• Consolidation. Modest moves across most markets. USD index remains heavy with EUR pushing higher. AUD hovering near top of its range.

• Macro pulse. US manufacturing ISM shows momentum still sluggish. US jobs report the main data focal point later this week.

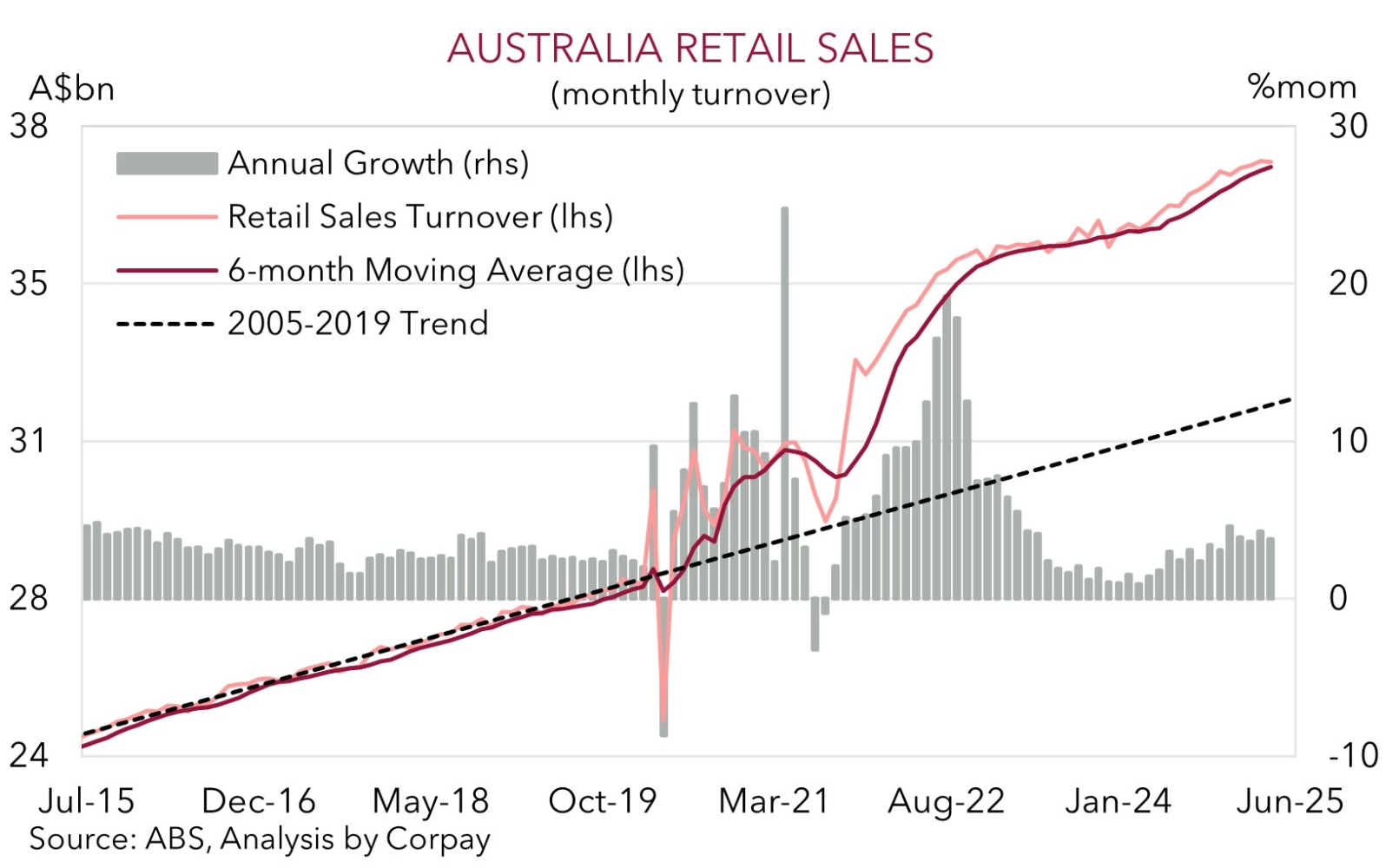

• AU data. Retail sales & building approvals released today. After a subdued start to the year will retail spending turn the corner?

Global Trends

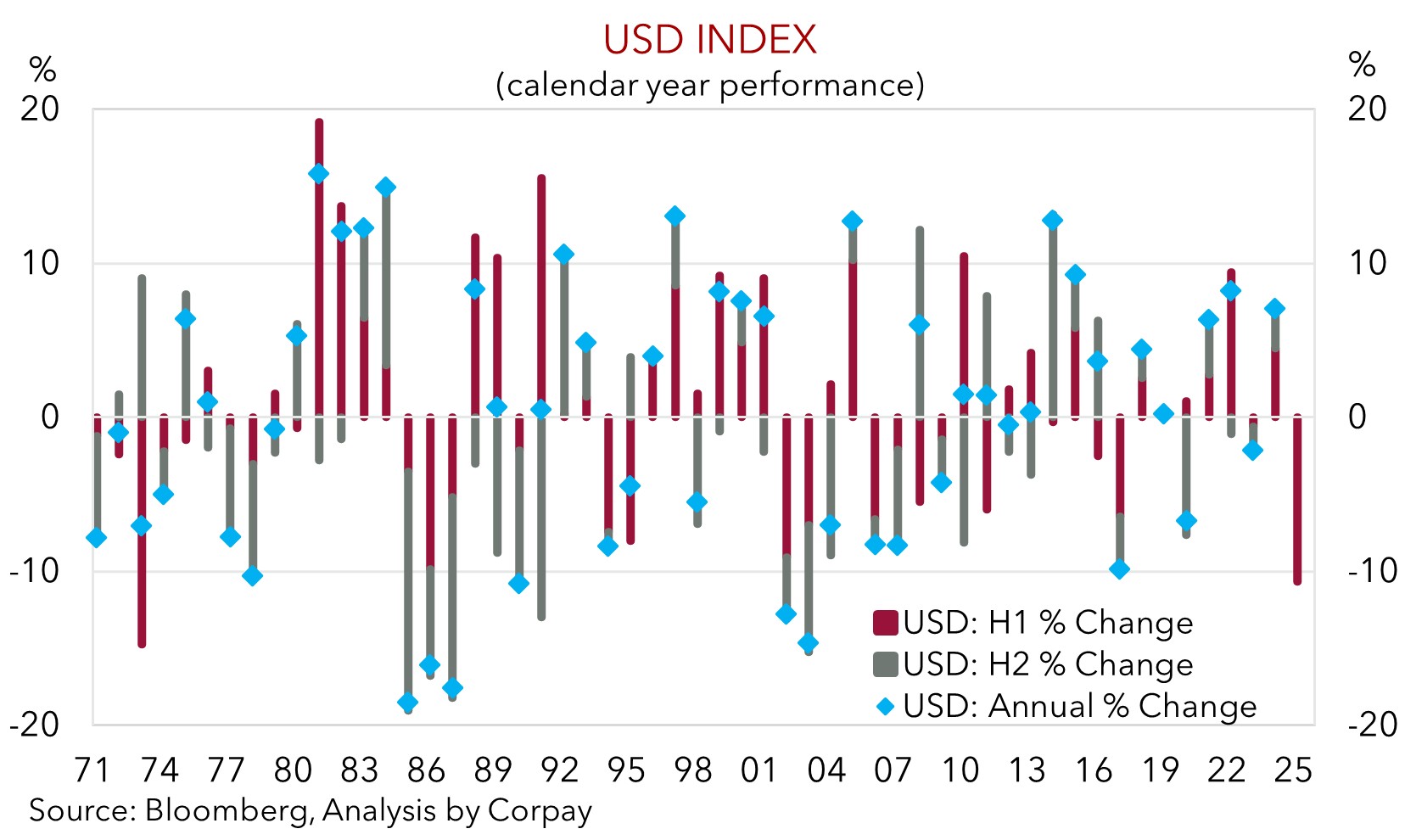

Modest moves across markets at the start of the new month. US equities slipped back a touch from record highs (S&P500 -0.1%), US bond yields nudged up after trending lower the past few weeks, and the USD index continues to languish near multi-year lows. As our chart shows, the USD’s performance over H1 2025 was one of the worst since the early-70s. EUR (the major USD alternative) extended its upswing to a fresh cyclical peak (now ~$1.1806) and USD/JPY (the second most traded currency pair) declined towards the bottom of its recent range (now ~143.39). The NZD (now ~$0.6099) and AUD (now ~$0.6582) tread water around the top of their respective multi-month ranges.

In terms of the news flow US President Trump’s One Big Beautiful Bill (OBBB) passed through the Senate but it may now face resistance from House Republicans. The Congressional Budget Office estimates the bill, which raises the debt limit, cuts Medicaid and expands tax breaks will increase the US deficit by $3.3trn over the next decade. The sustainability of the ever increasing US government debt burden is in the sights of markets. Data wise, the US manufacturing ISM survey showed activity remains sluggish with new orders and employment intentions weakening. And although JOLTS job openings rose in May a closer look finds that the increase was concentrated in leisure/hospitality jobs. The total hiring rate fell and when leisure/hospitality is excluded hiring is at last year’s lows with trade-exposed sectors like manufacturing weakening. On the policy front, Chair Powell stressed the US Fed has an open mind. US policymakers are going “meeting by meeting” and are watching the data, especially inflation impacts from tariffs. Notably, Chair Powell indicated the Fed “went on hold” when it saw the size of the tariffs, implying further interest rate cuts may have already been delivered if not for the trade policy changes.

US ADP employment is out tonight (10:15pm AEST) ahead of tomorrow’s monthly jobs report (Thurs night AEST). As outlined before, we believe heightened uncertainty and loss of momentum across business surveys and underlying activity suggests the US labour market is cooling. If realised, we think this could reinforce expectations looking for US Fed interest rate cuts over the next year and this may exert more downward pressure on the USD.

Trans-Tasman Zone

The quieter start to the new month across markets has flowed through to the AUD and NZD with both range-bound over the past 24hrs (see above). The AUD (now ~$0.6582) remains around the upper end of the range it has occupied since mid-November, while the NZD (now ~$0.6099) is near its 9-month peak. In contrast to the performance against the sluggish USD, the AUD lost a bit of ground on a few cross-rates with falls of ~0.1-0.4% recorded against the EUR, JPY, and GBP overnight.

On the data front, Australian retail sales and building approvals for May are released today (11:30am AEST). Household consumption accounts for ~50% of GDP, and while retail sales don’t capture a lot of information around spending on services they still provide a snapshot of the pulse of the Australian consumer. After a subdued start to the year we think retail spending might have perked up in May, particularly as warmer weather looks to have dampened clothing sales the month before. As our chart also illustrates, although momentum has softened from the robust strength in the period post COVID the level of retail turnover remains high and well above its pre-pandemic trend thanks in part to the larger population. We think an improvement in household consumption may temper the markets enthusiasm about how many interest rate cuts the RBA might deliver over the next year. Interest rate markets are pricing in almost 4 RBA rate reductions by May 2026. We believe cooling inflation points to more RBA rate relief but we don’t see it being more aggressive than what is baked in.

Furthermore, as outlined before, when it comes to the AUD it should be remembered that local developments typically play second fiddle to USD trends. Australia (and the AUD) are ‘price takers’ of what happens in the US. We believe the mix of fading US economic strength, outlook for US Fed rate cuts over late-2025/2026, and reduced investor demand for US financial assets given the volatile policy backdrop and lofty valuations should see the USD weaken over the medium-term. In our opinion, this, combined with moves by authorities in China to mitigate tariff-related headwinds via commodity-intensive infrastructure investment, could see the AUD edge higher over future quarters.