• US CPI. Uptick in US inflation has seen Fed rate cut expectations fall. USD firmer on the back of higher yields. AUD & NZD lose some ground.

• US data flow. US producer prices out tonight. US import prices & retail sales due tomorrow. More signs of tariff impacts could give USD more support.

• AU jobs. Australian jobs report also released tomorrow. The data has been volatile the past few months. Will unemployment rise in June?

Global Trends

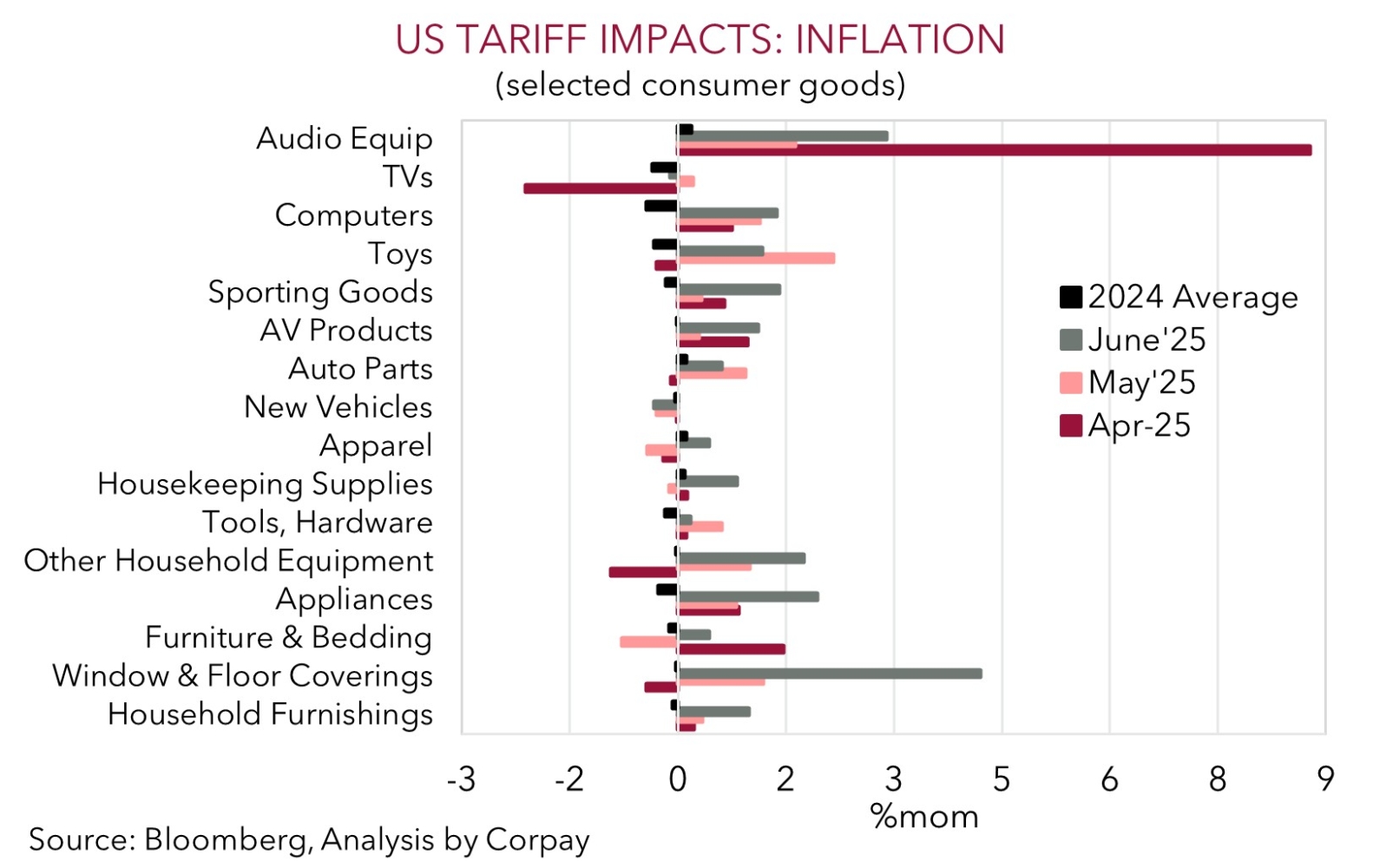

US economic data was in focus overnight with the latest CPI inflation report showing more of an impact on ‘goods’ prices from tariffs. US inflation edged up broadly inline with analyst’s predictions in June with headline and core CPI now running at 2.7%pa and 2.9%pa respectively. A closer look under the hood finds that on an aggregate level softer ‘services’ prices, such as rents and hotel accommodation, offset the pass-through from import levies on ‘goods’ prices. Notably, as our chart below shows, a broader range of consumer goods are seeing solid price increases, and this is likely to continue over coming months, in our view, as US firms pass on higher import costs to preserve margins.

In response markets pared back their near-term US Fed interest rate cut expectations with the odds of a move in late-July falling to next to nothing and a reduction in mid-September now seen as a 50/50 bet. Earlier this month traders were assuming the US Fed was set to cut rates in September. The shift in Fed thinking has flowed into US bond yields with rates rising ~4-5bps across the curve. This adjustment exerted a little downward pressure on US equities (S&P500 -0.4%) and supported the USD. The EUR has slipped to ~$1.16, a multi-week low, GBP (now ~$1.3384) is at the bottom of its two-month range, and the interest rate sensitive USD/JPY has edged up towards its 1-year average (now ~148.85). Elsewhere, USD/SGD has extended its modest uptick, while NZD (now ~$0.5946) and AUD (now ~$0.6515) have given back ground with the USD moves overpowering the generally better than predicted Q2 China GDP and June activity figures.

US producer price inflation is out tonight (10:30pm AEST), with import prices and retail sales released tomorrow. The PPI and import prices will provide more insight into tariff effects, while retail sales should give a snapshot of how the US consumer (the engine room of the economy) is tracking. As outlined before, we think tariffs on US imports are here to stay in some form. The announcement overnight the US had reached a deal with Indonesia that will see a base-line tariff of 19% imposed reinforces this view. We continue to believe that optimistic markets may have become complacent to the economic challenges created by tariffs. Although we have a negative USD outlook over the longer-run, we feel that more signs of re-emerging prices pressures in the US could generate a further USD supportive upward repricing in US interest rates over the near-term.

Trans-Tasman Zone

The firmer USD stemming from a reduction in near-term US Fed interest rate cut expectations due to some renewed tariff-induced inflation has exerted downward pressure on the NZD and AUD (see above). At ~$0.5946 the NZD is hovering around the lower-end of its two-month range while the AUD (now ~$0.6515) has drifted back towards its 50-day moving average. That said, the AUD has had more of a mixed performance on the cross-rates. AUD/EUR and AUD/NZD consolidated overnight, AUD/JPY touched its highest point since late-January, while AUD/CNH (-0.2%) and AUD/GBP (-0.3%) gave up ground.

The recent pull-back in the AUD has been in line with our thinking. As outlined over the past week we believed there was the potential for the beaten-down USD to rebound. We think there is scope for the USD’s revival to extend further over the near-term given the chances of renewed bursts of market volatility created by lingering US tariff concerns and as more of the economic impacts on US growth/inflation show up. US PPI inflation is released tonight (10:30pm AEST), with import prices and retail sales out tomorrow night. In our judgement, more signs of tariff related inflation may see markets trim their US Fed interest rate cut expectations further, which if realised could take more heat out of the AUD after its recent strong run. As would a softer Australian labour market report (released Thursday). We believe the subsamples within the labour force survey suggest the risks are tilted to the Australian unemployment rate rising. Cracks in the Australian jobs market might reinforce thinking the RBA will lower interest rates a few more times over H2 2025.

Further out, we would also note that the AUD has usually had a negative seasonal bias in late-July/August. AUD/USD has declined in August in 21 of the past 28 years. The implementation of the US’ new tariffs (1 August), recovery in US GDP growth (30 July), an on hold US Fed (30 July), US jobs report (1 August), a RBA rate cut combined with more ‘dovish’ guidance (12 August), more signs of tariff induced US inflation (12 August), and/or no more deals struck at the end of the US-China tariff truce (12 August) could be catalysts for this pattern to repeat in 2025.