The dollar is outperforming all of its major counterparts after the US reached a trade deal with the European Union, reducing uncertainties facing businesses and investors on both sides of the pond. Treasury yields are ticking higher, equity futures are pointing to modest gains at the open, and measures of implied volatility are pushing higher as traders brace for an intense and tumultuous week.

The euro is trading lower as investors process what looks like a lopsided deal. According to President Trump, imports from the EU will be tariffed at 15 percent—except steel and aluminium, which will remain at 50 percent—and the 27-member economic union will buy $750 billion in energy, invest an additional $600 billion in American assets, and purchase “vast amounts” of military hardware over an undefined period. Trump told reporters that Brussels also agreed to open up its markets to “trade at zero tariff”. Clearly, this would represent a hit to the European economy, with higher tariffs likely to lower exports over time.

But the devil is in the details. Other “deals” in recent months have proven less unbalanced than was initially presented. Officials in Vietnam are disputing having agreed to Trump’s 20-percent levy, and no clarity has been provided on how transshipment penalties would be calculated or enforced. After pledging to invest $550 billion during President Trump’s term in office, Japanese officials have since suggested that more than 98 percent of this will be in the form of loans and loan guarantees, and that the ratio of profits distributed will be in proportion to the scale of commitments from the US government. To our knowledge, no legally-binding trade agreement has been struck with any country thus far.

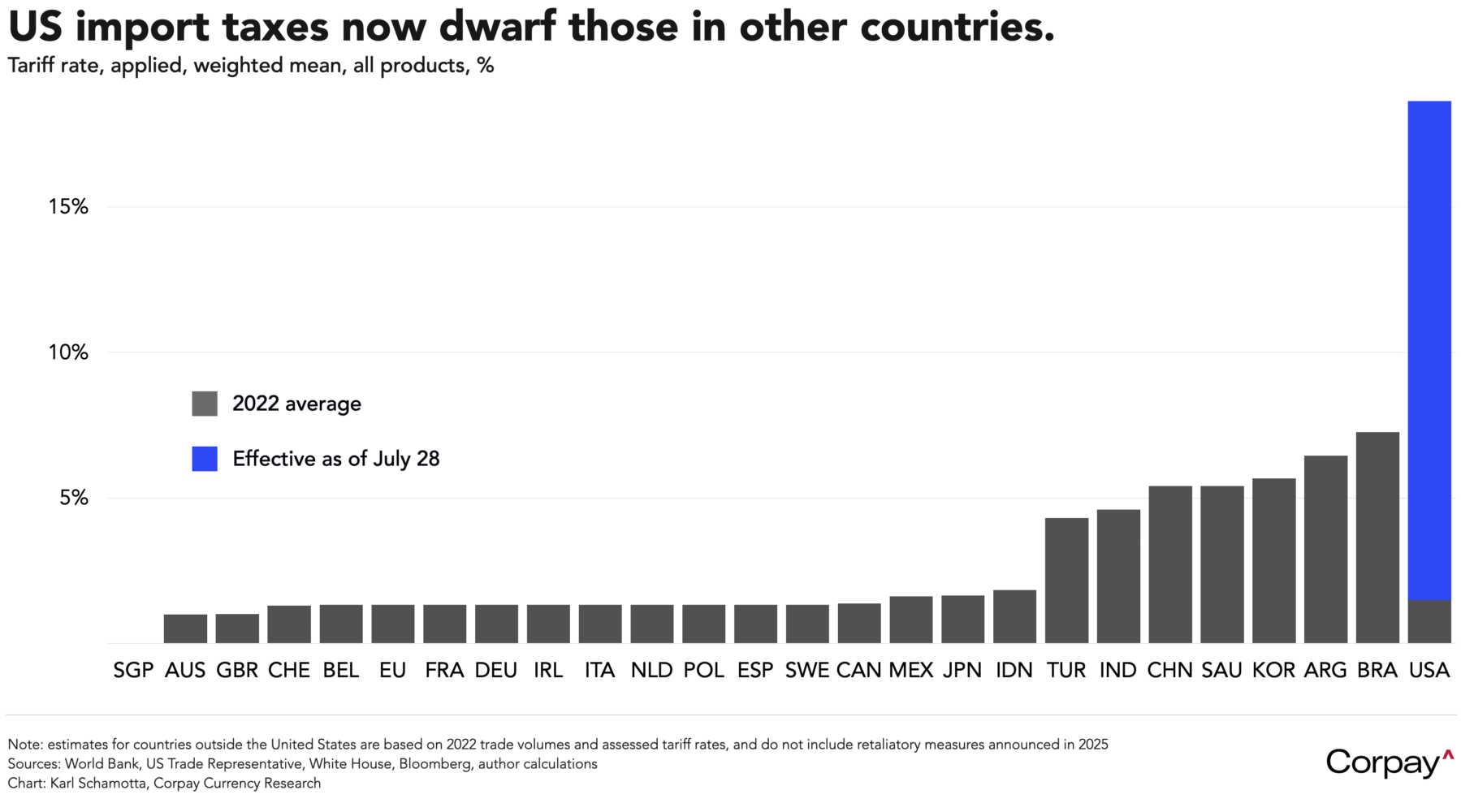

And Trump is slowly, but surely raising US import taxes. The average effective tariff rate charged to American companies is now more than six times higher than it was when the president took office this year, and is at its highest level since the 1930s. From a trade standpoint, this makes the US the most heavily-taxed major economy in the world—even after retaliatory measures in other countries are considered. This should exert drag on US growth rates over time.

After two weeks of relative calm, hedgers will face a relentless barrage of event risks in the coming days. To highlight a few:

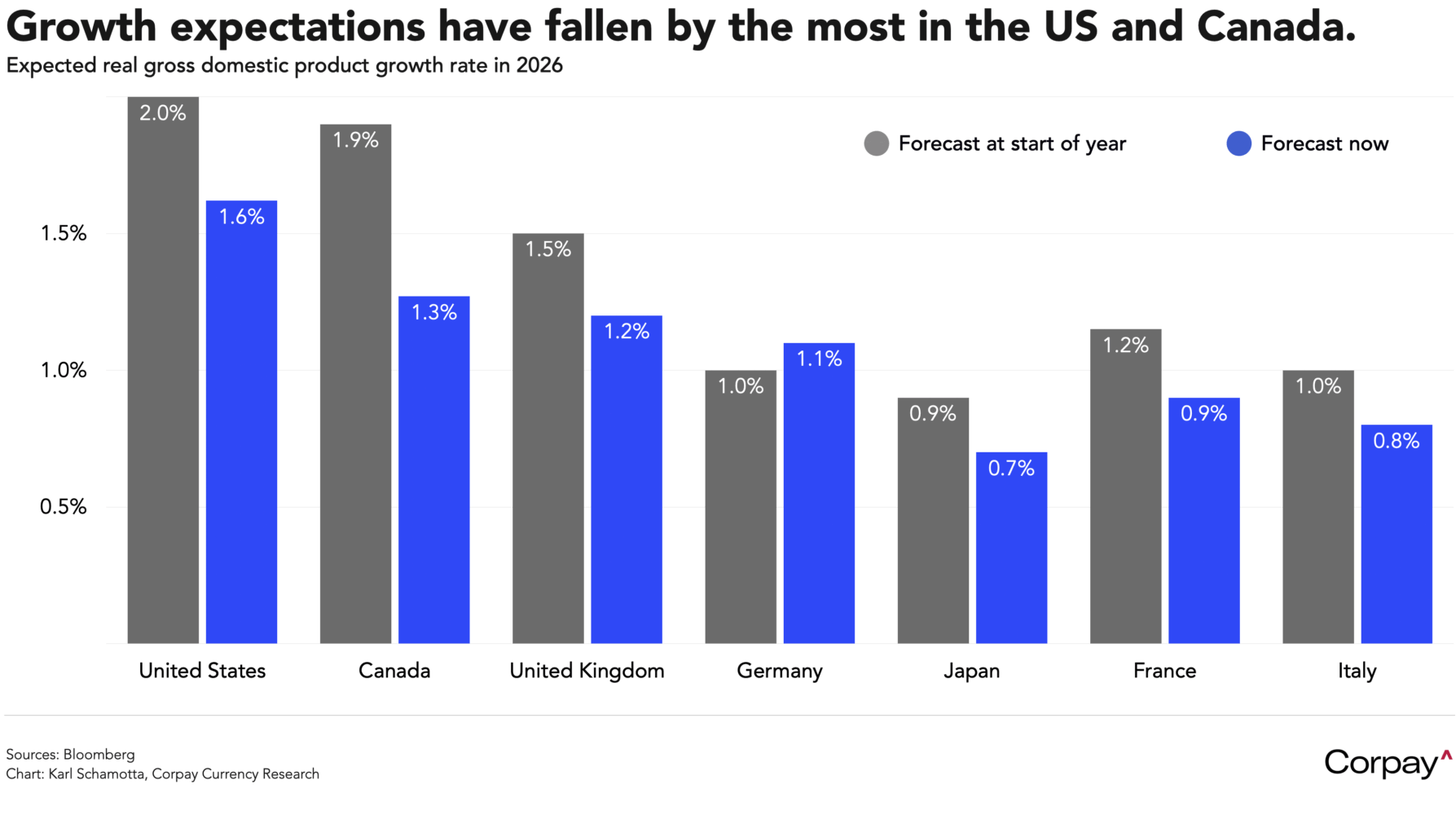

Wednesday’s gross domestic product report should show US economic activity rebounding in the second quarter on a narrowing in the trade deficit—a reversal of the decline seen in the first quarter as companies attempted to front-run tariff increases. The positive headline could bolster optimism among businesses and consumers, but when considered on an annualised basis, the country’s overall growth trajectory has fallen this year. Economists have lowered expectations for 2026, by more than in other economies (other than Canada) and a deceleration is widely expected in the second half.

North of the border, the Bank of Canada is overwhelmingly seen staying on hold as officials wait for more clarity on the direction of trade policy, economic growth, and inflation. Core inflation—as measured using the Bank’s preferred gauges—is running too hot, and showing signs of acceleration. Consumer spending has proven surprisingly strong. Unemployment rates remain at worrisome levels, but job creation is showing signs of rebounding. Last year’s rate cuts are flowing through into a modest recovery in real estate market activity. And the federal government’s fiscal spending is set to ramp up. For now, it makes sense to keep rates where they are—well within estimates of neutral territory—until trade policy changes are better understood, and the impact on the economy can be measured in a more clear-cut way.

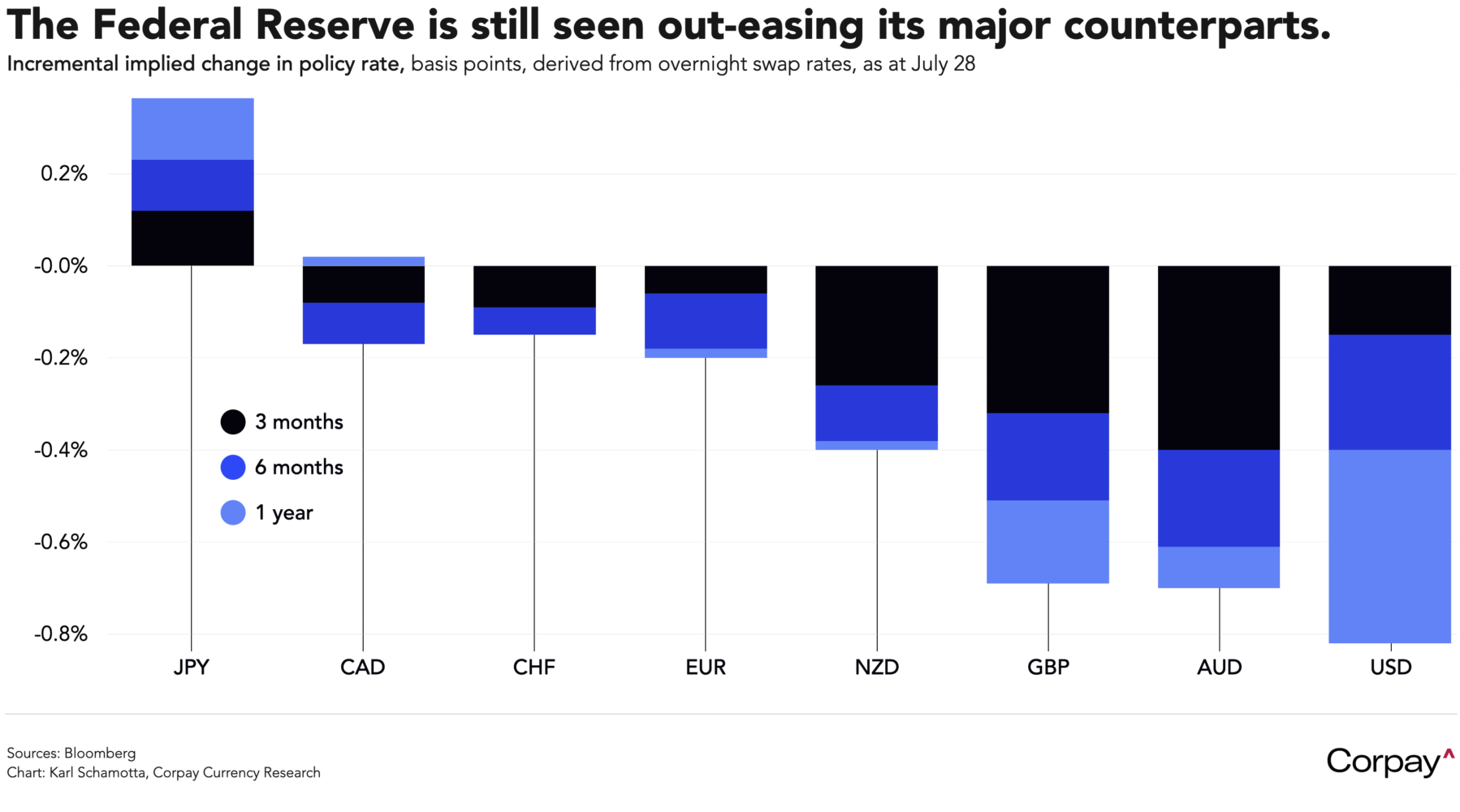

The Federal Reserve is likely to leave policy settings unchanged when it releases its latest decision later in the day, but signs of internal division are also likely to grow. Governors Bowman and Waller could cast dissenting votes in favour of cutting rates, while others—including Chair Powell—should vote with the majority, given that they are seeing strength in labour markets, and expect a bump in inflation over the coming months as tariff increases feed through. We don’t expect the statement to change much, and there are no forecast updates scheduled for this meeting, so the fireworks will most likely come during the post-decision press conference. Traders are placing circa-60-percent odds on a rate cut at the central bank’s September meeting, and have a total of four moves priced in over the next year.

Policymakers at the Bank of Japan are also likely to remain sidelined on Thursday as they navigate shifting economic and political cross-currents. Inflation has recently shown signs of decelerating, and there’s no evidence of the wage-price spiral that many analysts had feared late last year. The government is in turmoil after last weekend’s election and isn’t likely to provide clarity on its stimulus plans in the near term. And (as touched on above), the trade deal struck between Japan and the US is still on a napkin, meaning that changes could happen in the coming months. Governor Ueda could remain rhetorically hawkish, but is very unlikely to guide markets toward a specific policy trajectory.

Also on Thursday, the Fed’s preferred inflation gauge is expected to exhibit nascent signs of near-term tariff-led price increases, without pushing back on longer-term easing expectations. Investors expect a 0.3-percent monthly increase in both the headline and core personal consumption expenditure indices, with personal income and spending accelerating a touch relative to the prior month.

Friday’s July non-farm payrolls report is expected to illustrate a moderation in the pace of job creation, but forecasters aren’t looking for a radical downshift in overall employment levels. Private sector job creation has clearly slowed, but jobless claims remain restrained, and a host of factors, including seasonal adjustments, immigration, and local government hiring could keep the headline numbers somewhat elevated. A print above the 150,000 mark, particularly if combined with a decline in the unemployment rate, could push rate cut expectations further out and boost the greenback.