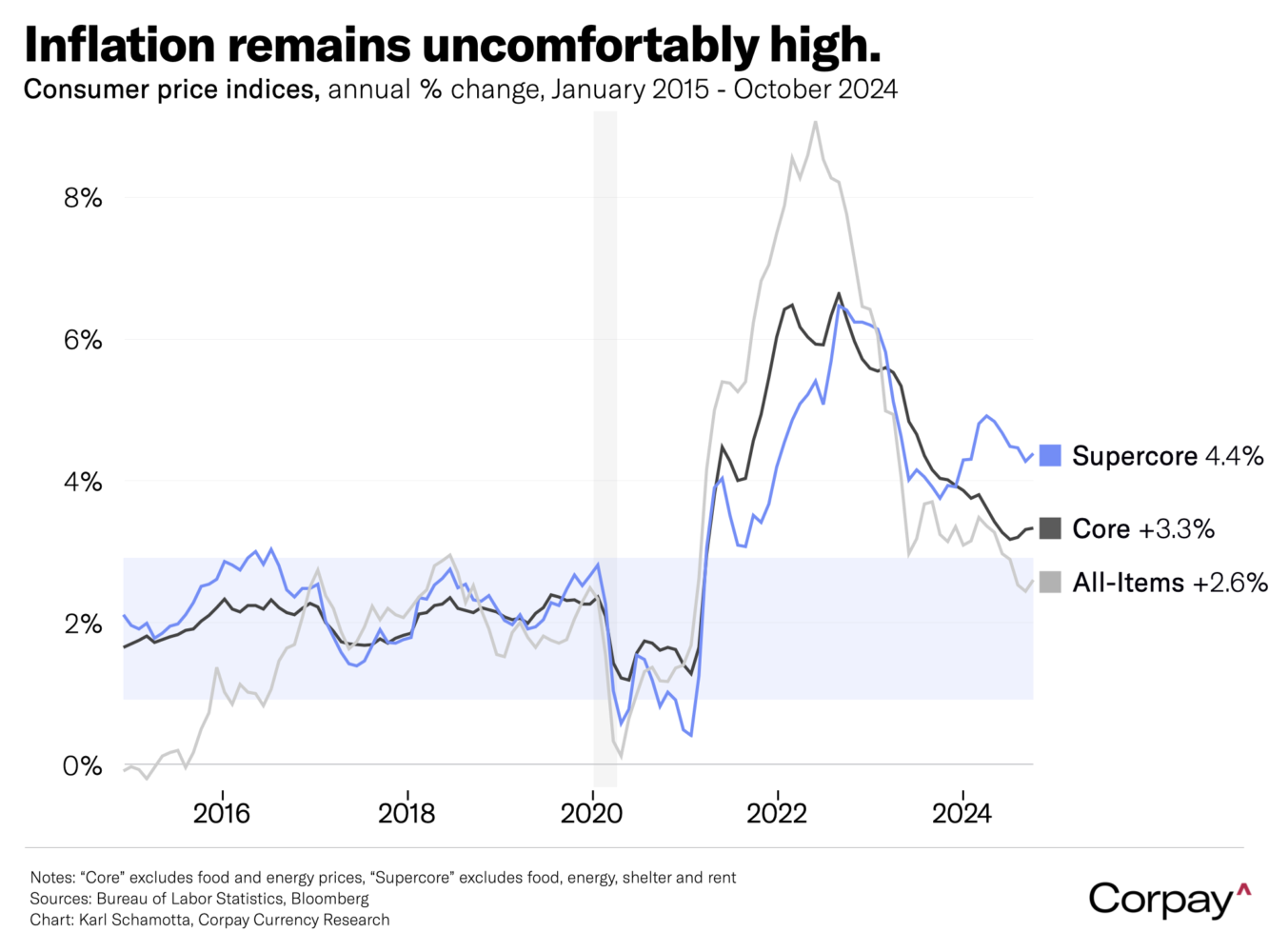

Unpleasant surprises were largely avoided in yesterday’s US consumer price report. Markets, which had been braced for a hurricane-related move to the upside, reacted with relief when the all-items inflation rose 2.6 percent year-over-year in October, aligning with consensus expectations. Futures traders moved to raise the odds on a quarter-point rate cut at the Federal Reserve’s December meeting to 82 percent from 58 percent ahead of the release.

But inflation remains uncomfortably high. Core consumer prices – closer to the personal consumption expenditures measure targeted by the Federal Reserve – climbed 3.3 percent in the year to October, holding at the same pace recorded in the prior two months. Shelter costs rose 4.9 percent and a proxy for Jerome Powell’s preferred “supercore” measure – which excludes shelter and rent costs, as well as food and energy – accelerated to 4.38 percent, and today’s October producer price index data showed increases in the medical and portfolio management categories that feed into measures of underlying inflation. If sustained, this combination of “sticky” price pressures could force policymakers to slow the pace of easing in the early new year.

Markets will get more insight into how the Fed is assessing risks later today when Jerome Powell delivers an economic outlook at 3:00 Eastern time this afternoon in Dallas, Texas, followed by a question and answer session. He’s likely to maintain a keep-calm-and-carry-on tone: in last week’s post-decision press conference, he called hotter-than-expected inflation “Just a catch-up problem. It’s not really reflecting current inflationary pressures. It’s reflecting past inflationary pressures,” and said “We’re not declaring victory, obviously, but we feel like the story is very consistent with inflation continuing to come down on a bumpy path”. But Dallas Fed president Lorie Logan sounded substantially more hawkish in a speech yesterday, suggesting that rates may have less room to fall, saying “I see substantial signs that the neutral rate has increased in recent years, and some hints that it could be very close to where the Fed funds rate is now.”

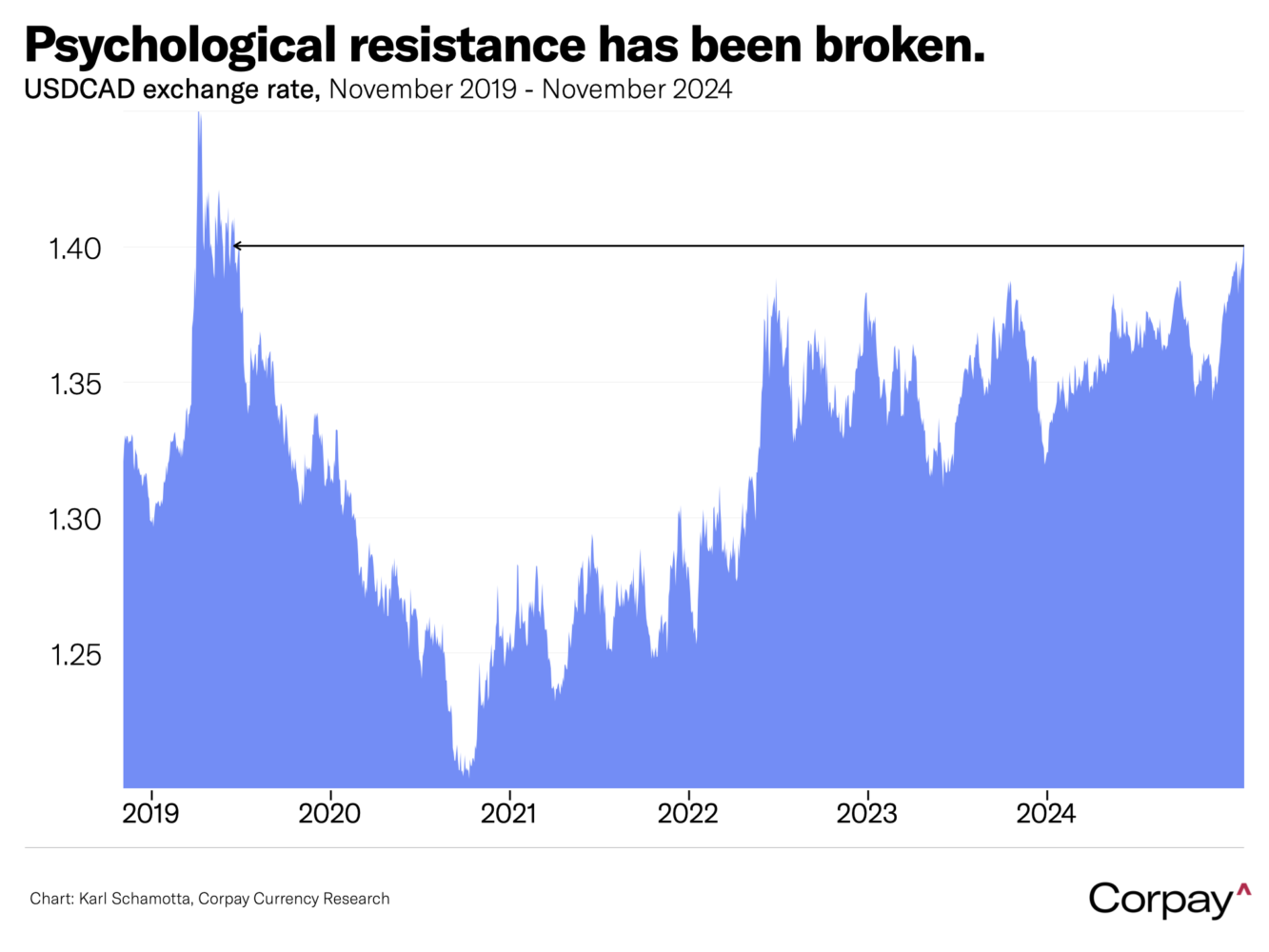

The Canadian dollar is trading north of the 1.40 threshold in interbank markets after flirting with a breakthrough for much of yesterday’s session. Currency forecasters have turned overwhelmingly bearish on the currency in recent months, with domestic weakness – households are still working through a sharp rise in debt carrying costs, and business investment remains lacklustre – seen intersecting with US outperformance and a constant drumbeat of trade threats to drive the exchange rate lower. We expect further weakness, with technical indicators opening up an air pocket between 1.40 and 1.43, but remain wary of an overshoot. Domestic fundamentals aren’t great, but aren’t apocalyptic either, and the currency is outperforming all of its major rivals against the dollar – suggesting that it could turn aggressively higher when the greenback’s rally inevitably gets exhausted.

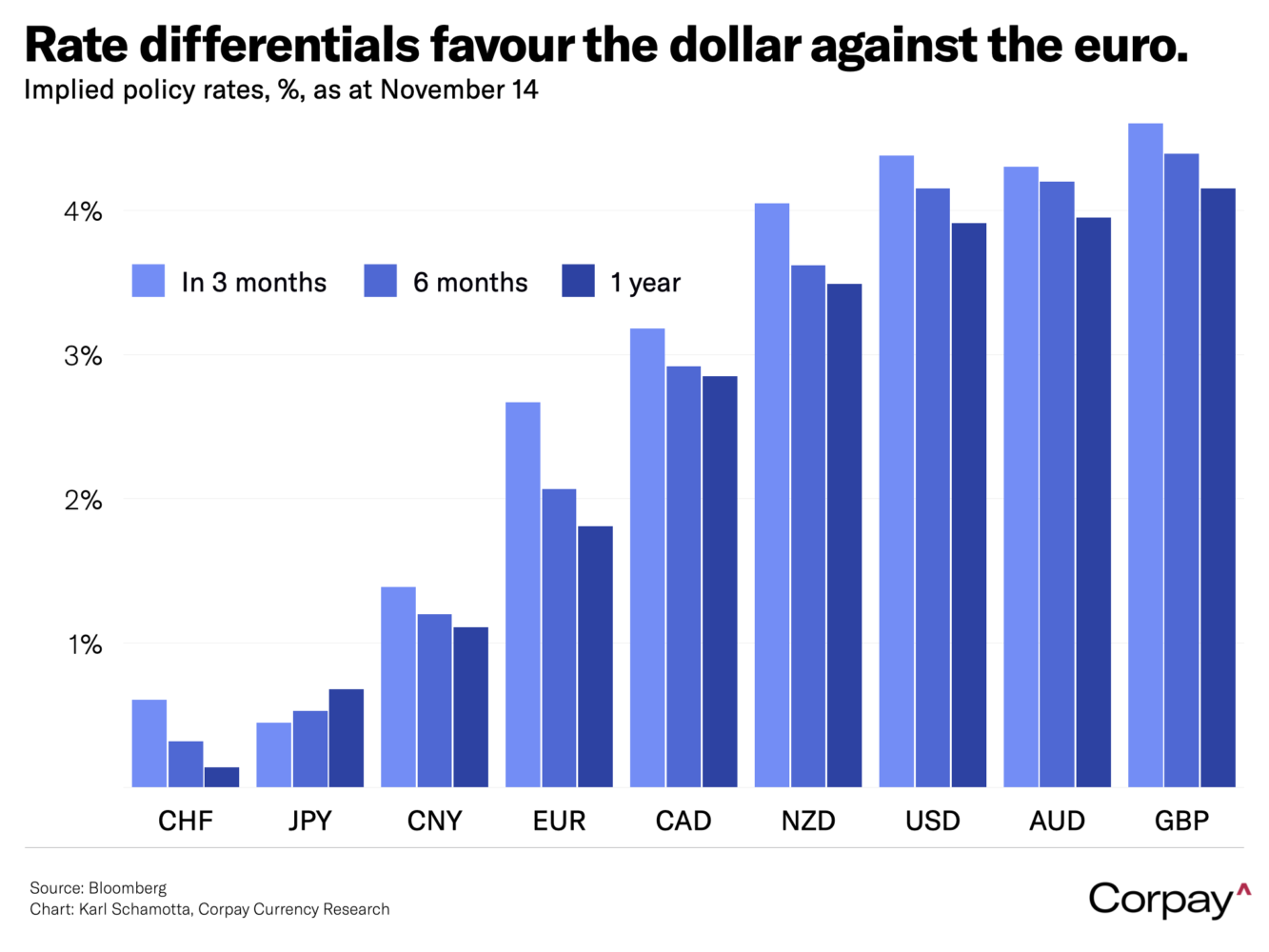

The euro is sharply weaker after factory activity fell by more than anticipated, bolstering the likelihood of more easing from the European Central Bank in the months ahead. According to Eurostat, industrial production tumbled 2.0 percent from the previous month in September, and the August print was revised down to 1.5 percent from 1.8 percent previously, with output in Germany – the bloc’s largest economy – plunging 2.7 percent. The common currency area’s manufacturing sector has suffered something resembling a perfect storm in the years since the pandemic hit, with weaker demand from China, more competition in the auto sector, and soaring energy costs delivering a series of shocks that are weighing on broader measures of consumer and investor sentiment. Central bankers are expected to respond with a total of six rate cuts between now and next October – twice as many as the three seen coming from the Federal Reserve – and enough to keep rate differentials steeply tilted against the common currency.

Mexico’s central bank is expected to cut interest rates by another 25 basis points later today, slightly narrowing rate differentials against the dollar. Policymakers are seen lowering their benchmark rate to 10.25 percent after core inflation hit 3.8 percent on a year over year basis last month – within the central bank’s 2-to-4 percent target range – and in line with the broader moderation in growth that has seen both the Banxico and private forecasters mark expectations down in recent months. Officials are likely to maintain a dovish bent in the accompanying statement, emphasising a data-dependent reaction function as they prepare for a possible shock to worker remittances, exports, and inward investment flows next year. Markets seem fairly optimistic – many investors expecting the government to bow to US demands on immigration and trade with China, allaying the likelihood of the most extreme scenario for tariffs – but the peso is still coming under selling pressure as the dollar steamroller accelerates.