• US trends. Outlook for US rate cuts supported sentiment & exerted more pressure on the USD. AUD at the top of its multi-month range.

• Macro forces. Patchy US growth & signs the labour market is loosening. Reports also indicate Pres. Trump may name the next Fed Chair early.

• USD downtrend. Various factors continue to move against the USD. There will be bumps along the way but we see the USD weakening over time.

Global Trends

The de-escalation of the situation in the Middle East has seen investors quickly refocus their attention on US macro trends. The run of US data released overnight was patchy and another sign the underlying economic strength is fading. US GDP growth was revised down to show a larger contraction in Q1; core orders for non-defence capital goods increased in May but have lost a step compared to earlier in the year as policy uncertainty dampens investment spending; and continuing jobless claims (a gauge of recurring unemployment benefits) ticked up to their highest level since late-2021 as the softer growth pulse works its way into the labour market. On top of that there were reports President Trump may look to name the next Fed Chair early in a “bid to undermine” current Chair Powell. The term of Chair Powell runs until May 2026 and he cannot be fired ‘without cause’. However, that might not stop the Trump Administration from attempting something unorthodox in its efforts to put in place a Fed Chair with a more ‘dovish’/low interest rate bias. As a reminder of how things change President Trump nominated current Chair Powell to his post in 2017.

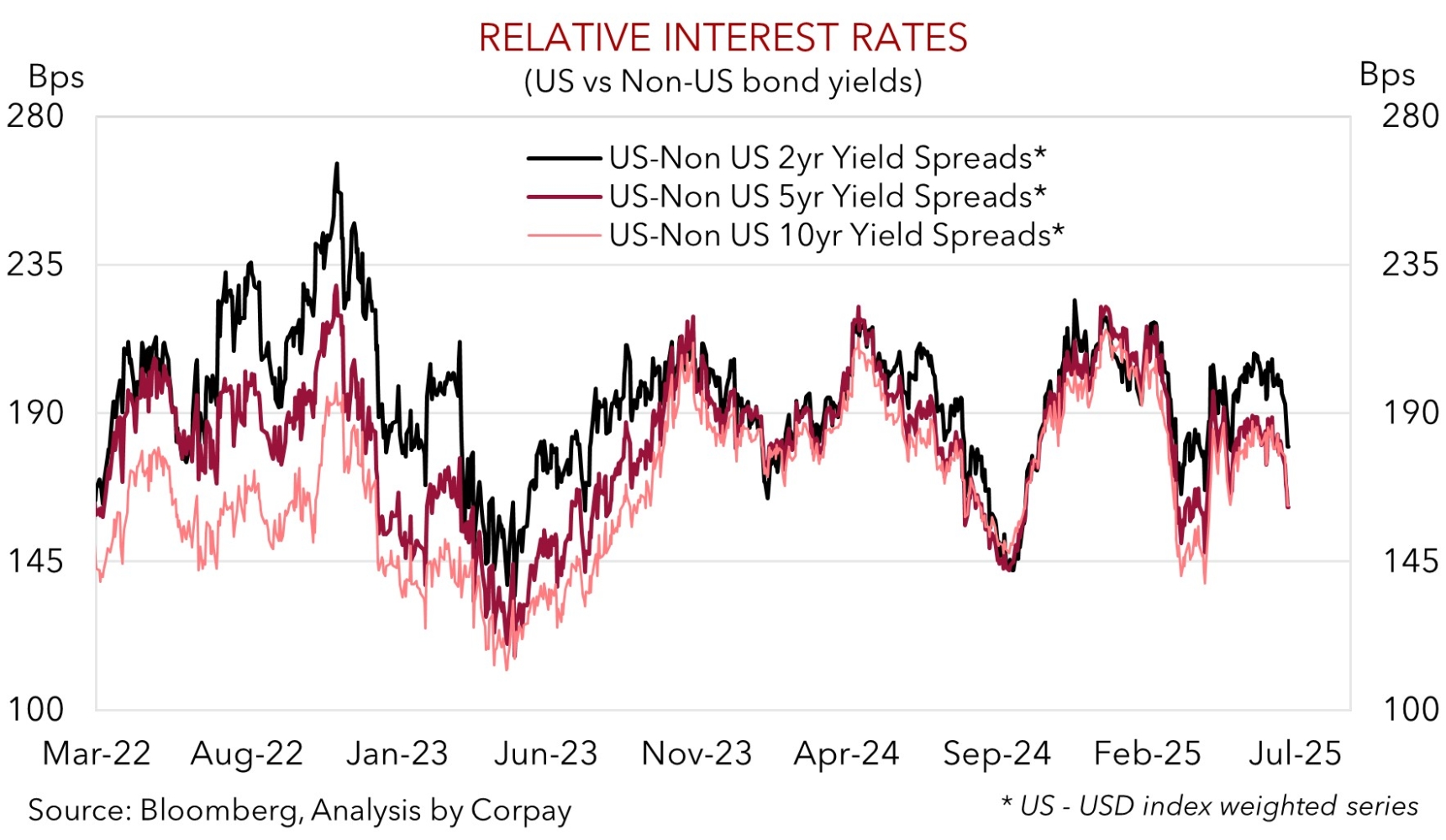

These factors have seen US bond yields fall as investors bolster expectations the US Fed could lower interest rates over future quarters. The US Fed is seen re-starting its rate cutting cycle in September, with ~5 reductions priced in by Q3 2026. US yields declined ~5-6bps across the curve with the benchmark 10yr rate (now ~4.24%) close to its 1-year average. The prospect for looser monetary policy supported US equities (the S&P500 (+0.8%) is on the cusp of hitting a new record high) and it also exerted more downward pressure on the USD. As our chart shows, relative yield spreads are moving against the US (and the USD). EUR (now ~$1.1697) is around the top of its multi-year range, as is GBP (now ~$1.3728). USD/JPY lost some ground and USD/SGD touched its lowest level since 2014 (now ~1.2744). The NZD edged higher and is within striking distance of its year-to-date peak (now ~$0.6056), while the AUD rose to its highest point since last November.

The US PCE deflator (the Fed’s preferred inflation measure) is due tonight (10:30pm AEST). More signs US inflation remains contained and tariff impacts still aren’t showing up might reinforce US Fed rate cut expectations and undermine the USD further, in our view. As outlined before we believe fundamental forces of downside US growth risks, outlook for lower US interest rates, and waning demand for US assets should see the USD weaken over the medium-term.

Trans-Tasman Zone

Heightened expectations of US interest rate cuts coming down the pipeline has underpinned risk sentiment and exerted more downward pressure on the USD overnight (see above). This mix has supported the NZD and AUD. At ~$0.6056 the NZD is approaching its year-to-date highs, while the AUD (now ~$0.6545) reached a fresh multi-month peak. The backdrop has also generally helped the AUD tick up on the major crosses with gains of ~0.2-0.4% recorded against the EUR, NZD, and CNH over the past 24hrs.

As outlined previously, while analysts are looking for the RBA to lower interest rates again in early-July and deliver a few more cuts over H2, this already looks priced into markets. Interest rate futures are discounting ~95bps worth of RBA easing by next February. This is important when it comes to the AUD as outcomes compared to expectations are what matter in markets. We think the improving underlying inflation trends in Australia point to more RBA easing over coming months, however barring a negative shock, we don’t see the RBA delivering more than what is now baked in.

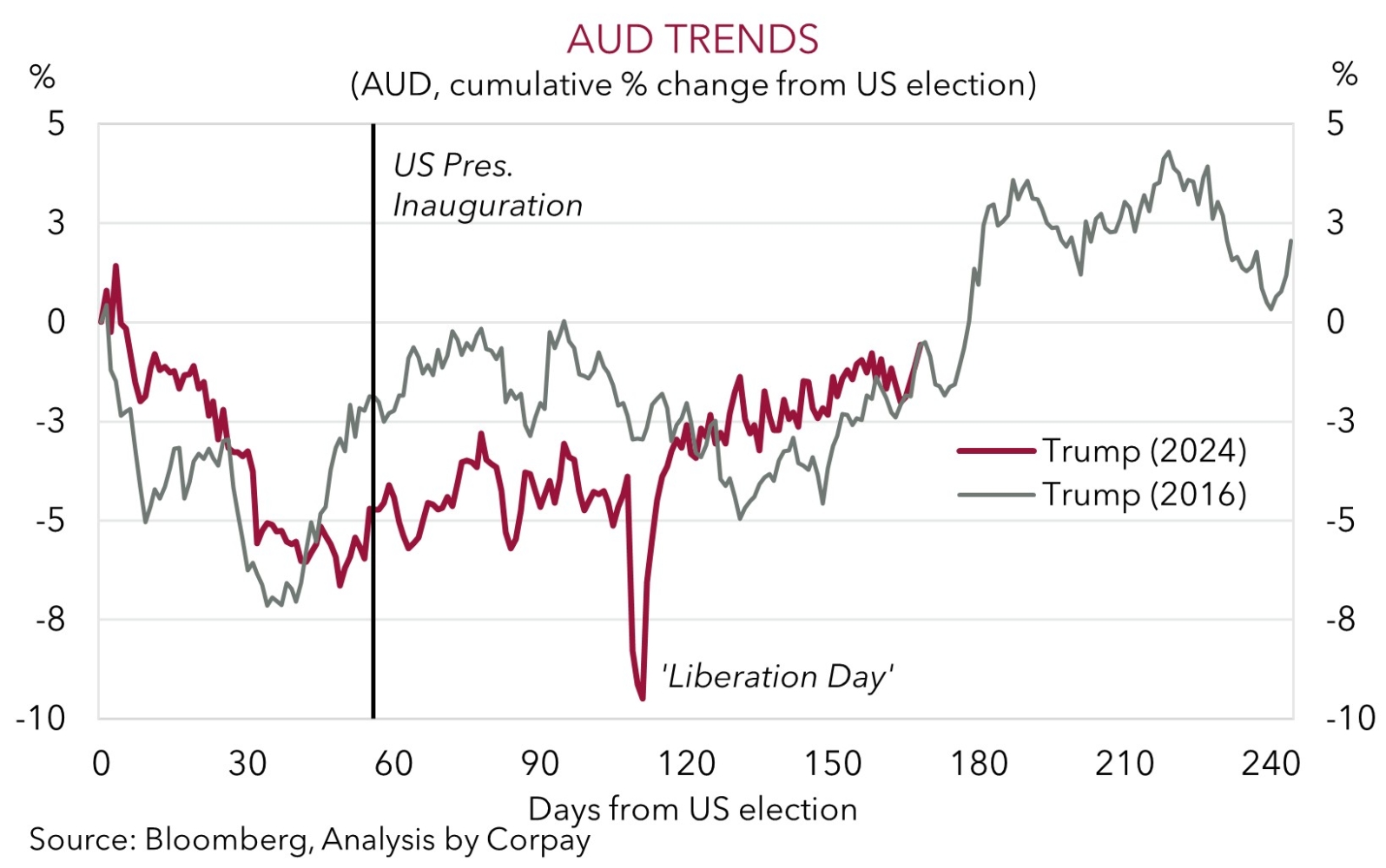

Moreover, when it comes to FX, it also shouldn’t be forgotten that local matters tend to play second fiddle to broader the USD developments. Australia and the AUD are ‘price takers’ of what happens in the US and the USD. As discussed before, we think the forces of fading US economic strength, expectations of further US Fed policy easing over the next year, and reduced investor confidence/demand for US financial assets given the volatile policy backdrop and lofty valuations should see the USD steadily weaken over coming quarters. This, coupled with steps by authorities in China to mitigate tariff-related growth headwinds via commodity-intensive infrastructure investment, and/or still positive momentum in the Australian economy could see the AUD grind higher over the next year, in our opinion. As our chart illustrates, much like the USD the AUD is following a similar path to what occurred in the first year of US President Trump’s first term.