• Mixed fortunes. US equities & bonds consolidated, while USD remains on backfoot. EUR & GBP near cyclical highs. AUD & NZD a little firmer.

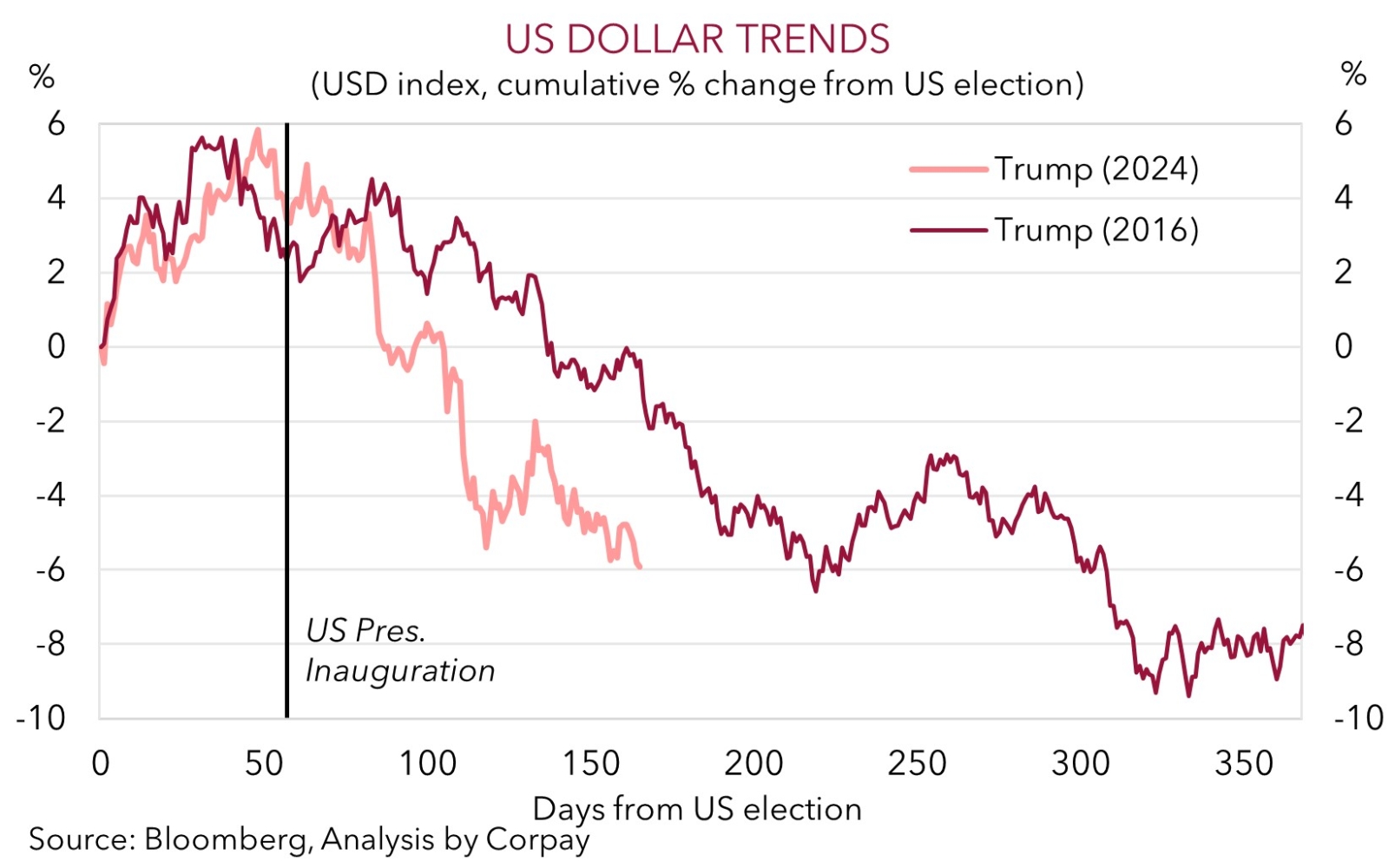

• USD trends. Fundamental forces continue to undermine the USD. It won’t be a straight line but we think these trends may continue for a while yet.

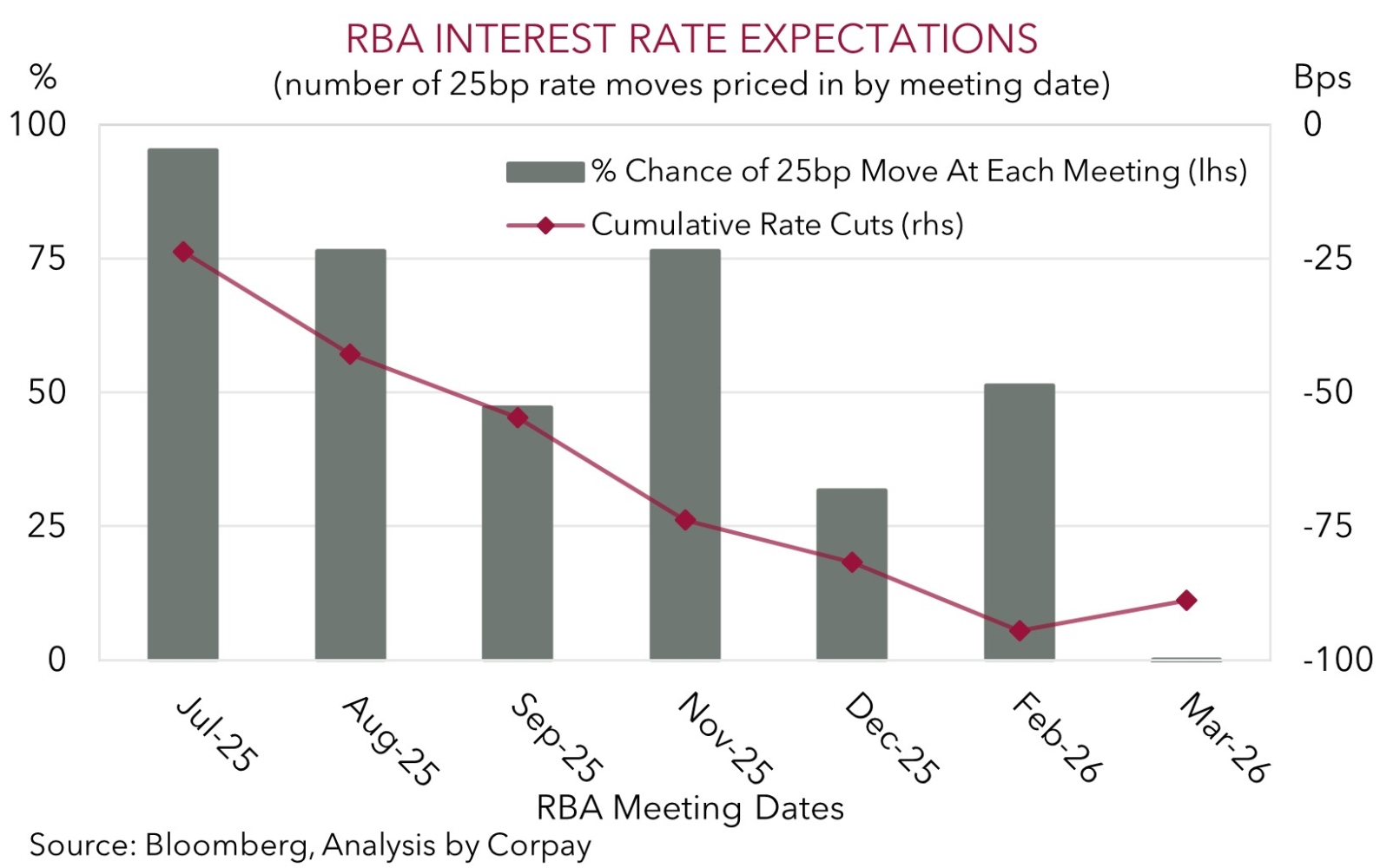

• AU CPI. Monthly inflation slowed more than forecast. RBA likely to cut interest rates again in early-July. However, this is largely priced in.

Global Trends

Some mixed fortunes across financial markets overnight, though on net the moves have been modest. In contrast to the solid rise across Asian equities yesterday, European stockmarkets eased back a little (EuroStoxx600 -0.7%) while the US S&P500 tread water within 1% of its record highs. US bond yields also consolidated with the benchmark 10yr rate hovering around ~4.29%, close to its 1-year average. Volatility in oil prices has receded with brent crude tracking at levels prevailing before the Israel/Iran conflict kicked off. And in FX, the USD has remained on the backfoot. The USD index is at the bottom of the range it has occupied since Q1 2022 with the EUR (the major USD alternative) (now ~$1.1658) and GBP (now ~$1.3662) near respective multi-year highs. NZD (now ~$0.6038) is within striking distance of its year-to-date peak, as is the AUD (now ~$0.6511) with yesterday’s soft monthly Australian CPI report not generating a lasting impact.

News wise, the Trump Middle East truce is still holding despite conjecture on the effectiveness of the US’ attacks on the Iranian nuclear facilities. At the NATO summit, members pledged to meet President Trump’s demand to lift defence spending to 5% of GDP by 2035. In the US, Fed Chair Powell delivered the second day of his semi-annual Congressional Testimony. Chair Powell stuck to the recent script and noted “there will be some” inflation from tariffs over the “course of the coming months” and as such policymakers are “waiting to see more data on that”. Markets see a small chance the US Fed lowers interest rates in late July (~25% probability priced in), though a full cut is factored in by September and another is discounted by year-end.

US trade data, initial jobless claims, and durable goods orders are released tonight (10:30pm AEST), with a few Fed officials also speaking. As outlined previously, barring a complete breakdown of the ceasefire we think the fundamental forces of downside US growth risks, expectations of US Fed interest rate cuts, and reduced investor demand for US assets are reasserting themselves and this should see the USD weaken over the medium-term. Also working against the USD is the outlook for greater fiscal/defence spending across Europe. As our chart shows, the USD continues to follow a similar path to what occurred during the first year of President Trump’s first term.

Trans-Tasman Zone

Domestic and global crosscurrents generated a little intra-day volatility in the AUD over the past 24hrs. But on the net, the softer USD trends won out and the AUD has inched a bit higher (now ~$0. 6511) to be within ~0.7% of its multi-month peak. Likewise, the global backdrop is propping up the NZD (now ~$0.6038) which is also near the upper end of its year-to-date range. That said, the AUD has been more mixed on the crosses with gains against JPY (+0.6%), CAD (+0.3%) and CNH (+0.4%) counteracted by some softness versus the EUR (-0.1%) and NZD (-0.2%).

In terms of the Australian data flow, the monthly CPI indicator for May was released yesterday and it showed price pressures are moderating faster than expected. Headline CPI stepped down to 2.1%pa and core inflation decelerated to 2.4%pa (the slowest since late-2021). The other core measure (i.e. ex volatile items and travel) inched down to 2.7%pa. On balance, the underlying impulse pulse looks to be tracking better than what the RBA was predicting. This has further opened the door to another interest rate cut at the 8 July RBA meeting. Markets agree with a 25bp reduction early next month now ~95% priced in. Almost 3 rate cuts are discounted by year-end. We think this looks fair, and would see the RBA policy rate (now ~3.85%) fall to ‘neutral’ over H2.

That said, for the AUD, what is important is outcomes relative to expectations, and what is happening with the USD. On the former, we doubt the RBA will be more aggressive than what is anticipated, and on the latter, as discussed above and previously, we believe the USD is in a long-run downtrend. Barring a breakdown of the Middle East ceasefire we think the fundamental forces of fading US economic outperformance, expectations of further US Fed easing, and reduced investor confidence/demand for US financial assets given the volatile policy backdrop and lofty valuations should see the USD steadily weaken over future quarters. This, coupled with steps by authorities in China to mitigate tariff-related growth headwinds, and still positive momentum in the Australian economy should see the AUD grind higher over the next year, in our opinion.