• Upbeat tone. US equities rose on Friday, so did commodities. This, & the decline in the USD helped the AUD & NZD extend their upswings.

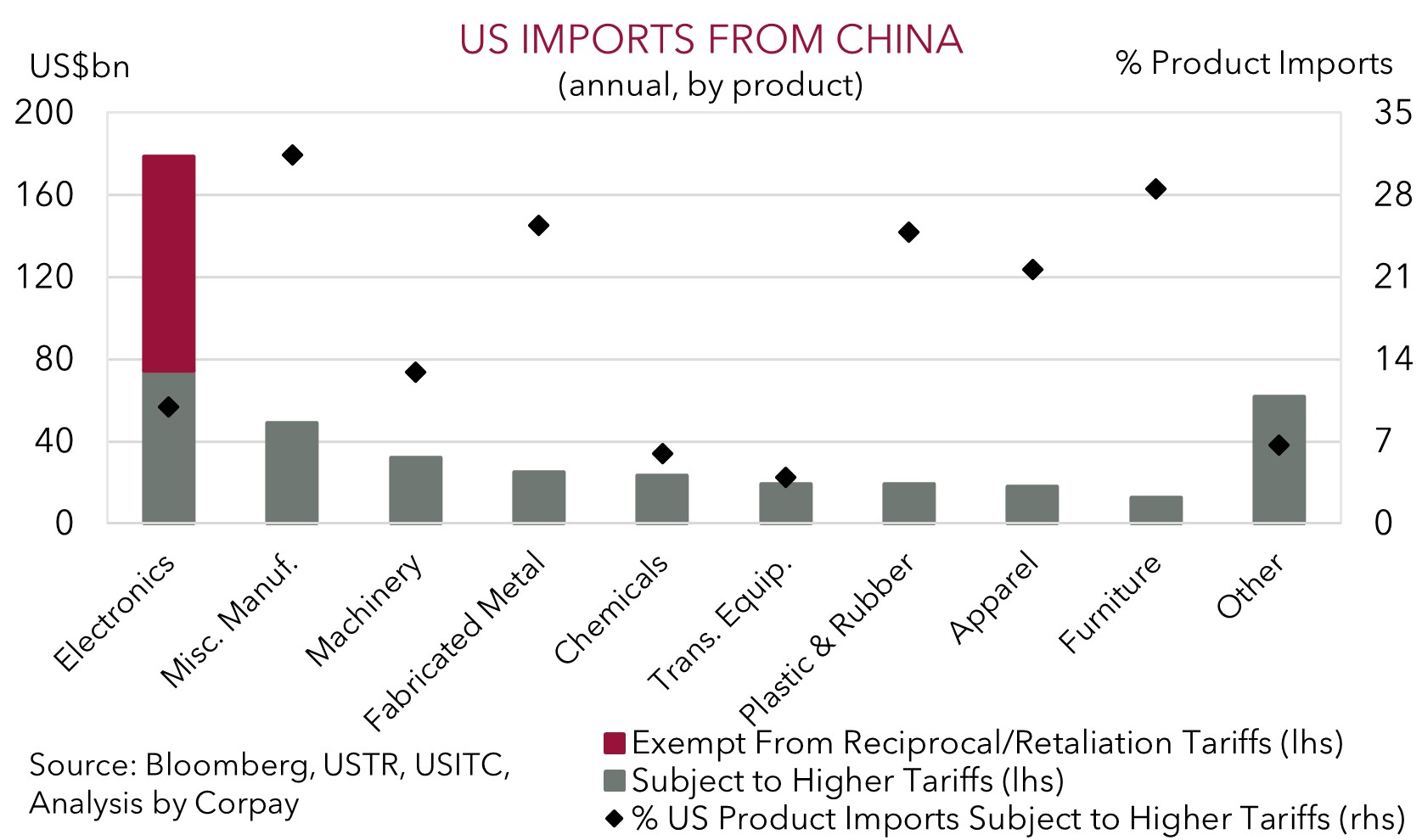

• Tariff news. US announced various electronics imported from China will be ‘exempt’ from higher tariffs. But it only looks like a temporary reprieve.

• Event Radar. China GDP, US retail sales, the BoC & ECB meetings, & a speech by Chair Powell are due this week. As is the AU jobs report & NZ CPI.

Global Trends

US tariff news remains in the driver’s seat. Sentiment improved in Friday’s US trade with equities pushing higher, sustaining the recent zig-zag pattern. The S&P500 (+1.8%) and tech-focused NASDAQ (+2.1%) were up strongly. US bond yields rose, although larger relative increases in the 2yr rate (+10bps to 3.96%) saw the yield curve flattened a touch. Commodities increased with WTI crude oil (+2.1%) and copper (+3.7%) leading the way, while in FX the USD remained under downward pressure. The USD index shed another ~1.2%, with EUR (now ~$1.1325) hitting its highest level since early-2022 before drifted back. USD/JPY has dropped below ~144, the lower end of its multi-month range, GBP appreciated (now ~$1.3083), and cyclical currencies such as the NZD (now ~$0.5835, the top of its year-to-date range) and AUD (now ~$0.6304) outperformed.

There was a rather muted impact from news on Friday China is raising tariffs on goods imported from the US to 125% in response to the recent US hikes. However, in a sign things may have reached a ‘peak’ in terms of tit-for-tat moves and ‘tariff severity’ China’s Finance Ministry added it would ignore any further US tariff increases given current levels mean the “there is no market acceptance for US goods exported to China”. Added to that the Trump Administration also issued updated guidance late Friday indicating a broad range of electronics (e.g. smartphones, laptop computers, memory chips and other items) will be exempt from the higher reciprocal/retaliatory tariffs (i.e. the cumulative 125% recently imposed on China). This has subsequently been clarified as a ‘reprieve’ as these goods will likely be subject to duties in a “month or two” when the US completes its look into “semiconductors and the whole electronics supply chain”, according to Commerce Secretary Lutnick and social media posts by President Trump. As our chart shows, the ‘exemptions’ account for a large share of the US electronics imports from China which is the largest product category shipped across. On our figuring a little less than ~1/4 of the US’ total goods imports from China won’t be slugged the outsized tariffs, at least not for a period of time. In our opinion, this may generate a bit of positivity in markets at the start of the week, but the prospect of the levies coming back down the track in a different ‘tariff bucket’ may keep a lid on the euphoria.

In addition to tariff developments, there are several global macro events scheduled in this holiday shortened week. The China data is due with this batch including Q1 GDP (Weds). In Europe, the ECB holds its meeting (Thurs night AEST). The Bank of Canada also meets (Weds night AEST). And in the US, retail sales are released (Weds night AEST) and several Fed officials including Chair Powell speak (Weds night AEST). On net we remain of the view that more volatility is likely, but downside US growth risks and shaken investor confidence can keep the USD on the backfoot over the medium-term.

Trans-Tasman Zone

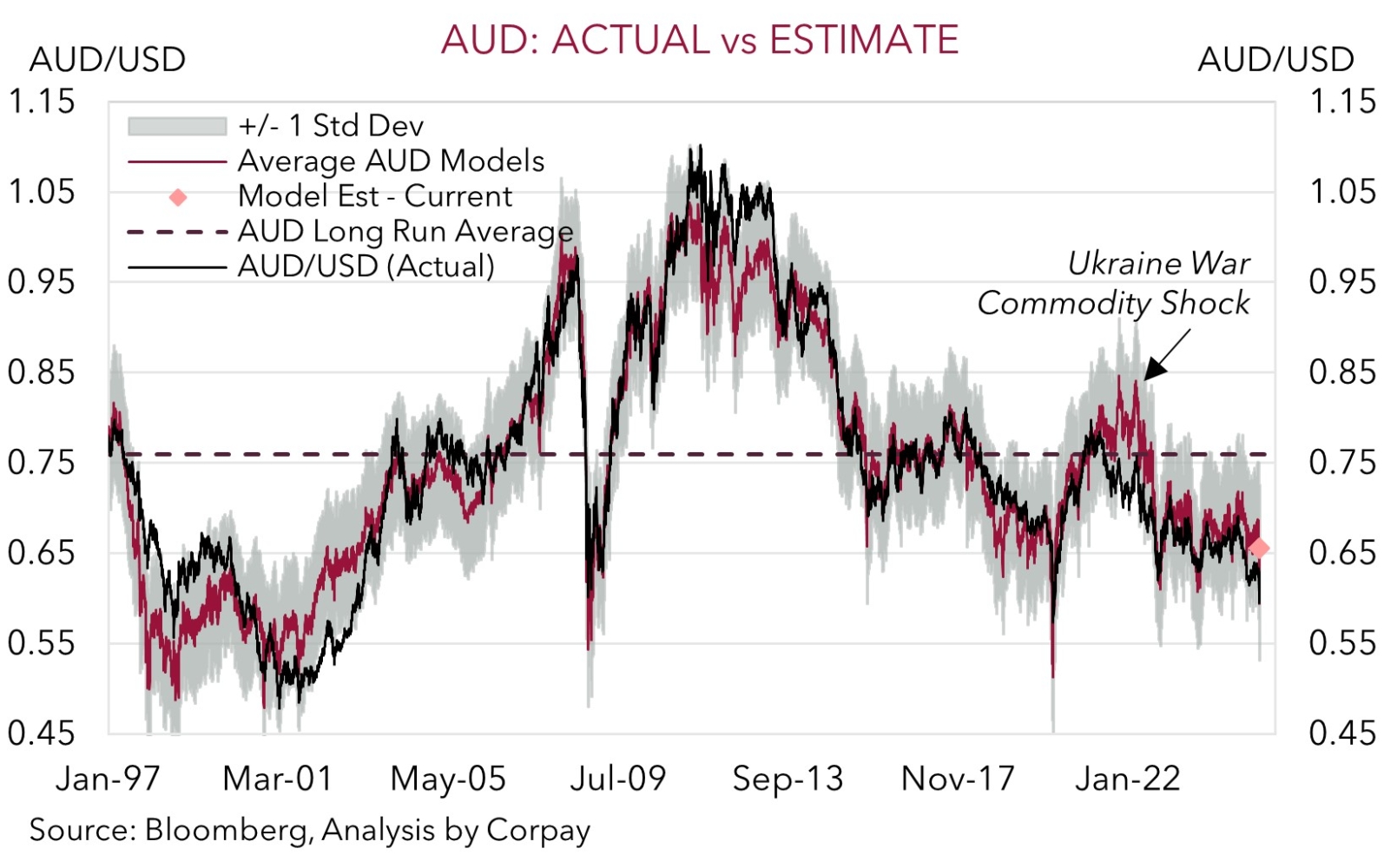

The more upbeat tone across markets and weaker USD helped the AUD and NZD extend their respective rebounds at the end of last week (see above). The NZD (now ~$0.5835) is at the upper end of its 2025 range, while the AUD (now ~$0.6304) is in positive territory year-to-date and ~6.5% above last weeks low. The AUD also ticked higher on the major crosses, with AUD/NZD an exception. The AUD rose by ~0.1-0.8% against the EUR, JPY, GBP, CAD, and CNH on Friday.

Locally the latest read on the labour market is due this week (Thurs), and in NZ Q1 CPI inflation is released (Thurs). On top of that, tariff developments will also continue to drive market sentiment, while Q1 China GDP (Weds), US retail sales (Weds night AEST), a speech by Fed Chair Powell (Weds night AEST), and the ECB meeting (Thurs night AEST) are also on the radar. In terms of the Australian jobs report we think there is scope for monthly employment to rebound after the surprising fall in February. A lot of the weakness last month looks to have been because of older employees delaying a return to work. If this is correct employment could snap back in March. We think signs the Australian jobs market is on solid ground might see markets pare back some of their built-up RBA rate cut expectations and this can be AUD supportive. Interest rate markets are factoring close to 5 RBA rate reductions by year-end, with odds of an outsized 50bp move being delivered in May still high (now ~35% chance).

We remain of the opinion that more bursts of market/AUD volatility should be anticipated over the near-term given the tricky backdrop. Markets don’t move in straight lines. That said, even after its recovery, we think there is still more upside potential for the AUD over the medium-term. Compounding our outlook for a weaker USD is the fact that domestic fundamentals in Australia still look reasonable with the level of activity across the economy elevated. On top of that, as discussed before, Australia’s direct trade with the US is limited (only ~4% of exports are sent to the US) and any pressure in China’s export sector looks set to be counteracted by steps to stimulate domestic growth. This is where Australia’s key exports are tied to. The AUD also still has valuation support with it tracking a few cents below our suite of ‘fair value’ models, even after accounting for last weeks moves.