• Cautious tone. Hawkish Fed soundbites & positive US data saw yields tick higher. US equities slipped back. AUD & NZD remain on the backfoot.

• Fed speak. Chair Powell speaks at Jackson Hole tonight. Speech should generate some volatility & set the tone for next week’s trading as well.

• Chair Powell. Market pricing more ‘dovish’ than the Fed’s view. Will Chair Powell lean against aggressive expectations or endorse them?

Global Trends

The cautious tone continued across markets overnight. Nervousness about tonight’s speech by US Fed Chair Powell at the annual Jackson Hole event (12am AEST) was compounded by ‘hawkish’ soundbites from a couple of other Fed members and stronger than predicted US business surveys. Three Fed officials (2025 voting member Schmid, and non-voters Bostic and Hammack) didn’t express a great deal of urgency to cut interest rates due to lingering inflation worries, while on the data front the US PMIs for manufacturing and services exceeded analyst forecasts.

As a result markets trimmed some of their near-term US Fed rate cut bets with odds of a mid-September move now sitting at ~75%. This adjustment flowed through to US bonds (yields rose ~4bps across the curve) and exerted a bit of downward pressure on US equities with the S&P500 (-0.4%) posting its 5th straight daily decline. Also dampening the mood was a warning from US consumer bellwether stock Walmart that tariffs will hit second-half results. In FX, the macro trends supported the USD. EUR slipped back to ~$1.1610 and USD/JPY has pushed up to ~148.35. Cyclical currencies like the AUD (now ~$0.6422) and NZD (now ~$0.5818) remained on the backfoot with the latter still weighed down by the ‘dovish’ RBNZ rate cut a few days ago.

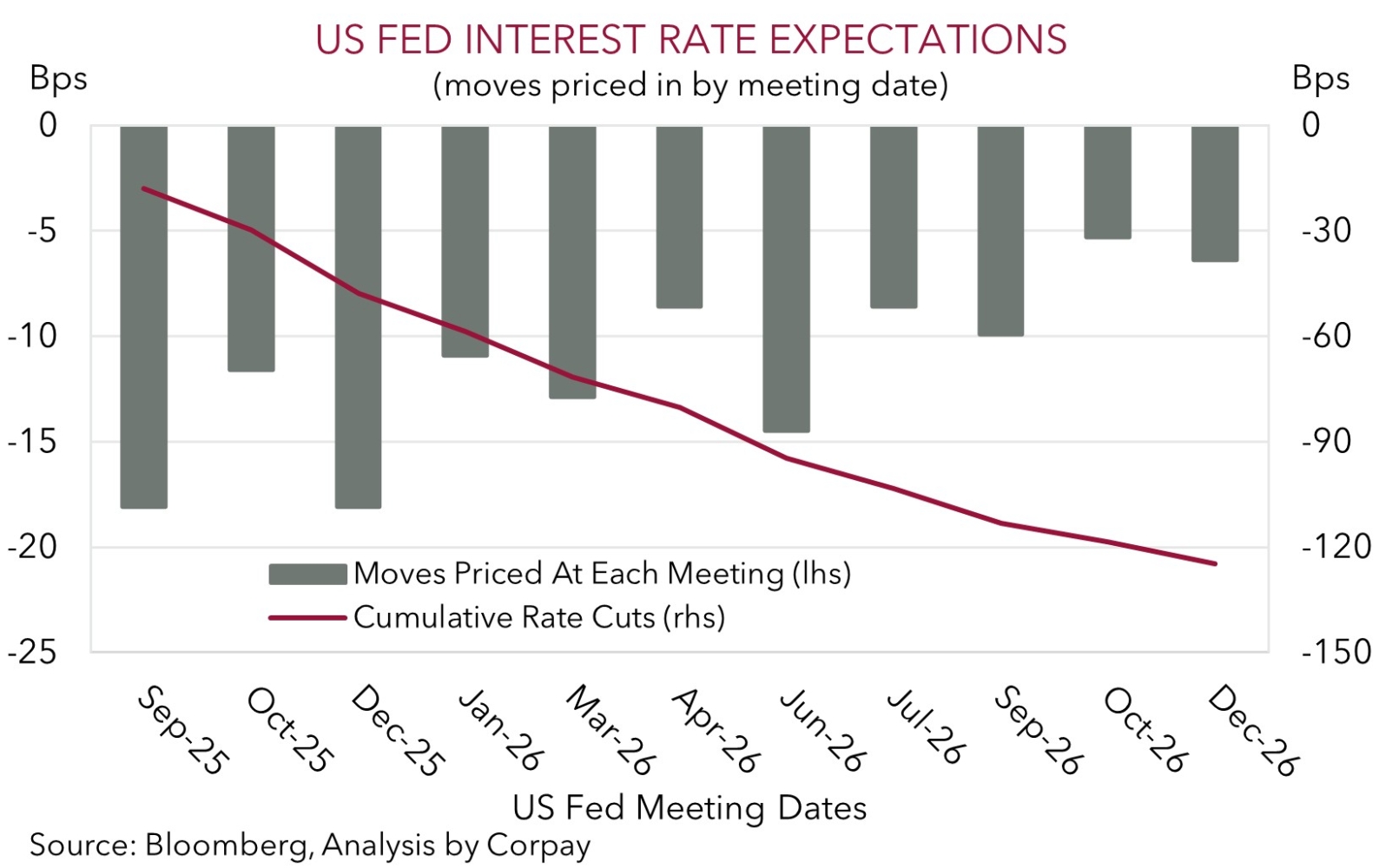

All eyes will be on Fed Chair Powell tonight (12am AEST). This will be the first time he has spoken since the weak July US jobs report. The annual Jackson Hole event has been used by Fed Chairs to signal changes in policy positions in the past. Some are hoping that after significant revisions to US non-farm payrolls Chair Powell opens the door to restarting the rate cutting cycle in September. We aren’t as convinced. While we believe Chair Powell could note some policy easing is likely later this year, as per the Fed’s current baseline forecasts which are factoring in ~2 cuts by year-end, we doubt he will explicitly call out a move in September as there is another round of data (including CPI and a jobs report) due before then. As mentioned this week, given the ‘dovish’ skew in market pricing we think a ‘cautious’ tone from Chair Powell may see markets pare back their near-term Fed rate cut expectations a little further, which if realised might give the USD more of a helping hand.

Trans-Tasman Zone

The shaky risk backdrop and firmer USD stemming from ‘hawkish’ vibes from a few US Fed officials and stronger US business surveys has kept the AUD and NZD on the backfoot (see above). At ~$0.6422 the AUD is tracking near the bottom end of the range its has occupied since late-May, while the NZD (now ~$0.5818) is around levels last traded in mid-April with the ‘dovish’ RBNZ cut earlier this week generating a sizeable downward adjustment in NZ interest rate expectations. That said, it has been more of a mixed performance for the AUD on the crosses. Over the past 24hrs the AUD has ticked up ~0.1-0.2% versus the EUR, GBP, and CAD, while it has risen by ~0.5% against the JPY. By contrast, the AUD has declined by ~0.1-0.2% vis-à-vis the NZD and CNH.

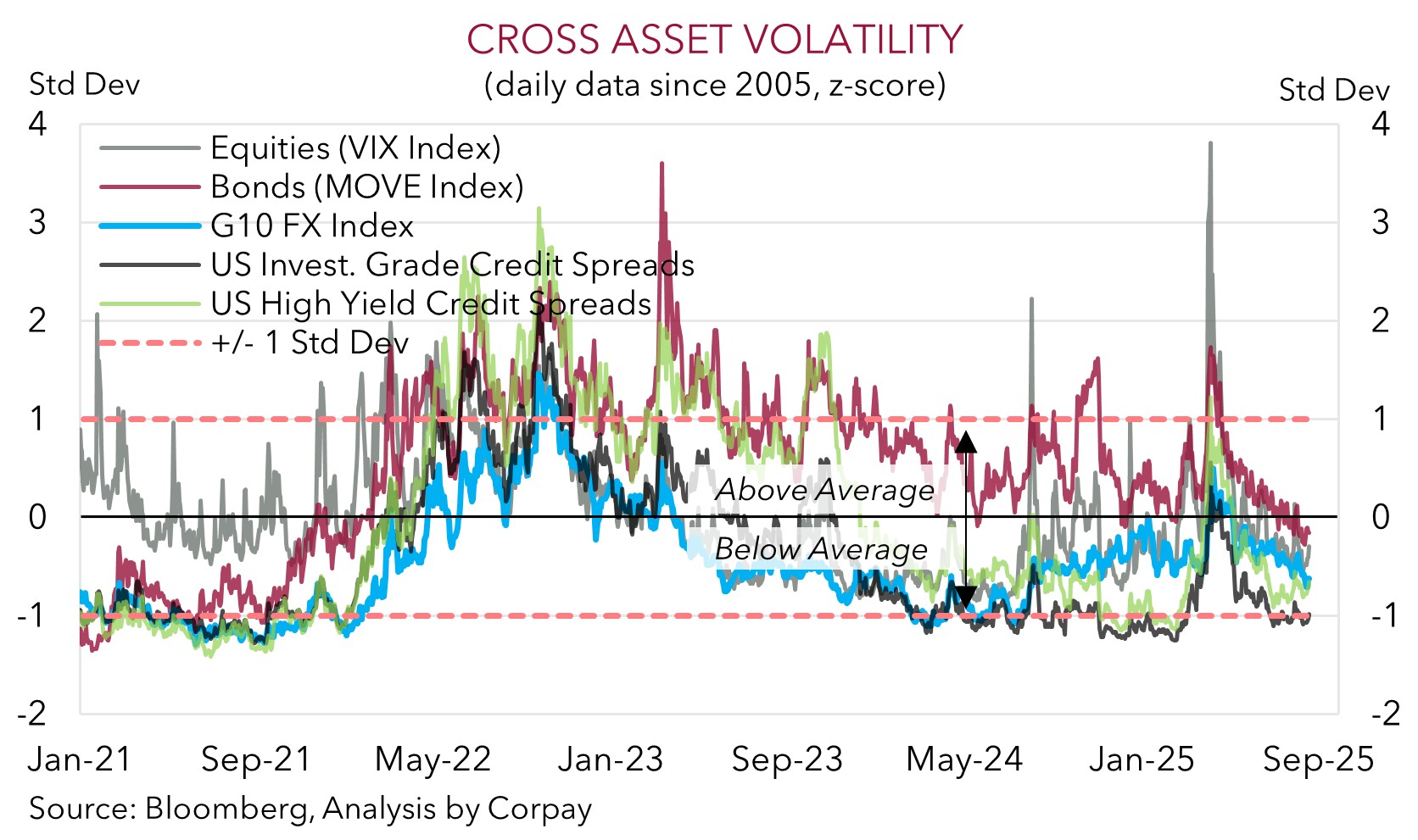

As flagged above and over recent days, the major market event is tonight’s speech by US Fed Chair Powell (12am AEST). In addition to being today’s focal point the speech is also likely to set next week’s market tone. As our chart below shows, various measures of cross-asset volatility are tracking at or below their respective long-run averages. Hence, we see a risk that Fed Chair Powell’s comments spark a burst of volatility, particularly if he leans against expectations looking for a steady stream of interest rate cuts by the US central bank over the back end of 2025 and 2026.

As mentioned, we think US Fed Chair Powell may be hard pressed to sound more ‘dovish’ than what is already priced in. Outcomes relative to expectations matter for markets. Hence, in our view, if Chair Powell isn’t as open to an interest rate cut in September as what is baked in given lingering inflation concerns the potential upward repricing in US yields could boost the USD a bit more and exert further downward pressure on AUD/USD. The pullback in the AUD that has come through recently isn’t unusual for this time of the year. Risk assets and the AUD tend to come under pressure towards the backend of the US/European summer. Over the past 28 years AUD/USD has declined in August 21 times.