• Turnaround. Middle East concerns returned overnight. Oil rose, US equities & bond yields declined. USD firmer. AUD & NZD lost ground.

• Fluid situation. More headline driven volatility looks likely near-term. As seen the past few days sentiment can turn course quickly.

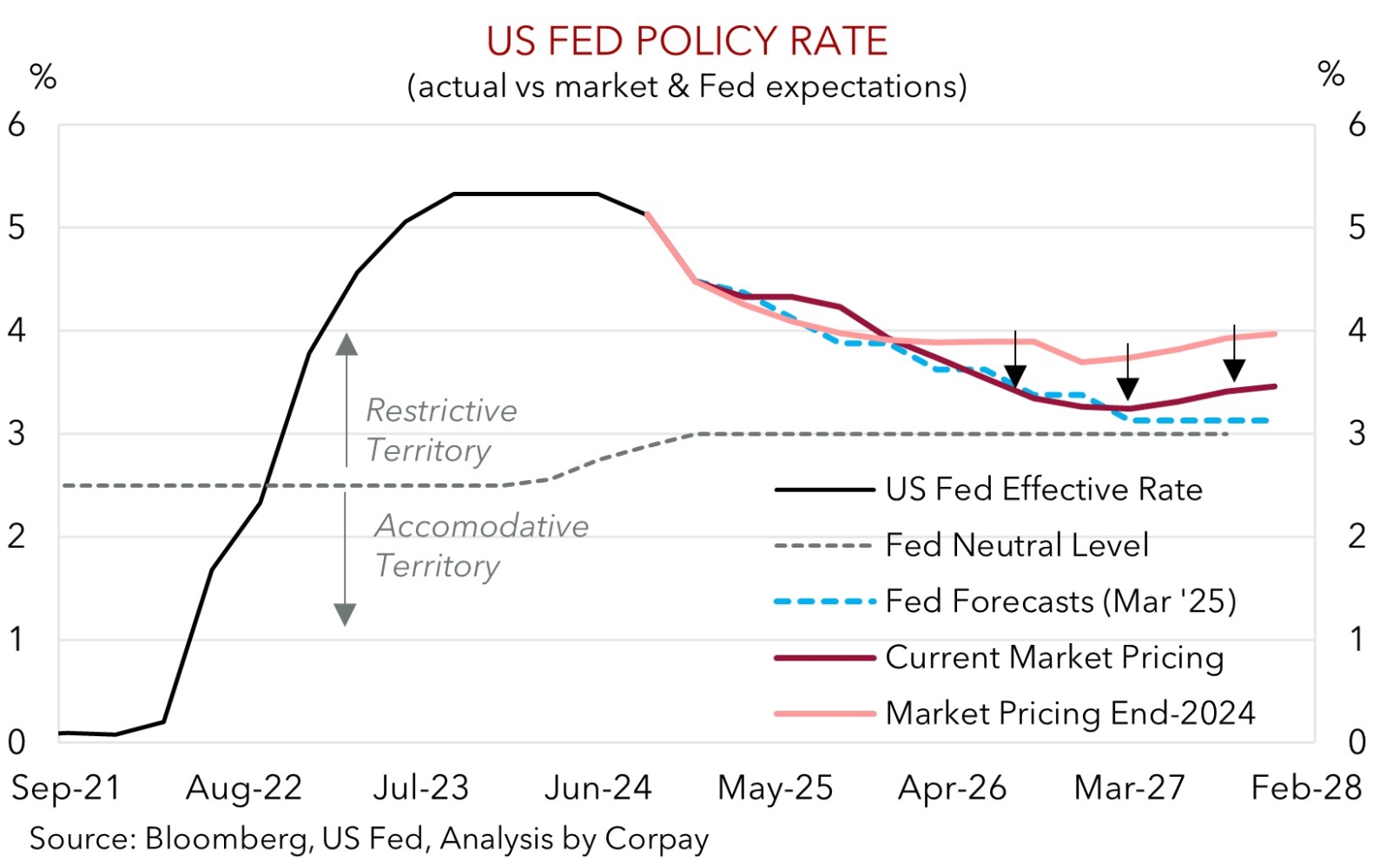

• US Fed. No policy changes expected tomorrow. But will the US Fed tweak its ‘dot plot’ given inflation risks stemming from trade tariffs?

Global Trends

Geopolitical driven market gyrations continued overnight. Yesterday’s cautiously optimistic view on the Israel/Iran conflict reversed course with sentiment souring again. President Trump cut short his time at the G7 meeting and a flurry of social media posts heightened concerns the Middle East situation may worsen with the US potentially stepping in. In addition to signaling that the US knows the location of the Supreme Leader President Trump posted “unconditional surrender” which some analysts think is now the end goal. On top of that a deployment of US military assets to the region looks to be underway, with President Trump also meeting with his national security team.

The nervousness weighed on risk assets, though not as much as the headlines might make you think. US equities retraced yesterday’s gains with the S&P500 (-0.8%) where it was tracking on Monday. Bond yields edged lower with the Middle East concerns compounded by patchy US economic data. The US 10yr yield shed ~6bps (now ~4.39%). US industrial production declined in May, as did topline retail sales. Though the 0.9% drop in US retail spending largely reflected an unwinding of the jump in auto sales ahead of trade tariffs being imposed. The retail sales ‘control group’, which feeds directly into US GDP, grew in May in line with its 20-year average pace.

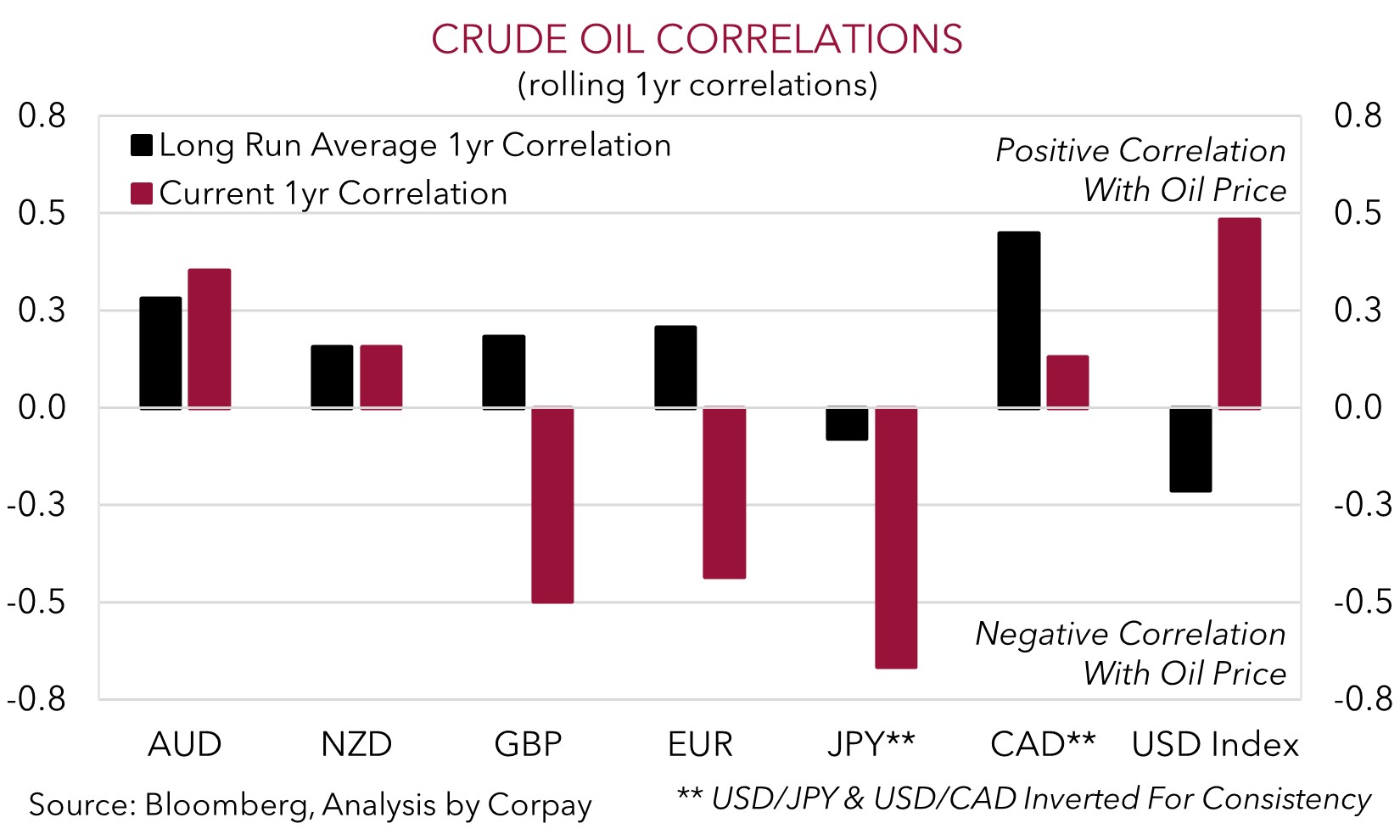

Elsewhere, oil remains at the forefront of the volatility with Brent crude prices up ~4%. At US$76.45/brl Brent crude is well up from its May cyclical lows and approaching its 2-year average. In FX, the renewed jitters supported the USD. As did the lift in oil prices. As outlined before, and shown in the chart below, the USD now has a positive correlation to oil prices thanks to the increase in US production and the swing by the US to becoming a ‘net energy exporter’. EUR eased (now ~$1.1482), as did GBP (now ~$1.3425), while USD/JPY ticked higher (now ~145.26). NZD (now ~$0.6017) and AUD (now ~$0.6477) lost ground with both near where they were earlier this week.

The Middle East situation remains fluid, and as seen over the past few days the mood can shift quickly. More bouts of headline/event driven and USD supportive turbulence are possible, in our opinion. Macro wise, tomorrow’s US Fed meeting (4am AEST) and press conference (4:30am AEST) will also be in focus. No policy changes are anticipated; however we do see a chance the underlying pulse of the US economy and inflation risks posed by tariffs sees the Fed lean against ‘dovish’ market expectations via tweaks to its ‘dot plot’ projections. If realised, we believe this could also give the USD a helping hand.

Trans-Tasman Zone

The renewed nerves about the evolving situation in the Middle East has dampened risk sentiment and generated some USD support over the past 24hrs (see above). As a result, the NZD (now ~$0.6017) and AUD (now ~$0.6477) have slipped back to be tracking a little below where they were this time on Monday. That said, the AUD has been more mixed on the crosses with underperformance versus the JPY (now ~94.08) and CNH (now ~4.6573) offset by gains against GBP (now ~0.4824). Other crosses such as AUD/EUR, AUD/NZD and AUD/CAD tread water overnight.

As discussed over the past few days and reiterated above, we believe further bouts of Middle East headline driven volatility are possible over the near-term. The situation is fluid and as observed so far this week the market tone can switch course quickly. Given its positive correlation to cyclical assets, increased nervousness across markets may exert more downward pressure on the AUD in the short-run, in our opinion.

As could upcoming economic events. The US Fed meets tomorrow (4am AEST) and the Australian jobs report is due (Thurs 11:30am AEST). As mentioned, we feel the US Fed risks sounding a tad more ‘hawkish’, at least relative to current thinking, given the possible inflation impacts from trade tariffs down the track. This may see the US Fed push back on market pricing looking for multiple interest rate cuts over late-2025/early-2026 via an upward adjustment to its ‘dot plot’ forecasts. If realised, this could give the USD a further boost. Added to that, the volatile Australian jobs report might also show softer momentum after the outsized employment gains posted in April. A weaker labour force print may boost bets the RBA will deliver another interest rate cut on 8 July. This is currently ~85% factored in.