Financial markets are heaving a sigh of relief after president-elect Donald Trump picked Scott Bessent – a relative moderate and someone with a firm grasp of macroeconomics – to lead the Treasury Department. The hedge fund manager and Soros Fund alumni is seen as someone who might steer the incoming administration’s fiscal and trade policies in a more pragmatic direction, reducing the negative effects of an “America First” approach on other economies. The benchmark ten year Treasury yield is down six basis points from Friday’s close, equity futures are setting up for a strong open, and the dollar is down against all of its major counterparts, excepting the safe-haven Swiss franc.

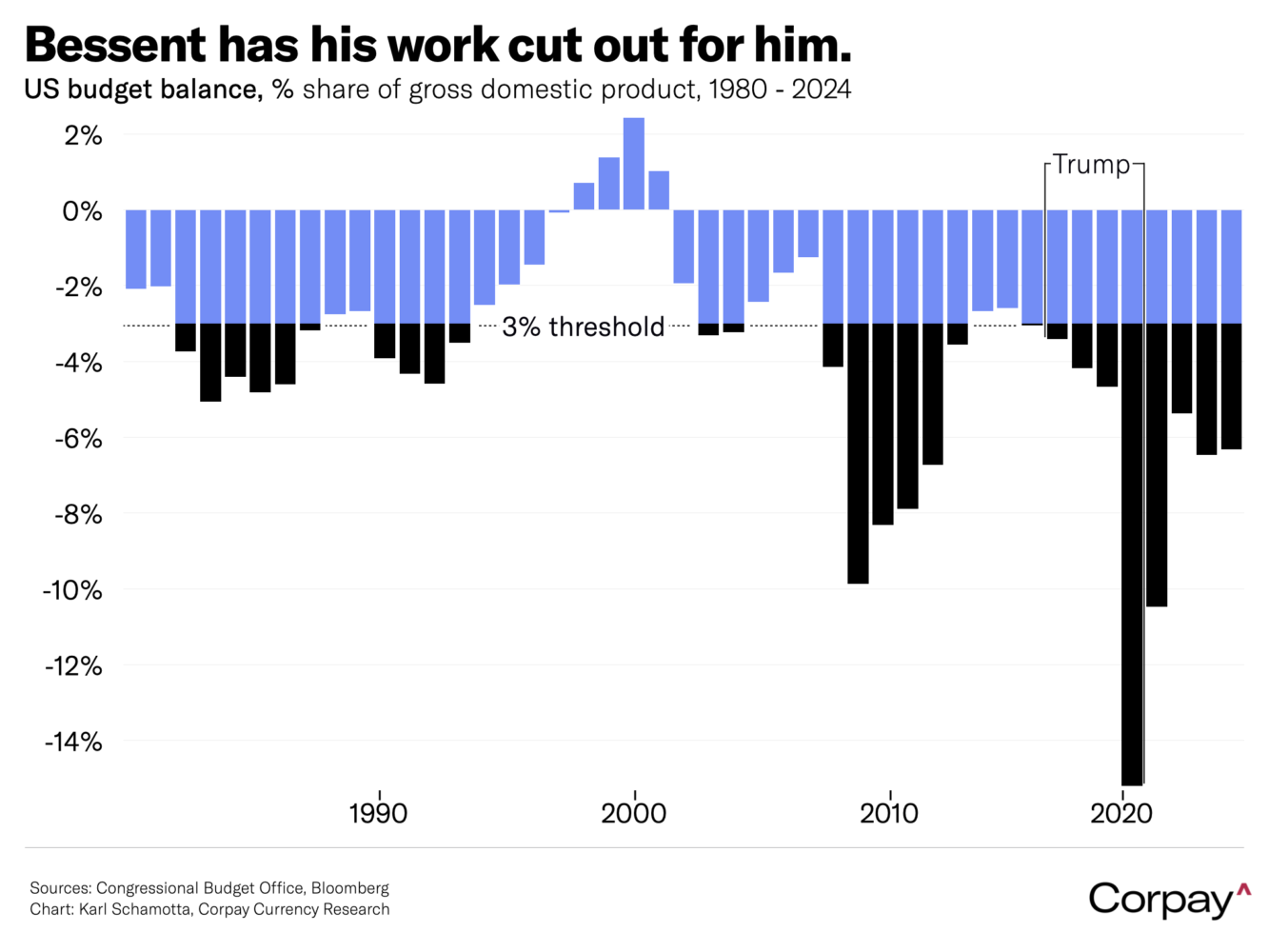

Bessent’s appointment is helping assuage market concerns about the US fiscal position, given that he has often espoused a “3-3-3” plan, under which the government would seek to increase US oil production by 3 million barrels a day, hit a 3-percent growth target, and reduce the budget deficit to less than 3 percent of gross domestic product. We think this correction is justified: talk of an imminent return of the “bond vigilantes” had gotten overwrought in recent weeks, pushing yields beyond levels justified by the change in the economic outlook. But having a relative fiscal hawk in the room is no guarantee of moderation – Trump inherited an economy running a 3-percent deficit in 2016, and proceeded to widen it substantially before the pandemic hit, becoming part of a Republican tradition that goes back to Ronald Reagan, who said, “I am not worried about the deficit. It is big enough to take care of itself”.

With the Thanksgiving holiday set to shut US markets on Thursday, dollar-centric economic event risks are packed into the first three days of the week.

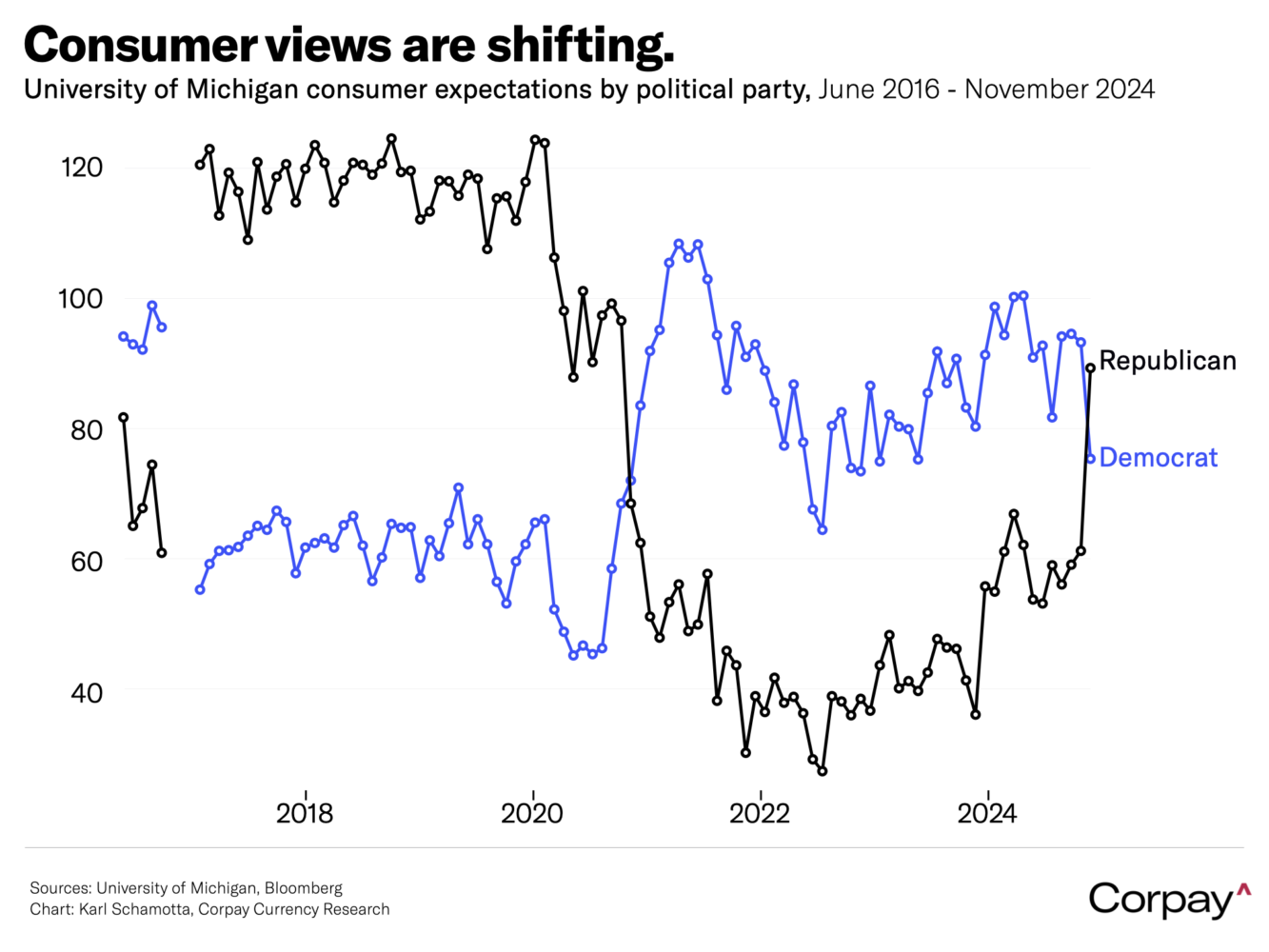

Tomorrow’s Conference Board consumer confidence index should show continued signs of improvement as Trump’s victory reduces uncertainty and unleashes “animal spirits” in the economy. As always, this will be highly skewed by partisanship among respondents: Friday’s consumer sentiment index from the University of Michigan showed Republican expectations soaring to the highest levels in four years, while optimism among Democrats plunged. It is difficult to extract a meaningful trading signal from this: strong spending dynamics in recent years would suggest that what people tell pollsters isn’t necessarily reflective of their actions, and post-election estimates suggest that counties contributing roughly 40 percent of US gross domestic product voted for Trump, while those generating 60 percent opted for Harris.

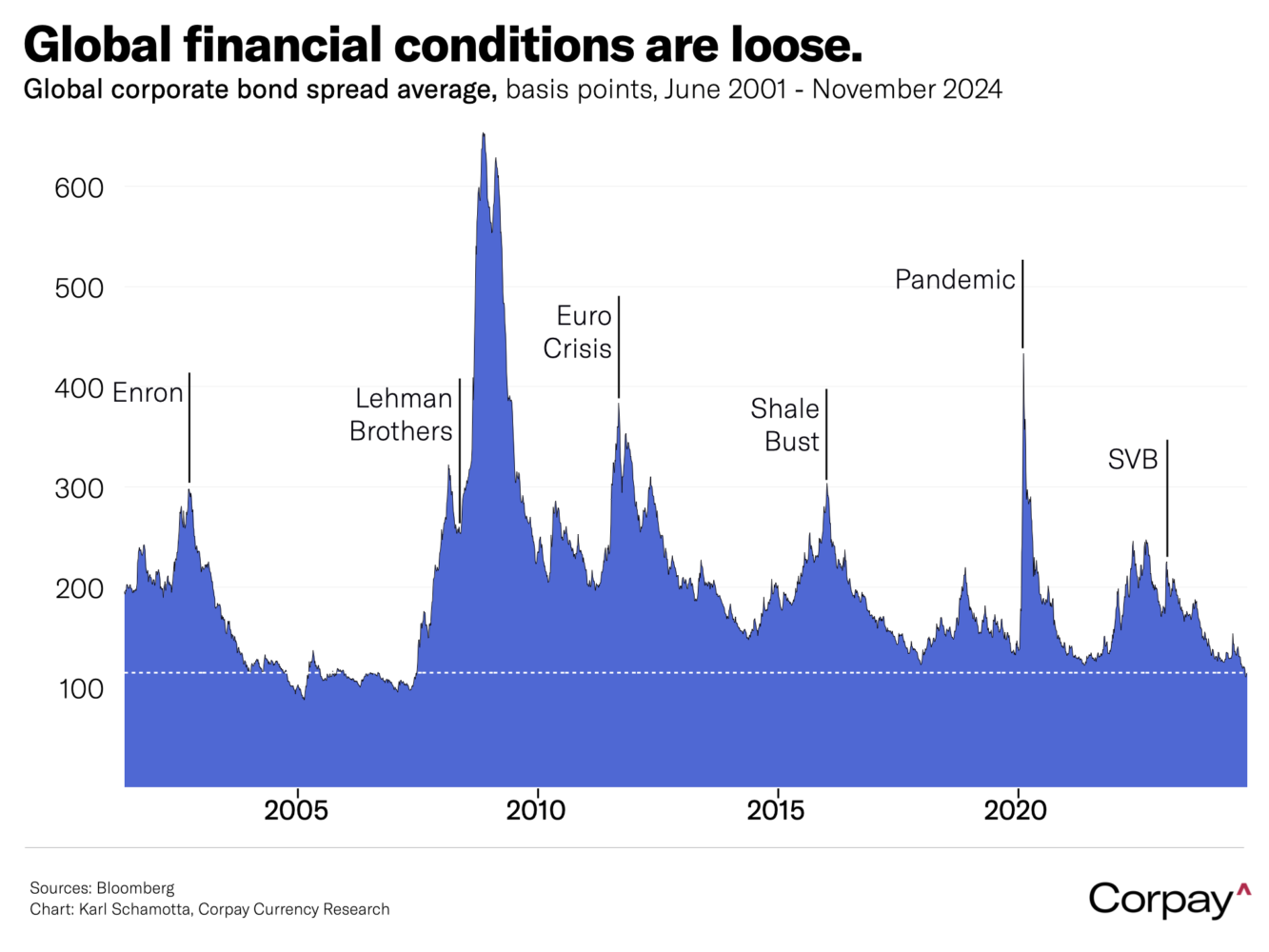

Tomorrow will also see a record of the deliberations during the post-election Federal Reserve meeting released. Fed officials are not in the habit of front-running government policy changes, meaning that the minutes are unlikely to contain any direct acknowledgement of the outcome, with officials instead discussing the extent to which incoming data has proven surprisingly robust. Employment, growth, and inflation numbers are all pointing to an improvement in underlying conditions, financial conditions – as measured using credit spreads – have loosened to levels not seen since the run-up to the global financial crisis in 2008, and policymakers have turned more hawkish in a range of recent appearances. Markets expect the central bank to deliver one rate cut between now and March, implying a pause at either the December or January meetings.

Wednesday’s core personal consumption expenditures deflator could bolster this perspective. The Fed’s preferred inflation measure is expected to rise at a 0.28-percent pace on a month-over-month basis in October, putting upward pressure on a year-over-year print that is already running near the top of the central bank’s target band. Spending and income growth are also seen holding up, keeping a virtuous cycle in the economy running for longer.

Beyond the US, we will be keeping an eye on Friday’s flash inflation estimate for the euro area and Canada’s gross domestic product print.

In the euro area, core consumer prices may have climbed 2.8 percent in the year to November, accelerating from 2.7 percent in the prior month, but base effects likely played a significant role, giving the European Central Bank room to continue easing policy. Although consumer demand in the common currency area remains weak and business investment is soft, there are some signs of a thaw ahead: Friedrich Merz, the leading candidate to become the next German chancellor signalled an openness to loosening the country’s fiscal “debt brake” in comments last week, saying it would depend on how government spending would be allocated. “If the result is that we spend even more money on consumption and social policy, then the answer is no,” he said, but “If the result is that it is important for investment, it is important for progress, it is important for the livelihoods of our children, then the answer may be different.”

The Canadian economy is seen undershooting the Bank of Canada’s expectations, growing at a 1.9-percent annualised pace in the third quarter, and the handoff into the fourth – as shown in Statistics Canada’s advance estimate for October – will be closely scrutinised in light of an apparent acceleration in real estate market activity, household spending, and inflation. When these factors are taken in combination with last week’s stimulus announcement from the federal government, we think the central bank will opt for a quarter point cut in December, foregoing a rapid move toward “neutral” rates in the months ahead as economic risks become more two-sided – but next week’s jobs report could play the clinching role.