• Intra-day swings. More headline driven gyrations on Friday. US equities swung around. USD index a bit softer. NZD on backfoot. AUD a little higher.

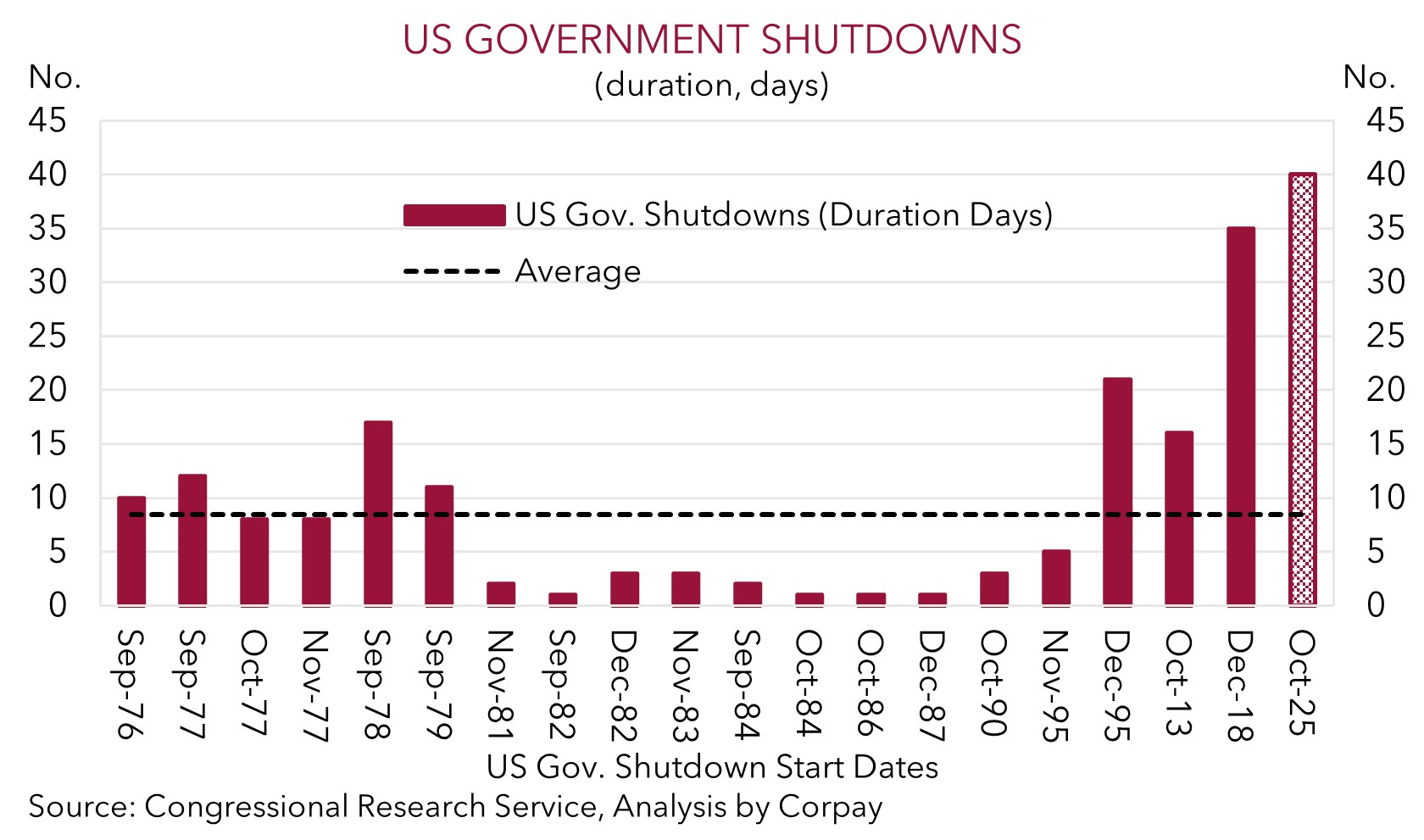

• US shutdown. Current US gov. shutdown longest in history. Macro impacts starting to show. Pressure on lawmakers to reach a deal is growing.

• Event Radar. In Australia the monthly jobs report is due (Thurs). The China data batch is out (Fri). Several US Fed members also set to speak this week.

Global Trends

Intra-session market gyrations continued at the end of last week with US Government Shutdown newsflow in the driver’s seat. Thanks to a late-session recovery generated by hopes of a compromise so the record-long US government shutdown might soon end the S&P500 swung from being ~1.3% lower to closing Friday in positive territory. This extended the recent zig-zag pattern in US stocks, though if you take a step back, on net, the S&P500 still recording its first weekly decline in a month. Elsewhere, US bond yields consolidated with the benchmark 10yr rate (now ~4.1%) hovering in the bottom half of its year-to-date range. In FX the USD index drifted back a bit with a slightly firmer EUR (now ~$1.1561) and GBP (now ~$1.3147), and stronger CAD after the Canadian jobs data blitzed expectations, more than offsetting the move up in USD/JPY (now ~153.86, near the upper end of the range occupied since mid-February). By contrast, the NZD remained on the backfoot (now ~$0.5624, the bottom of its multi-month range), yet the AUD edged higher (now ~$0.6493).

In terms of the US shutdown which has entered its 6th week pressure on lawmakers to reach a deal is building in large part because of the more visible economic consequences. The bipartisan Congressional Budget Office estimates the shutdown may shave ~0.4%pts from Q4 US GDP growth by mid-November. More specifically, food benefits for ~42mn Americans have been diminished, over 1mn federal workers aren’t being paid, resources to pay military services members may soon be exhausted, and airport delays are increasing with the US Thanksgiving holiday period approaching. Given the political backdrop, the ongoing cost-of-living squeeze, and cracks appearing in the jobs market it is no surprise that US consumer sentiment has slumped and is tracking around the bottom of its historic range. This doesn’t bode well for future spending by US consumers, in our opinion.

Official US statistics remain on ice, and this will remain the case until the shutdown ends. Several US Fed members are due to speak this week and in China the monthly data batch is scheduled (Friday). On balance, we think the drag on US economic activity stemming from the shutdown as well as the impact from higher import costs/tariffs and softening labour market conditions should see the US Federal Reserve deliver more rate cuts over coming months. More short-term headline driven volatility is likely, but in our view, a step down in US interest rates, weaker US growth, and structural pressures such as the US’ wide current account deficit should see the USD lose ground over the medium-term.

Trans-Tasman Zone

The slightly softer USD index on Friday on the back of the deterioration in US consumer sentiment and increasingly visible economic impacts of the drawnout government shutdown has given the AUD a bit of a lift (see above). That said, at ~$0.6493 the AUD remains slightly below its 1-month and 6-month averages. Strength on most of the major cross-rates also gave the AUD a helping hand. The AUD rose by ~0.2-0.4% versus GBP, NZD, and CNH, while it recorded an ~0.8% gain against the JPY. In level terms, AUD/EUR (now ~0.5616) is lingering in the middle of the low range it has occupied the past few months, AUD/CNH (now ~4.6264) is just shy of its 1-year average, while a heavy NZD has propelled AUD/NZD to levels last traded in October 2013 (now ~1.1545). Relative economic and interest rate trends remain firmly in Australia’s favour, in our opinion.

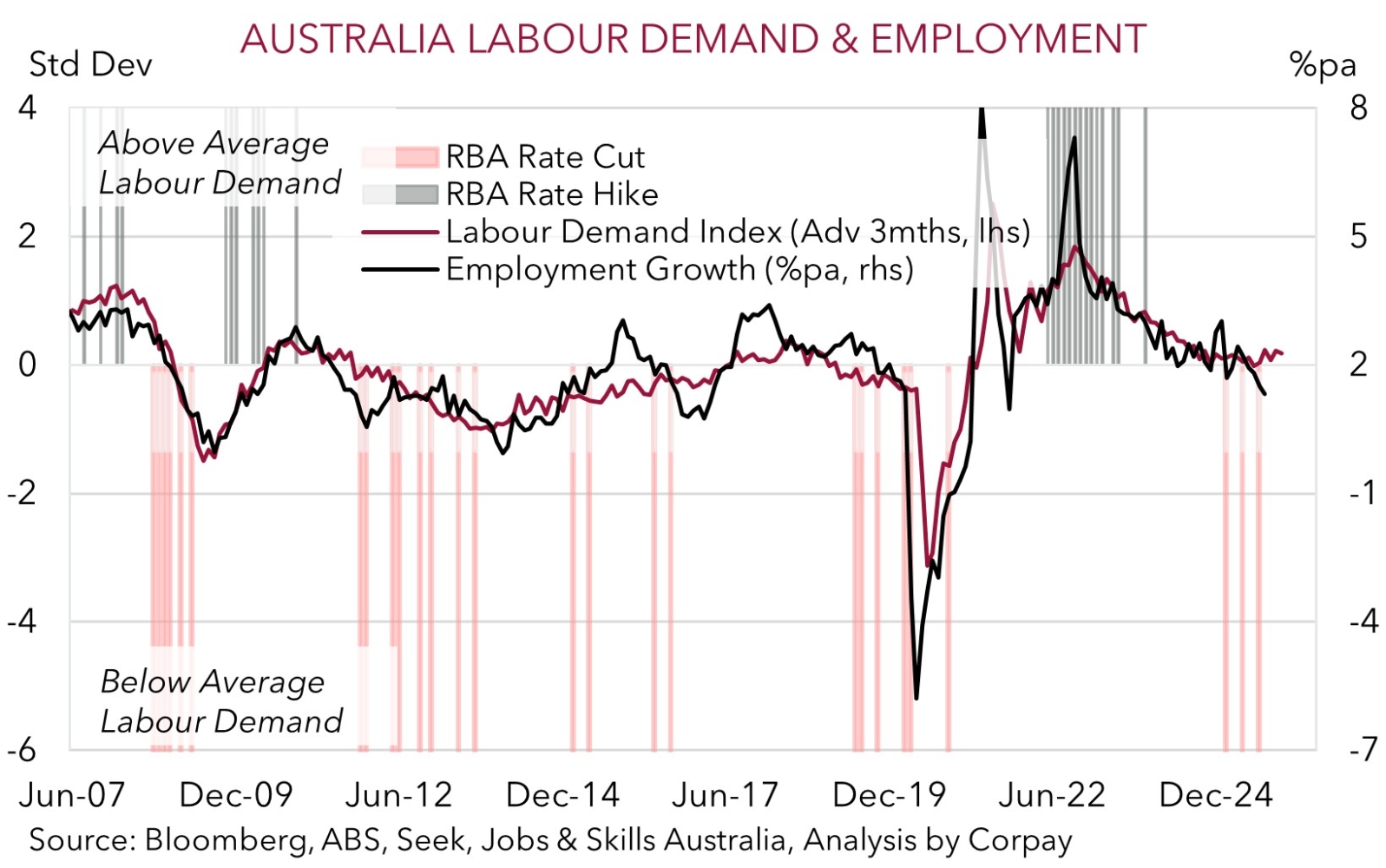

This week the monthly China data batch is due (Friday), while in NZ 2-year ahead inflation expectations are scheduled (Friday). In Australia the monthly jobs report is out (Thursday), with RBA Deputy Governor Hauser also speaking today (10:30am AEDT). The monthly Australian employment statistics are volatile. And we believe this could be on show once again in the October figures. We believe employment growth may accelerate and/or the unemployment rate retraces some of last months surprising lift. We feel school holiday impacts may have been at play, and as our chart shows, gauges of labour demand have stabilised at levels indicative of relatively stronger jobs growth.

An improvement in Australian labour market conditions should reinforce views that the RBA will remain on a different interest rate path to its peers. We think the mix of sticky Australian core inflation, a resilient jobs market, and signs of improvement in growth momentum may mean the RBA doesn’t cut interest rates again this cycle. Markets don’t move in straight lines and more bouts of headline/data driven volatility should be anticipated. But on net, we continue to project the AUD to grind up into year-end and over early-2026 because of improvement in US/China trade relations, diverging policy trends between the RBA and other central banks such as the US Fed, more favourable yield spreads, and/or firmer growth in China as its stimulus push gains traction.