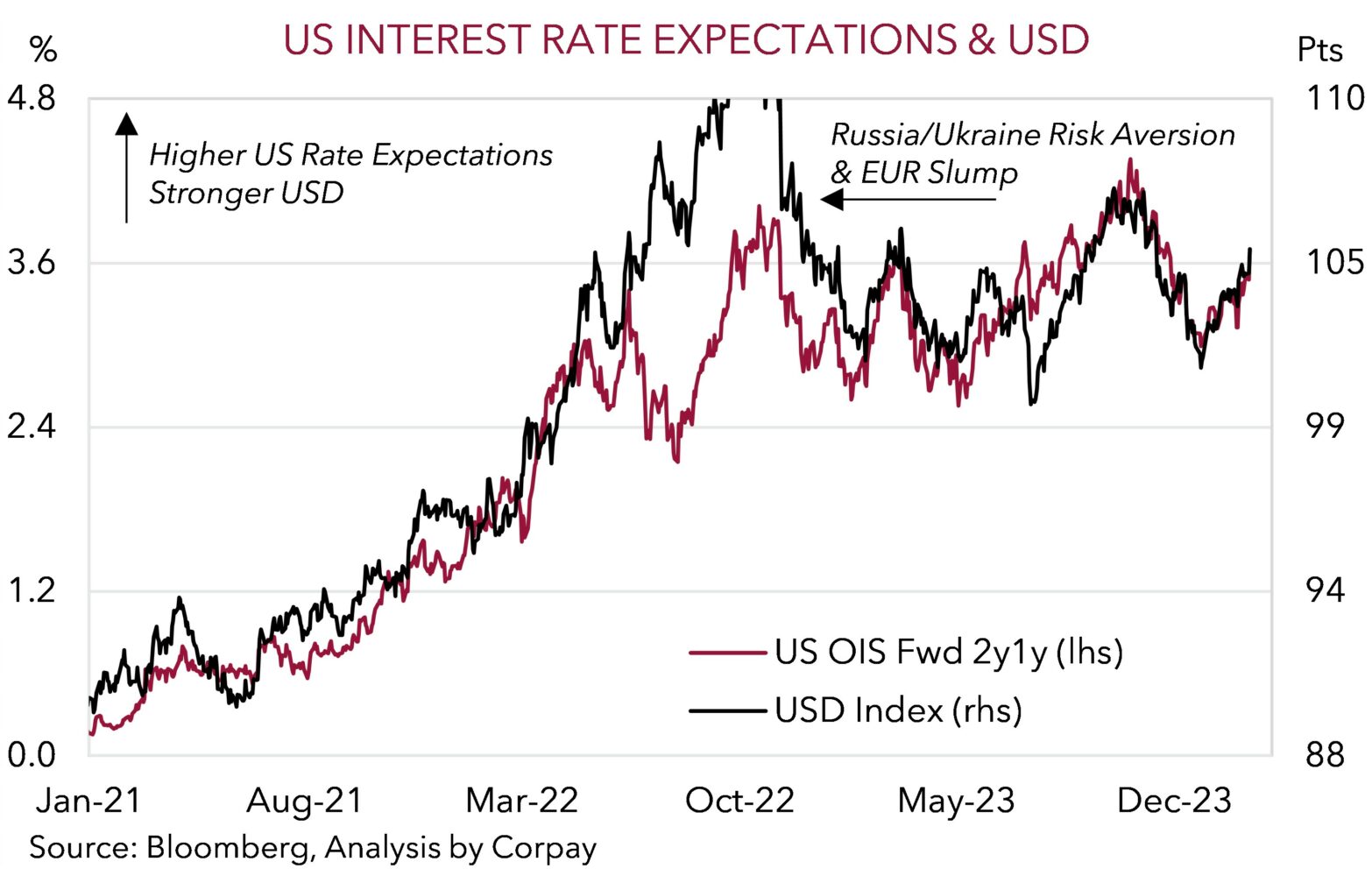

The USD has been on a tear over early 2024, with the USD Index undergoing a round trip. The USD pull-back that transpired at the end of last year has unwound just as quickly. Given the rest of the world is a ‘price taker’ and what happens with the USD is the key cog in the FX machine, this has seen currencies like the EUR (now ~$1.0710) and the AUD (now ~$0.6460) fall back, and others such as USD/JPY (now ~150.40) and USD/SGD (now ~1.35) rise, to levels last traded in mid-November.

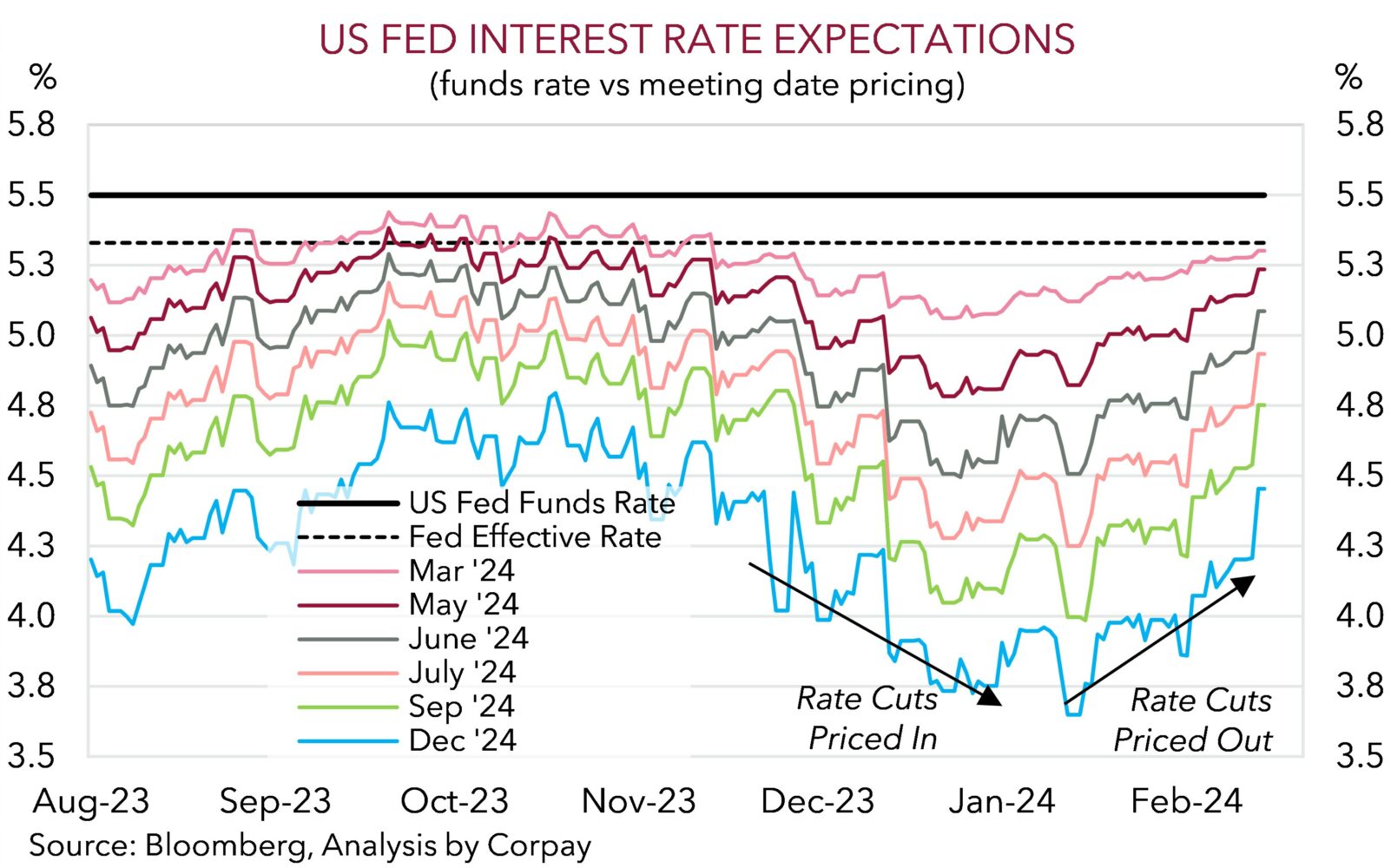

A string of positive US data surprises, the latest being the overnight released January CPI inflation report, and push back by Federal Reserve policymakers on the ‘dovish’ US interest rate assumptions that had been baked in has generated an abrupt re-think. As our chart shows, odds of the first rate reduction by the US Fed coming through in March, which we viewed as having a very slim chance of materialising, have been slashed, as have the number of rate cuts assumed over 2024. After discounting nearly 7 rate cuts by the US Fed over 2024 in mid-January, futures markets are now penciling in a bit more than 3 cuts over H2. The resultant jump in US yields has underpinned the USD’s resurgence.

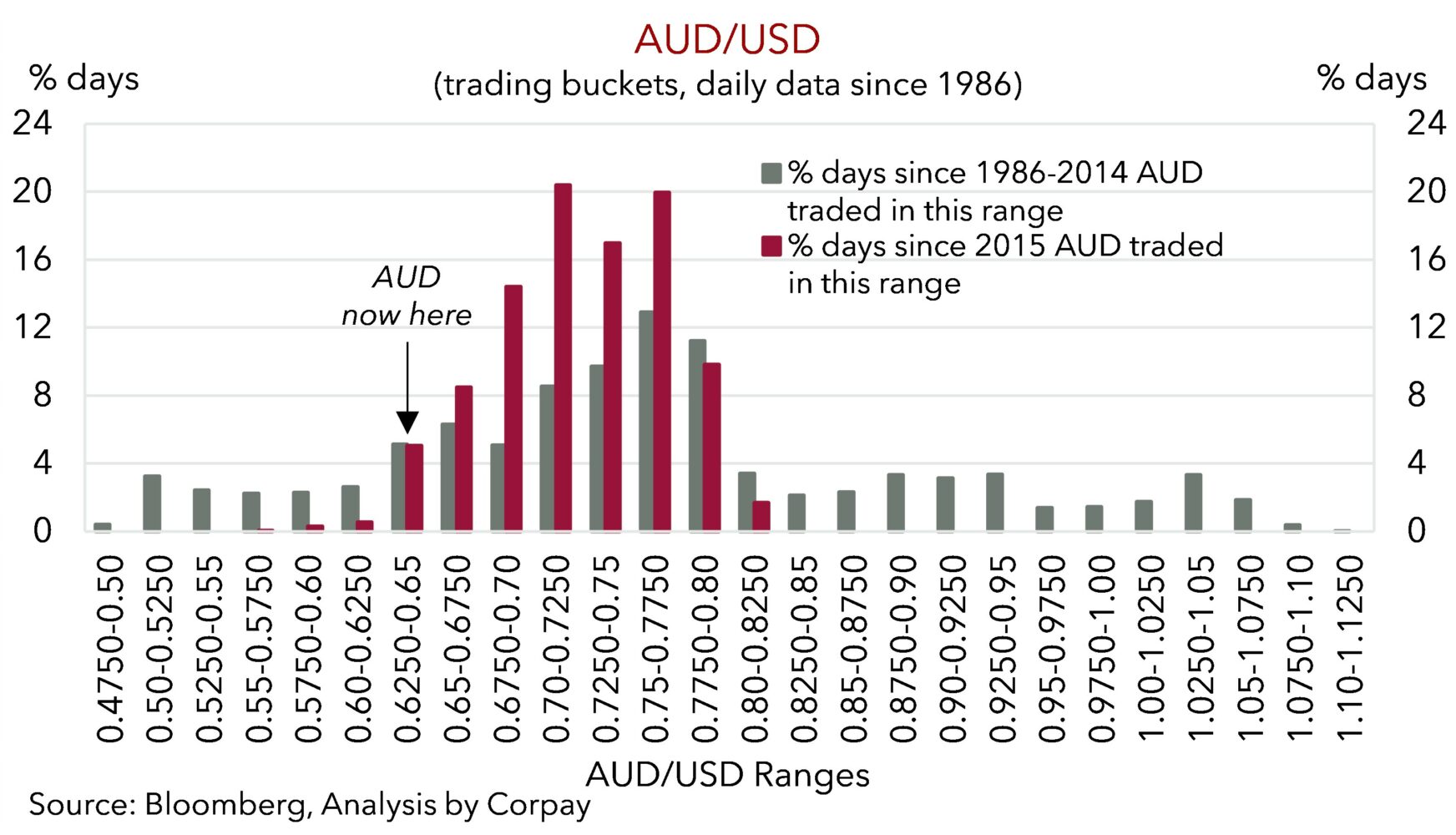

The key question is whether the USD’s upswing has more room to run, or will it begin to level off and deflate steadily over the medium-term? From our perspective, barring a risk aversion driven boost due to an exogenous shock, we feel that the USD’s revival could soon run out of puff with the positive jolt from the upward repricing in US interest rates having largely run its course, and the US’ economic strength hard-pressed to carry on. Hence, while it may not fall away quickly given the US’ ongoing absolute yield advantage, upside potential in the USD from current levels looks far more limited, with most major currencies (i.e. EUR, JPY, and AUD) trading below ‘fair value’ estimates. Indeed, we believe a lot of negativities are discounted in the AUD down near current levels and sentiment is quite bearish. ‘Net short’ AUD positioning (as measured by CFTC futures) is stretched, the AUD is ~2-3 cents under the average ‘fair value’ estimate from our suite of models, and statistically the AUD has only been below ~$0.6450 ~5% of the time since 2015 with the bulk of this small sample occurring during bouts of acute market stress.

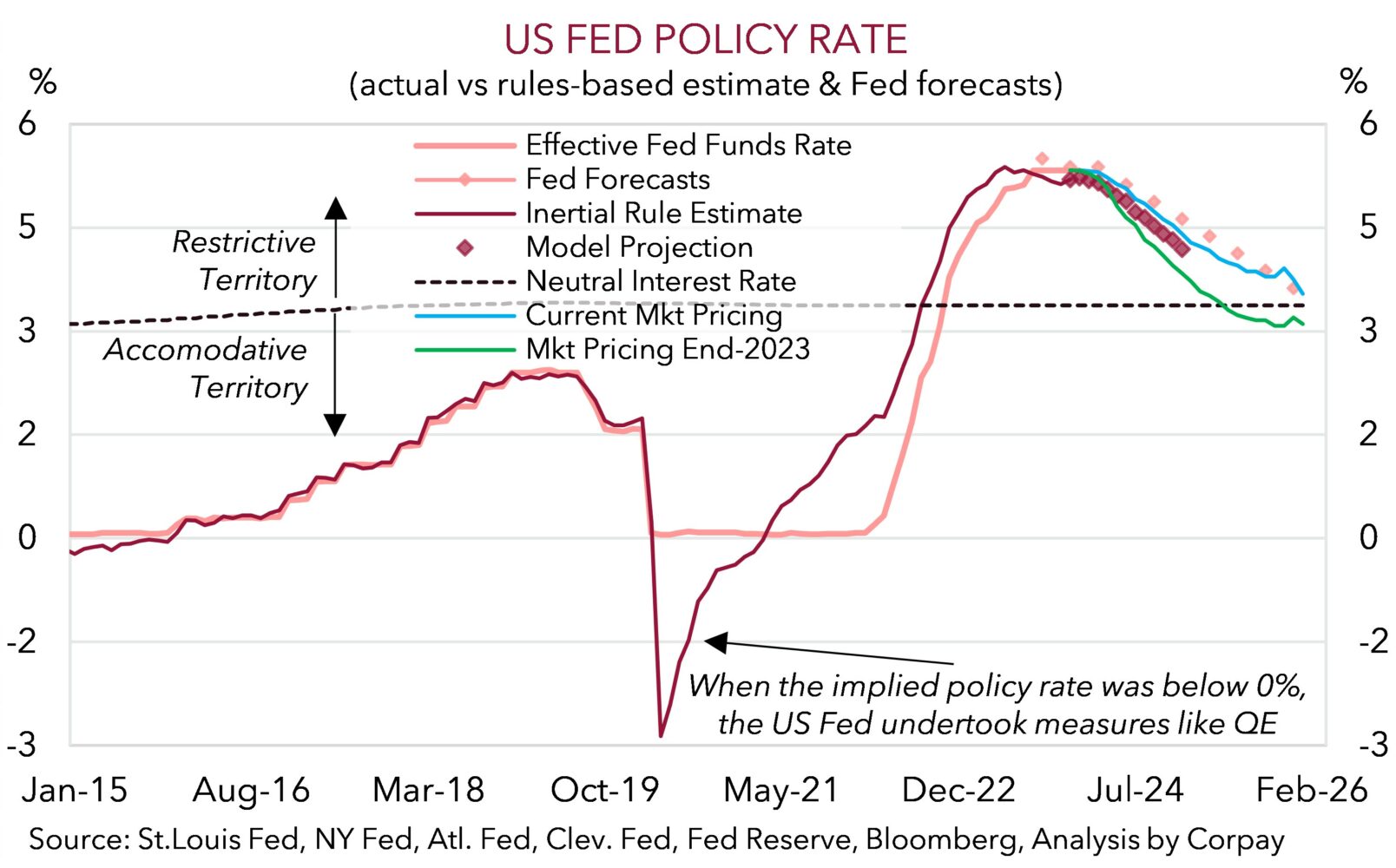

Notably, after calling its bluff for many months, markets have (finally) converged to the US Fed’s interest rate view looking for a modest easing cycle to kick off mid-year. This is the signal our replication of the US Fed policy rules have been pointing to for a while, and although some of the topline economic figures out of the US have generated questions about the start date, a broad appraisal of recent developments still suggests this remains the most likely path (see Market Musings: US Fed pivot has further to run). Importantly, as we have pointed out previously, with a close eye on trying to thread the needle and stick a ‘soft landing’, a more forward-looking risk management approach to the US Fed’s policy decisions should gain prominence over the period ahead. Inflation is still high, and policymakers will continue to talk tough for a bit of time yet, but this approach still points to some interest rate relief later this year to keep pace with the general slowdown in inflation. Without doing so the US Fed’s policy stance (which is measured by the gap between real interest rates and the equilibrium ‘neutral’ rate) would mechanically become progressively more ‘restrictive’ over time and this could in turn increase the odds of a more disruptive ‘hard landing’ manifesting.

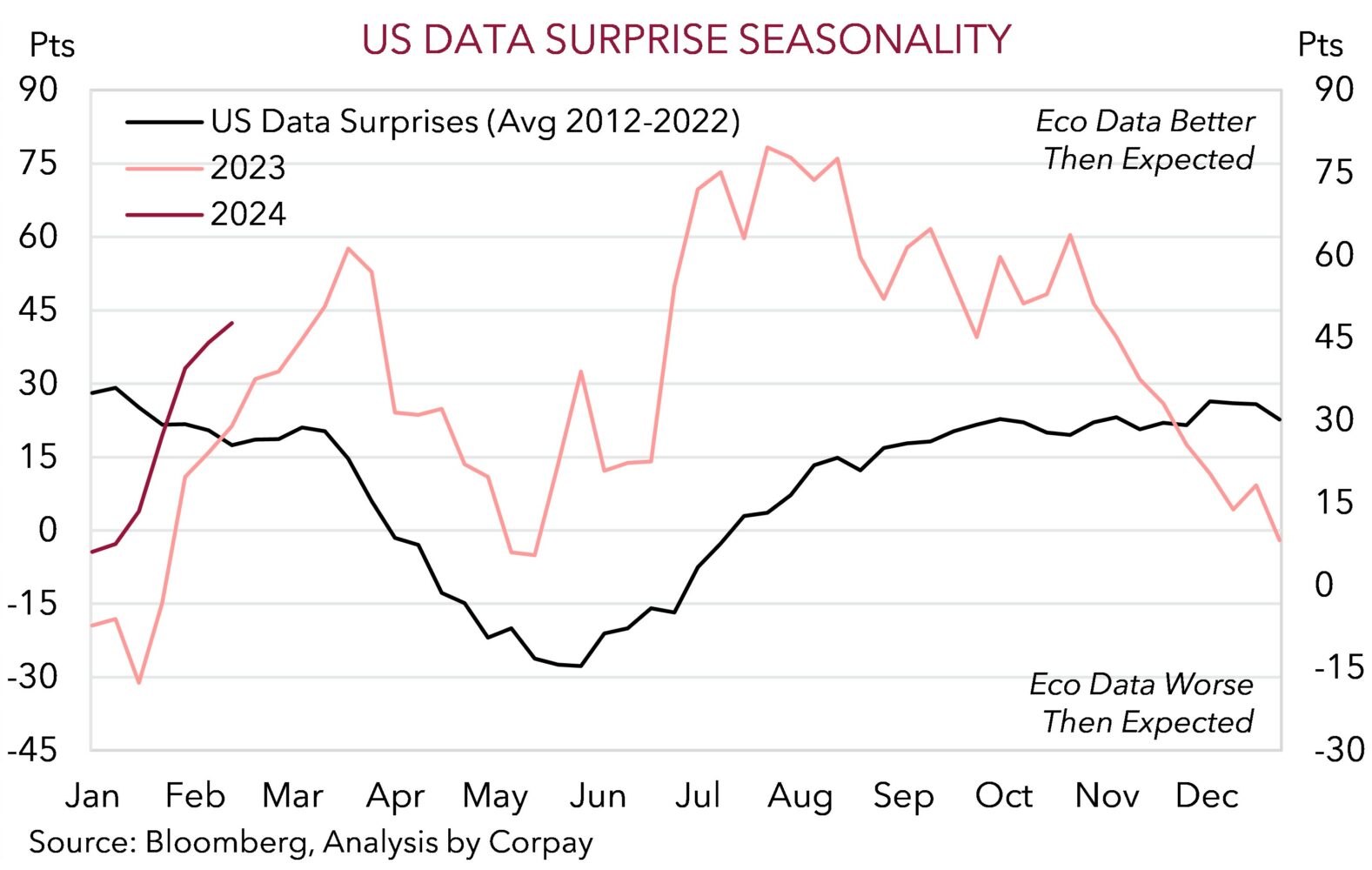

Moreover, we believe analysts look to have fallen into an old trap of under-estimating the US economic data at the start of the year. US economic data surprises have been quite positive recently with outcomes generally exceeding consensus forecasts. But as illustrated this tends to be the case at this time of the year, and it is one of the reasons (along with the negative Eurozone trade/capital flow dynamics) why the USD is typically seasonally stronger in Q1 (see Market Musings: History doesn’t repeat, but…).

Issues stemming from statistical shenanigans around seasonal adjustment factors not being able to fully capture changing underlying patterns and/or amplifying raw outcomes, in part due to the lingering effects of the large COVID shock, might be at play. We think residual seasonality is something that made the recent ‘good’ US jobs report look ‘great’ and it could be a quirk behind why January US CPI inflation came in hotter than almost all analysts predicted. A strange looking re-acceleration in owners equivalent rents, which moved counter to other timelier rent measures, explained a large chunk of the upside surprise in US services/core inflation that has generated the market conniption. In our judgement, this is at risk of reversing course over the next month or two as the statistical noise washes out. At the very least, the US economic data could soon begin to undershoot loftier hurdles, as it has done repeatedly over the second quarter of the year.

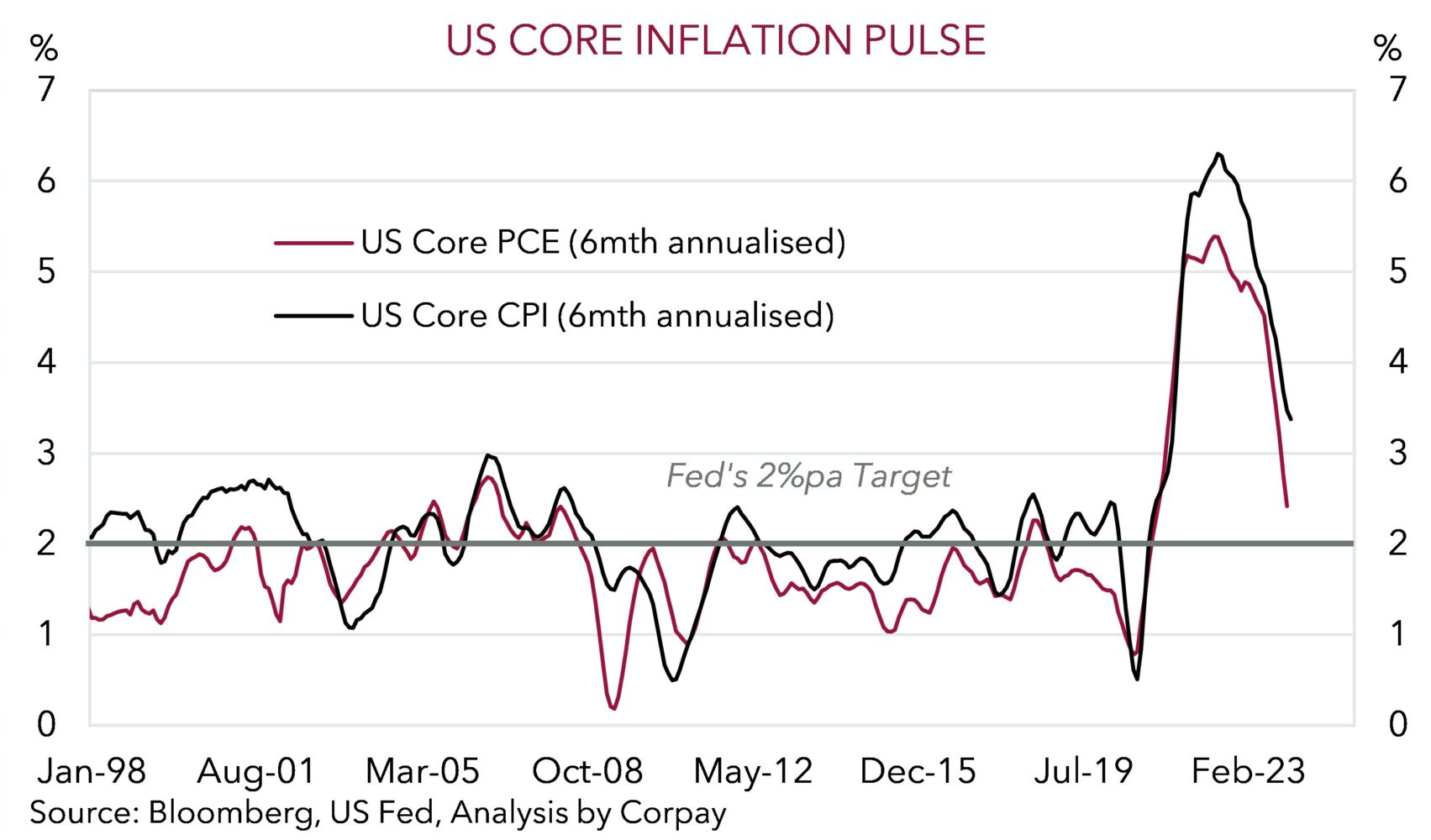

Moreover, it is also worth remembering that although CPI gets a lot of focus the US Fed’s preferred inflation metric is the PCE deflator. As our chart below shows a wedge has opened between the two measures with core PCE deflator slowing more rapidly over the past few quarters. The US PCE deflator (due 1 March AEDT) has a lower weighting to housing, and other services components that rose sharply in the January CPI so the quickening in inflation may not be replicated in the gauge that matters more to US Fed policymakers. If the disinflation trend in the PCE deflator remains intact we expect the door to US rate cuts from mid-2024 to remain open. As the actual start date comes closer into view, a renewed decline in US yields and the USD is anticipated.