• US Fed. No surprises with the Fed keeping interest rates on hold & noting uncertainty has “increased” due to what is happening policy-wise.

• Mixed markets. US equities rose while bond yields declined. The USD gave back earlier gains. AUD near ~$0.6360 ahead of today’s AU jobs report.

• NZ GDP. Data confirmed NZ emerged from recession in Q4 ’24. But there is still a lot of ‘slack’ suggesting more RBNZ rate cuts still likely.

Global Trends

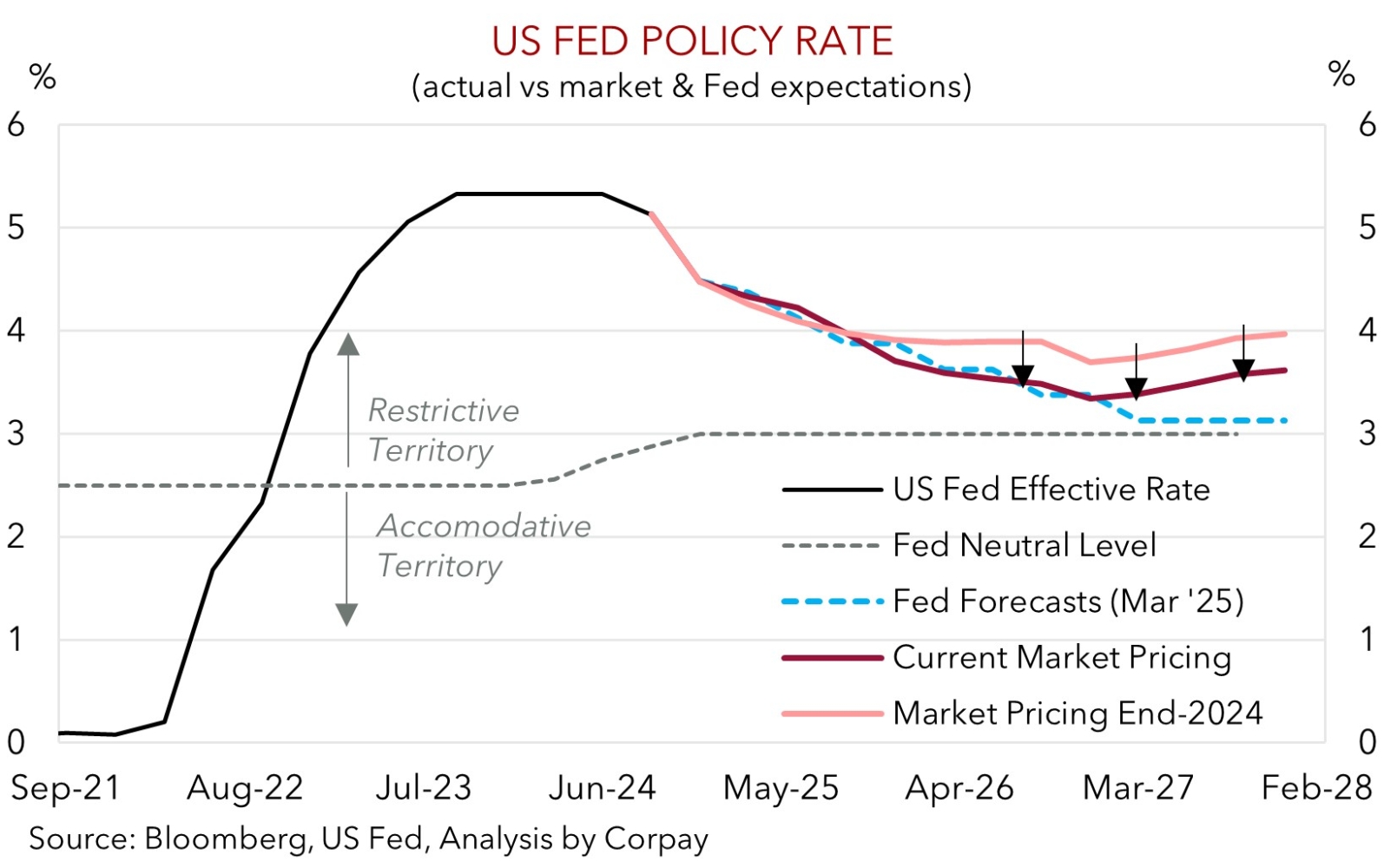

The US Federal Reserve was in focus this morning. And much like the broader market the world’s most influential central bank stressed that the various Trump Administration policies have “increased” the uncertainty around the outlook. As expected, the US Fed kept interest rates on hold, and while the average across its ‘dot plot’ continues to pencil in 50bps of cuts this year the distribution among individual expectations has shifted upward suggesting there is a greater bias not to lower rates as far as was implied in December. This partly reflects the upgrades to the Fed’s near-term inflation forecasts (now 2.8% in 2025 from 2.5%) which have come about despite downgrades to economic growth (now ~1.7% in 2025). Fed Chair Powell once again noted policymakers can wait for greater clarity. Although this may itself be a challenge given how quickly the Trump Administration has announced measures only to then walk things back.

In terms of the numbers, US equities added to their pre-Fed meeting gains after the event with the S&P500 rising ~1.1%. By contrast, US bond yields and the USD retraced earlier gains. On net, the US 10yr yield fell ~4bps to be below its 1-year average (now ~4.24%) and the US 2yr declined ~7bps with bond investors more nervous about the US’ lower growth trajectory rather than the anticipated ‘transitory’ near-term bump in inflation stemming from tariffs on imported goods. Despite slipping back post the US Fed the USD index is still a fraction above where it was this time yesterday with the EUR (the major USD alternative) giving back ground (now ~$1.0904). By contrast, the JPY is firmer with USD/JPY dropping towards ~148.70 (where it started the week). Yesterday the Bank of Japan kept interest rates steady but with Governor Ueda indicating “wages and prices are on track” expectations for further rate rises remain entrenched. Elsewhere, GBP is hovering just below ~$1.30, the top end of its multi-month range, ahead of tonight’s Bank of England decision (11pm AEDT), while the AUD is tracking north of its 100-day moving average (~$0.6340) with the Australian labour force data due today (11:30am AEDT).

The outlook is uncertain, and we think there could be more bursts of volatility over coming weeks, particularly in and around the announcement of US ‘reciprocal’ tariffs which are due to be unveiled on 2 April. Renewed bouts of market turbulence may generate some intermittent USD strength. However, over the medium-term we remain of the view that the USD should trend lower as growth differentials between the US and other major nations narrow, and as a loosening in US labour market conditions ultimately brings interest rate cuts by the US Fed back on the agenda.

Trans-Tasman Zone

The uncertainty about the US outlook, as outlined by the US Fed at this morning’s meeting (see above), has generated some market divergence with equities rising and bond yields falling. The push and pull forces have seen the AUD range trade overnight. The AUD is tracking just above its 100-day moving average (~$0.6340), which on net is little different from where it was this time yesterday. There has been a bit more movement on some of the AUD crosses with a softer EUR helping AUD/EUR tick up (now ~0.5833) and the firmer JPY following the ‘hawkish’ signals at yesterday’s BoJ meeting exerting downward pressure on AUD/JPY (now ~94.55).

The NZD has followed a similar pattern, though its post-US Fed rebound extended a bit further after Q4 2024 NZ GDP data confirmed the economy emerged from recession. The NZ economy grew by 0.7% in Q4, stronger than consensus and RBNZ were predicting with activity on a per capita basis recording its first increase in two years as aggressive rate cuts and spending by tourists (thanks to the lower NZD) boosted momentum. The NZ GDP result should somewhat please policymakers that the worst of the downturn has passed. But we doubt it will extinguish the need for the RBNZ to lower rates further given settings are still ‘restrictive’. In our view, this may act as a ceiling on the NZD.

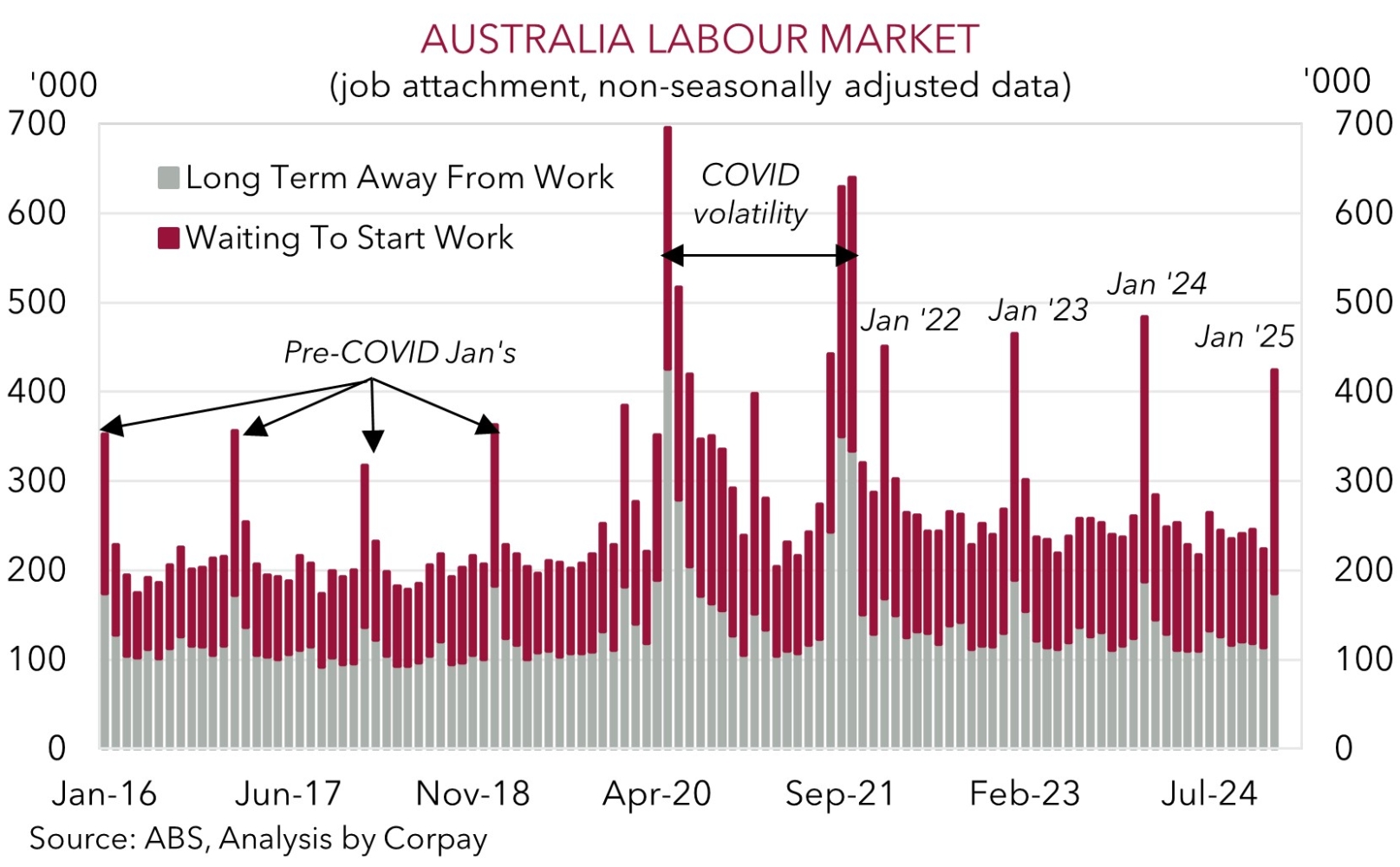

Today, in Australia the monthly jobs report is due (11:30am AEDT). We believe the jobs data will show conditions remain solid. Last month there was a larger than normal number of people unemployed but waiting to start work. This group transitioning into jobs points to another robust report, which if realised could solidify expectations looking for a slow/limited RBA rate cutting cycle and generate AUD support, in our view.

On balance, we continue to think more bouts of AUD volatility are probable as 2 April approaches. This is when the US will make its broader ‘reciprocal tariff’ announcements. But over the medium-term we believe there is more upside than downside potential for the AUD. A decent amount of negativity still looks baked in with the AUD running ~3-4 cents under our ‘fair value’ models. The AUD has also not traded much below where it is over the past decade (AUD has only closed below $0.6385 ~5% of the time since 2015). Structural forces that cushioned the AUD down here (i.e. Australia’s improved capital flow trends and higher terms of trade) remain. Moreover, as flagged previously, we think any tariff induced export pain in China should be offset via measures aimed at boosting commodity-intensive infrastructure investment. This is AUD supportive given this is where Australia’s key exports are plugged into. The stronger EUR stemming from greater European fiscal spending and JPY due to BoJ rate rises may also be indirect AUD supports via drags created on the USD.