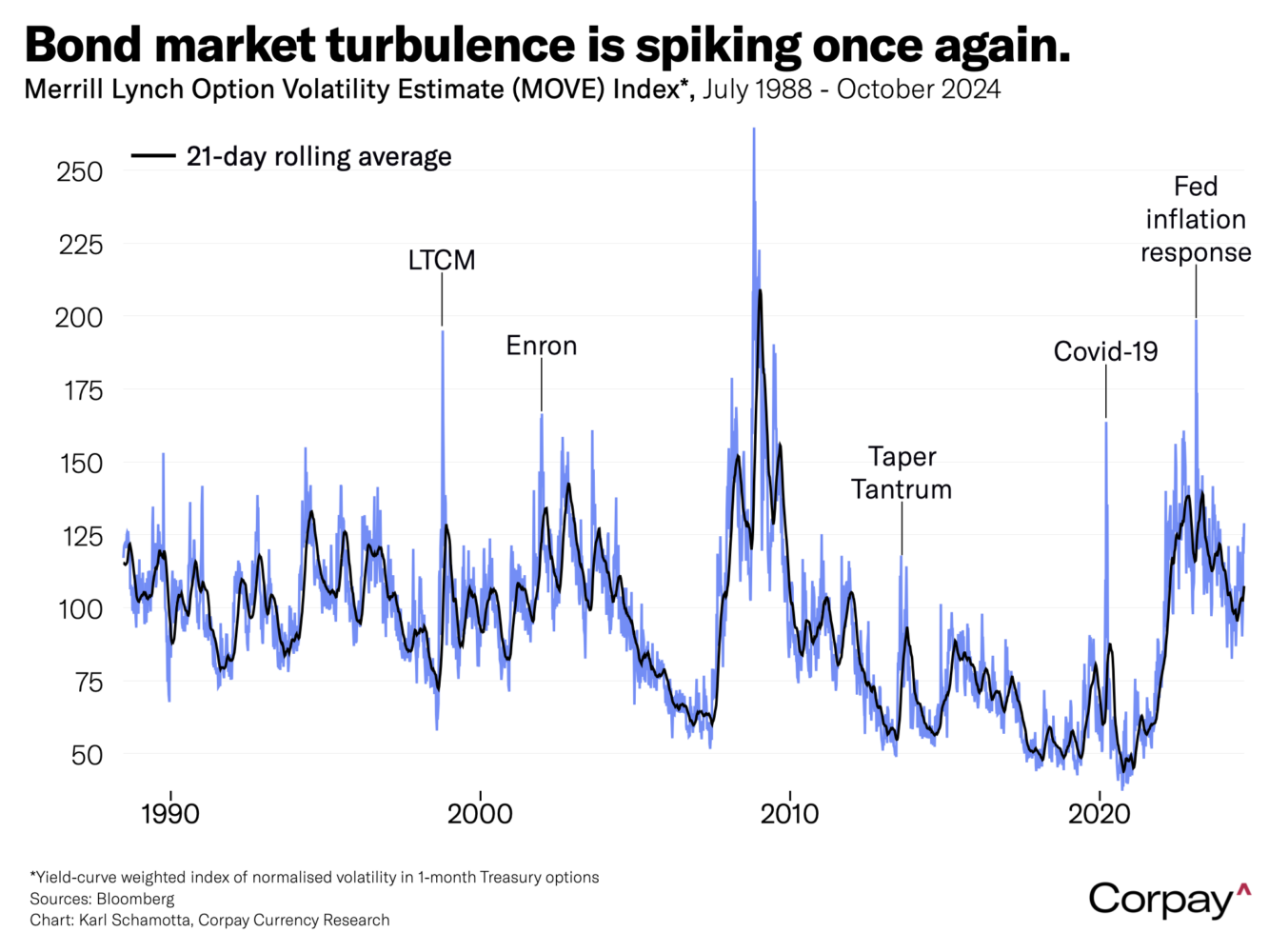

Bond markets continue to puke like the cast of Family Guy after drinking Ipecac*. The ten-year US Treasury yield is holding above the 4.2-percent threshold this morning – up from 3.6 percent in mid-September – after a violent bond selloff during yesterday’s session, and a widely-watched measure of Treasury yield volatility – the MOVE index – is pushing higher as traders brace for more turbulence.

Currency markets are reacting accordingly. The dollar is outperforming most of its major rivals, keeping the euro and pound stuck near recent lows as rate differentials tilt in America’s favour. The yield-sensitive yen is coming under sustained selling pressure, with a decisive break above the 150 level looking increasingly likely in the coming days.

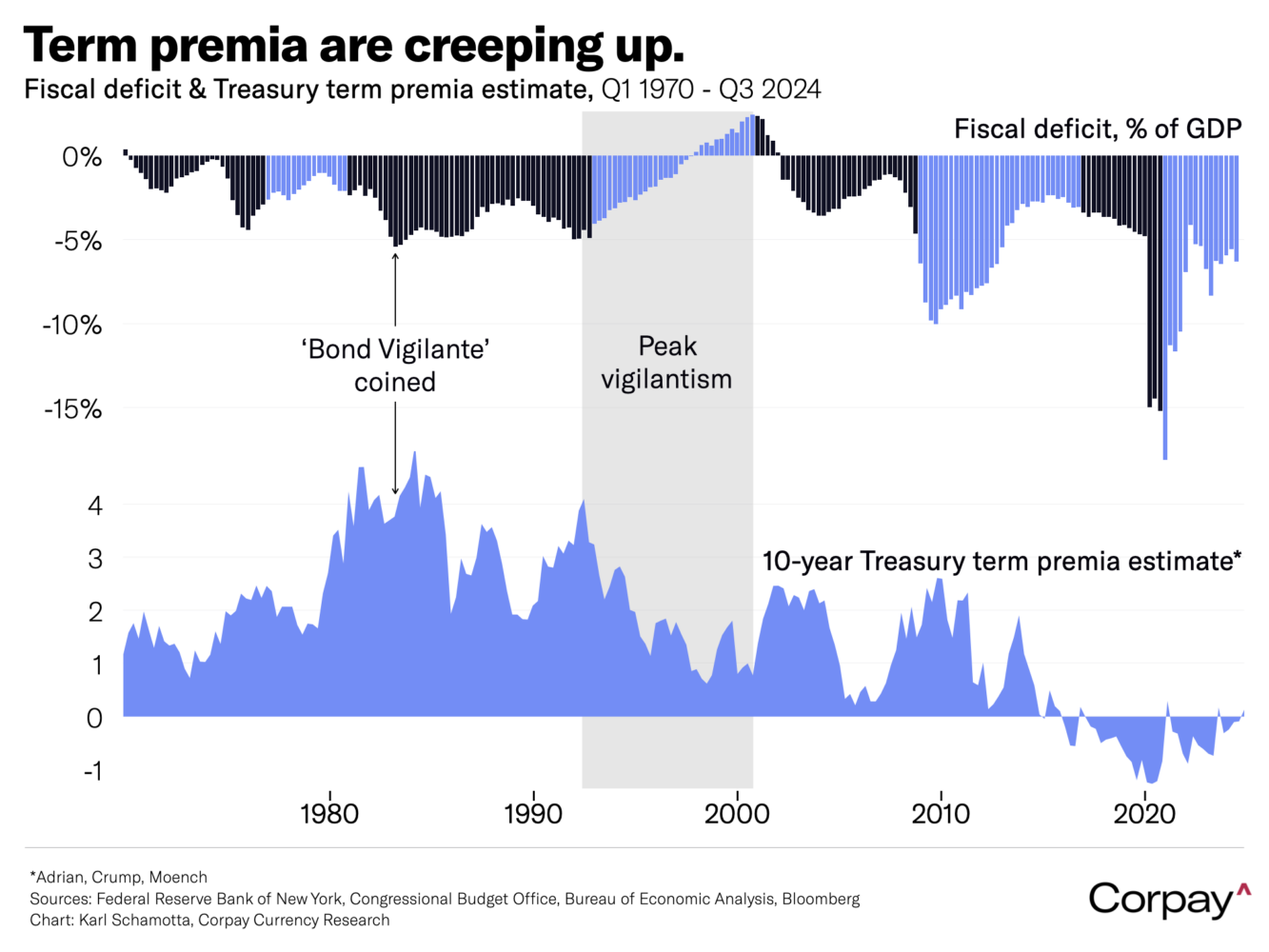

The ‘bond vigilantes’ could be back. With odds on a Republican sweep climbing ahead of the upcoming US election, a number of pundits have suggested that players in the fixed-income markets are seeking to impose fiscal discipline on the incoming administration. The term premium** is rising, suggesting that we might be seeing a repeat of the dynamic in play during the early Clinton years – when repeated spikes in borrowing costs forced the government to expand the tax base and cut spending, prompting Democratic strategist James Carville to say: “I used to think that if there was reincarnation, I wanted to come back as the President or the Pope or as a .400 baseball hitter. But now I would want to come back as the bond market. You can intimidate everybody.”

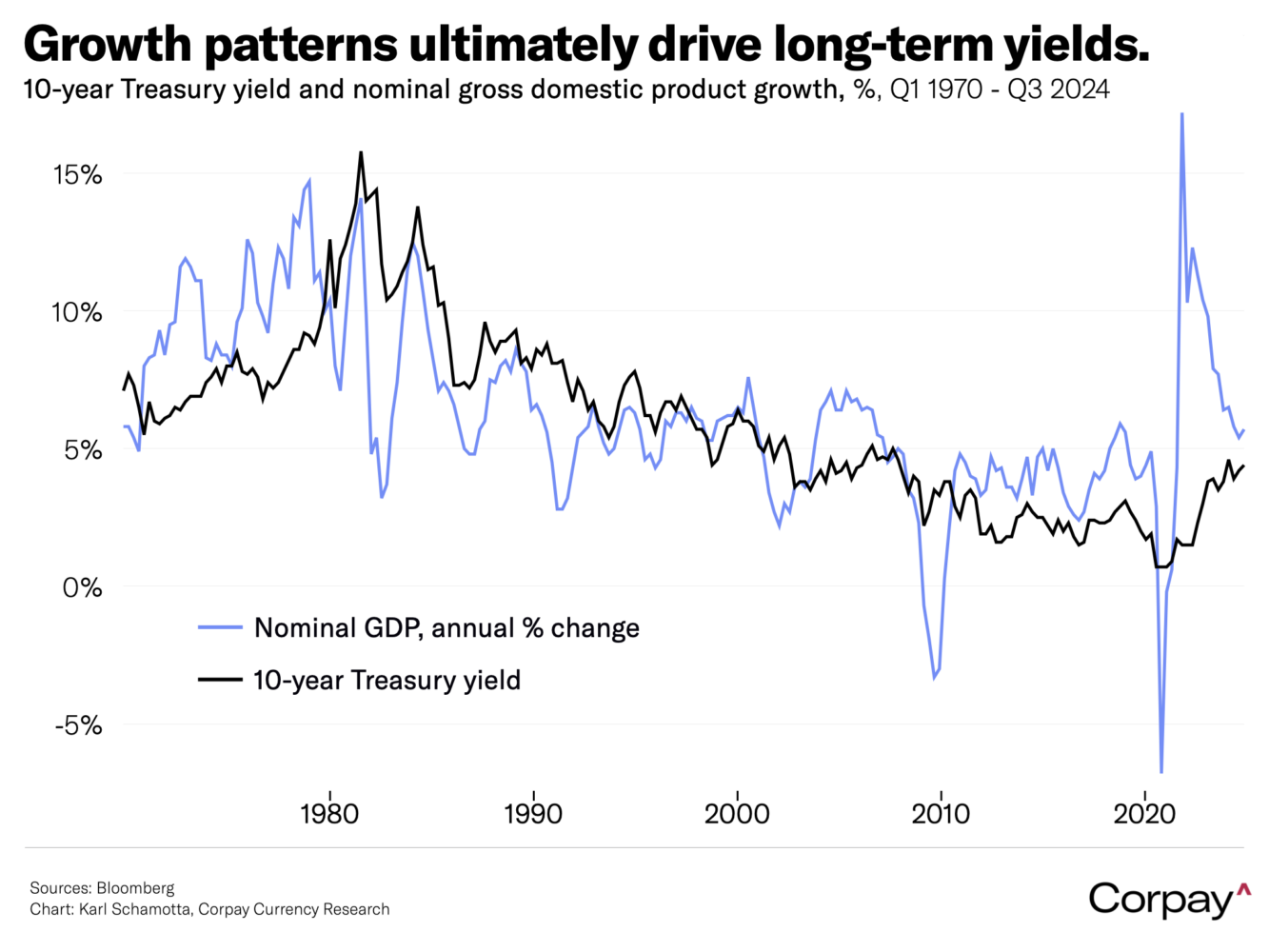

But this might – again – be overblown. Bond markets will undoubtedly eventually baulk in the face of ever-growing US borrowing, but the long-term relationship between yields and nominal gross domestic product growth suggests that investors are mostly reacting to an upward revision in underlying economic momentum and an upward move in future neutral rate*** expectations, not to the possibility of a “buyer’s strike” in Treasury markets.

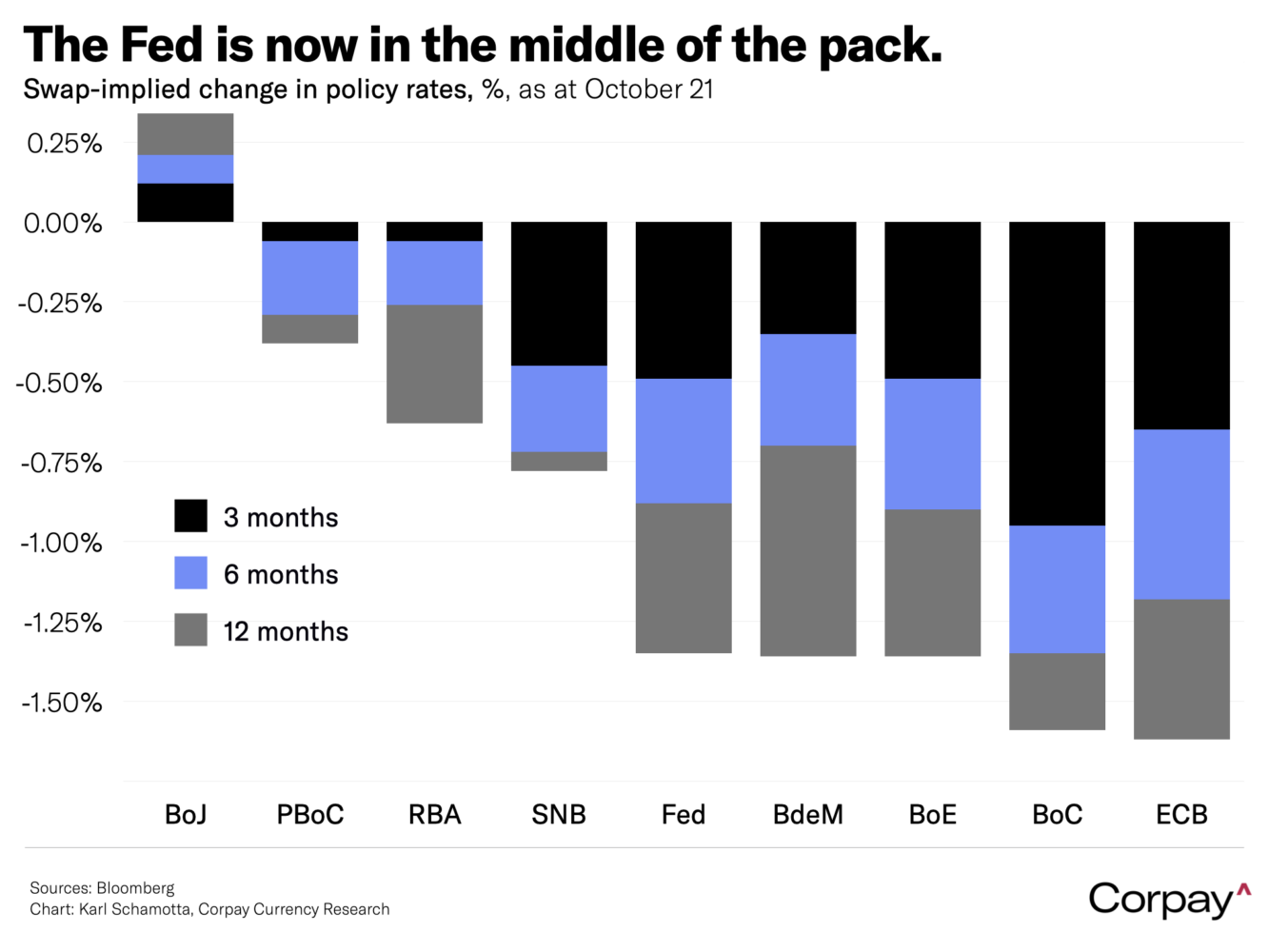

And shifting Fed expectations are clearly a driving force. According to Bloomberg, Dallas Fed President Lorie Logan yesterday argued that “a strategy of gradually lowering the policy rate toward a more normal or neutral level can help manage the risks and achieve our goals,” Minneapolis’s Neel Kashkari said he is “forecasting some more modest cuts over the next several quarters to get to something around neutral, and Kansas City’s Jeff Schmid warned markets against expecting more September-style easing, saying he wants to “avoid outsized moves, especially given uncertainty over the eventual destination of policy”. US central bankers are now expected to cut rates by 127 basis points over the next year, below the Bank of England’s 133, less than the Bank of Canada’s 154, and well short of the European Central Bank’s 157.

The Canadian dollar is trading near the bottom of its recent trading range as the gap between US and Canadian yields widens ahead of tomorrow’s central bank decision. The Bank of Canada is widely expected to respond to signs of underlying economic weakness, persistent disinflationary pressures, and the Federal Reserve’s precedent by delivering its own jumbo-sized rate cut, and traders have placed 30-percent odds on another one in December. We think an outsized move at tomorrow’s meeting is the most likely outcome, but would caution hedgers that an upside Canadian dollar surprise is possible, particularly if policymakers take a more hopeful view on the economic outlook in the accompanying Monetary Policy Report.

Broadly speaking, it is difficult to see the greenback’s recent strength reversing ahead of the US vote. But a repeat of 2016’s post-election surge is becoming less likely by the day as market pricing converges with any reasonable trajectory for inflation and interest rates under a Republican-dominated government in the years ahead – and as outlined in last week’s webinar, there are good reasons to suspect that the proposed policy mix could slow US growth just as it shocks policymakers in other countries into taking more decisive action on the fiscal front. The dollar could still shock market participants by slipping from the upper right corner of the “dollar smile”**** toward the bottom before year end.

*The Family Guy scene can be found here (warning, this may be disturbing to anyone without children or dogs).

**The term premium measures the additional compensation that investors demand for bearing the risk that interest rates may change over the life of a bond. More simply, it is the amount by which the yield on a long-term bond is greater than the yield on a series of shorter-term bonds.

***The ‘neutral rate” is the theoretical rate at which monetary policy is neither contractionary nor expansionary. It tends to rise during periods of strong economic growth and high productivity, and to fall during prolonged periods of underperformance.

****The “dollar smile” is best described here.