• Fed moves. US Fed cut rates by 25bps & flagged more down the track. But this was priced. A burst of vol. overnight. AUD slipped back from ~11mth highs.

• Rate cuts. Chair Powell labelled it ‘risk management’. But negative labour market trends point to a steady stream of Fed rate cuts, in our view.

• Data flow. Bank of Canada also cut rates overnight. NZ GDP weaker than expected. Australian jobs report out today. BoE set to hold steady tonight.

Global Trends

The US Fed policy meeting was in focus overnight. The outcome generated a bit of volatility due to some push-pull forces and elevated expectations baked in by overzealous markets ahead of the event. As anticipated the US Fed cut interest rates for the first time since December with the target range lowered by 25bps to 4.00-4.25%. There was a risk the Fed might have announced a larger (i.e. 50bp) reduction, but in the end only 1 member of the committee (President Trump’s recent appointee Stephen Miran) voted for the more aggressive action. According to the Fed uncertainty about the outlook remains “elevated” with the “downside risks to employment” rising. This characterization isn’t surprising given the signal from leading indicators and negative revisions to the pace of jobs growth.

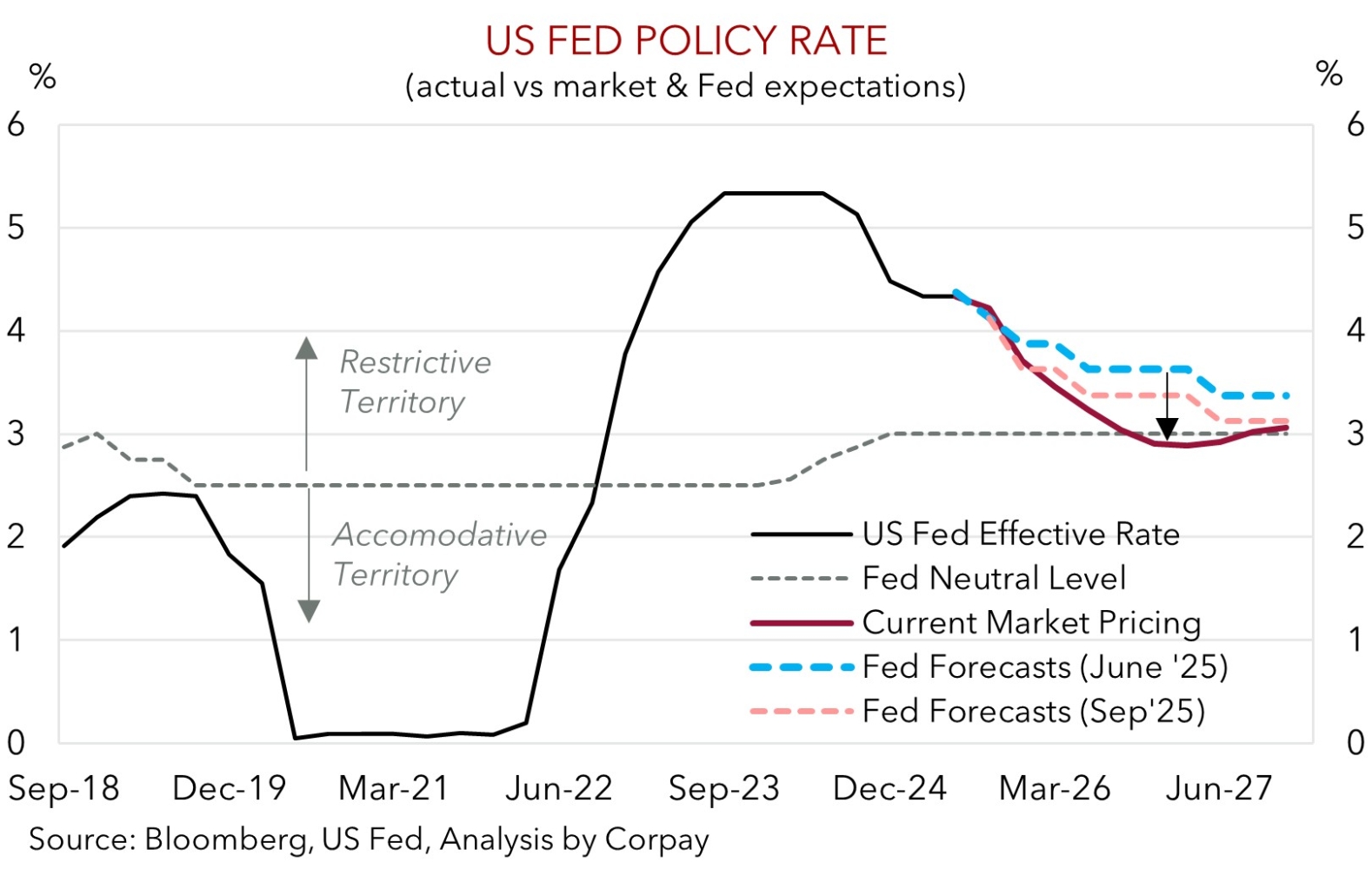

Based on the evolving balance of risks the US Fed now sees a few more interest rate reductions ahead than it did. The Fed’s updated ‘dot plot’ shows rates falling by 50bps over the final two meetings of 2025, with another 25bps penciled in in 2026, and a further 25bps anticipated in 2027. But as our chart shows, the downshift in the US Fed’s interest rate thinking only partially closed the gap between its previous forecasts and where markets are sitting. This coupled with Fed Chair Powell’s comments that today’s cut is for “risk management” reasons saw the knee-jerk response of lower US bond yields, uptick in US equities, and a softer USD (higher AUD and NZD) reverse course. On net the S&P500 closed a fraction lower (-0.1%), US bond yields rose ~5-6bps across the curve, and the USD recovered lost ground with the EUR (now ~$1.1818), NZD (now ~$0.5946), and AUD (now ~$0.6654) back peddling later in the session. Indeed, this followed the EUR initially reaching a fresh multi-year peak and the AUD hitting its highest level since last October.

The market swings aren’t a surprise to us. We had been calling out the chances of a burst of volatility and USD rebound the past few days due to the lofty Fed rate cut expectations that had been factored in. That said, as we also noted previously, we don’t see these moves lasting too long or extending too far. In our opinion, the more challenging US economic environment and widening cracks in the labour market should see the US Fed deliver a steady stream of interest rate cuts over the next few quarters. We believe the balance of risks reside with the Fed delivering an easing cycle closer to what interest rate markets are projecting than its own updated forecasts. Over the medium-term, we think the mix of slower US growth, downshift in US interest rates, and/or reduced inflows into US assets should see the USD trend lower.

Trans-Tasman Zone

A bit of US Fed induced volatility saw the AUD and NZD swing around a little overnight (see above). On net, the AUD has slipped back after touching its highest point since last October in the wake of the initial Fed announcement (now ~$0.6654). The AUD has also lost some ground on a few of the major cross-rates with falls of ~0.1-0.5% recorded against the JPY, GBP, CAD, and CNH over the past 24hrs.

It was a similar story for the NZD, although this mornings weaker than anticipated Q2 NZ GDP added to the downward pressure (now ~$0.5946). The data showed the NZ economy contracted by a sizeable 0.9% in the June quarter, much larger than what consensus and the RBNZ were predicting. In our opinion, this should bolster the case for the RBNZ to deliver more interest rate support at the October and November meetings. This is a NZD headwind with the diverging economic and interest rate trends in Australia’s favour pointing to further AUD/NZD strength over the period ahead, in our view.

The monthly Australian jobs report is released today (11:30am AEST). Leading indicators point to growth in labour demand from employers that we believe should outpace labour supply. If realised, this mix might deliver another decent month of jobs growth (mkt 21,000) and low unemployment (mkt 4.2%). And would support the case for the RBA to deliver only a little more interest rate relief over coming months. This should, in our opinion, be AUD supportive. Indeed, as outlined above and the past few days, we don’t think tactical rebounds in the USD/pull-backs in the AUD (such as the one that came through overnight) should be overly big or last too long.

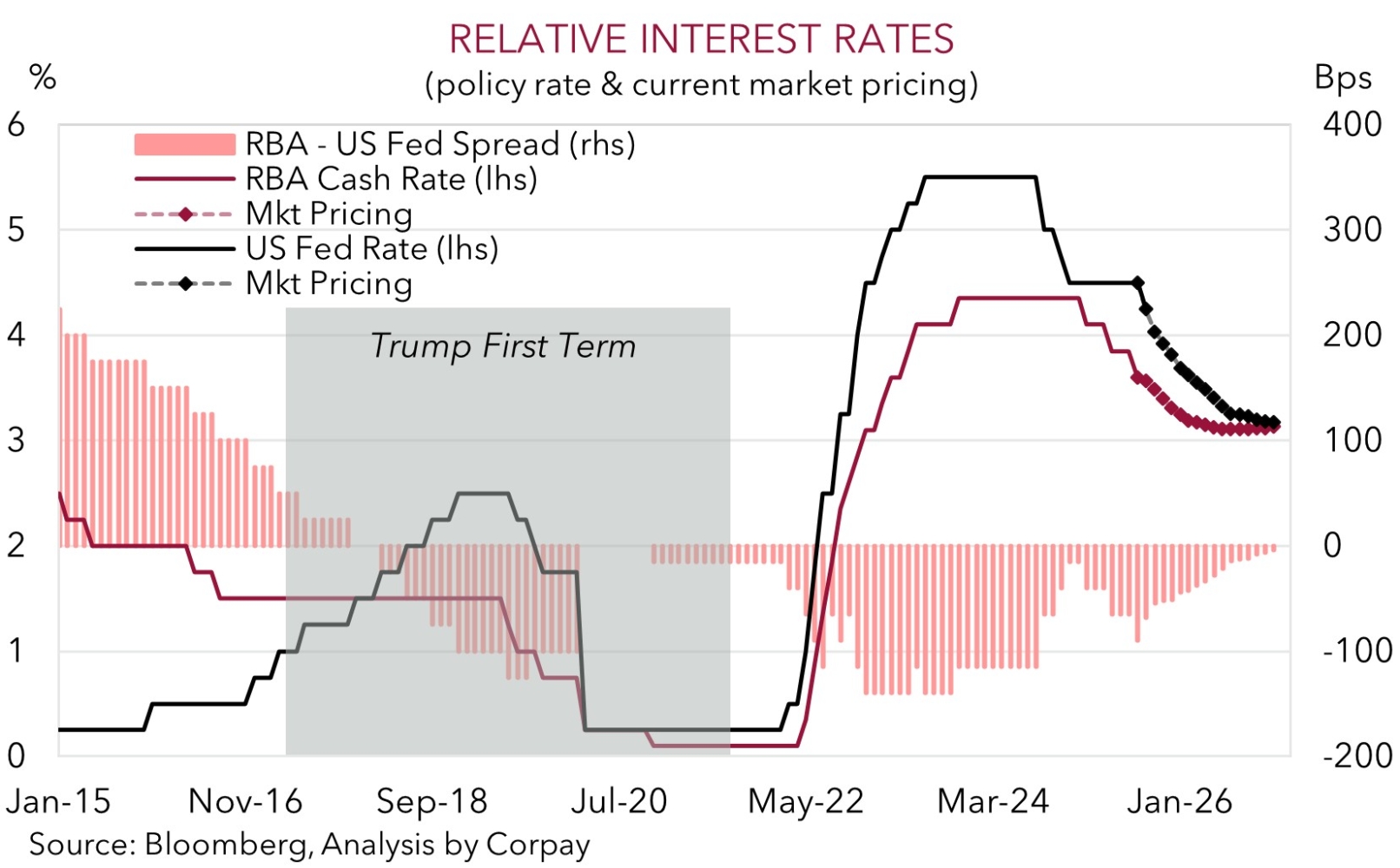

Over the medium term (i.e. next ~3-12 months) we believe the AUD can continue to grind higher. We think the AUD should be underpinned by a mix of a weaker USD as the US Fed steadily lowers interest rates, signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds, firmer momentum in Australia’s economy, and ongoing cautious approach from the RBA. As our chart shows, relative RBA and US Fed interest rates settings are set to converge over the next year.