• Holding on. Markets take the latest US shutdown in stride. US equities edged up while bond yields slipped back. USD & AUD tread water.

• US shutdown. No real sense of urgency to strike a deal quickly. US shutdown could drag out. This might be a negative for US growth & the USD.

• Data void. US government shutdown also means US economic data, such as Friday’s non-farm payrolls report, may be put on hold.

Global Trends

The latest US Government Shutdown kicked off yesterday and financial markets have so far taken it in stride. European equities registered solid gains (EuroStoxx600 +1.2%) while the US S&P500 recovered from an initial dip to end the session in positive territory (+0.3%). US bond yields declined ~5-7bps across the curve with the benchmark 10yr rate (now ~4.10%) unwinding the bulk of its recent uptick, although the moves look to be more a function of weak ADP employment data than shutdown concerns. ADP employment fell 32,000 in September, the 3rd decline in 4 months, another sign the US jobs market is feeling the weight of slower growth and policy uncertainty. The US ISM manufacturing survey also remained in ‘contractionary’ territory with new orders falling and hiring intentions weak. In FX, the USD tread water with EUR consolidating (now ~$1.1733), while the interest rate sensitive USD/JPY tracked the drop in US yields (now ~147.05). Elsewhere, NZD nudged up (now ~$0.5818) and AUD tread water (now ~$0.6614).

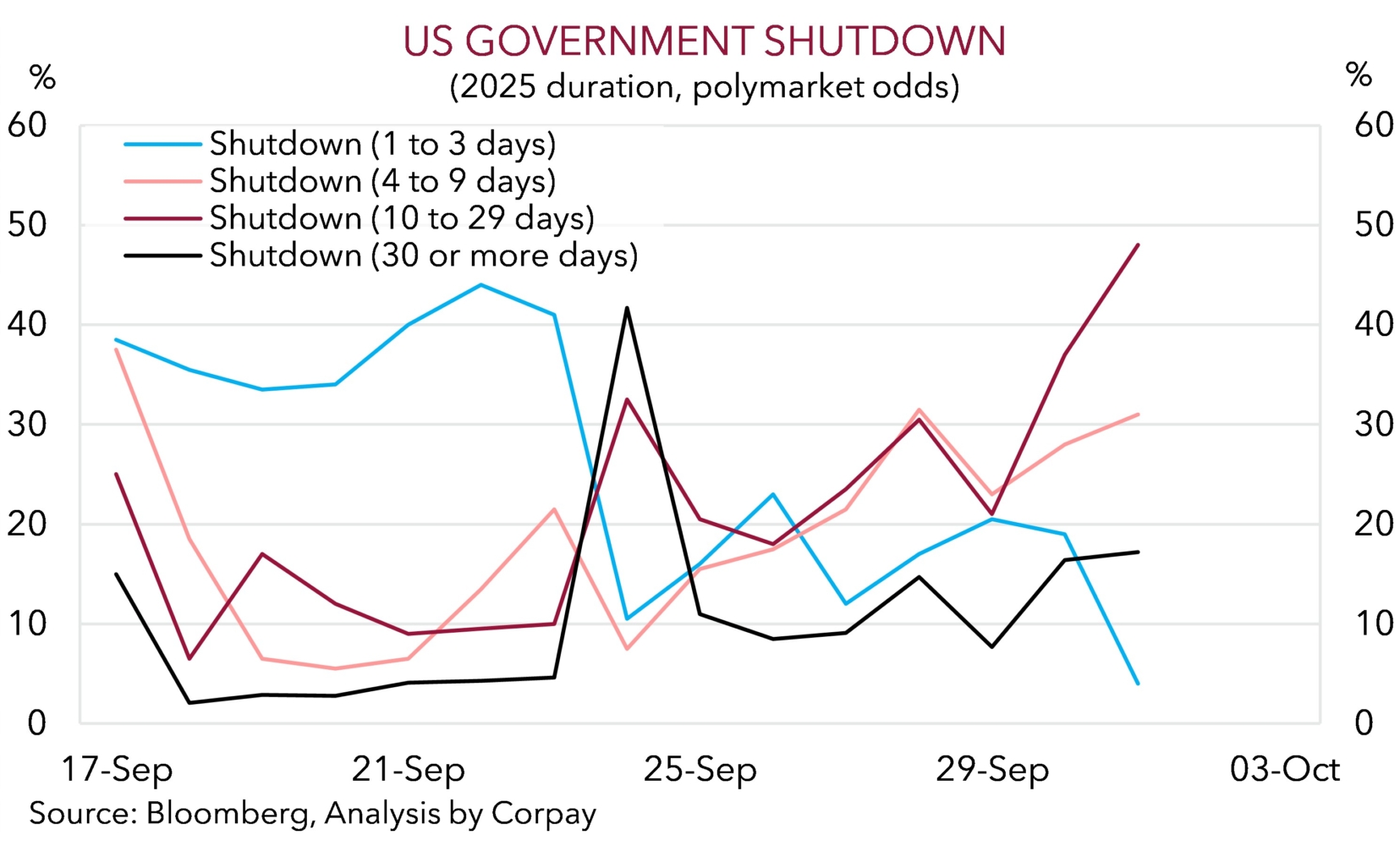

In terms of the US Government Shutdown there doesn’t look like there is any sense of urgency from either side to get a deal done quickly. And with this iteration not having the ‘debt ceiling’ (and risk of US default) attached to it things might drag out for a while. As our chart shows, market odds are currently favouring a 10-29 day duration. This is within the ballpark of the last few shutdowns. US government agencies are activating contingency plans that will sideline federal workers. It is estimated ~750,000 employees could be furloughed. This will mechanically depress US economic activity over the near-term with past shutdowns shaving ~0.1%pts off US GDP growth each week the shutdown lasted.

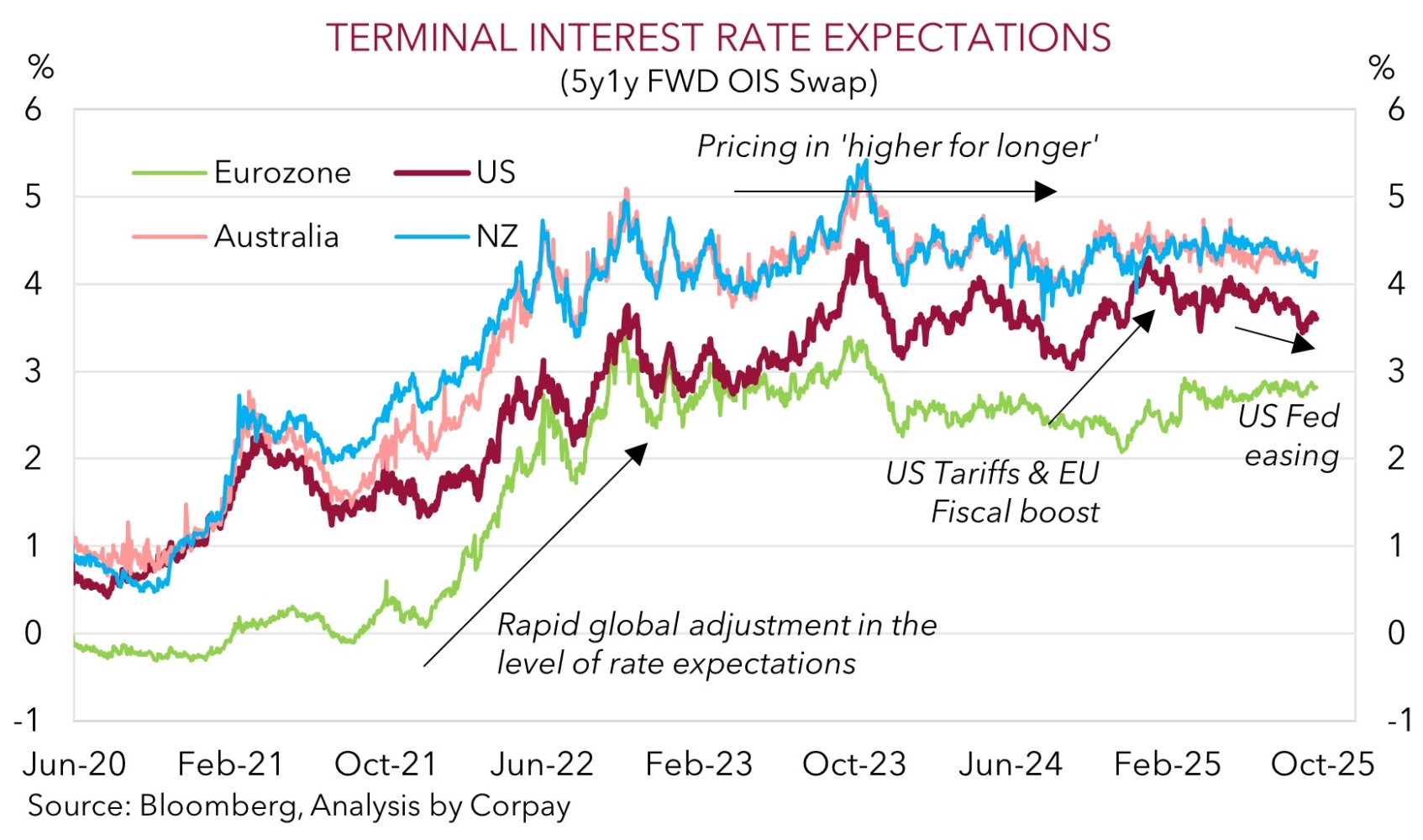

Official US economic statistics like tonight’s weekly jobless claims and tomorrow’s non-farm payrolls report also look set to be delayed. The data vacuum could mean the US Fed is flying somewhat blind at its next meeting in late October. As a result, we think the current situation bolsters the case for the US Fed to run with its recent forecasts and cut rates again. Moreover, long-term Fed interest rate cut expectations may also get an added boost if President Trump follows through with threats to fire thousands of Federal workers. This would be coming at a time when the US jobs market is already weakening. On net, we remain of the view that the more challenging backdrop in the US and outlook for US Fed rate cuts can exert downward pressure on the USD over the period ahead.

Trans-Tasman Zone

The consolidation in the USD at the start of the latest US Government Shutdown has seen the AUD tread water over the past 24hrs (now ~$0.6614) while the NZD has ticked a bit higher (now ~$0.5818) (see above). In line with the push-pull forces and contrasting performance across equities and bonds overnight the AUD has put in a mixed performance on the crosses. While the AUD has held up versus the EUR, CAD and CNH it has lost ground versus the JPY (-0.6%) and NZD (-0.4%) after strong runs. Indeed, at ~1.1367 AUD/NZD is still around levels last traded in Q2 2022 with economic and interest rate trends firmly in Australia’s favour.

Today in Australia the monthly trade and household spending figures are due, as is the RBA’s semi-annual Financial Stability Review (11:30am AEST). Household spending has been picking up recently, on the back of more services related activity and as past rate cuts work their way through the system. The improved momentum across parts of the Australian economy, particularly household spending, combined with stickiness in inflation and resilient labour market are reasons why we (and the market) think further RBA rate cuts are likely to be limited and drawn-out. Markets are now only fully pricing in the next RBA reduction by next March with another move after that not discounted.

Offshore, the US government shutdown should dominate the headlines. As mentioned, this iteration might drag out. A protracted shutdown could weigh on growth, bolster US Fed rate cut expectations and exert pressure on the USD, in our opinion. If realised, this may generate support for the AUD. We continue to forecast a further grind higher by the AUD into year-end and over H1 2026. We believe the mix of: (a) a cautious/gradual approach by the RBA; (b) upturn in Australia’s economy; (c) an improvement in China’s growth pulse; and (d) a weaker USD as the US Fed steadily lowers interest rates to combat growth challenges and downside labour market risks should be AUD positives over coming months.