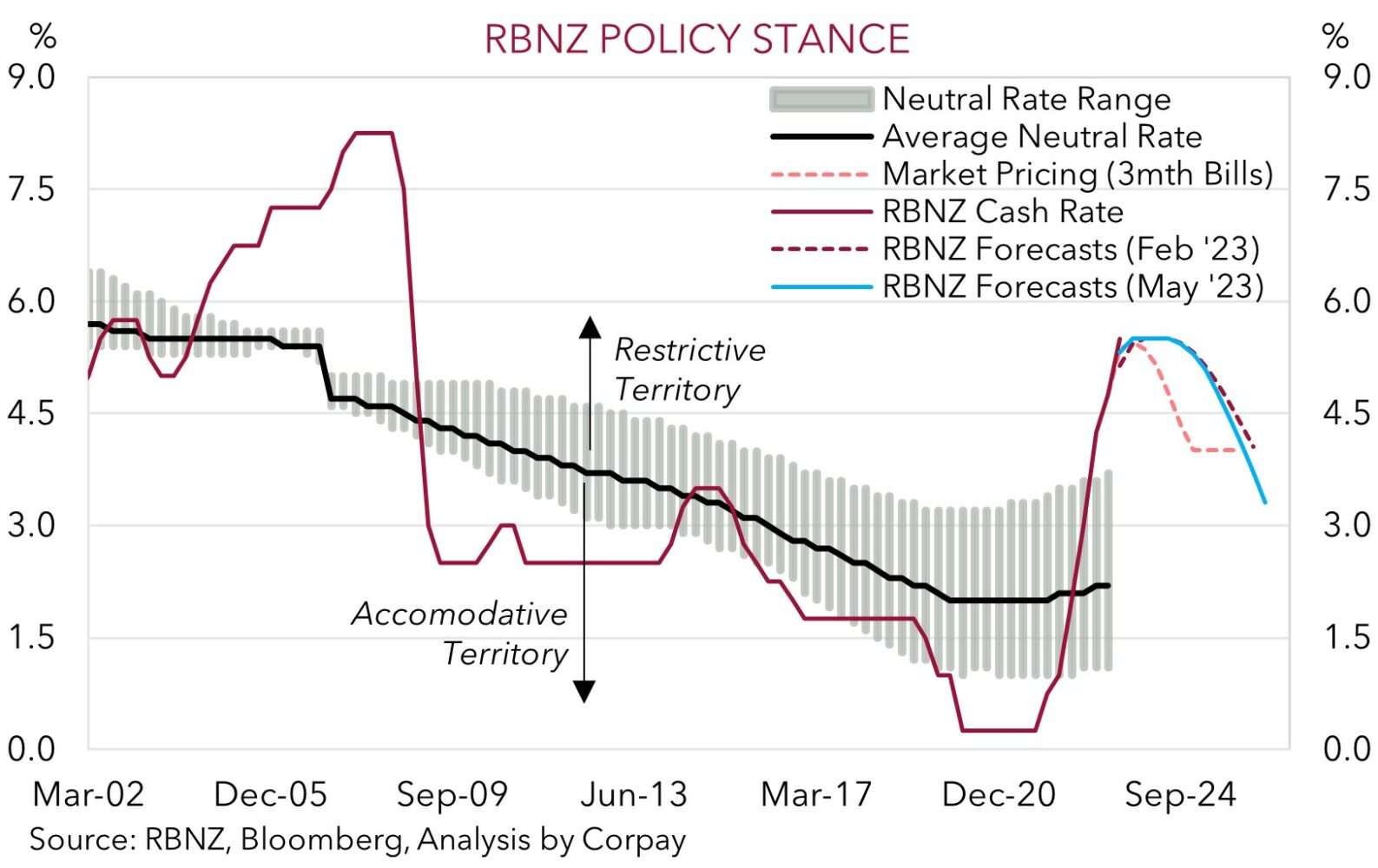

At its May 2023 meeting the RBNZ looks to have delivered its last interest rate hike for this cycle. The 25bp move, which was predicted by most market analysts, takes the Official Cash Rate up to 5.5%, a high since late-2008. And as the chart below shows, following the very abrupt tightening phase which started in NZ in October 2021, interest rates are now well into ‘restrictive’ territory (i.e. above the estimated equilibrium neutral rate). According to the RBNZ rates will need to “remain at a restrictive level for the foreseeable future” to ensure inflation (now 6.7%pa) returns to the 1-3% target band.

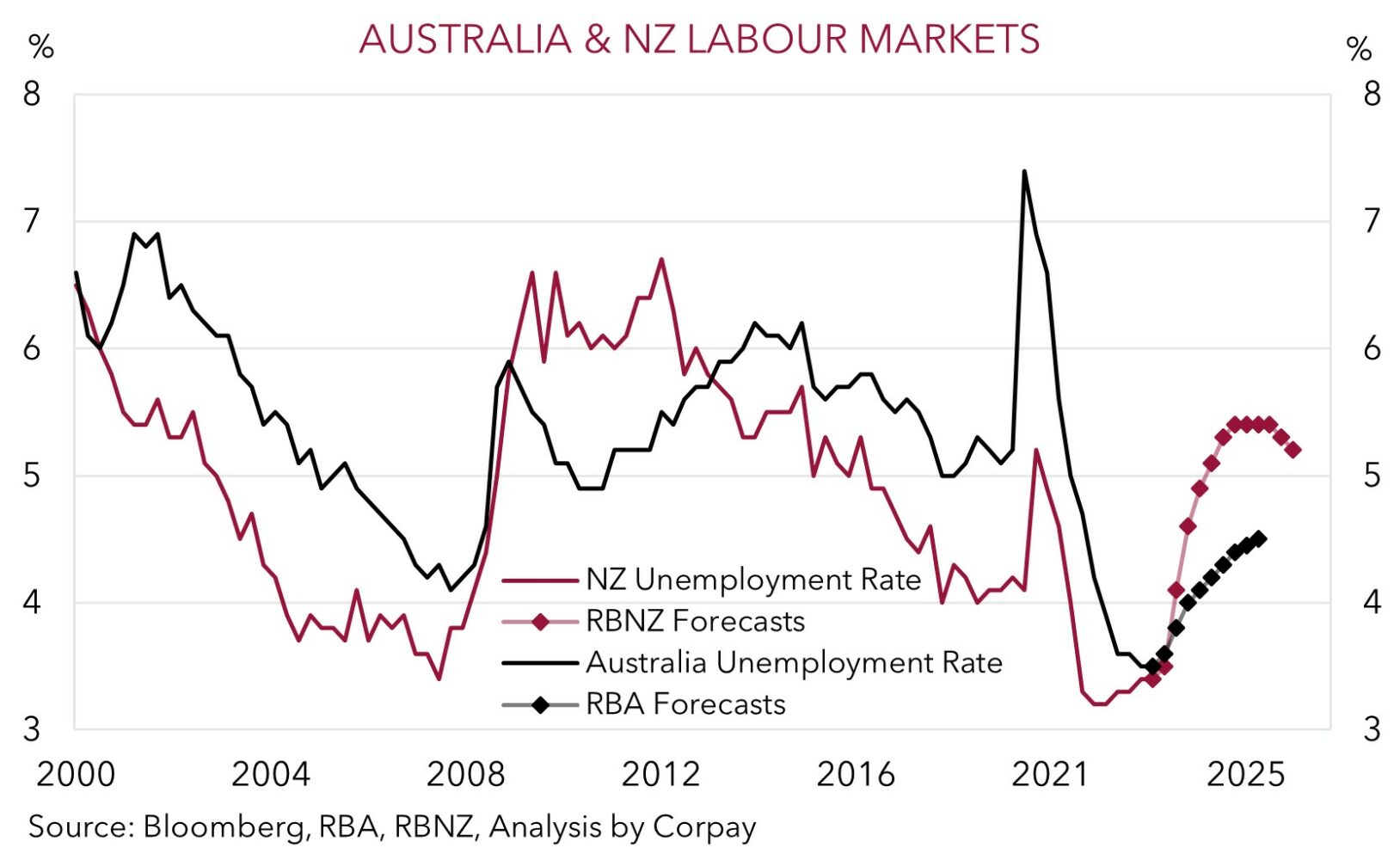

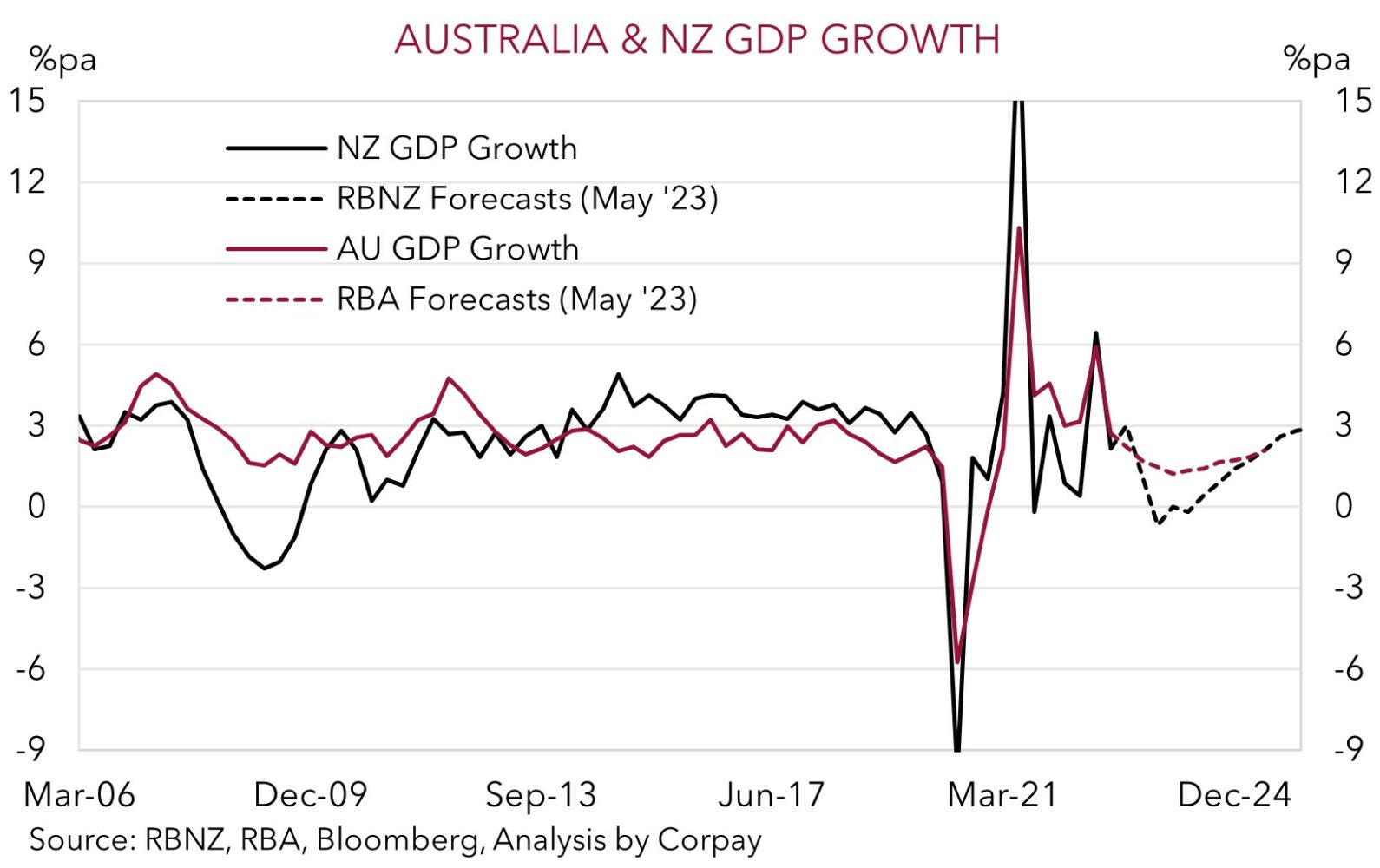

Things have started to move in the right direction, but the falls in inflation aren’t expected to be quick, and there is likely to be quite a bit of (required) economic pain along the way. The RBNZ is projecting inflation to get back to the middle of its target band in Q3 2025. But this is also due to the substantial hit to growth and the labour market that such high interest rates are forecast to generate. Unlike some of its peers, the RBNZ remains quite honest in its assessment, with a NZ recession still anticipated over 2023 and very weak activity on the cards in 2024. This extended period of sub-trend growth should flow through to the labour market over time (NZ unemployment is projected to rise from 3.4% to 5.4% by end-2024) and inflation.

We think the unfolding slowdown across the NZ economy is likely to be more pronounced than what the RBNZ is penciling in. Such high/restrictive interest rates should substantially constrain spending by households and curtail business investment. Indeed, below average business confidence, the downturn across the NZ housing market, and contraction in NZ retail sales volumes over the past few quarters indicates that the jump up in interest rates has already been biting quite hard. These trends should intensify over time, in our view, and when macro amplifiers such as high debt levels and rising unemployment kick in the negative effects could quickly become non-linear. The RBNZ is assuming that interest rates remain at current levels for a while before an easing cycle starts in Q3/Q4 2024, with the OCR falling back down at ~3.3% by mid-2026. We believe the risks reside with the rate cuts starting sooner and coming through more quickly than the RBNZ is factoring in.

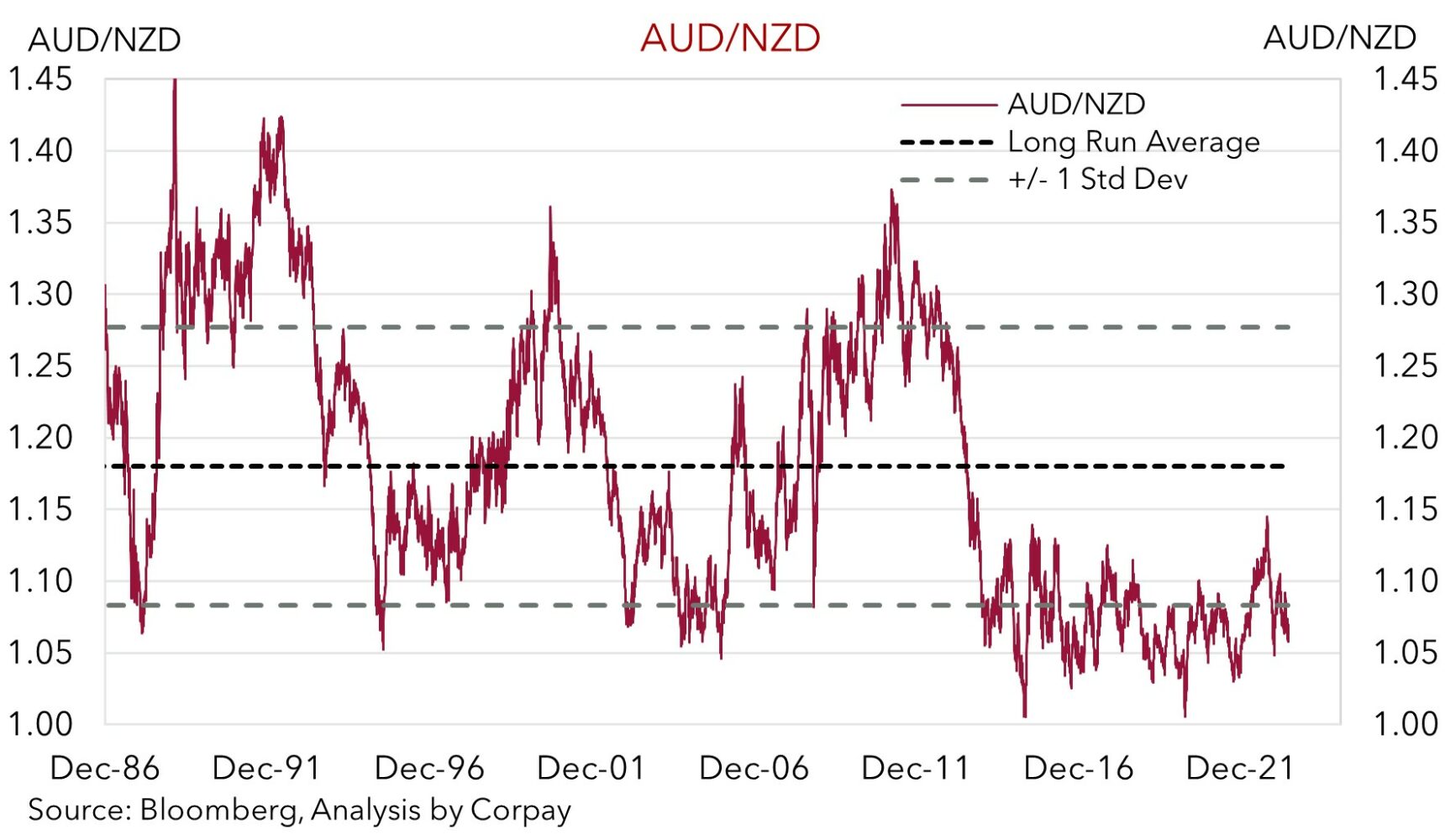

In the wake of the RBNZ’s ‘dovish’ hike, and thoughts that the policy ‘peak’ has been reached, the NZD fell by ~1.3%. AUD/NZD has also spiked back up towards ~1.07 as relative interest rate differentials shifted against the NZD. While it is likely to be a bumpy road, we continue to see AUD/NZD trending higher over the medium-term.

Importantly, we remain of the opinion that once tightening phases are over (as it now looks like it is in NZ), FX markets should begin to focus more on other relative differentials such as growth, labour market trends, current account positions, and commodity prices. On these broader metrics, we judge that the AUD should outperform the NZD over the period ahead. In contrast to NZ’s large current account deficit (now ~9% of GDP) Australia runs a current account surplus (~1% of GDP). Australia’s more favourable balance of payments position should be relatively supportive for the AUD during periods of market turbulence. Moreover, the RBNZ’s earlier and more aggressive actions, when compared to the RBA, point a larger negative impact on the NZ economy and labour market. Unemployment swings have historically provided a guide to medium-term AUD/NZD direction, with a relatively lower Australian unemployment rate typically a backdrop where the AUD outperforms the NZD.

Added to that, statistically AUD/NZD is also tracking in somewhat rarefied air. AUD/NZD’s long run average is ~$1.18, and since the mid-1980s it has only traded below current levels ~12% of the time. As broader macro trends garner more attention, and if they move against NZ like we envisage and the RBNZ’s next rate cutting cycle comes closer into view, we expect AUD/NZD to push higher as 2023 rolls on.