• Calm markets. Modest moves in US equities while bond yields dipped. AUD & NZD tick up a bit. AUD also firmer on major cross-rates.

• US shutdown. US government shutdown looks set to finally end. Delayed US data should be released over coming weeks. This may see vol. increase.

• AU jobs. Monthly jobs data released today. Will the surprise lift in unemployment retrace? Solid report would support RBA ‘on hold’ views.

Global Trends

Modest moves across markets over the past 24hrs. Solid gains in European equities (EuroStoxx600 +0.7%) weren’t replicated in the US with the S&P500 ticking up slightly (+0.1%) and tech stocks dipping (NASDAQ -0.5%) overnight. US bond yields eased with falls of ~3-5bps coming through across the curve. In FX, the USD index tread water, although under the surface it was a mixed picture with EUR consolidating (now ~$1.1589), GBP weakening (now ~$1.3131, just above its 1-year average), and USD/JPY extending its climb higher (now ~154.79, a high since mid-February).

Expectations of more fiscal support and constraints being placed on further BoJ rate hikes by Japan’s new Prime Minister Takaichi are undermining the JPY. When speaking yesterday she noted the government and BoJ will “work together” to forge a strong economy and stable inflation. We think markets have taken an overly simplistic view of things. Inflation dynamics in Japan are different to the past and USD/JPY could endure an abrupt reversal down the track, in our opinion, given it is tracking too high relative to drivers such as yield spreads. Closer to home NZD nudged up but at ~$0.5666 it remains near the lower end of its multi-month range. The AUD also added to recent modest gains (now ~$0.6542).

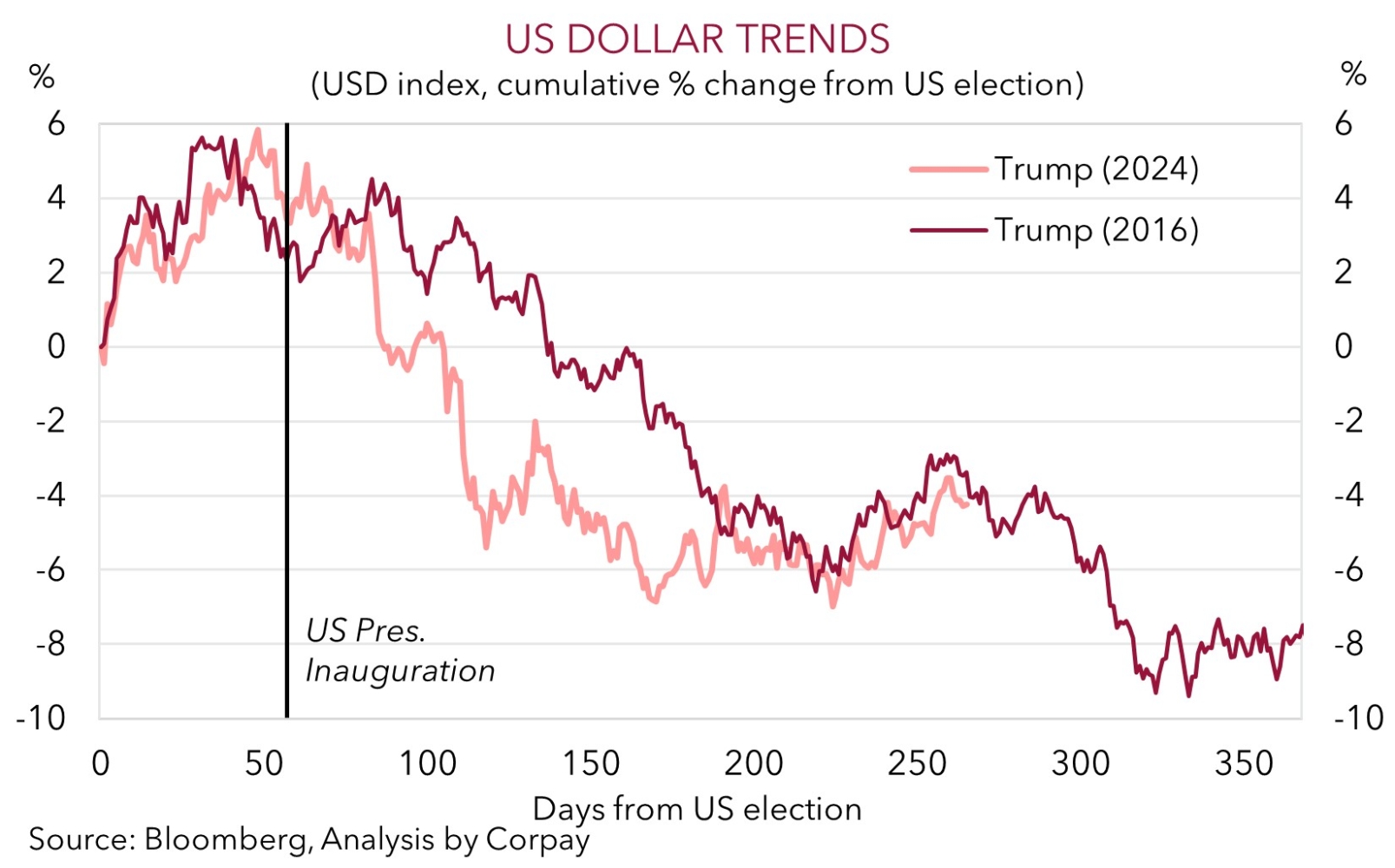

The US Government Shutdown, the longest in history, looks to be ending. A negotiated package passed the US Senate earlier this week and the House is expected to vote later today on the measures that will reopen the government through to late-January and fund some federal agencies until next September. Once things return to normal operations the US statisticians will get back to work and there should be a deluge of delayed data released into year-end. This may see market (and FX) volatility pick up from current depressed levels as the inflowing information generates adjustments in central bank expectations. On balance, we think the drag on US economic activity stemming from the prolonged shutdown as well as the impact from higher import costs/tariffs and softening labour market conditions should see the US Federal Reserve deliver more rate cuts over coming months. Short-term headline driven volatility is likely, but in our view, a step down in US interest rates, weaker US growth, and structural pressures such as the US’ wide current account deficit could see the USD lose ground over the medium-term. As our chart shows, the USD continues to follow a similar path to what played out in the first year of President Trump’s first term. Using history (and our macro views) as a guide, we believe another leg down in the USD might soon unfold.

Trans-Tasman Zone

The relative sense of calm and a bout of optimism generated by news the US government shutdown will finally end has supported the AUD and helped the beleaguered NZD stabilise (see above). At ~$0.5666 the NZD has nudged up a little over the past few days, however it remains near the bottom of its multi-month range with expectations of more RBNZ rate cuts still acting as a handbrake. The AUD (now ~$0.6542) has edged higher and is back above its ~6-month average. Strength on the major crosses is giving the AUD a helping hand. AUD/EUR (now ~0.5645) is approaching its 200-day moving average, AUD/NZD (now ~1.1547) remains up around its multi-year peak, and AUD/JPY (now ~101.25) is at the top of its 1-year range. We remain of the view that there are uneven risks for AUD/JPY up near current levels given it appears stretched compared to drivers such as yield differentials.

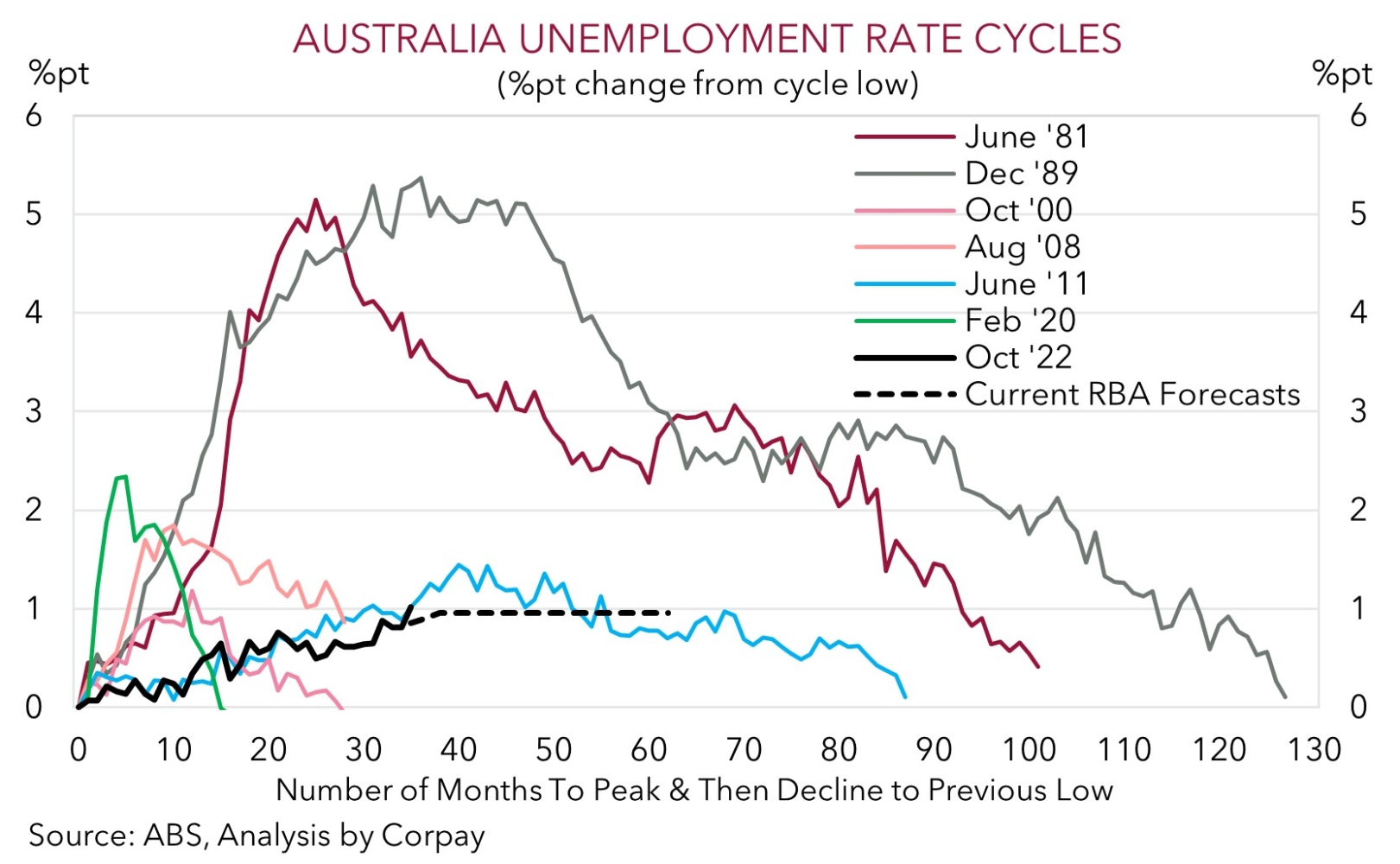

Today in Australia the monthly labour force lottery is due (11:30am AEDT). The monthly jobs data is notoriously volatile. This volatility was on show last month, and we think it could be on show again in the October figures. We believe employment growth might have picked up (mkt +20,000) and/or the unemployment rate retraced some of last months surprising lift (mkt from 4.5% to 4.4%). The RBA is projecting the Australian unemployment rate to stabilise and average ~4.4% over the next year.

In our judgement, solid Australian labour market conditions should reinforce expectations that the RBA remains on a different interest rate path to its peers. We think the combination of sticky Australian core inflation, a resilient jobs market, and signs of improvement in growth momentum may mean the RBA doesn’t cut interest rates again this cycle. Markets seem to agree with another RBA reduction no longer fully factored in. More bouts of headline/data driven volatility should be anticipated over the near-term. But on net, we continue to project the AUD to grind up into year-end and over early-2026 because of improvement in US/China trade relations, diverging policy trends between the RBA and other central banks such as the US Fed, favourable yield spreads, and/or firmer growth in China as its stimulus push gains traction.