• Holding on. Pockets of volatility on Friday but on net US equities & bond yields rose. EUR continues to climb. AUD drifted a little lower.

• US macro. Consumer spending fell. Some signs of tariff impacts on US inflation. Has the uncertainty flowed through to the US jobs market?

• Event Radar. China PMIs today. Annual ECB conference & EZ inflation due this week. US jobs report scheduled (Thurs night AEST) ahead of US holiday.

Global Trends

Markets were whipsawed a little during Friday’s trade by a couple of tariff related developments and US economic releases. Risk sentiment temporarily soured a touch after news broke that President Trump terminated trade discussions with Canada in response to its planned implementation of a digital services tax on US firms. But at the same time officials from China confirmed a trade framework with the US had been reached after recent talks. Data-wise US consumption fell 0.3% in May. This and downward revisions to prior months puts Q2 activity on a sluggish footing, with the core PCE deflator (the US Fed’s preferred inflation gauge) also nudging up a bit more than predicted (now ~2.7%pa) on the back of some modest initial tariff related impacts on ‘goods’ prices.

On net, US equities rebounded from their intra-day dip with the S&P500 (+0.5%) closing at a record high. US and European bond yields edged higher with the benchmark US 10yr rate hovering around its ~1-year average (now ~4.28%). In FX, the USD index remains near its multi-year lows with EUR (the major USD alternative) extending its upswing to levels last seen in Q3 2021 (now ~$1.1728). GBP (now ~$1.3721) tread water, as did USD/JPY (now ~144.56) with USD/SGD (now ~1.2760) tracking towards the bottom of its cyclical range. NZD consolidated (now ~$0.6060) while the AUD (now ~$0.6537) drifted a fraction lower.

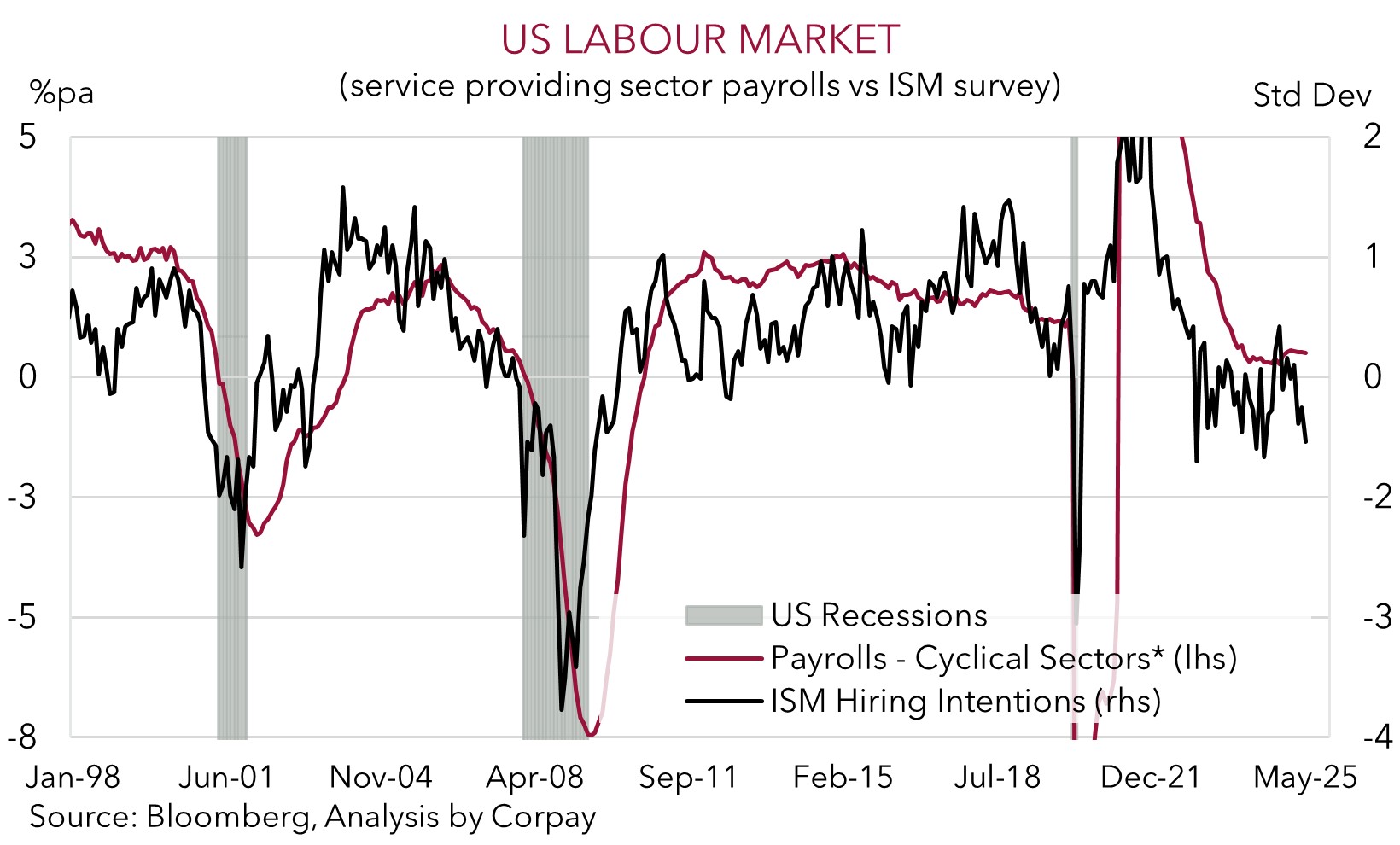

It is a holiday shortened week in the US with the Independence Day break on the horizon. As a result the release of the monthly US jobs report has been brought forward (Thurs night AEST). Elsewhere, the China PMIs are released today (11:30am AEDT), the annual ECB conference is being held with the marquee panel discussion by global central bank heavyweights in focus (Tues night AEST), and on the tariff-front the 9 July end of the US’ ’90-day pause’ is fast approaching. In our opinion, the heightened policy uncertainty and loss of momentum across business surveys and underlying activity suggests the US jobs market is cooling and that risks around the June labour report are tilted to the downside. If realised, we believe this could reinforce expectations looking for US Fed interest rate cuts to re-start in coming months and further undermine the USD. As outlined before we believe downside US growth risks, outlook for lower US interest rates, and waning demand for US assets should see the USD weaken over the medium-term.

Trans-Tasman Zone

The patchy performance across global markets on the back of conflicting US trade news and economic data saw the AUD drift a little lower on Friday night (see above). That said, at ~$0.6537 the AUD remains near the upper end of its multi-month range and above its ~1-year average. Similarly, the NZD (now ~$0.6060) is tracking around the top of the range it has occupied since mid-October. The AUD also slipped back on most of the crosses with it shedding ~0.4% versus the EUR, ~0.2% against the NZD, and ~0.1% vis-a-vis GBP.

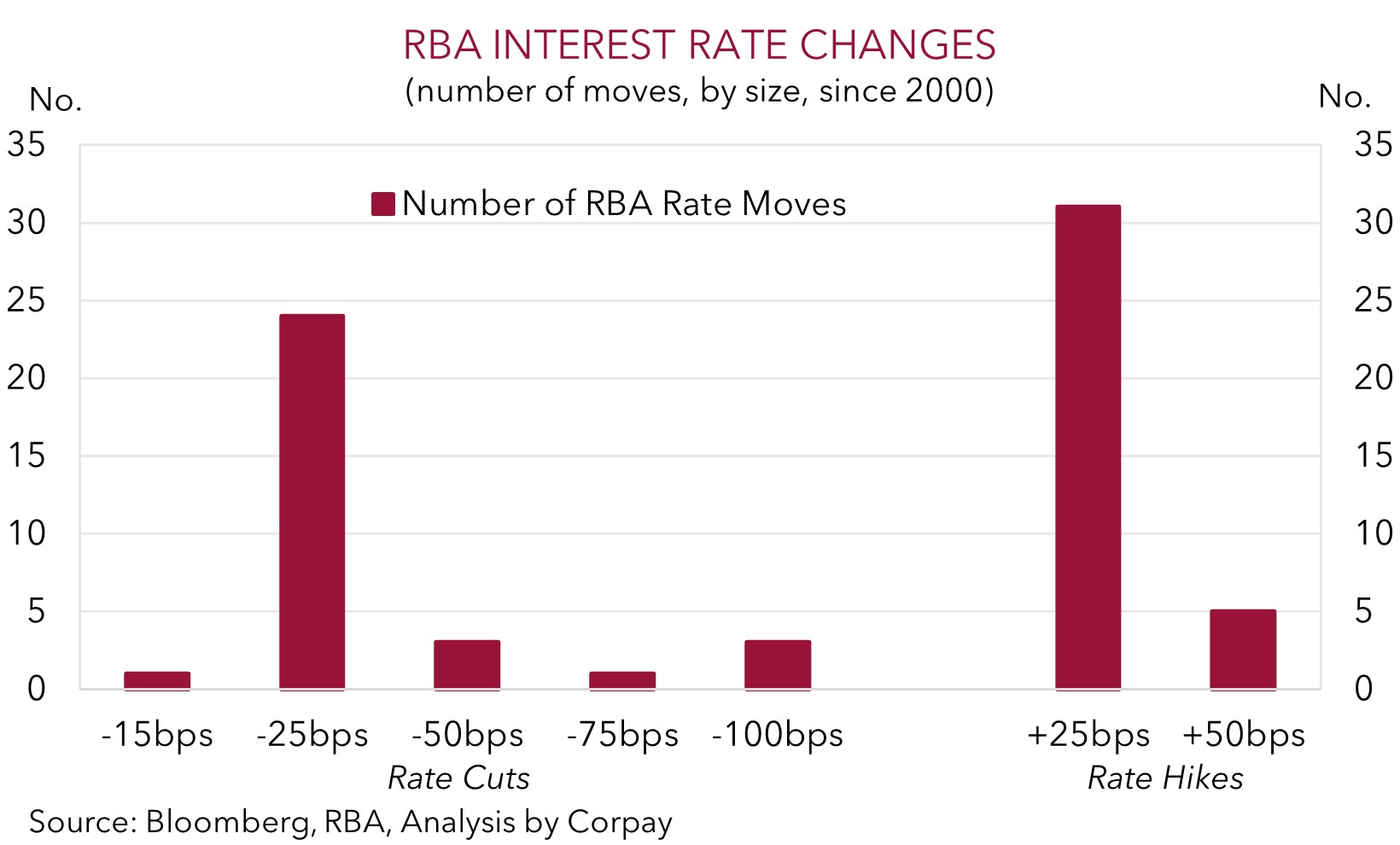

The Australian economic calendar is limited this week with retail sales (Weds) and household spending (which will replace retail sales going forward) (Fri) due. Signs household consumption picked up steam in May may temper the markets enthusiasm about how many interest rate cuts the RBA could deliver down the track. Markets are currently assigning a ~95% chance the RBA lowers the cash rate on 8 July with almost 4 cuts discounted by next May. We think the underlying inflation trends in Australia point to more RBA easing over coming months, however barring a sustained negative shock, we don’t see the RBA delivering more than what is now baked in because of the resilient labour market.

As discussed before, when it comes to FX, it shouldn’t be forgotten that local matters tend to play second fiddle to broader USD developments. Australia and the AUD are ‘price takers’ of what happens in the US and the USD. And as mentioned above, we believe fading US economic strength, expectations of further US Fed policy easing over the next year, and reduced investor confidence/demand for US financial assets given the volatile policy backdrop and lofty valuations should see the USD steadily weaken over time. This, coupled with steps by authorities in China to mitigate tariff-related growth headwinds via commodity-intensive infrastructure investment, and/or still positive momentum in the Australian economy could see the AUD grind higher over late-2025/2026, in our opinion.