• Mixed markets. US equities fell back with higher bond yields & jitters about the autoworkers strike weighing on sentiment. USD & AUD consolidated.

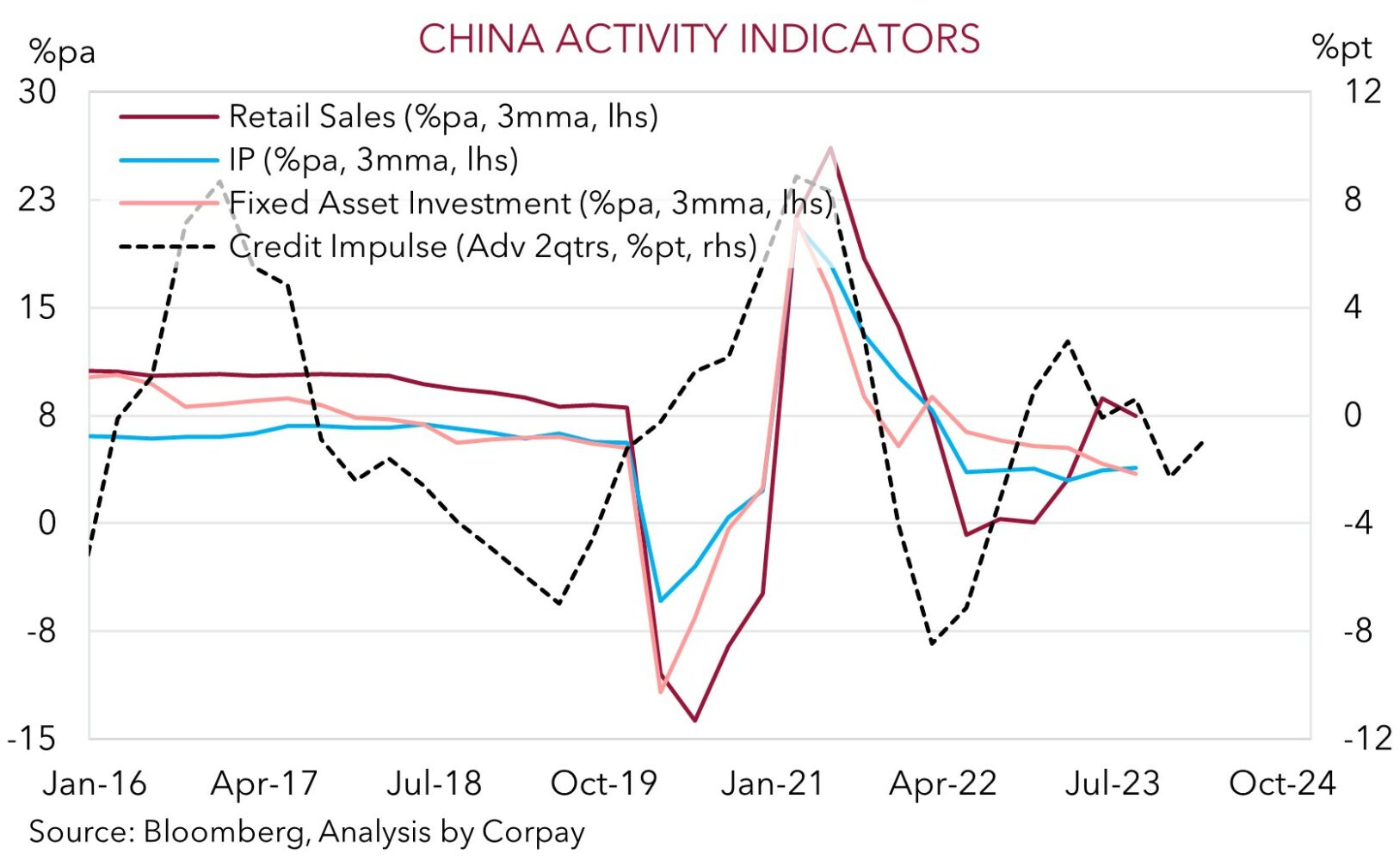

• China data. The China activity data was generally better than expected. This supports our thinking that growth momentum could be bottoming out.

• Event calendar. US Fed (Thurs morning AEST), BoE (Thurs AEST), & BoJ (Fri AEST) decisions in the spotlight. European/US PMIs (Fri) also in focus.

Mixed fortunes across asset classes and regions on Friday. In contrast to the lift by most major Asian and European stock markets, US equities fell back, led by the tech-sector (NASDAQ -1.6%). The boost to investor sentiment from better-than-predicted data out of China (see below) unwound on the back of indications of weak demand from Taiwan’s TSMC (the world’s top chipmaker), higher bond yields, and confirmation of a strike by US autoworkers. Approximately 13,000 members of the US automobile workers (UAW) are striking against 3 carmakers. While this is only a fraction of total US employment (~156mn people are employed in the US), the strike may generate volatility for production and jobs data, drag on Q3 US GDP growth, and if it lasts long enough, create upward pressure on vehicle prices and inflation.

US 10yr bond yields rose ~5bps to 4.33%, although a rebound in Europe also played a role (German and UK 10yrs increased ~8bps). The lift in German bond yields more than unwound the previous days drop, with a news article indicating that some ECB members want to keep the door open to another rate hike by year-end if the data warrants it raising doubts that the tightening cycle is over. FX markets were relatively more sedate. The USD Index consolidated with EUR hovering near ~$1.0665 and USD/JPY inching up towards ~147.80. By contrast, GBP has continued to ease and is now tracking under ~$1.24 for the first time since late-May. AUD has remained range bound (now ~$0.6437).

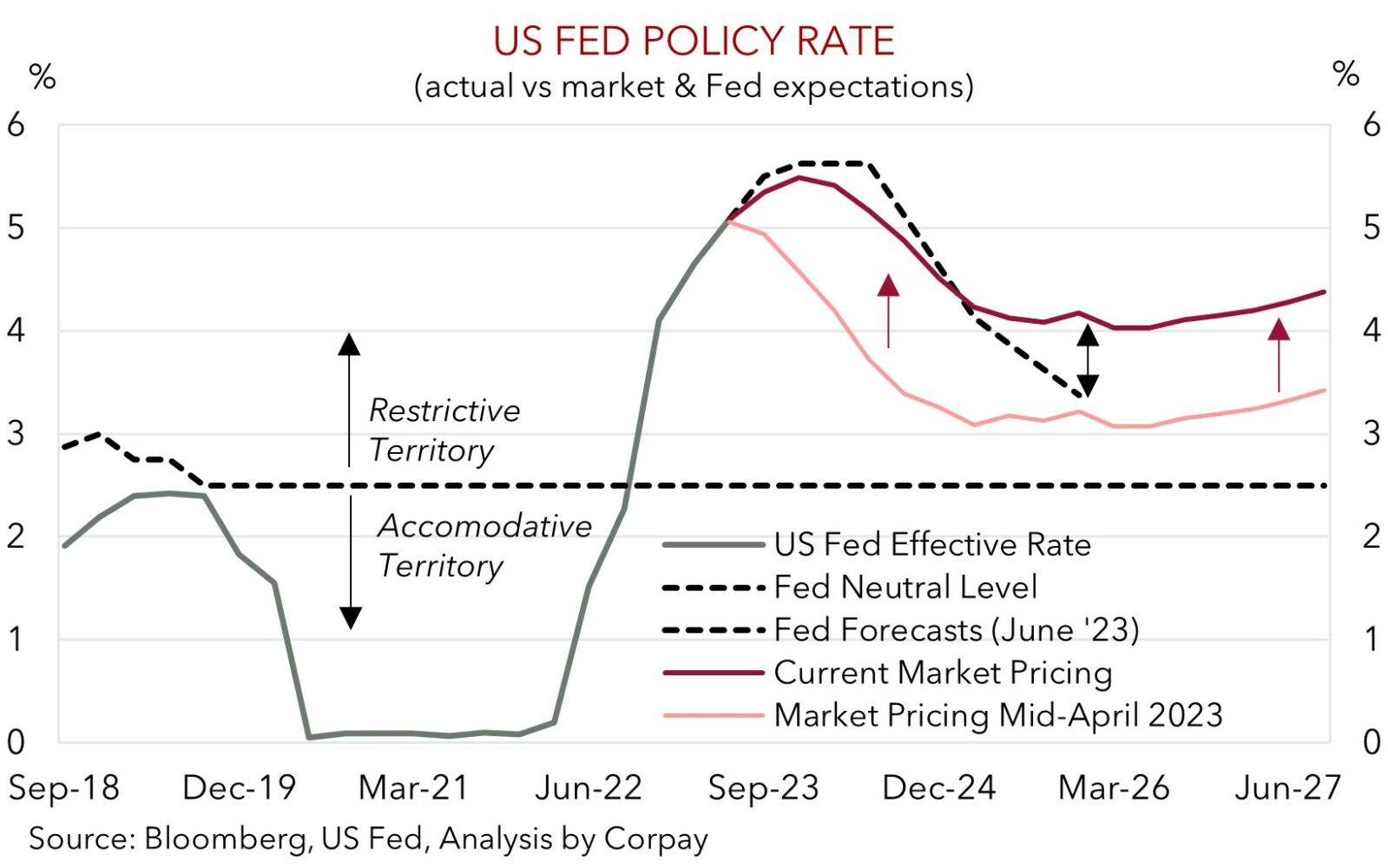

Central bank decisions will be in focus later this week with the US Fed announcement and press conference (Thurs 4am and 4:30am AEST), and outcomes of the Bank of England (Thurs 9pm AEST), and Bank of Japan (Friday AEST) meetings in focus. That said, only the BoE is likely to move, though another 25bp hike this week is nearly ~90% priced in. Indeed, we think GBP could continue to weaken if the BoE delivers another rate rise but signals settings are now restrictive and that future decisions may be data dependent. The US Fed is widely expected to keep rates steady this week, with attention on the forward guidance and updated forecasts. As per its recent rhetoric, we believe the Fed may reiterate it could hike again near-term, but this will depend on incoming data, and that rates look set to remain at high levels for some time to help bring down inflation. But as our chart shows, a ‘higher for longer’ view now looks well discounted, with the market already more ‘hawkish’ than the Fed. As such, we think the USD could lose a bit of ground if the Fed doesn’t deviate from its recent script, particularly if the BoJ also starts to lay the foundations for further policy tweaks down the track and/or the European PMI data (released Fri) improves.

Global event radar: US Fed Meeting (Thurs), Bank of England Meeting (Thurs), Bank of Japan Meeting (Fri), Eurozone/US PMIs (Fri), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD corner

The AUD whipped around a little at the end of last week, trading in a ~0.8% range, but on net it is little changed compared to this time Friday (now ~$0.6437) with the USD consolidating (see above). On the crosses, the AUD has been mixed with some modest falls against the EUR (-0.2% to 0.6038) and CNH (-0.2% to 4.6847) offset by a slight uptick versus the JPY (+0.2%), GBP, and NZD (both +0.1%). AUD/NZD is back above 1.09 for the first time since late-July, though we think that after its positive run it could dip back this week if Q2 NZ GDP shows the economy returned to growth (released Thursday AEST). We see upside risks to consensus forecasts for NZ Q2 GDP (mkt +0.4%qoq).

The China activity data released on Friday was generally better than expected. Industrial production growth quickened more than anticipated (+4.5%pa vs mkt 3.9%pa), a positive sign for commodity demand. Retail sales were also stronger (+4.6%pa, vs mkt 3%pa), and the decline in property investment was a touch less than predicted. In our opinion, the data provides more evidence that growth momentum in China may be bottoming out. And with policymakers in China continuing to push through more supportive stimulus measures the outlook is improving. We believe this should be a positive impulse for the AUD over the medium-term, and supports our thinking that the AUD can higher from its current low levels over the back end of 2023 and early-2024 (see Market Musings: AUD: Always darkest before the dawn).

This week the local economic calendar is quite limited with only the minutes of the early-September ‘on hold’ RBA meeting released (Tues). We expect the minutes to repeat the RBA’s mild conditional tightening bias. Offshore, the US Fed (Thurs morning AEST), BoE (Thursday night AEST), and BoJ (Friday AEST) decisions will be in the spotlight. With the US Fed set to remain on hold markets will be focusing on the forward guidance and latest economic projections. As discussed above, while we believe the US Fed may repeat that it could hike rates again, and that its 2024 interest rates forecasts may be slightly upgraded, markets (and the USD) look to have already baked that it. Outcomes relative to expectations drive markets. And with this in mind, should the US Fed reiterate it current message we feel that the USD could give back some ground, supporting the AUD, particularly if the Eurozone PMI data lifts and/or the BoJ opens the door to further policy normalisation over the period ahead.

AUD event radar: US Fed Meeting (Thurs), Bank of England Meeting (Thurs), Bank of Japan Meeting (Fri), Eurozone/US PMIs (Fri), AU CPI (27th Sep), AU Retail Sales (28th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

AUD levels to watch (support / resistance): 0.6320, 0.6360 / 0.6547, 0.6615

SGD corner

USD/SGD consolidated on Friday with the pair tracking near ~1.3630. This was inline with the broader USD move (see above). On the crosses, in contrast to the rebound in European bond yields, EUR and EUR/SGD (now ~1.4542) only ticked up modestly. SGD/JPY (now ~108.45) also nudged up towards the top of its historic range.

As outlined above, central banks will be in focus later this week with the US Fed (Thursday morning), BoE (Thursday night), and BoJ (Friday) decisions handed down in a 24hr window. While the US Fed is widely anticipated to keep rates on hold this week, most analysts also expect the Fed to reiterate that rates could rise again and that settings will need to stay ‘restrictive’ for an extended period. However, we think this outlook is now quite well priced into the rates markets and the USD. In our view, a repeat of this message by the US Fed, coupled with some improvement in the European PMIs (Friday) and/or signals from the BoJ that it may adjust its settings sooner than people assume, could see the USD (and USD/SGD) ease back.

SGD event radar: US Fed Meeting (Thurs), Bank of England Meeting (Thurs), Bank of Japan Meeting (Fri), Eurozone/US PMIs (Fri), Singapore CPI (25th Sep), Eurozone CPI (29th Sep), China PMIs (30th Sep).

SGD levels to watch (support / resistance): 1.3402, 1.3465 / 1.3690, 1.3711