• Mixed markets. US equities touched a record. Bond yields rose, as did the USD. AUD drifted back after coming close to its year-to-date peak.

• US jobs. Revisions to US payrolls larger than anticipated. Pace of jobs growth looks a lot slower. US Fed likely to deliver a series of rate cuts.

• Inflation trends. US producer price inflation due tonight. Consumer prices out tomorrow. Will the data show greater pass-through from tariffs?

Global Trends

A mixed performance across markets overnight. The US S&P500 (+0.3%) hit a fresh record with the index now over 10% higher compared to where it ended last year (or a hefty ~34.5% above its early-April ‘Liberation Day’ low). Bond yields reversed course with US rates rising ~5-7bps across the curve, though this comes after an extended pull-back. At ~3.56% the US 2yr yield is still near the lower end of its cyclical range. It was a similar story in FX with the USD edging up after being under pressure recently. EUR eased (now ~$1.1711), as did GBP (now ~$1.3525) while USD/JPY was range bound (now ~147.40). On net, NZD slipped back a fraction (now ~$0.5926) and the AUD also gave back a bit of ground after coming within a whisker of posting a fresh year-to-date high (now ~$0.6583).

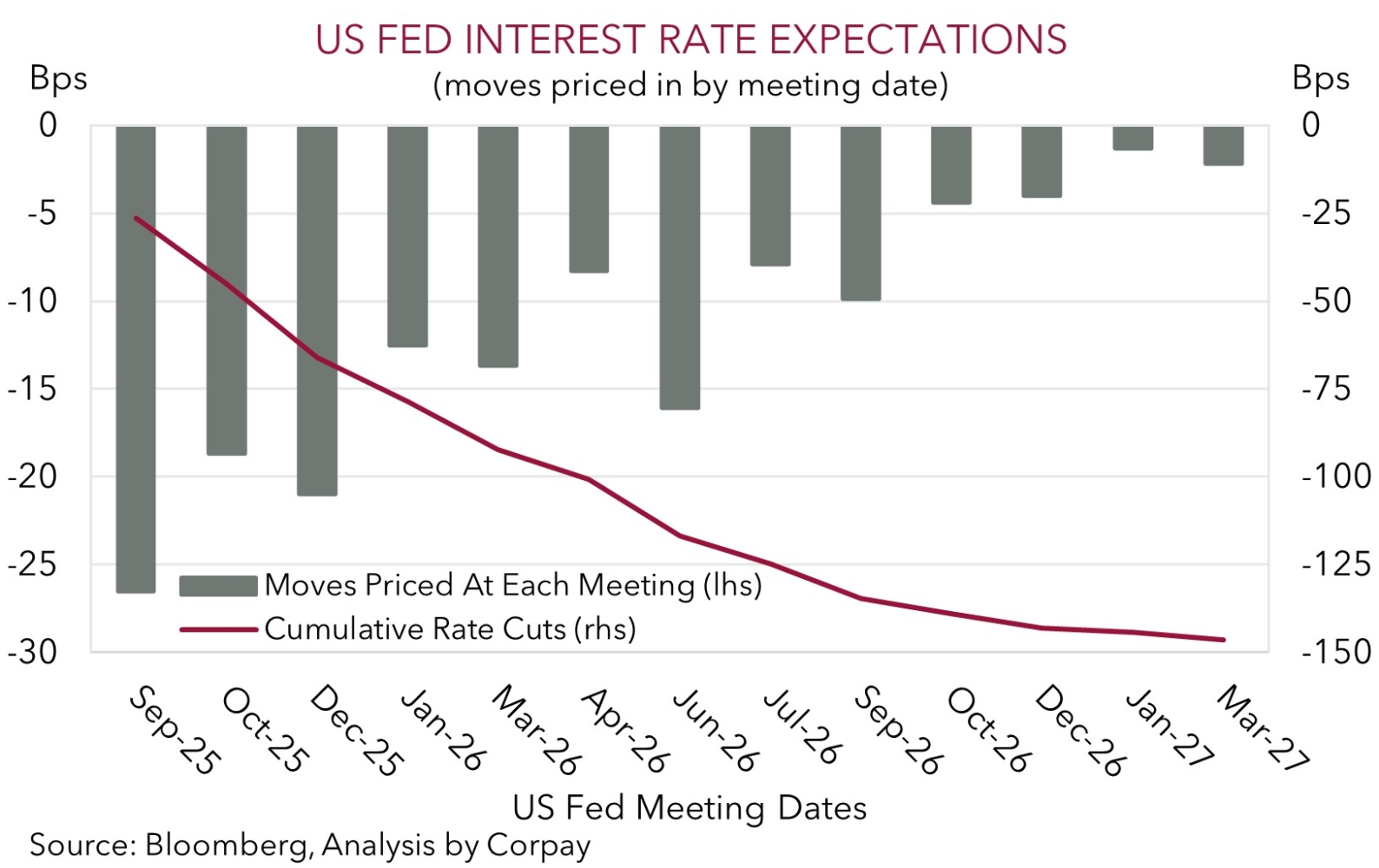

Data wise the focus overnight was on the US with preliminary annual benchmark revisions to non-farm payrolls released. In the end the figures were more negative than many had anticipated with non-farm payrolls between April-2024 and March-2025 revised down by a sizeable 911,000. When taken together with adjustments to monthly payrolls since August revisions equate to 1.2mn fewer jobs than initially reported and suggest a sharp slowdown in employment growth. On our figuring the pace of jobs growth between April 2024 and March 2025 has been more than halved (from +146,000/mth to +71,000/mth). In our opinion, had US Fed officials had the revised jobs data in real time, interest rates would be lower today than they are. The weaker state of play in the labour market points to a steady stream of US rate cuts over the next few quarters. Traders agree with a move next week by the US Fed more than fully priced in and ~153bps worth of cuts discounted by early-2027.

In theory, the more negative underlying trend in the US labour market might see US Fed officials play ‘catch up’ and deliver an outsized 50bp reduction next week. However, we think differences across the committee and lingering inflation pressures mean the most likely outcome is a 25bp reduction, albeit with strong signals interest rates should keep moving lower over future meetings.

Indeed, in terms of inflation, US producer prices are due tonight (10:30pm AEST) and consumer price data is out later in the week (Thurs night AEST). We believe the data may show signs of greater pass-through to inflation from tariffs. If realised, we feel this might see markets trim their more aggressive near-term Fed easing bets (markets are factoring in a ~8% chance the US Fed delivers a 50bp rate cut in September). A modest upward adjustment in US interest rate expectations could see the beaten down USD rebound a little further in the short-term, in our view.

Trans-Tasman Zone

The AUD and NZD have been pushed and pulled by intra-day swings in the USD over the past 24hrs (see above). On net, the NZD slipped back a little (now ~$0.5926) as has the AUD (now ~$0.6583), though that comes after the AUD came within a few pips of posting a fresh year-to-date high. Indeed, in level terms the NZD is still above its 1-year average while the AUD is hovering near the upper end of its multi-month range. The AUD has also ticked up a bit on some of the cross-rates with gains posted versus the EUR (+0.3%), NZD (+0.1%), and CAD (+0.2%) overnight. However, the AUD did slip back against the JPY (-0.2%) after its recent strong run, and CNH (-0.1%).

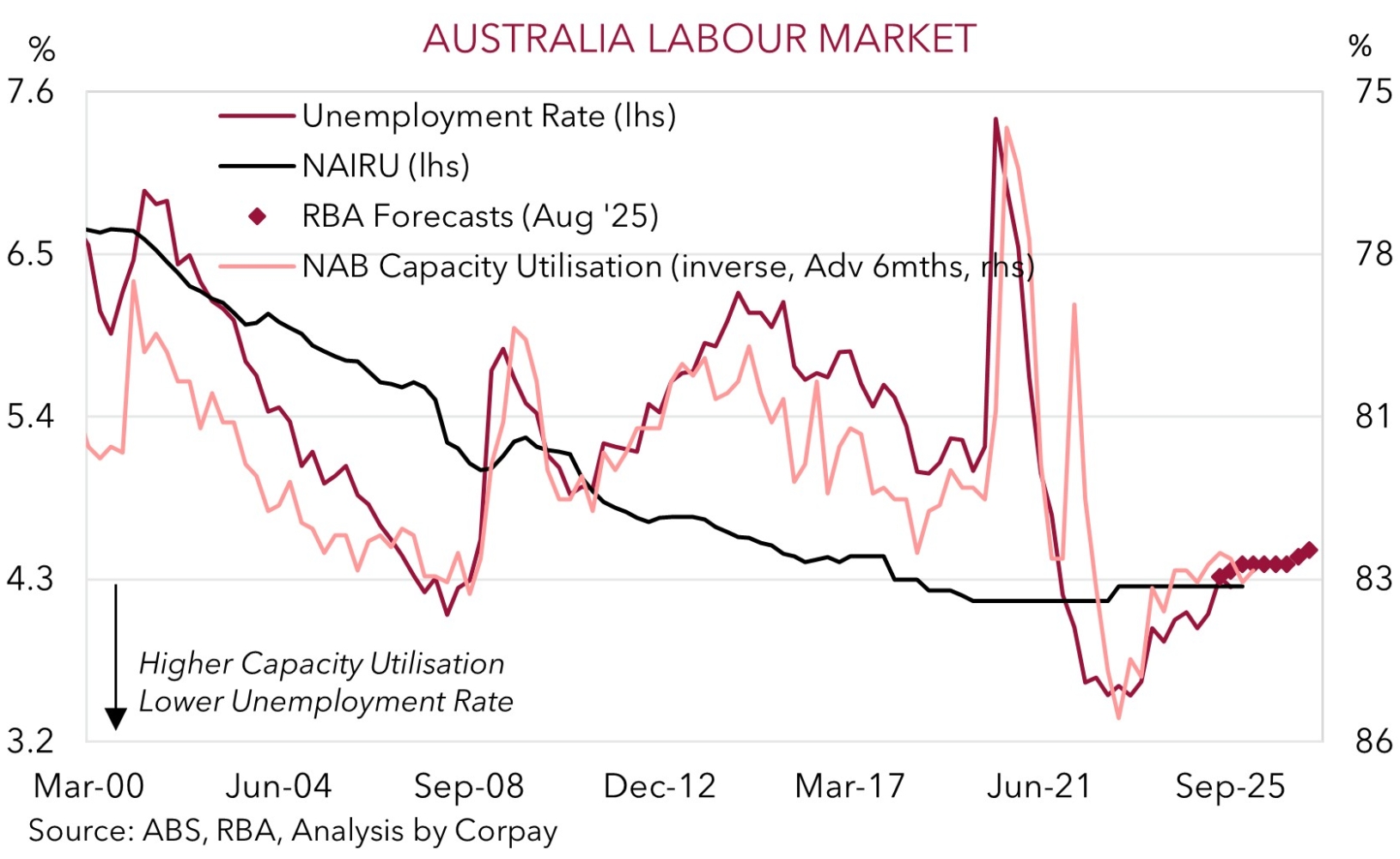

Locally, NAB business conditions were released yesterday. The survey captures many areas of the Australian economy, hence it is a timely read on how things are unfolding. Business conditions rose and now sit around long-run average levels with gains in employment intentions and profitability leading the way. Notably, forward orders (a guide to future activity across the private sector) increased again and capacity utilization ticked further above average, a reflection of the high level of activity still in place across the economy. As our chart shows, the rate of capacity utilization is indicative of unemployment holding in the low 4%’s over the period ahead.

As discussed above, over the next few days we feel the US producer price (10:30pm AEST) and consumer price (Thurs night AEST) data may help the USD recover a little more ground, and this may take some more heat out of the AUD. In our opinion, the US PPI and CPI reports might show firmer inflation pressures due to the pass-through of tariffs. This type of result could see markets pare back their aggressive near-term US Fed easing bets. But we don’t believe rebounds in the USD/pull-backs in the AUD will be overly large or last too long. Over the medium term (i.e. next ~3-12 months) we think the AUD can continue to trend higher. In our view the AUD could be supported by a combination of a weaker USD as US Fed rate cuts re-start, signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds across its export sector, stronger momentum in Australia’s economy, and/or ongoing cautious approach from the RBA.