• Volatility. Tariff news continues to generate volatility. US equities unwound early gains to end the day lower. AUD & NZD followed. CNH also weaker.

• Tariff news. While there were signals about deals for some nations, goods from China are set to be hit with another tariff. This dampened sentiment.

• Macro events. RBNZ expected to cut interest rates again today. Tariff developments will continue to drive markets for a while.

Global Trends

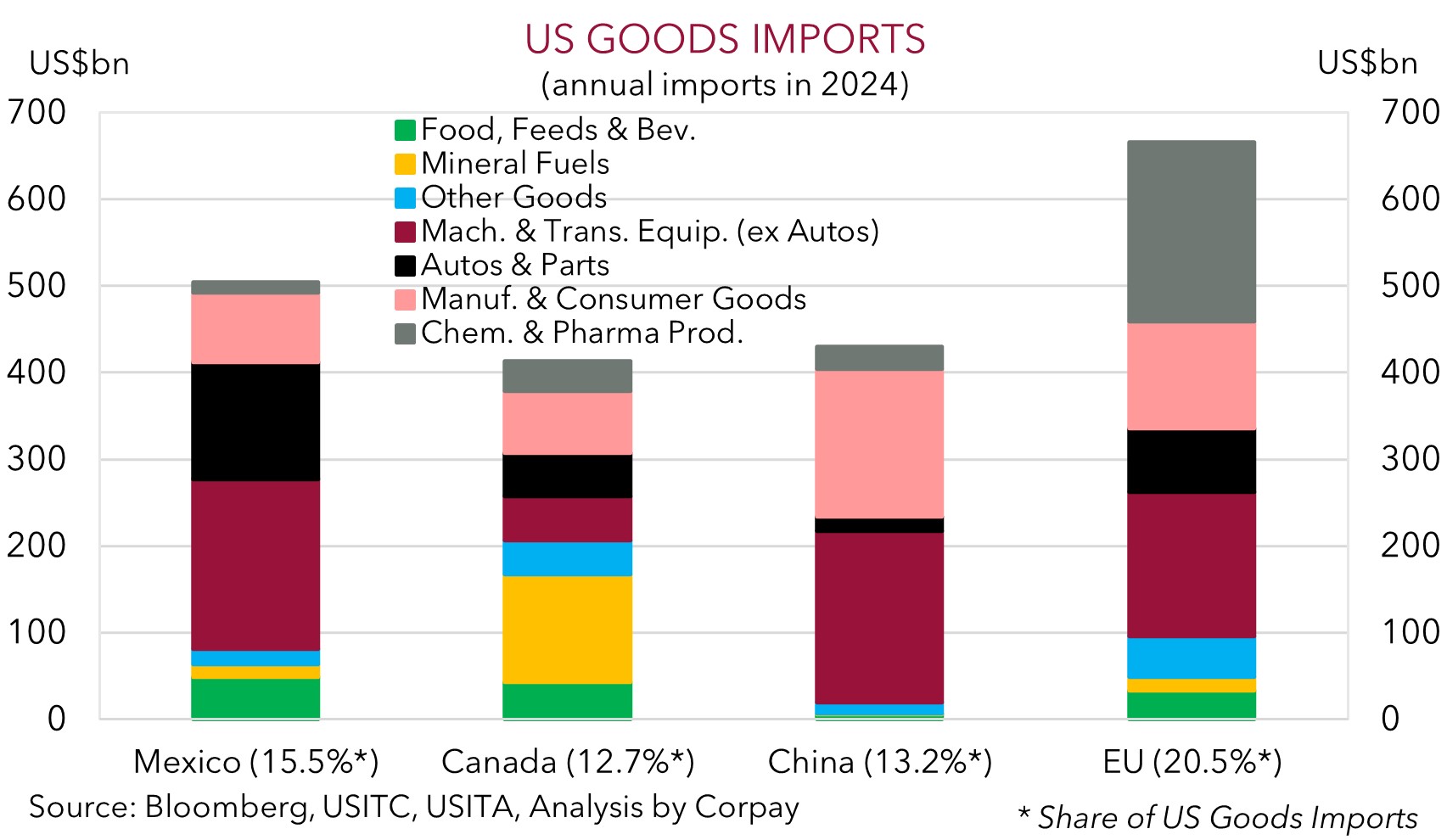

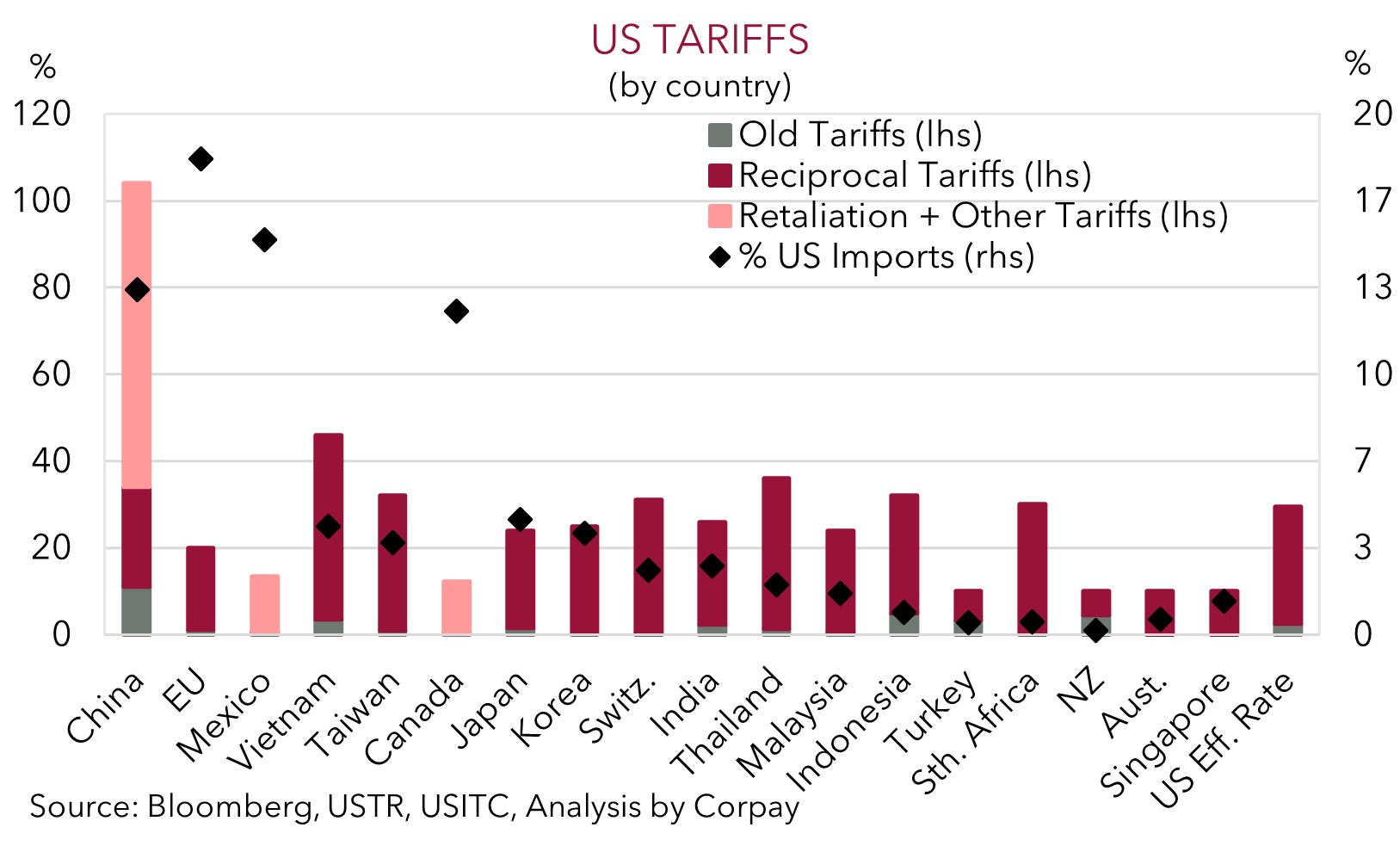

Volatility in markets has continued with tariff-related headlines still the driving force. The initial positive sentiment in the US session following the rebound in Asian and European equities faded as trading unfolding and the news flow soured. The volatility again showed how tricky current market conditions are and that sentiment can swing quickly. The initial optimism stemmed from hopes that some ‘deals’ could be reached with President Trump noting he had a great call with South Korea, while other Asian and European nations are also said to be lined up for talks with Japan set to be given priority according to Treasury Secretary Bessent. But things quickly reversed after officials confirmed an additional 50% tariff on goods from China (threatened after last week’s retaliation to the ‘reciprocal’ duties) are scheduled to start today (2:01pm AEST). These levies are on top of what was already announced and will lift the tariff on goods imported from China to 104%. With ~13% of US goods imports coming from China this will see the US’ ‘effective tariff rate’ jump further, adding to the growth headwinds created by the higher prices faced by US consumers and businesses. Indeed, the latest US small business survey indicated conditions are worsening with sales expectations dropping and hiring intentions scaled back.

On net, the US S&P500, which traded in another wide 6.8% range overnight, closed the day ~1.6% lower with the tech-focused NASDAQ underperforming (-2.2%). Elsewhere, the rekindled growth worries saw WTI crude oil and copper decline by ~4.5%, with oil trading near a 4-year low (now ~US$58.30/brl). The US yield curve steepened as the 2yr rate dipped (-4bps to 3.73%) and the 10yr rate increased (+11bps to 4.29%) on the back of the growth/inflation cross-currents from the latest developments. In FX, the USD index lost a bit of ground with EUR ticking up (now ~$1.0959), and USD/JPY declining (now ~146.30). USD/CNH rose by over 1% (now ~7.4226, a new cyclical high) after authorities again set a weaker CNY reference rate. This, and the reversal in sentiment, exerted downward pressure on NZD (now ~$0.5529) ahead of today’s RBNZ meeting where another rate cut is expected (12pm AEST) and AUD (now ~$0.5951).

In addition to the RBNZ meeting BoJ Governor Ueda is also set to speak today (4:15pm AEST). However, barring a surprise these events should play second fiddle to US tariff news. As outlined before, sentiment and momentum are overriding fundamentals. This means heightened market volatility may continue for a while yet. More economic worries and/or further tariff retaliation could boost the USD, while signs deals might be struck and/or tariffs are wound back should see the USD weaken.

Trans-Tasman Zone

Inline with the swings in cyclical assets and sentiment on the back of the unfolding tariff developments the intra-day volatility in NZD and AUD has continued (see above). On net, the reversal of fortunes during US trade overnight and weaker CNH have seen the NZD (~$0.5529) and AUD (now ~$0.5951) slip back from where they were this time yesterday. The AUD has also softened on the major crosses with AUD/EUR (-1.1%), AUD/JPY (-1.7%) and AUD/GBP (-1%) experiencing the largest moves. AUD/EUR (now ~0.5432) is at the bottom of its post-COVID range, and AUD/GBP (now ~0.4661) is around levels last traded in late-2015. AUD/NZD drifted back (now ~1.0762, just under its 1-year average), while AUD/CNH nudged up (now ~4.4180).

Today, the RBNZ meets (12pm AEST), and another smaller 25bp rate cut is anticipated. If realised, this will lower the RBNZ cash rate to 3.5%, down from a peak of 5.5%. NZ is a small open economy that is heavily influenced by global macro trends. Hence, how the RBNZ sees recent tariff developments can be an important signpost for the thinking of other central banks. In our view, the volatile backdrop and already weak NZ economy should see the RBNZ keep the door open to even more policy easing down the track. This in turn may help AUD/NZD recoup lost ground.

More broadly, as outlined yesterday, we think the “shoot first, ask questions later” market mindset has seen participants quickly factor in something more sinister than a stepdown in US/global activity, and that the AUD has been unduly impacted (see Market Musings: Global risks don’t equate to a crisis). As ‘crisis’ concerns recede we expect the USD to depreciation and the beaten up AUD to rebound. Notably, despite the laser focus on the stockmarket, US credit spreads (which have historically proven to provide a better guide of underlying risks) have widened due to growth worries but they aren’t flashing ‘red’. Moreover, as mentioned before Australia’s direct trade exposure with the US is limited (only ~4% of exports are sent to the US), and authorities in China are stepping in to counteract headwinds by stimulating domestic activity. China’s Premier Li stressed they have ample policy tools to “fully offset” shocks. This is where Australia’s key exports are plugged into with a limited amount used in products sent from China to the US such as consumer goods and machinery.

Markets are driven by outcomes compared to expectations, and it often appears darkest before the dawn. In our judgement a lot, if not too many, negativities now look baked into the AUD. We believe there are uneven risks around the AUD near current levels (i.e. there is more upside than downside potential) given the low starting point (the AUD has only closed below ~$0.60 in 9 trading days since 2015) and valuation support (the AUD is ~5-6% below the average of our suite of ‘fair value’ models).