• Positive talks. Constructive talks between US/China over the weekend. But a deal may take some time. This may temper the markets excitement.

• Market trends. Equity futures have opened positively. USD index a little firmer. AUD & NZD ticked up thanks to relative strength on cross-rates.

• Event Radar. In AU the monthly jobs report is out (Thurs). In the US, CPI, retail sales, import prices due this week. Tariff impacts will be looked for.

Global Trends

Markets consolidated at the end of last week with limited economic data released and with participants lasering in on the weekend meeting between US and China trade officials. The S&P500 tread water on Friday, as it had for much of last week, following its recent rebound (the S&P500 has risen more than 17% from its early April tariff shock low). Bond yields also moved sideways with the US 10yr rate hovering near ~4.38%. And in FX the USD index was range bound with the EUR a touch softer (now ~$1.1217) and USD/JPY a fraction higher (now ~146.15). NZD (now ~$0.5919) and AUD (now ~$0.6425) nudged up slightly.

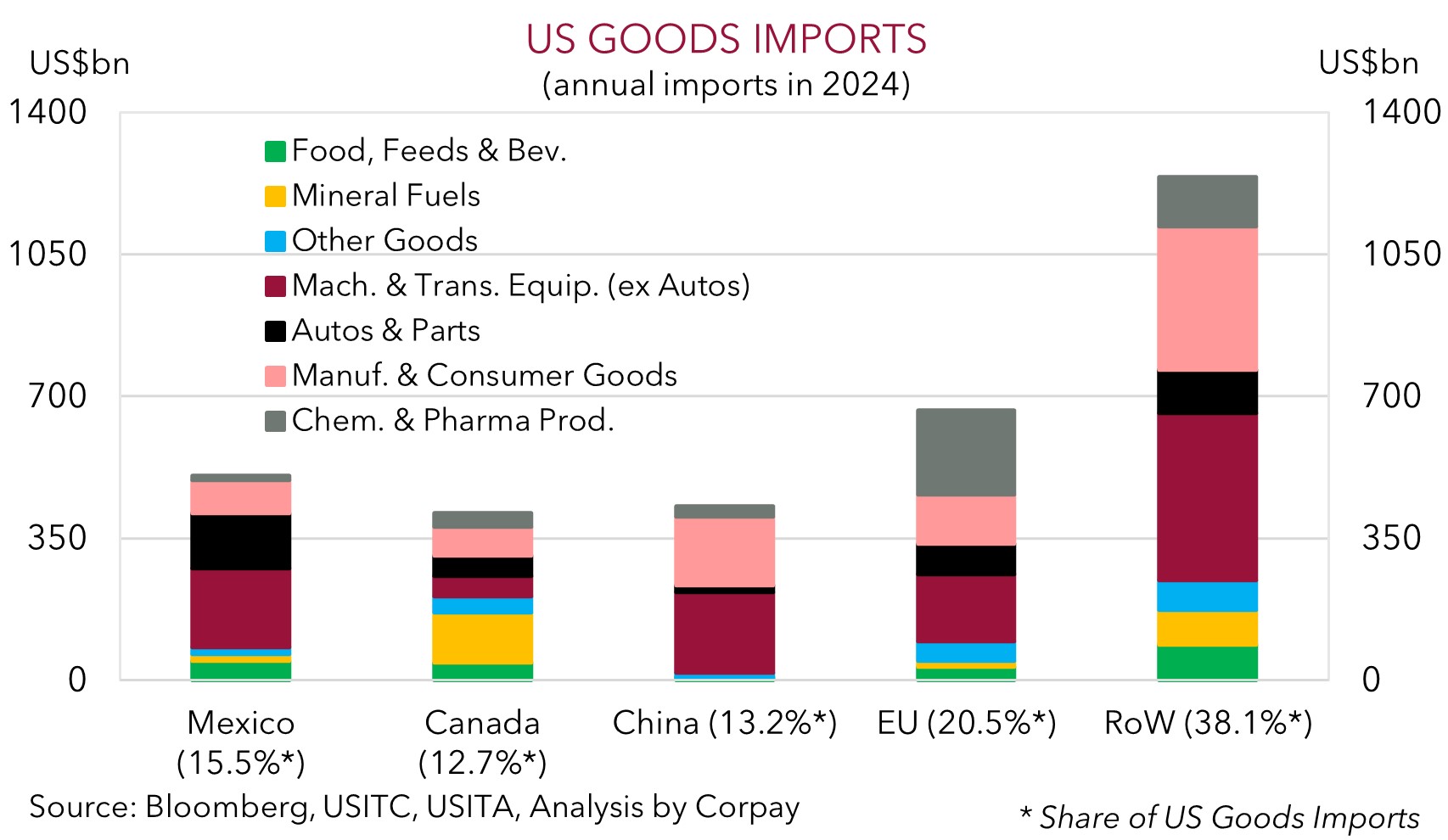

The mood music coming out of the weekend US/China meeting appears positive. No concrete measures were announced but US Treasury Secretary Bessent said there had been “substantial progress” in negotiations and Chinese Vice Premier He Lifeng stated “an important first step” toward resolving differences had been achieved. Both sides agreed to create a mechanism for more discussions down the track. Things look to be moving in the right direction with respect to a de-escalation in the US/China trade war. The positive/constructive tone may support risk sentiment at the start of the new week (US equity market futures have opened positively, and the USD index has ticked up), however we also think the lack of detail and negative economic impacts of what has already been put through could act to cap the markets enthusiasm. As our chart shows, given the wide-ranging products imported into the US, the levies that have been imposed should act as sand in the gears of consumer spending and business investment over the period ahead.

This week in addition to reaction to the weekend talks and renewed hopes of a Ukraine/Russia ceasefire (the two leaders are reportedly set to meet later this week) there are a few important macro events scheduled. US earnings season continues, with Walmart (a bellwether for US consumer activity) out on Thursday. On top of that US retail sales are released (Thurs night AEST), as is US CPI inflation (Tues night AEST), PPI inflation, and import prices (both Thurs night AEST). The April US data will be scoured for clues regarding the pass-through of the US tariffs with categories like clothing, furniture and consumer durables likely to be in the spotlight. On net, as outlined last week, we believe that over the near-term the USD (which is still tracking below our ‘fair value’ model) has scope to claw back more lost ground, particularly against currencies such as the EUR and JPY.

Trans-Tasman Zone

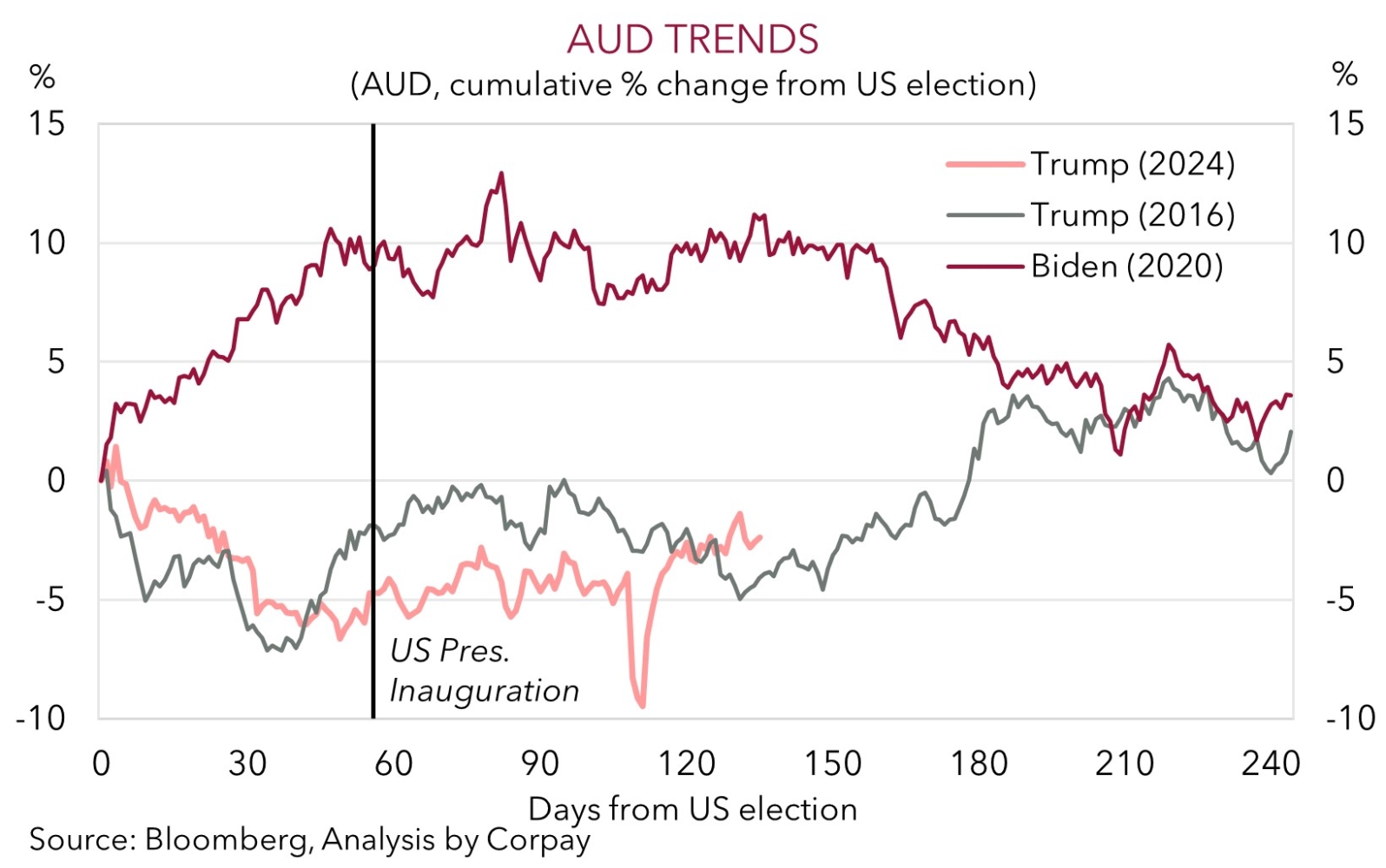

The AUD and NZD drifted a little higher on Friday and ticked up a fraction further in this morning’s early trade. The positive tone in markets and constructive comments from the weekend US/China trade talks have offset the firmer USD (see above) with relative outperformance by the NZD and AUD on a few cross-rates providing a helping hand. At ~$0.5919 the NZD is just below its ~1-year average, while the AUD (now ~$0.6425) is trading towards the upper end of its multi-month range. The AUD has edged up versus the EUR, JPY, GBP, NZD, CAD, and CNH with gains of ~0.1-0.5% recorded compared to where these cross-rates were at this time on Friday.

Locally, there are a few important releases scheduled this week that may influence RBA interest rate expectations and in turn generate some AUD volatility. Q1 Australian wages data is out on Wednesday and the volatile monthly jobs report is due Thursday. Tight labour market conditions and the introduction of higher wages in childcare in January could help hold up wages. Working the other direction is the chance of a negative surprise in the labour force data. School holidays in several states coincided with the employment report survey period. In our judgement, based on past trends this may generate a softer monthly employment print (mkt consensus 20,000). That said, if you step back from the month-to-month noise the underlying trend should still be solid. In our view, this points to the RBA delivering another 25bp rate cut on 20 May as it tries to help keep the economy on positive footing. This is already factored into interest rate markets.

On balance, as discussed above and over the past week, we think the prospect of the USD recouping more lost ground on the back of upbeat sentiment regarding a potential trade war de-escalation may act as a headwind and drag on the AUD a bit over the near-term. However, as also mentioned, we believe this should be a short-term phenomenon with retracements in the AUD unlikely to be too deep and/or last too long. In our judgement, the USD should depreciate over the longer-term as the economic impacts of US tariffs and higher import costs slow growth. While positive US/China talks over the weekend are a step in the right direction the two sides still look to be some way from reaching a deal and/or some form of tariffs are likely to remain in place. This in time should weigh on the USD, in our view. Added to that, we think the AUD has scope to strengthen against other currencies such as the EUR, NZD, and CNH because of diverging policy impulses between the RBA and other central banks, the resilience in the Australian economy, and moves by authorities in China to offset pain in its export sector via measures to boost domestic activity.