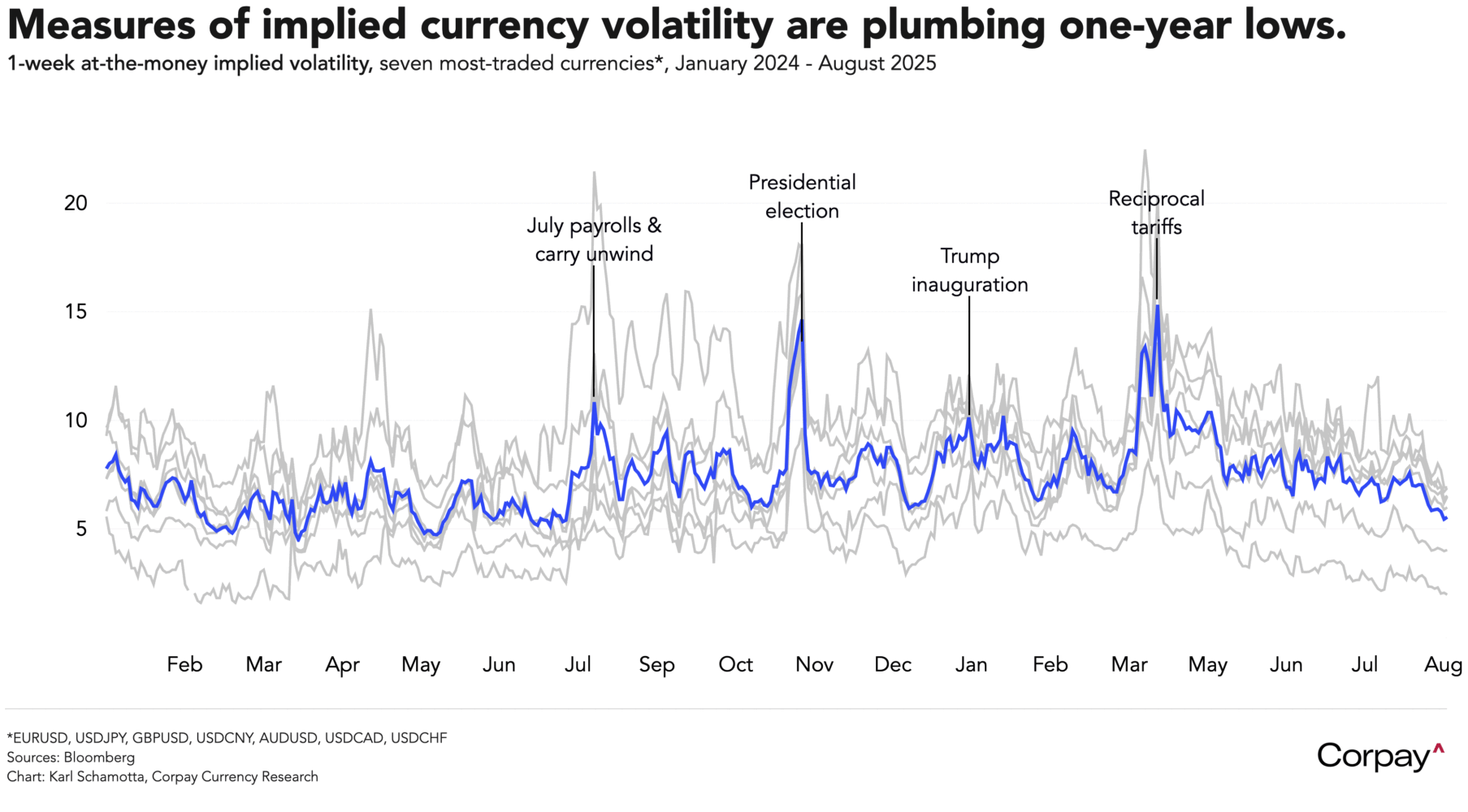

A sense of calm has descended upon global financial markets as the data cadence slows, geopolitical developments settle to a dull roar, and monetary policy expectations stabilise. Benchmark Treasury yields are almost unchanged relative to yesterday’s open, equity futures are pointing to another day of incremental gains, and measures of implied currency volatility remain low—even across short-term tenors that include Friday’s hotly-anticipated speech from Federal Reserve chair Jerome Powell.

Here in Canada, inflation pressures subsided more than expected last month, slightly raising the likelihood of a rate cut in early 2026. Data released by Statistics Canada this morning showed the headline consumer price index climbing 1.7 percent on a year-over-year basis in July, undershooting market forecasts in decelerating from the 1.9 percent increase recorded in June, and rising just 0.1 percent in month-over-month terms. Gasoline prices fell 16 percent from a year prior as the removal of the federal government’s carbon tax flattered comparisons. Core inflation—which strips out food and energy prices—and is computed as the average of the two price measures now preferred by the Bank of Canada (trim and median), increased 3.05 percent over the same period last year, up from 3.00 percent in the prior month. On a three-month average, underlying price pressures eased however, and the number of categories generating above-target inflation fell from the previous print.

The Canadian dollar is slipping lower as swaps traders anticipate more monetary easing over the next year, but front-end moves could prove limited, given that another report is set to land on the day prior to the Bank of Canada’s September meeting. We suspect that markets will eventually price in a return to the Bank’s rate cutting cycle as growth risks re-emerge, and think that downward pressure could be exerted on the loonie as that plays out—but we also don’t expect the effect to prove terribly durable, given that the full impact of this year’s turn toward isolationism has yet to impact the US economy. The loonie could move lower in the short run, but seems poised for gains by early next year as rate differentials narrow in its favour.

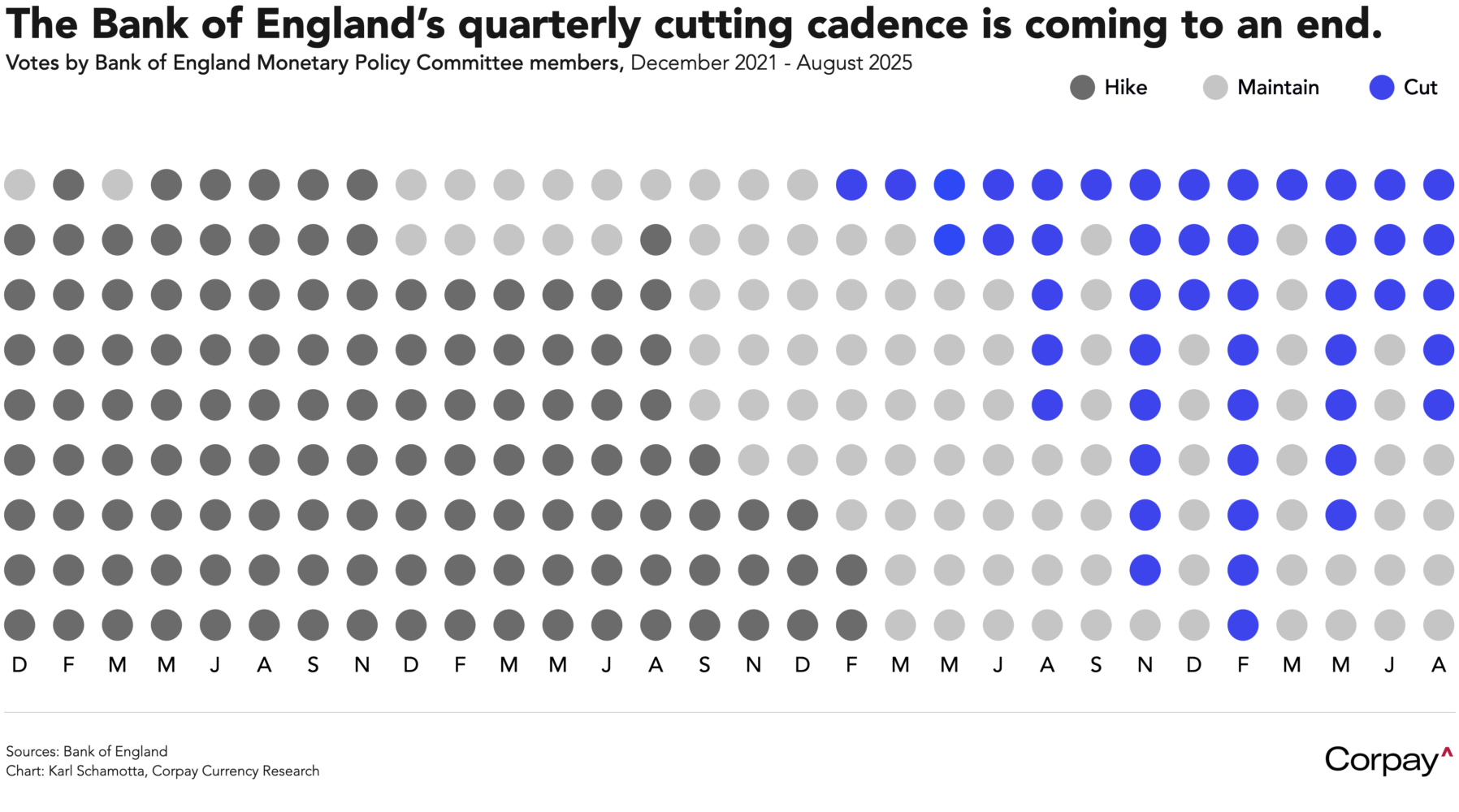

Across the pond, traders will be keeping a close eye on tomorrow’s UK inflation update after the early August Bank of England meeting resulted in an unexpectedly hawkish rate cut. Economists think headline consumer price growth accelerated slightly to 3.7 percent year-over-year in July, up from 3.6 percent in the prior month, and services inflation—watched closely by monetary policymakers as a measure of underlying price pressure—is also seen speeding up, hitting 4.8 percent after printing at 4.7 percent in June.

Inflation has been running at much higher levels than in the US or the euro area over the last year, and central bank officials are growing less confident in the need for further easing. On the 7th, members of the Monetary Policy Committee voted by an unusually-tight 5-4 margin to lower policy rates to 4 percent, and raised inflation forecasts to show price growth holding above target for most of the next two years, forcing traders to sharply downgrade the likelihood of another rate cut before year end. Swap market participants now have just a single move priced in over the next year, down from the two expected at the beginning of August, and the pound has climbed back above the 1.35 threshold on an improvement in rate differentials.

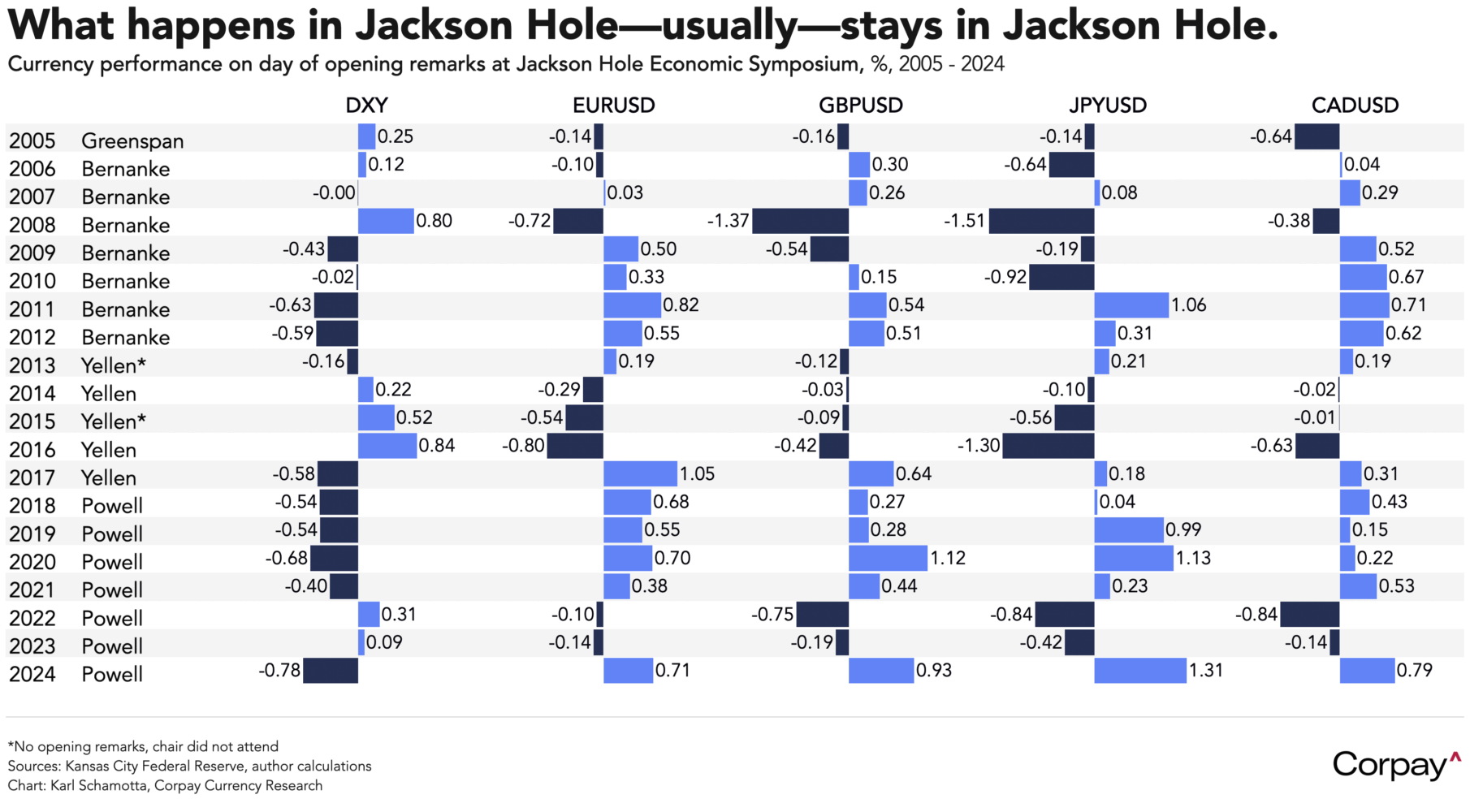

Tomorrow’s Fed minutes could help set the stage for Friday’s appearance from Jerome Powell, with investors poised to examine late July’s meeting record of evidence of disagreement on labour market conditions, the outlook for inflation, and the likely course of policy. If the balance of opinion has clearly shifted toward a preventative course of rate cuts, traders will double down on expectations for a move at the September meeting, depressing yields across the policy-sensitive end of the curve and pushing the dollar lower. Alternatively, if a steadfastly-cautious stance from the centrists on the committee is on display, some firming in rates and the greenback could play out over the back half of the week.

As outlined in yesterday’s note, we expect a less hawkish message from the chair, but don’t think economic conditions yet support a dramatic pivot into dovish territory. Powell may instead follow in the footsteps of many of his predecessors in offering a relatively anodyne outlook before focusing on the Fed’s framework review—which could have deeper long-term implications but might stop short of providing market participants with a tradeable narrative in the near term. Against this backdrop, risks to the dollar are slightly skewed to the upside from a tactical standpoint, but moves should be on the smaller end of the historical distribution.