• US wobbles. US equities declined & USD softened. Public spat between Musk & Trump intensified. AUD touched a fresh year-to-date high.

• Macro trends. ECB delivered a ‘hawkish’ cut. Tweaks to inflation forecasts & rhetoric suggest ECB is nearing the end of its easing cycle.

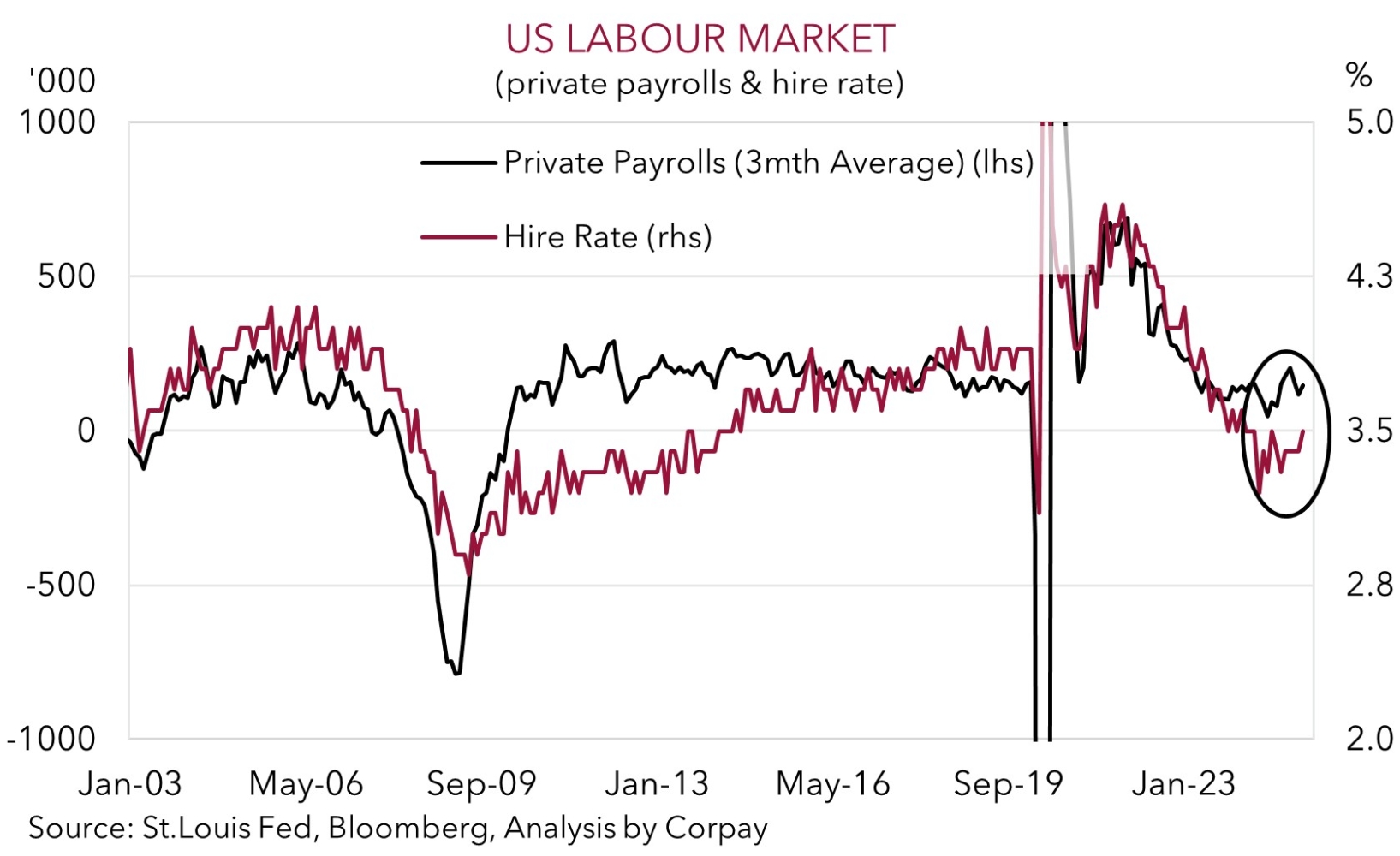

• US jobs. Monthly US jobs figures in focus tonight. Various indicators point to a cooling US labour market. Will the data spring a surprise?

Global Trends

A couple of push-pull forces generated a few wobbles overnight. On net, in contrast to the modest uptick in European equities the major US markets declined (S&P500 -0.5%) with the tech-focused NASDAQ underperforming (-0.8%). Elsewhere, yields rose with the rise in European rates on the back of a ‘hawkish’ ECB cut leading the way. The German 2yr yield increased ~8bps and the US equivalent edged up ~5bps (now ~3.92%). In FX, the USD recouped some of its intra-session losses but is still below where it was tracking this time yesterday. EUR (now ~$1.1447) appreciated, as did GBP (now ~$1.3573), while USD/JPY (now ~143.52) tracked the lift in bond yields. NZD also nudged up (now ~$0.6034, the top of its multi-month range) and the AUD (now ~$0.6504) touched a fresh year-to-date high.

In terms of the movers, as mentioned, the ECB lowered rates by 25bps. This was expected and puts the deposit rate at 2%, a low since early-2023. However, based on tweaks to the ECB’s inflation projections and policymaker rhetoric further action may not come through, at least not quickly. According to ECB President Lagarde “with today’s cut, and the current level of interest rates, we are getting to the end of the monetary policy cycle”.

In the US the public spat between Elon Musk and President Trump intensified with exchanges on social media signaling the bromance has ended. The back and forth was a catalyst for a slump in the Tesla share price (-14.3%) and this dragged on the overall index. With respect to trade, Presidents Trump and Xi reportedly spoke on the phone for 90 minutes. The varying accounts from the two sides makes it difficult to work out if progress was genuinely made or if anything other than further talks among the teams was agreed.

Macro focus tonight will be on the monthly US jobs report (10:30pm AEST). Based on the heightened trade uncertainty, ‘restrictive’ monetary settings, and higher import costs faced by consumers and businesses we think the US economy is losing steam. This points to a stepdown in employment and increased labour market slack over time. In our view, a softer US jobs report could bolster expectations looking for the US Fed to re-start its interest rate cutting cycle over coming months (a 25bp rate cut by the US Fed is almost fully baked in by September). If realised, we believe this can exert more downward pressure on the USD.

Trans-Tasman Zone

The softer USD stemming from a firmer EUR, underwhelming run of US economic data, and lingering US policy uncertainty has supported the NZD and AUD (see above). At ~$0.6034 the NZD is hovering near the top of its multi-month range, while the AUD (now ~$0.6504) touched a new year-to-date high overnight. Outside of AUD/EUR which consolidated (now ~0.5683) just above its 50-day moving average, the AUD also perked up a bit on the other major crosses. Modest gains of ~0.1-0.2% were recorded against GBP, NZD, CAD, and CNH, while AUD/JPY rose 0.7%.

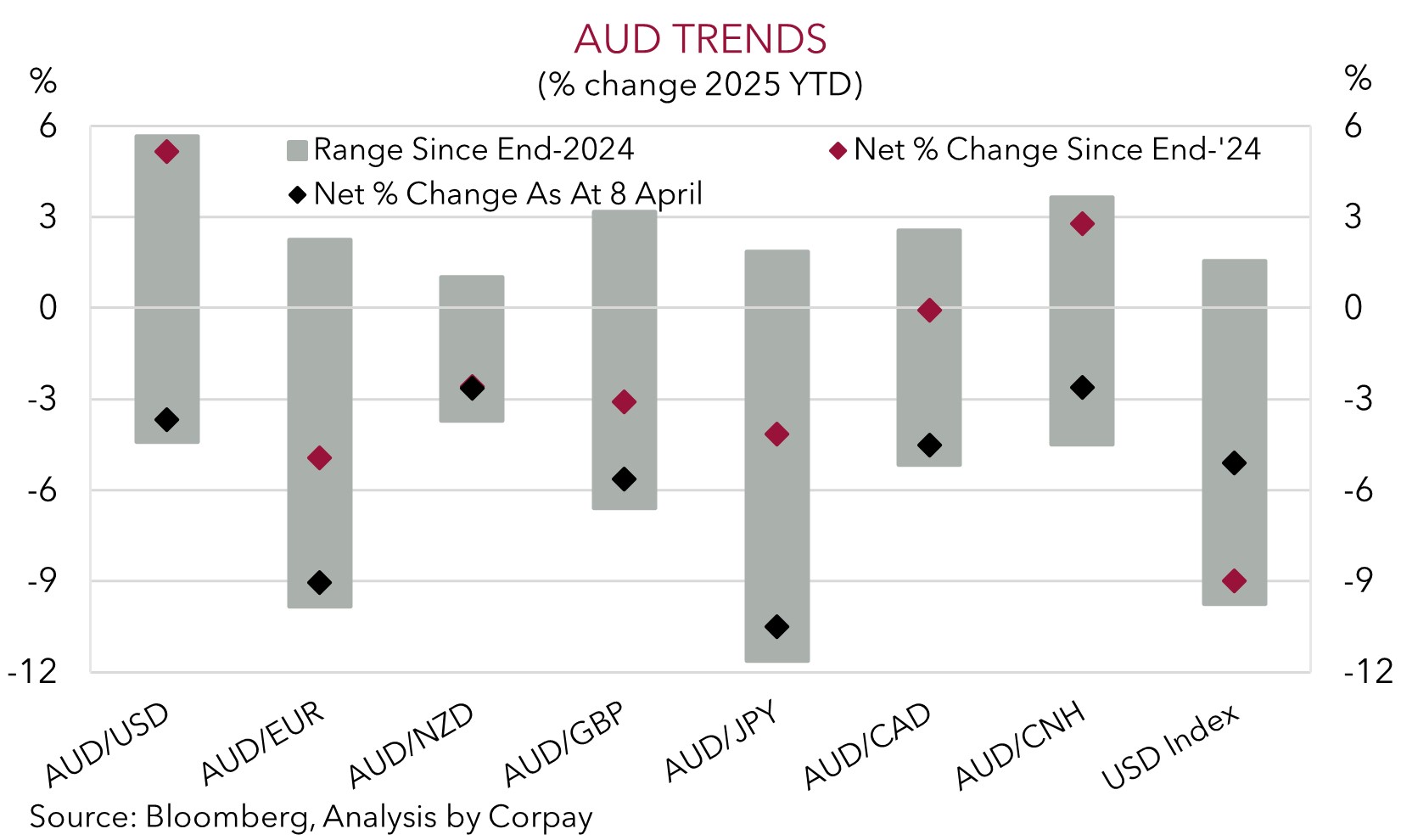

As our chart shows, the AUD has snapped back sharply from its April ‘Liberation Day’ panic lows. The AUD is ~10% above its 9 April trough, and is around levels last traded in early-December. The monthly US jobs report is a market focal point tonight (10:30pm AEST). As is typically the case the data can generate some volatility and short-term swings in the AUD. On balance, as discussed above, we think the various economic forces hitting the US economy point to a cooling in the jobs market. A softer US employment report could in our opinion exert a little more downward pressure on the USD which in turn supports the AUD and NZD. That said, even if the US employment figures were to positively surprise we doubt that any knee-jerk USD positivity would last too long or extend too far. We see the USD steadily losing ground over the longer-run as the Trump Administrations policies crimp US economic activity and/or act to dampen investor confidence in holding US financial assets. This in time should help the AUD trend higher over the medium-term.

Also helpful for AUD’s longer-term outlook are the steps being taken by authorities in China to boost domestic growth, especially commodity intensive infrastructure investment. As is the resilience of the Australian labour market and stickiness in core inflation. In our judgement, this suggests the RBA may remain ‘cautious’ and deliver only a few more interest rate cuts this cycle. Importantly, this already looks discounted with markets already pricing in ~3 more 25bp rate reductions by the RBA this year.