• Risk uptick. US equities ended a 3-day losing streak on Friday. USD eased back. AUD & NZD tick up. No change expected by RBA this week.

• US shutdown. US politics in focus with another shutdown looming. Last minute deal needed. A shutdown could see US data releases put on hold.

• Event Radar. In addition to the risk of a US government shutdown the RBA meets (Tues). China PMIs also out (Tues) as is Eurozone CPI (Weds).

Global Trends

A more positive tone across markets at the end of last week. US and European equities rose on Friday with the S&P500 (+0.6%) ending a three-day losing streak, its longest negative run in a month. Bond yields consolidated with the benchmark US 10yr rate (now ~4.18%) tracking just below the midpoint of its three-month range following its modest upswing since bottoming in mid-September. And in FX, the USD drifted back a little, though it still recorded a weekly gain. EUR (the major USD alternative) nudged above ~$1.17, and USD/JPY (the second most traded currency pair) eased a fraction after touching its highest point since early-August. GBP rose (now ~$1.3402), while the NZD (now ~$0.5775) and AUD (now ~$0.6549) ticked up, in line with the more positive risk backdrop.

Macro wise traders looked through the flurry of new sector specific tariffs announced by the US on Friday. Effective from 1 October unless firms are building a plant in the US “any branded or patented Pharmaceutical Product” will be slugged a 100% import duty, while heavy trucks will be subject to a 25% tariff, bathroom vanities and associated products face a 50% levy, and imported upholstered furniture will be hit with a 30% tariff. On the data front, the US PCE deflator (the Fed’s preferred inflation gauge) came in as expected with core inflation holding steady at 2.9%pa. At the same time, consumer spending was stronger than predicted in August. Consumer activity (the engine room of the US economy) looks to be tracking a bit firmer in the early part of Q3.

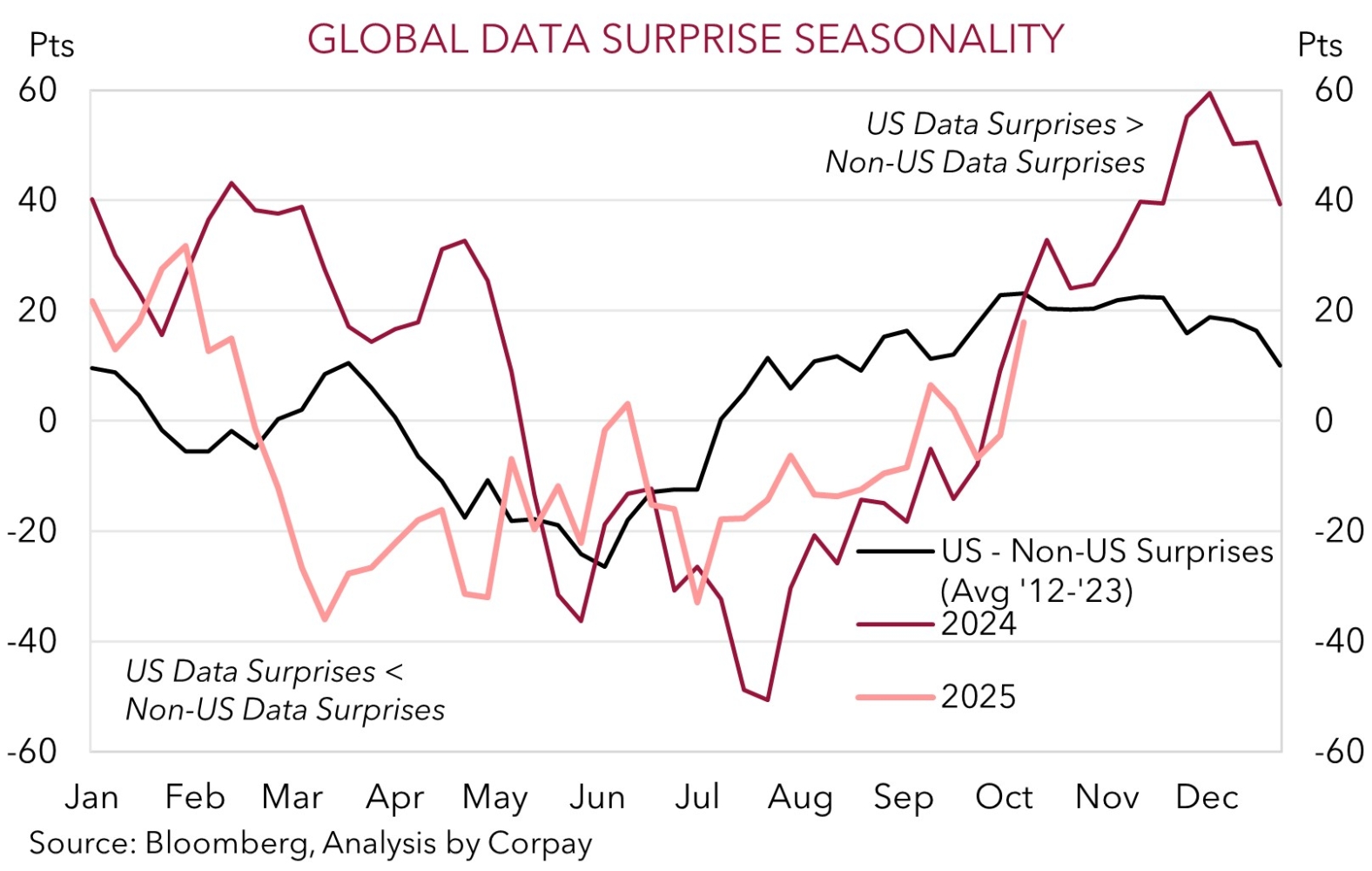

As our chart shows, US data surprises have improved recently with the US data generally coming in better than forecast while economic releases outside of the US have underwhelmed. This isn’t that unusual for this time of the year and it helps explain some of USD’s recent recovery. This week the monthly US jobs report is the highlight (Friday night AEST). Leading indicators point to another soft result. However, the release of the data is contingent on a US government shutdown being avoided. Without a last minute stop-gap deal being passed through the US Senate large parts of the US government will be shutdown from ~2pm Wednesday AEST. Federal workers will be furloughed, which could act as a drag on US economic activity, and things like official economic releases will be put on hold. This isn’t one of those instances where the US ‘debt ceiling’ is also involved. The last government shutdown of this nature lasted 35 days (December 2018-January 2019). In the current environment we think the failure to avoid a government shutdown could further highlight the more challenging backdrop in the US which in turn may exert downward pressure on the USD.

Trans-Tasman Zone

After a weak run the improvement in risk sentiment and softer USD helped the AUD and NZD tick a bit higher at the end of last week (see above). That said, the net moves weren’t overly large with the AUD (now ~$0.6549) hovering near the middle of its three-month range. The NZD (now ~$0.5775) remains close to the bottom of the range it has occupied since mid-April with the prospect of more aggressive RBNZ rate cuts over the next few meetings a NZD headwind. The diverging economic and interest rate trends between Australia and NZ remain firmly in the AUD’s favour, and this has helped push AUD/NZD up to levels last traded in Q4 2022 (now ~1.1340).

Locally, the RBA meets this week (Tuesday 2:30pm AEST, press conference 3:30pm AEST). No change in policy is expected by economists or traders with the cash rate forecast to remain at 3.6%. Indeed, we think it should be a unanimous decision with the recent run of activity data and stronger than predicted Australian inflation pulse potentially pushing the Board and Governor Bullock to be more ‘hawkish’ in its guidance to further reduce expectations about more policy easing this year. We believe there is a possibility no more interest rate cuts are delivered by the RBA this cycle.

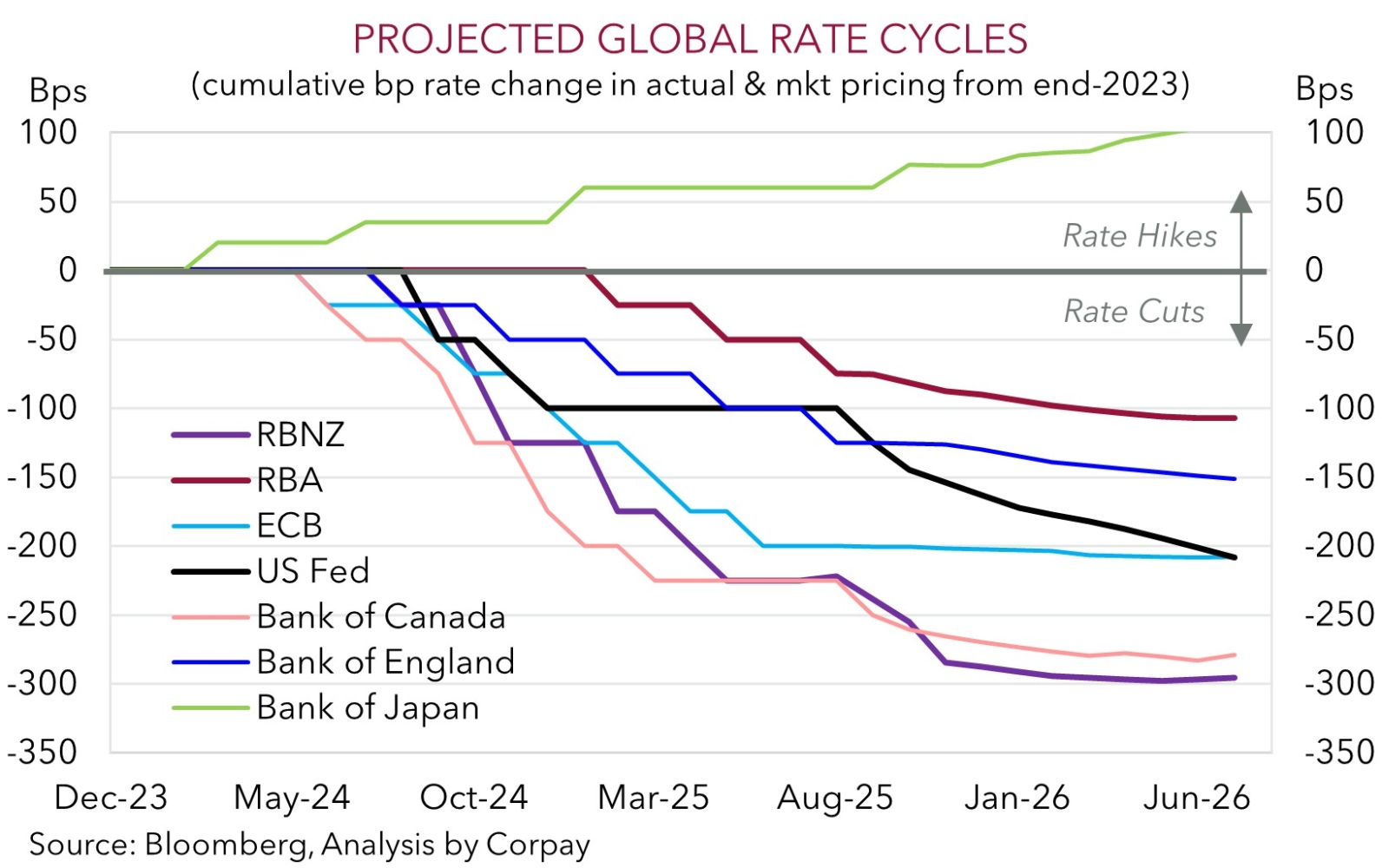

Market expectations have shifted noticeably with another RBA rate cut now only fully factored in by March. Another move after that is no longer priced in. In the short-term, relatively more ‘hawkish’ vibes from the RBA this week, combined with the prospect of a US government shutdown (which we think may act as a drag on the USD) could see the AUD/USD claw back some lost ground. The diverging monetary policy trends between Australia and other central banks may also see the AUD edge up against other currencies such as the NZD, EUR, CAD, and CNH, in our view. Moreover, over the medium term (i.e. next ~3-12 months) we continue to see the AUD grinding higher. We believe the AUD can be underpinned by a combination of a weaker USD as the US Fed steadily lowers rates, signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds, firmer momentum in Australia’s economy, and cautious approach from the RBA.