The US dollar is trading with a consolidative bias this morning, advancing steadily against its major rivals ahead of this week’s thinly-populated data calendar. Treasury yields are up, North American equity futures are positioned for a healthy open, and oil prices are inching higher on a ratcheting up in geopolitical tensions in the Middle East.

Markets are becoming more focused on the risks associated with the upcoming US presidential election. Option prices are beginning to ratchet up around the polling date, trade-sensitive currencies are softening, and ten-year Treasury yields are moving higher at a steady pace, with many market participants expecting a rebound above the 5-percent threshold in the coming months.

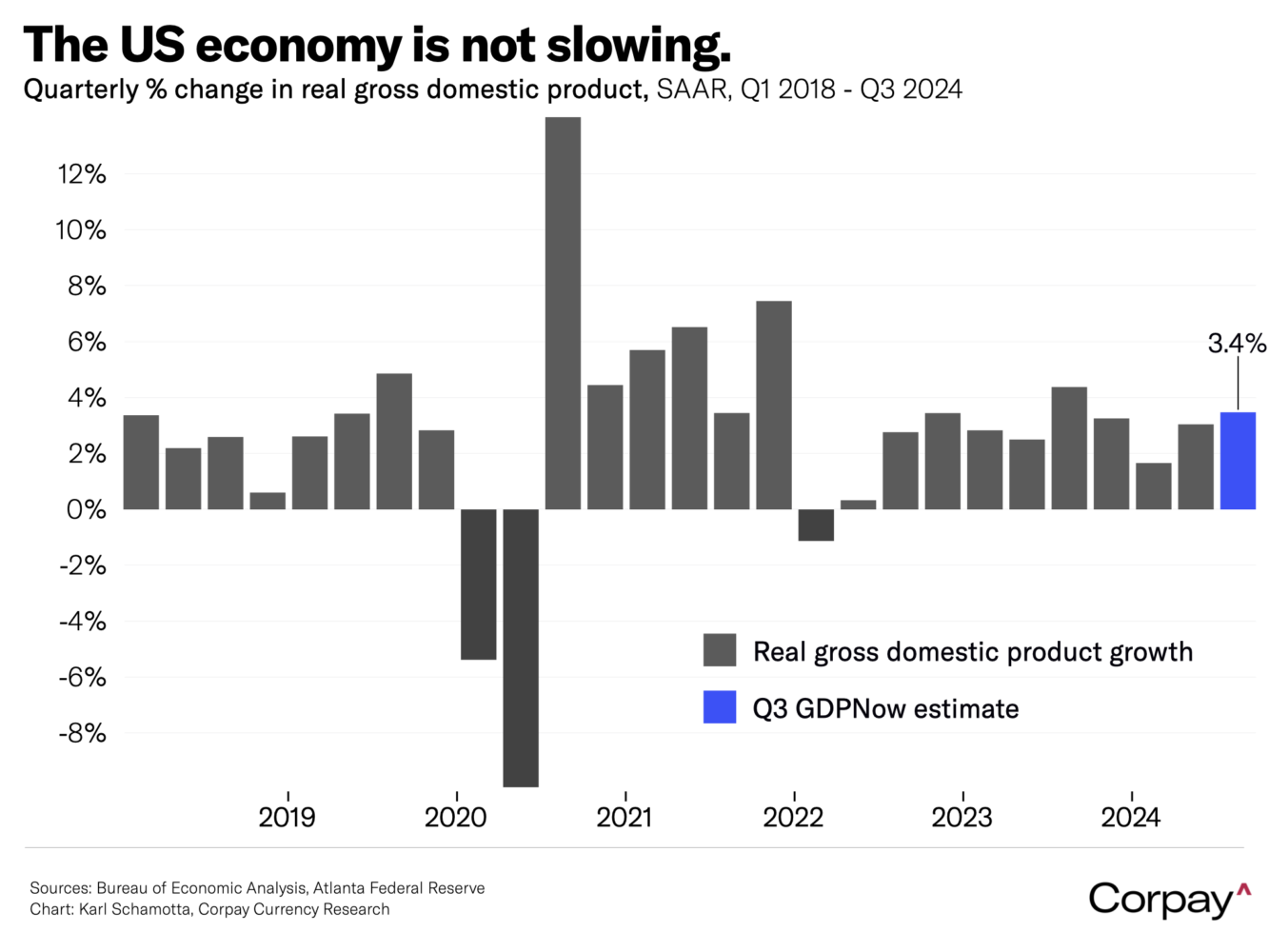

But amid all the political noise, it is mostly the American economy’s outperformance that is driving the dollar higher. A series of data releases last week – especially September’s extraordinarily-strong retail sales report – have led to an upward revision in growth expectations, with the Atlanta Fed’s GDPNow forecasting model now estimating a third-quarter expansion nearing the 3.4-percent mark – well above consensus forecasts from a few months ago.

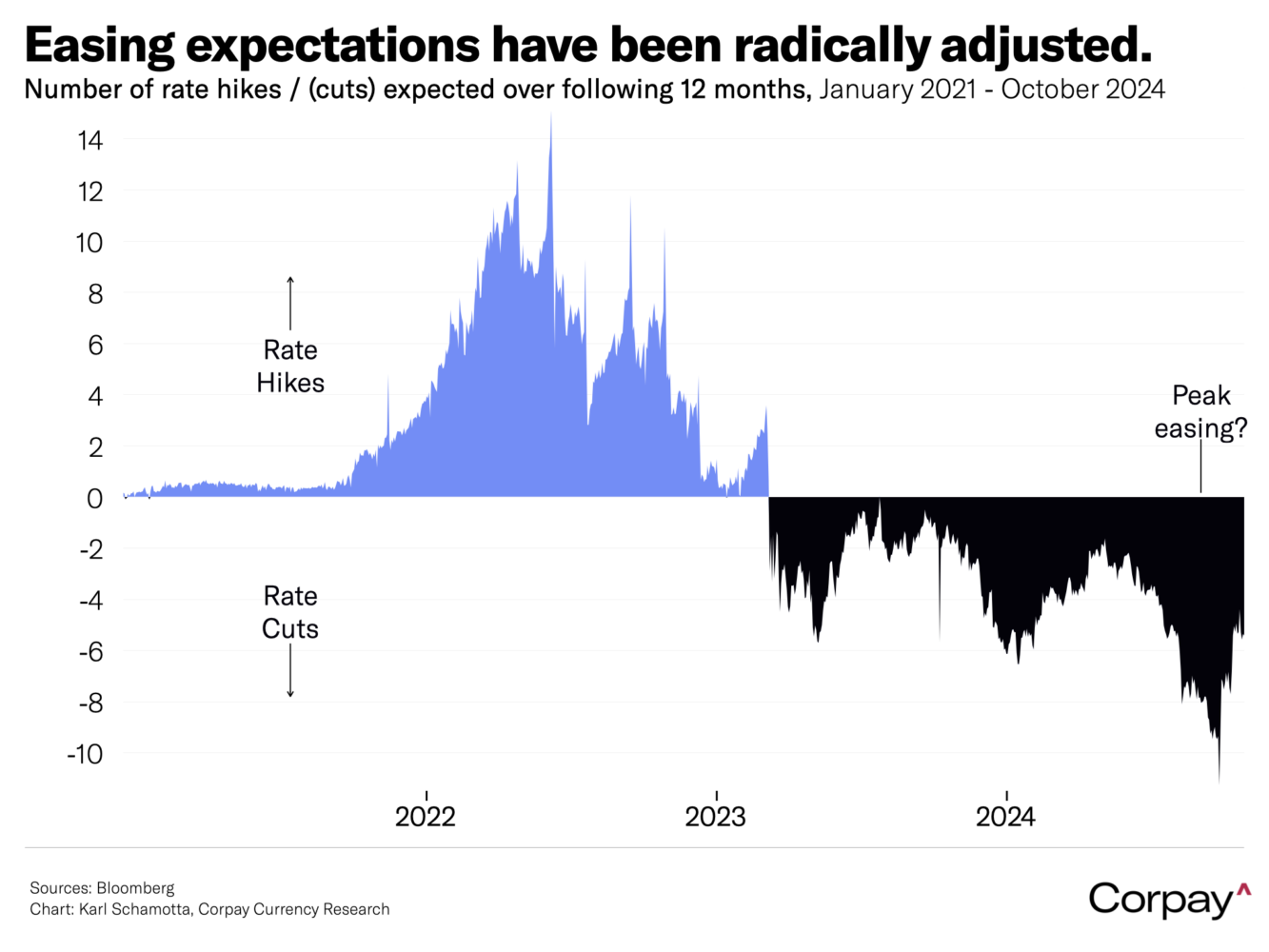

Expectations for an aggressive easing campaign have plunged since the Fed’s September meeting, helping tilt interest rate differentials back toward the dollar. Futures markets are now anticipating less than 6 rate cuts over the next year, down dramatically from just three weeks ago, when at least 8 moves were priced in.

This seems unlikely to change materially in the week ahead. Wednesday’s Beige Book survey will be scarred by the impact of Hurricanes Helene and Milton, but unaffected states could report stable activity. Thursday’s weekly jobless claims report will also be heavily distorted, meaning that market participants should be well-prepared for a jump in applications. And Friday’s durable goods report might show demand held up in September even as businesses expressed uncertainty ahead of November’s presidential election. Corporate earnings releases should keep risk appetite well-supported.

Against this backdrop, other major currencies will struggle to make headway. The euro – already on the defensive after the European Central Bank cut rates and lowered inflation forecasts last week – looks vulnerable to speculative attack as traders focus on growth risks and brace for more trade friction with the US. The pound looks more fairly valued, but is also vulnerable to downside risk if the economy continues to lose momentum, depressing currently-favourable interest differentials. And yen bulls are a largely-extinct breed after last month’s reversal, with weak growth and inflation seen keeping the exchange rate under pressure for now.

This week could be a Worthwhile Canadian Initiative*: most of North America’s key economic event risks are clustered on the northern side of the 49th Parallel, with Wednesday’s central bank decision offering the greatest potential for volatility in the dollar-Canada exchange rate.

The Bank of Canada is overwhelmingly seen delivering a jumbo-sized rate cut, with 49 basis points in easing already priced into overnight index swap markets. The economy is underperforming the Bank’s early-year projections, unemployment continues to grind higher, and inflation is undershooting expectations, making policymakers likely to seize the opportunity afforded by the Fed’s oversized September move to execute one of their own.

Markets are slightly more confident than we are. Growth remains relatively solid if recently-fashionable per-capita calculations aren’t used, spillovers from the powerhouse US economy are still incoming, hiring activity is showing signs of picking up, and recent survey data suggests that household expectations for housing prices are on the rise. A smaller cut – or a 50 basis-point cut coupled with a less-negative growth outlook in the accompanying Monetary Policy Report – remains entirely within the realm of possibility. An upside surprise could provide the impetus for a modest recovery in the Canadian dollar, even if it remains difficult to take a constructive view on the loonie when uncertainty surrounding the US election seems destined to keep growing.

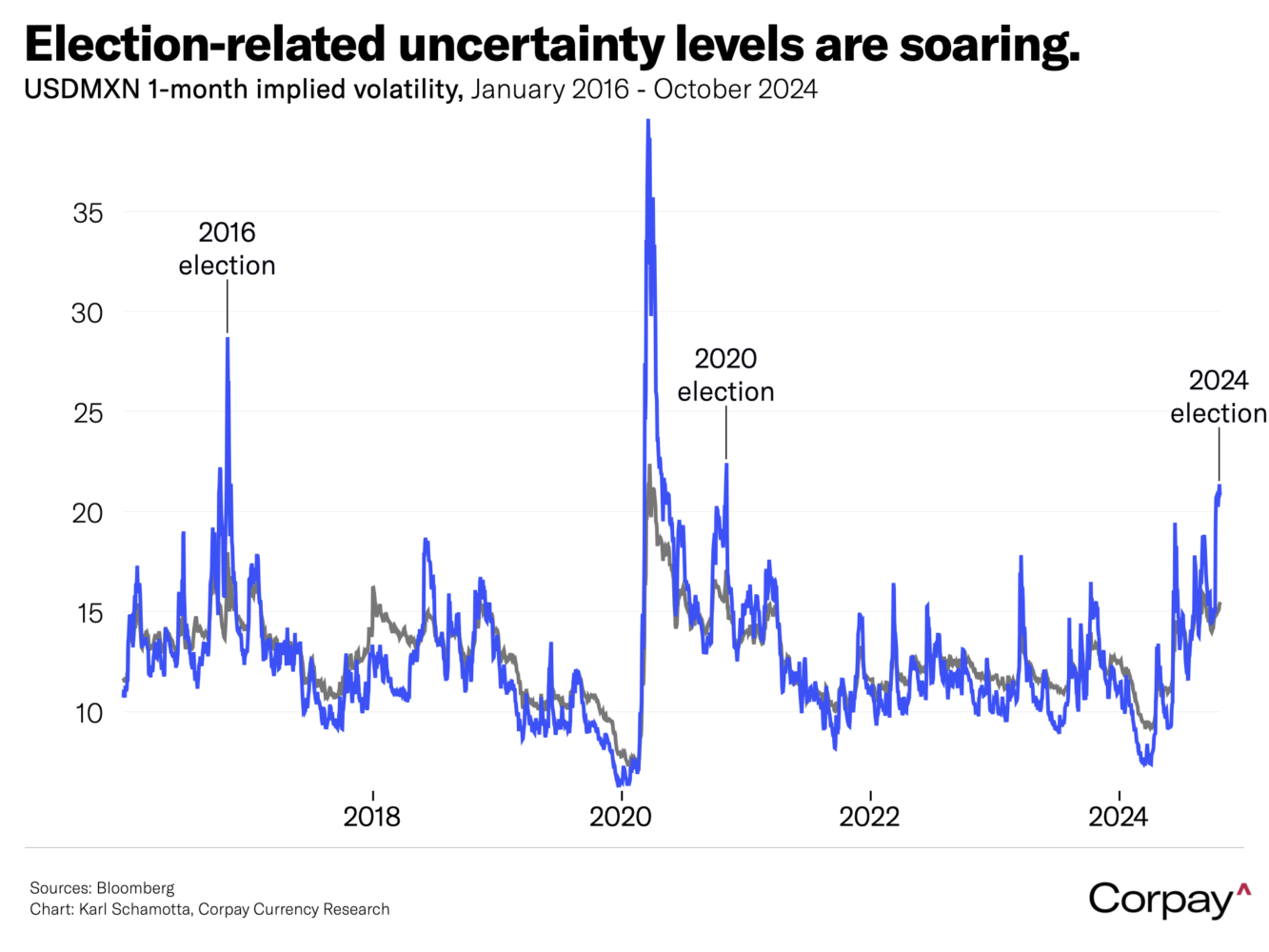

The currency-market locus for the “Trump trade” – the Mexican peso – is showing growing signs of stress. The exchange rate has fallen almost 3 percent in the last week, and one-month implied volatility – a measure of expected swings – has exceeded levels seen after Claudia Sheinbaum’s Morena party achieved a ‘supermajority’ in June’s elections, and is rapidly approaching the peaks hit just prior to the 2016 and 2020 US elections.

Counter-intuitively, this could mean that the peso remains surprisingly stable in the immediate aftermath of a Trump victory. We don’t expect the peso to escape unscathed, but with an election discount already priced in, the Banco de Mexico more likely to hold rates at prevailing levels for longer, and the threat of currency intervention potentially helping put a floor under the exchange rate, the magnitude of any selloff might be smaller than would otherwise be the case. It’s also important to remember that the peso outperformed through most of Trump’s first term, with strong US consumer spending helping support remittances and investment flows into Mexico. A repeat can’t be ruled out.

*In 1986, The New Republic magazine ran a contest to see if anyone could find a more boring headline than “Worthwhile Canadian Initiative” – the title of a piece in the New York Times describing early efforts to build support for what later became the NAFTA agreement. No one succeeded, but in retrospect, other candidates, including “University of Rochester Decides to Keep Name,” “Trade: A Two-Way Street,” and “Prevent Burglary by Locking House, Detectives Urge,” might have been more deserving of ridicule – while also bearing an uncomfortable resemblance to the titles of research notes I’ve had the misfortune to have written.