• USD strength. Positive USD data & a patient Fed has supported the USD. This has weighed on other currencies like the AUD & NZD.

• AU CPI. Q2 inflation softer than predicted. This reinforced expectations looking for the RBA to cut rates in August & deliver more ‘relief’ later this year.

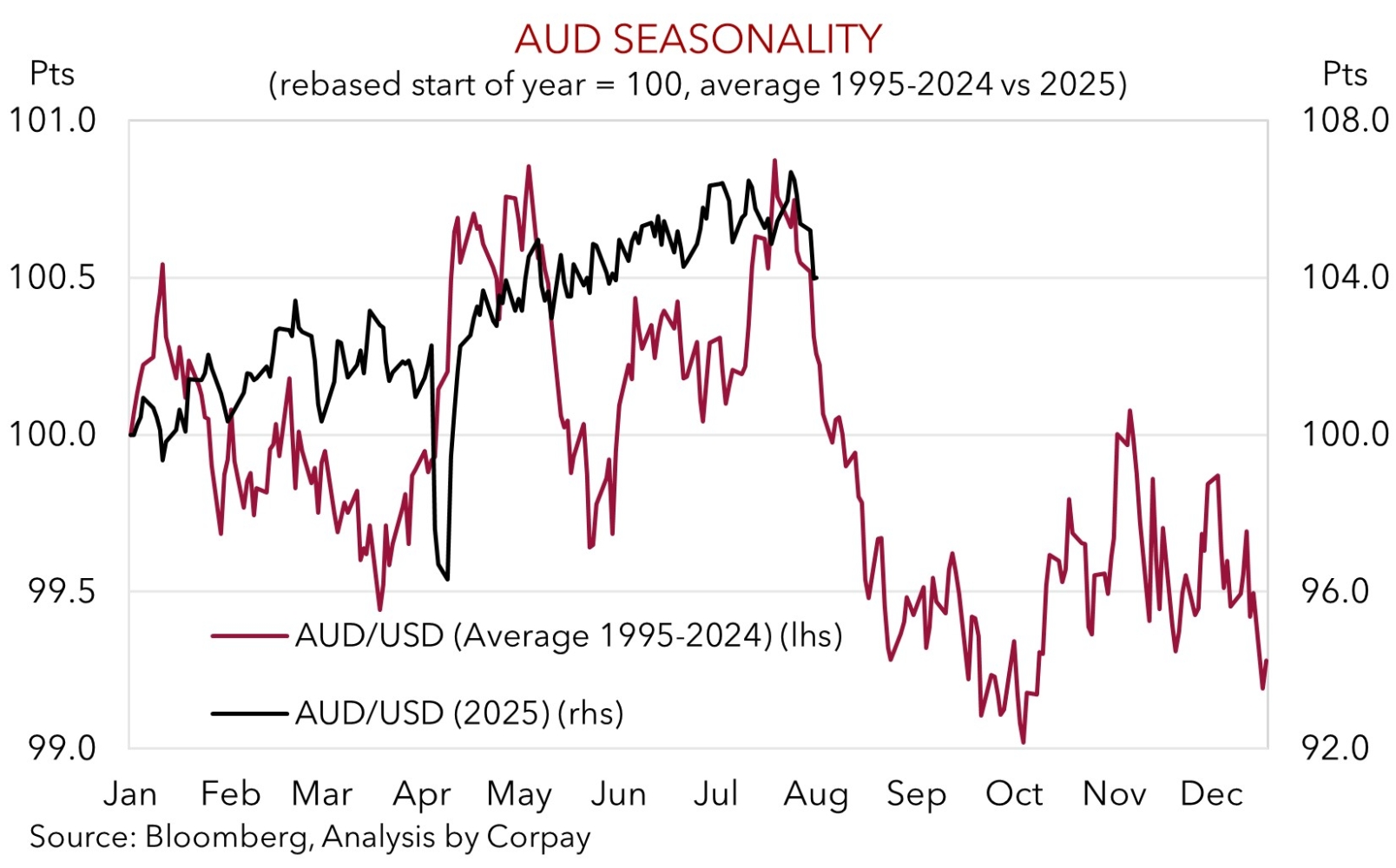

• Seasonal trends. USD rebound & unfolding AUD weakness inline with seasonal patterns at this time of year. Risk of more to come.

Global Trends

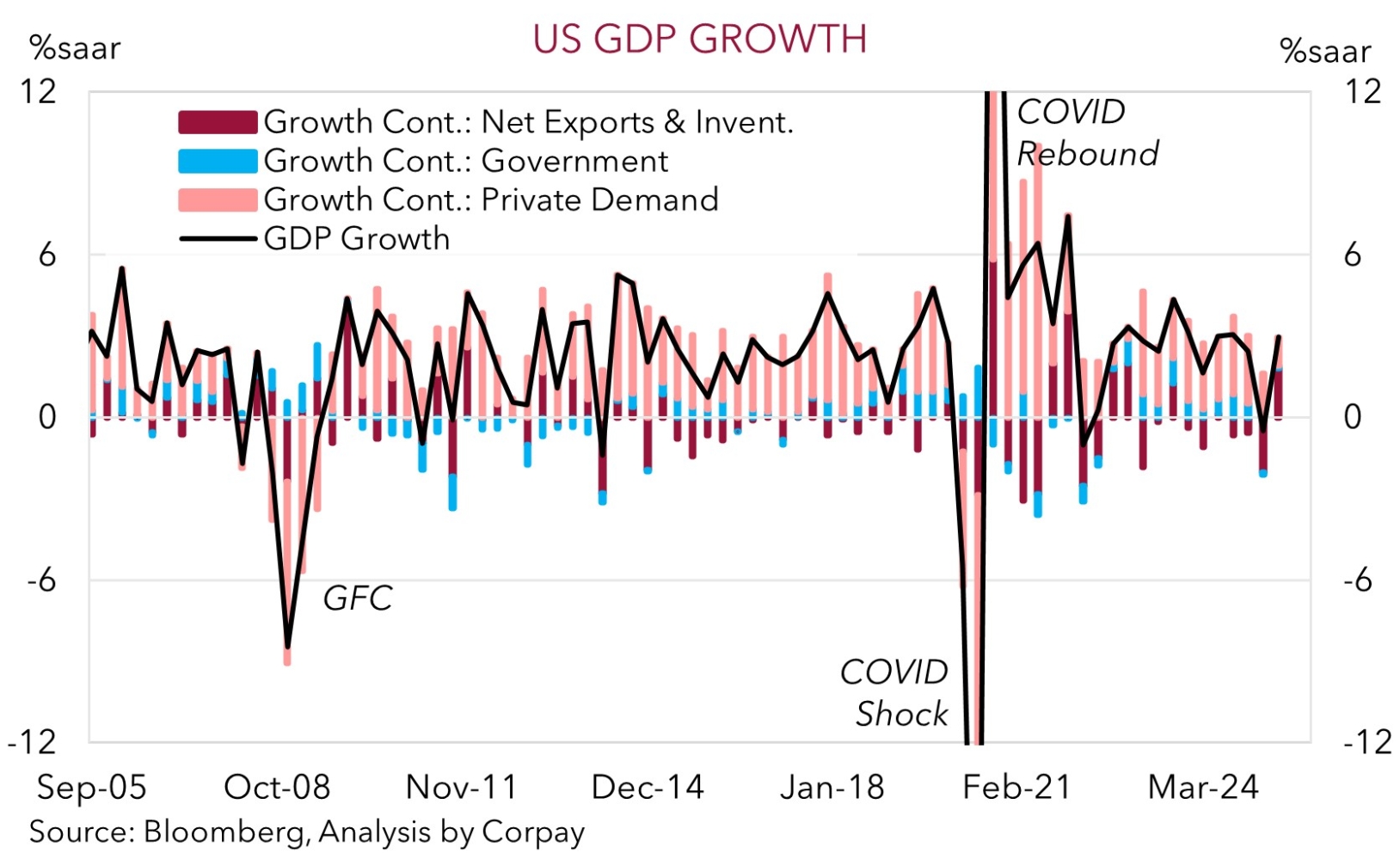

A run of positive US centric events boosted US bond yields and the USD overnight. Firstly, the latest batch of US data extended the recent run of positive surprises. ADP employment was better than predicted with 104,000 jobs added in July, and Q2 GDP rebounded sharply as the outsized drag on Q1 growth from net exports mechanically unwound. The US economy expanded at a 3% annualised pace in Q2. Though it wasn’t all rosy as private demand continued to lose steam with business investment decelerating over the second quarter on the back of the still high US interest rates and trade uncertainty. Secondly, the US Fed held interest rates steady. While 2 members of the committee dissented in favour of a rate cut for the first time since 1993, the overall tone of Chair Powell’s press conference leaned a bit more “hawkish” about the chances of a change as soon as September by stating “no decisions” have been made given the push-pull growth/inflation forces buffeting the economy. Indeed, the tariff situation remains fluid. US President Trump said goods from India will face a 25% tariff from 1-August, plus a penalty for buying Russian military equipment and energy. And copper prices plunged (-18%) after the US Administration backtracked on product specific tariffs. Less finished items such as copper ore will be exempt, though semi-finished goods like pipes and wires will face a 50% levy.

US equities were whipped around by the macro events and after tracking in positive territory for most of the session the S&P500 ended the day a little lower (-0.1%). Elsewhere, the reduction in US Fed rate cut bets over the next few meetings pushed up bond yields 5-7bps across the curve. This helped the USD with EUR (the major alternative) shedding ~1.2% to be back down around ~$1.14, the bottom end of its 2-month range, thanks also in part to a sluggish Eurozone GDP print. The Eurozone economy grew by just 0.1% in Q2. The interest rate sensitive USD/JPY rose (now ~149.45) back above its 1-year average. Closer to home, the AUD (now ~$0.6438) and NZD (now ~$0.5987) declined to the bottom of their respective 1-month ranges.

Today, the China PMIs are due (11:30am AEST), the BoJ holds its policy meeting (no set time), country level CPI for France (4:45pm AEST) and Germany (10pm AEST) is out, and in the US initial jobless claims, the PCE deflator (the Fed’s preferred inflation gauge), and employment costs (a wide ranging wages measure) are released (10:30pm AEST). On balance, we remain of the view that the USD (which is still tracking below our ‘fair value’ estimate) can recapture more lost ground over the near-term as positive seasonal forces come through and/or the US data continues to exceed downbeat predictions.

Trans-Tasman Zone

The jolt of USD strength stemming from a string of positive US data releases including Q2 GDP and upward adjustment in US interest rate expectations in the wake of this mornings ‘on hold’ Fed meeting has exerted downward pressure on the NZD and AUD (see above). At ~$0.5987 the NZD is around the bottom of the range it has occupied since late-May, while the AUD (now ~$0.6438) is near the lower end of its 1-month range and just below its 1-year average. On the crosses, outside of AUD/EUR which consolidated over the past 24hrs, the AUD has also generally weakened by ~0.1-0.7% against the other major currencies.

Also weighing on the AUD was yesterday’s Q2 Australia CPI report which reinforced the case for the RBA to cut interest rates again in August and potentially deliver more ‘relief’ later this year. Based on the comprehensive quarterly measure headline inflation slowed to 2.1%pa, while the trimmed mean eased to 2.7%pa. The quarterly annualised rate, the pulse looked at by the RBA, is tracking close to the mid-point of the target band for the first time in a long while. From our perspective, the cracks appearing in the labour market, step down in momentum across the private sector, and contained inflation point to the RBA moving settings closer to ‘neutral’ (i.e. a cash rate ~3.1%) over the next few quarters.

Over the past few weeks we have repeatedly warned about the AUD’s negative seasonal tendencies in late-July/August. As outlined before the AUD has declined in 21 of the past 28 August’s. We think we are in the midst of this pattern unfolding again in 2025, particularly as the USD (which is tracking below our ‘fair value’ estimate) has scope to rebound further (see above). From our perspective, the prospect of a RBA rate cut on 12 August and messaging there could be more to come, combined with a continued run of positive US data such as Friday’s non-farm payrolls figures, bursts of renewed tariff-related volatility, sluggish China growth signals (the latest business PMIs are out today at 11:30am AEST), and/or seasonal USD strength could see the AUD give back more ground over the next few weeks.