• Market wobbles. US shutdown ends. Market jitters return. US equities fall while yields rise. USD softer versus majors like EUR & JPY. AUD slips back.

• AU jobs. Employment conditions rebound with unemployment declining. Odds RBA doesn’t cut rates again have risen. China data batch due today.

Global Trends

There were a few renewed wobbles in risk sentiment overnight with US assets at the forefront of the moves. There was a small sense of the ‘sell America’ theme, which dominated market action a few months ago, returning. US equities lost ground with the tech-sector leading the way (NASDAQ -2.3%, S&P500 -1.7%). At the same time, US bonds endured a bit of a sell-off which pushed yields a little higher (~3-5bps across the curve) and the USD weakened against the major alternatives such as EUR (now ~$1.1632), JPY (now ~154.56), and GBP (now ~$1.3185). That said, the modest bout of risk aversion saw the NZD (now ~$0.5655) and AUD (now ~$0.6529) underperform with the latter’s Australian job market boost unwinding overnight.

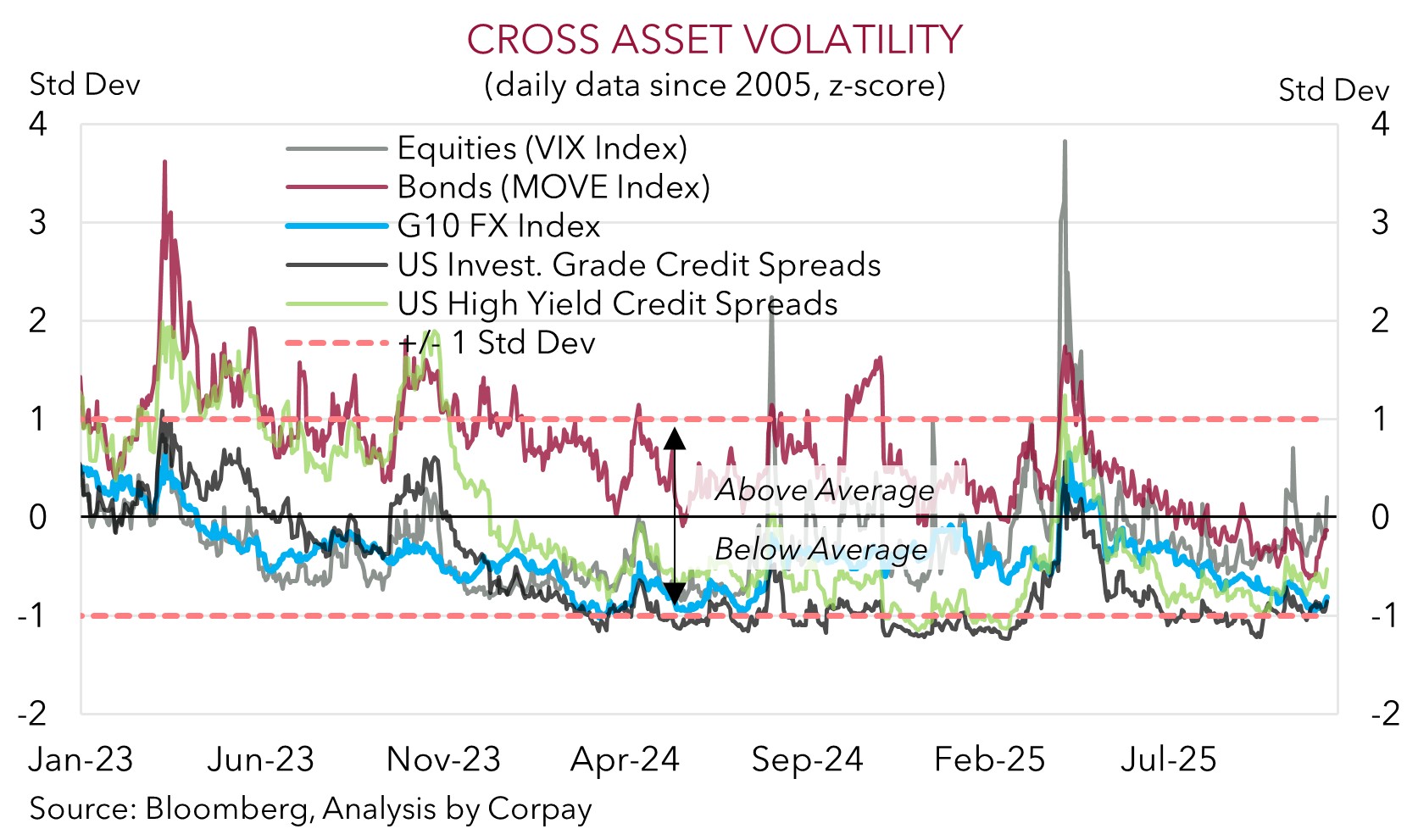

With the US Government Shutdown ending, some nervousness about the deluge of delayed data that should soon start to flow seems to have crept in. The extended shutdown is likely to have dampened US economic activity and/or seen the cracks in the jobs market widen. Time will tell. The prolonged shutdown may mean some US stats that were skipped like the October CPI and unemployment rates won’t be released, but others like non-farm payrolls should be with normal operations resuming over the next few weeks. A reason for the rather suppressed market volatility recently has been the lack of economic information. We think market (and FX) volatility could pick up as the US dataflow normalises. Compounding the post US shutdown jitters were comments by some US Fed officials, with odds of another rate cut in December trimmed to ~50%. Notably, Boston Fed President Collins, a voter in December, said she favoured keeping rates steady “for some time to balance the inflation and employment risks in this highly uncertain environment”.

Today the China data batch for October is due (1pm AEDT). The national holiday period suggests momentum in areas such as industrial production may have slowed. But this may be more noise than signal as the post-holiday return to work and government stimulus measures point to firmer growth into year-end, in our view. Bigger picture, in terms of the US, we believe the drag on activity from the drawn-out shutdown, higher import costs/tariffs, and lower confidence should see the US Federal Reserve deliver more rate cuts over the next ~3-6 months. Short-term headline driven volatility is likely, but in our opinion, a step down in short-end US interest rates, sluggish US growth, and structural pressures such as the US’ wide current account deficit could see the USD gradually re-weaken over the medium-term.

Trans-Tasman Zone

A bit of volatility in the AUD and NZD over the past 24hrs with domestic trends (in the case of Australia) and global forces generating intra-day swings. On net, the NZD (now ~$0.5655) remains near the bottom of its multi-month range with expectations of more RBNZ rate cuts continuing to create headwinds. Markets are pricing in a small chance the RBNZ delivers another larger 50bp rate cut on 26 November. In terms of the AUD, after ticking up in the wake of the solid Australian labour force figures yesterday the overnight wobbles in risk markets have seen it reverse course. That said, at ~$0.6529 the AUD remains north of its ~1-month and ~6-month averages. The shaky risk sentiment also saw the AUD back peddle on the major crosses with falls of ~0.3-0.6% recorded against the EUR, JPY, GBP, and CNH.

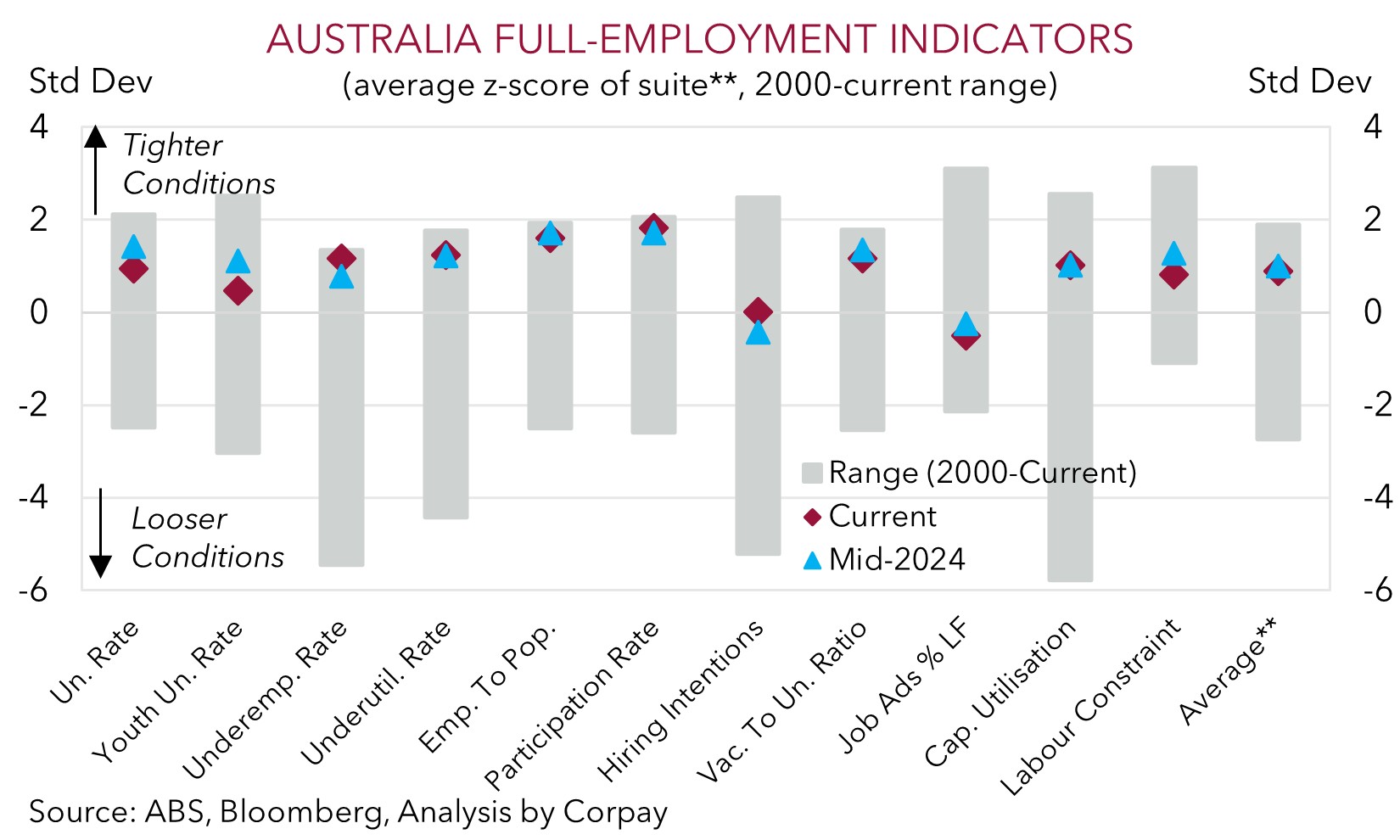

In terms of the Australian data there was a solid rebound in employment conditions. Employment rose ~42,200 in October, driven by a hefty increase in full-time jobs (+55,300). This, and a steady participation rate, saw the unemployment rate slip back to 4.3%. The data confirms suspicions the lift in the unemployment rate last month was in part due to the volatility in the series and that markets were too quick to jump at shadows. In our opinion, the combination of sticky Australian core inflation, a resilient jobs market, and signs of improvement in domestic growth point to an extended period on hold by the RBA. Moreover, the longer the RBA stands still the greater the chance the next (eventual) move in policy ends up being a rate hike. Trying to preserve the gains in the labour market and support growth was an active decision by the RBA. That is why the RBA didn’t go as high as their peers during the tightening phase, but it also means the RBA isn’t able to be as aggressive during the easing cycle.

Looking ahead, the monthly China activity data is released today (1pm AEDT). This may generate more intra-day AUD volatility. However, on balance, we remain of the view that an improvement in US/China trade relations, diverging policy trends between the RBA and other central banks such as the US Fed, favourable yield spreads, and/or firmer growth in China as its stimulus push gains traction should help the AUD grind higher into year-end and over early 2026.