• US trends. US equities rose, as did bond yields & the USD. US ISM better than expected. Reports about potential US/China trade talks also helpful.

• Macro news. Dovish tilt from BoJ weighed on JPY. US jobs report tonight. Signs the labour market is holding up could be USD supportive & drag on AUD.

• AU election. Federal election takes place tomorrow. Polls pointing to a Labor win. We don’t expect the outcome to impact the RBA trajectory or the AUD.

Global Trends

Sentiment towards US assets continued to improve overnight with equities rising and the USD index appreciating. Stronger earnings reports from megacap tech stocks Microsoft and Meta helped push the S&P500 0.6% higher while the NASDAQ outperformed (+1.5%). This is the 8th straight daily rise in the S&P500, its longest winning streak since August. Yet if you take a step back, despite the S&P500 being well up from its early-April tariff panic sell-off lows it remains ~9% from its record highs and in negative territory year-to-date.

Also helping were reports from China state media indicating the Trump Administration had reached out to initiate trade talks which is “something China sees little downside in exploring at his stage”. In terms of the US data flow, the bellwether ISM manufacturing index also wasn’t as bad as feared. The ISM only edged down a little further with new orders and hiring intentions positively surprising in April.

Elsewhere, US bond yields increased with the 2yr rate rising ~10bps (now ~3.70%) and the benchmark 10yr rate ~6bps higher (now ~4.22%). And in FX, the USD clawed back more ground against the EUR (now ~$1.1292, the bottom of its 3-week range). GBP drifted back (now ~$1.3280), as did the NZD (now ~$0.5908), and to a lesser extent the AUD (now ~$0.6385). The largest mover was USD/JPY which has jumped 1.6% over the past 24hrs (now ~145.30). Compounding the higher US bond yields was a dovish tilt by the Bank of Japan at yesterday’s meeting. There was no change in rates but the BoJ was more cautious about the outlook by revising down its growth forecasts and noting risks to prices are skewed to the “downside”. Odds of further BoJ rate hikes have been whittled back.

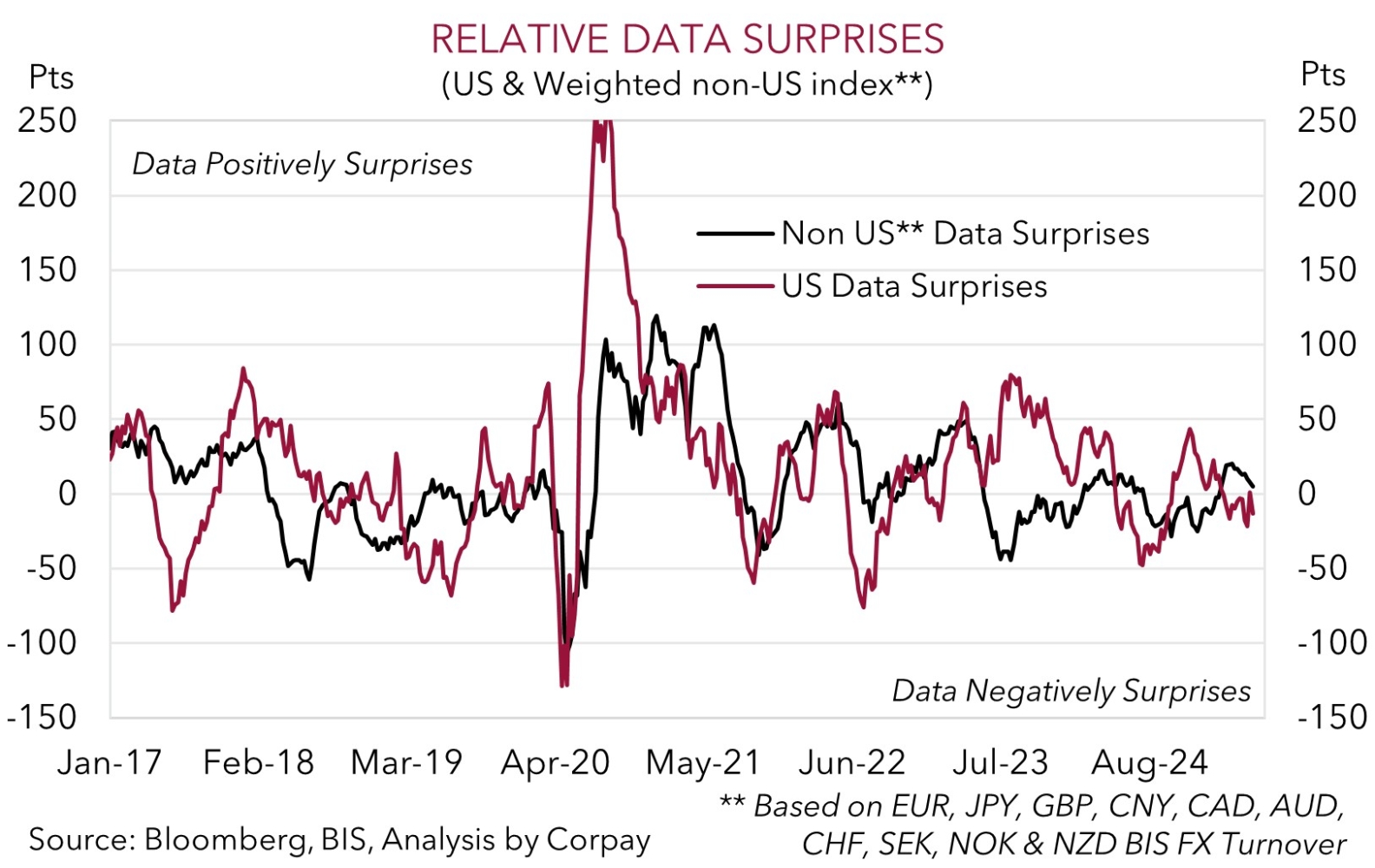

The monthly US jobs report is in focus tonight (10:30pm AEST). As we have outlined the past few days the important thing for markets isn’t if something is good or bad but rather if it is better or worse than predicted. With this framework in mind, we believe there is a risk the slow-moving US labour market report may come in a little better than feared. The US is facing medium-term growth challenges because of the impact from higher import prices and uncertainty; however this takes time to work its way through the system and flow through to jobs. We think signs the US labour market is holding up can give the beleaguered USD, which is still tracking below our model estimates, more short-term support, particularly against the EUR and/or JPY.

Trans-Tasman Zone

The slightly firmer USD on the back of comments suggesting a potential de-escalation in the US/China trade war, higher US bond yields, and a better-than-predicted US ISM survey (see above) has exerted a bit of downward pressure on the NZD (now ~$0.5908) and AUD (now ~$0.6385). That said, the moves are modest in comparison with the recent upswing. The NZD remains north of its 200-day moving average (~$0.5882) while the AUD is still hovering towards the upper end of its multi-month range. Relative outperformance on the crosses has given the AUD a helping hand. The AUD recorded modest 0.1-0.2% gains versus the EUR, GBP, NZD, and CAD over the past 24hrs, while the weakness in the JPY on the back of the dovish tilt by the Bank of Japan has seen AUD/JPY rise ~1.3% (now ~92.80) (see above).

Today, Australia retail sales figures for March are due (11:30am AEST), but they should play second fiddle to tonight’s US jobs report (10:30pm AEST). As mentioned, we think there is a risk the US employment data holds up better than anticipated. If realised, we believe this could give the USD a bit more support in the near-term which in turn could see the AUD give back a little more ground after its recent strong recovery. That said, we think outperformance against currencies such as EUR, NZD, CNH, and JPY because of diverging policy trends between the RBA and other central banks, coupled with the ongoing resilience in the Australian economy/jobs market, can help cushion the impact on AUD/USD.

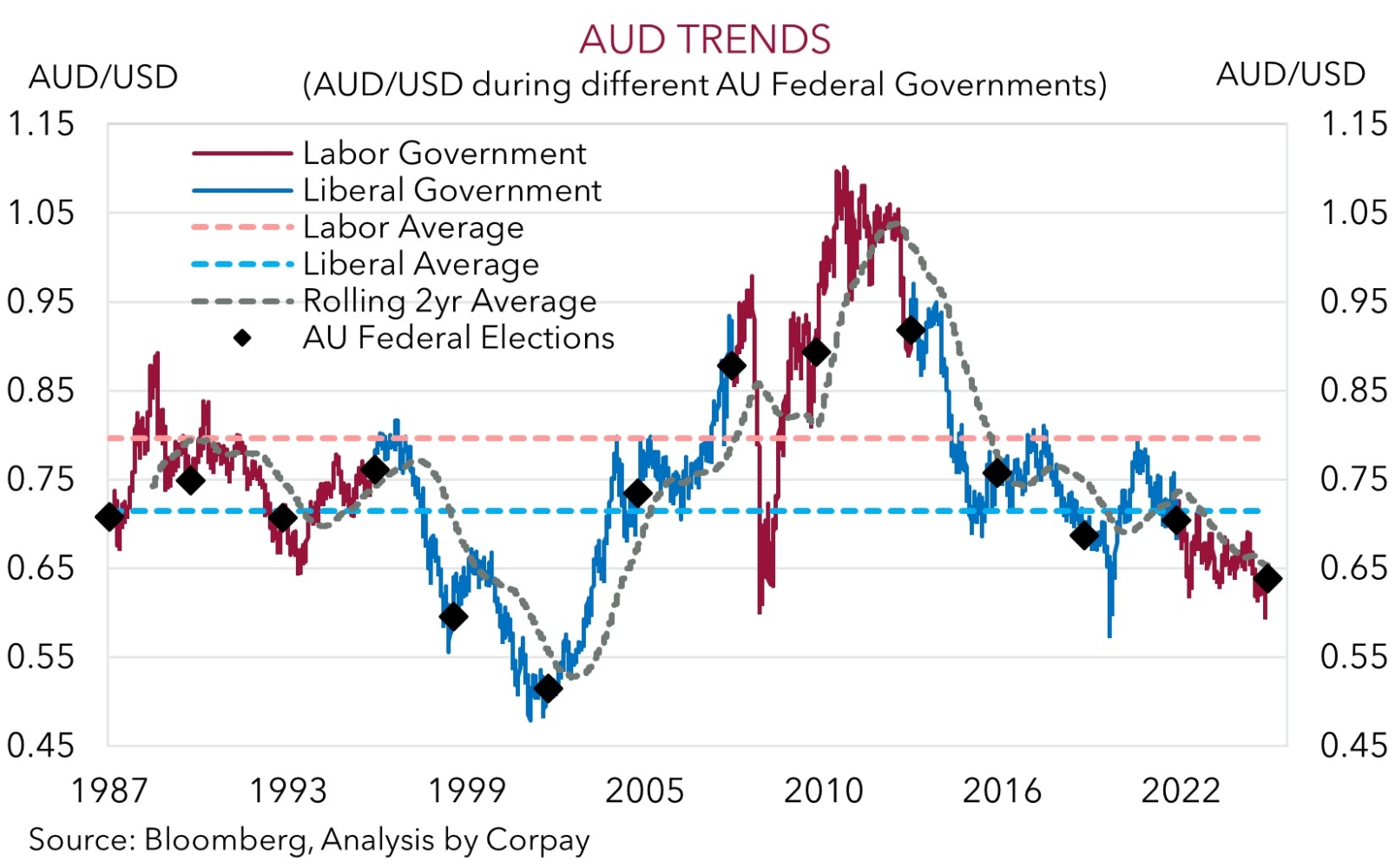

Also on the radar is this weekend’s Australian Federal Election. The opinion polls and betting markets are pointing to Labor being re-elected with a majority government. Both sides have been focused on cost-of-living and housing affordability challenges during the campaign, with the policies lacking the substantive big picture reforms needed to tackle Australia’s lacklustre productivity and other structural issues. The election outcome shouldn’t impact the RBA’s trajectory with further gradual/modest interest rate relief in the pipeline due to slowing inflation and with policymakers focused on keeping the economy on its ‘narrow path’. Hence, we also don’t expect the election result to affect the AUD. Australia is a small open economy, and when it comes to financial markets (and the AUD) it remains a price taker with developments offshore (and particularly in the US) more important drivers. This is particularly true at present given the Trump Administration’s disruptive tariff policies.