• Consolidation. Quieter markets on Friday. US equities near record highs. USD tread water. AUD hovering near the top of its multi-month range.

• Central banks. US Fed expected to re-start its cutting cycle. Focus will be on updated guidance. Markets pricing in a series of Fed rate reductions.

• Event Radar. China data today. Australia jobs report scheduled (Thurs). NZ GDP due. US Fed the focal point (Thurs). US retail sales also out (Tues).

Global Trends

It was a relatively subdued end to last week in markets, but there are a few events on the horizon which could liven things up over the next few days. Another weak US consumer sentiment reading didn’t move the dial with confidence hitting its lowest point since May as anxiety about employment prospects and personal finances remains elevated. In terms of the numbers the US S&P500 consolidated near record highs with the index climbing ~1.6% last week (its 7th gain in the past 9 weeks). European markets were also little changed however in Asia stocks in Japan, South Korea and Taiwan closed at record levels.

Elsewhere, the bond market rally took a breather with yields moving a bit higher and curves steepening. US yields ticked up ~1-4bps, while in Europe long end rates rose as nervousness about public debt remains after Fitch downgraded France from AA- to A+. In FX, there were limited net moves on Friday, but this comes after some decent swings during the week. The USD index continues to hover near the lower end of its range with EUR (now ~$1.1732) and USD/JPY (now ~147.74) treading water on Friday. The NZD eased lower (now ~$0.5956) as did the AUD (now ~$0.6648) although both posted strong gains last week with the AUD tracking around its highest point traded since early-November.

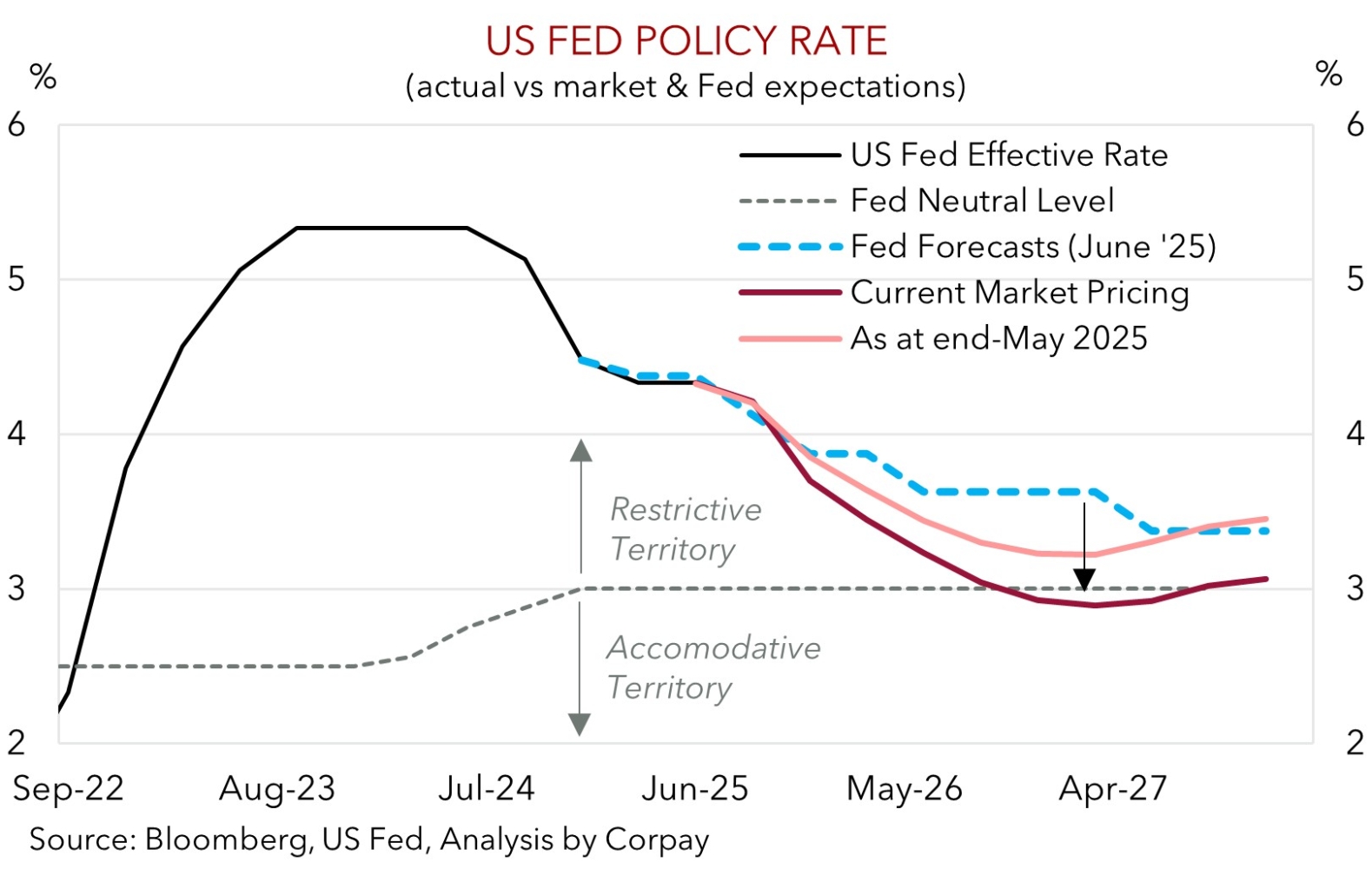

There are a couple of major central banks meeting this week. The Bank of England (Thurs) is seen on hold, as is the Bank of Japan (Fri). By contrast, the Bank of Canada (Weds) looks set to cut rates by another 25bps, while the US Fed (Thurs morning AEST) is expected to re-start its easing cycle after holding steady since December. Upside US inflation risks have lessened however downside growth/employment risks have intensified. In our mind this points to a steady stream of US Fed rate cuts over coming months. Key questions are how will the US Fed kick off this phase of its cycle and how far will it move down the track? We think a 25bp move this week is probable, though a larger 50bp step isn’t out of the realm of possibilities. We also believe that based on negative underlying US economic trends the committee should lower its medium-term interest rate projections down towards current market pricing. Markets are driven by outcomes compared to expectations. Hence, in the short-term, based on the already quite ‘dovish’ market views the USD may recoup some lost ground. But, we don’t think these types of move will last too long or extend too far. Over the longer-run, the outlook for slower US growth and downshift in US interest rates should see the USD trend lower, in our view.

Trans-Tasman Zone

After a strong run earlier in the week the AUD and NZD consolidated on Friday, in line with the more subdued trading conditions (see above). The NZD (now ~$0.5956) is lingering near its 100-day moving average, while the AUD (now ~$0.6648) is still up around the top end of its ~10-month range with last week’s ~1.4% gain helping it break out of the rather narrow bound it had been trading in. The AUD put in a mix performance on the cross-rates on Friday, although the moves were limited and they follow some positive trends. AUD/EUR (now ~0.5667) is close to its ~3-month high, AUD/JPY (now ~98.22) is closing in on its year-to-date peak, AUD/GBP (now ~0.4903) is near its 1-year average, AUD/NZD (now ~1.1163) is at the upper end of its cyclical range, and AUD/CNH (now ~4.7374) is towards the top of the range it has occupied since December.

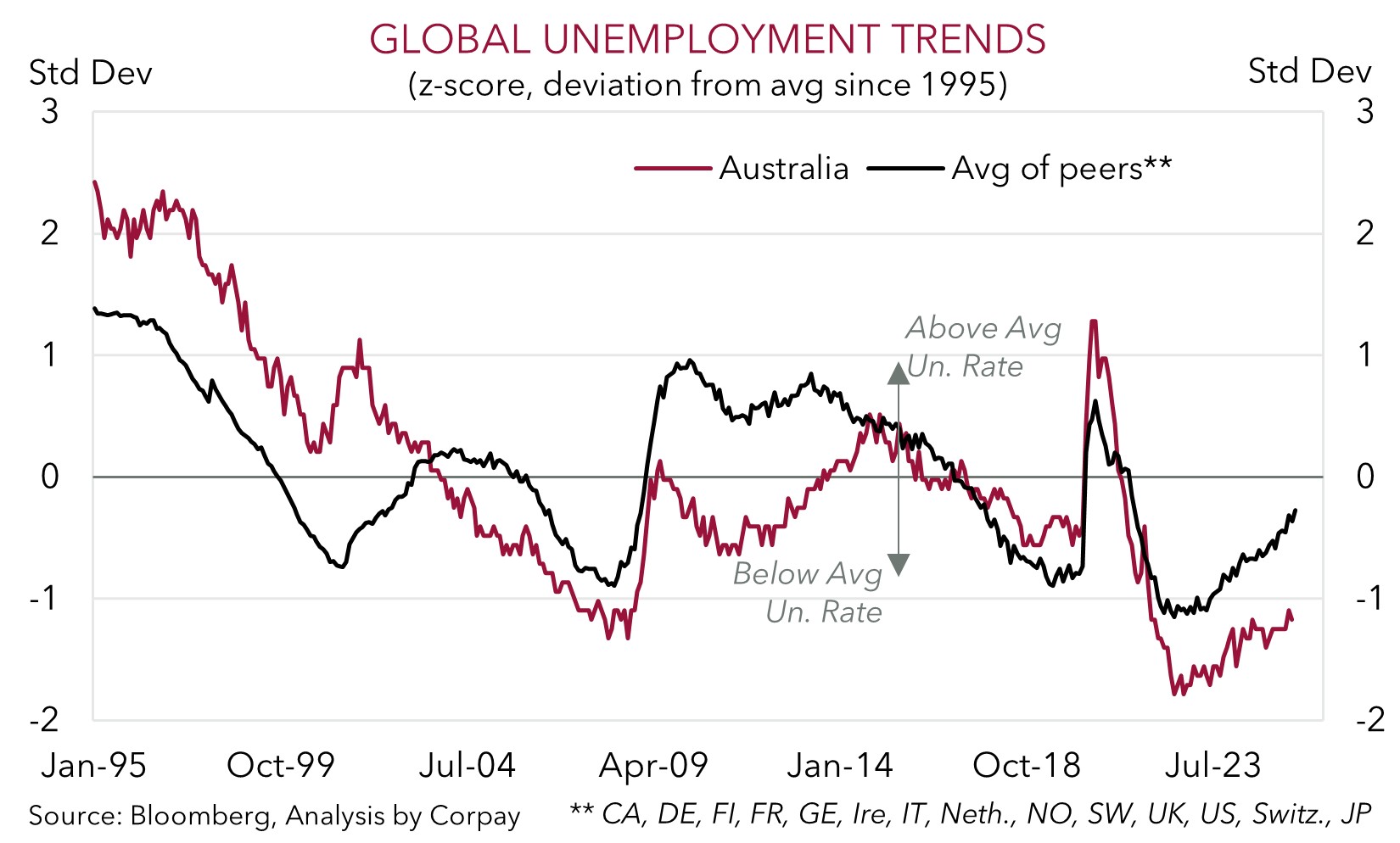

The global economic calendar heats up this week. The monthly China data batch is due today (12pm AEST). In the US retail sales (Tues night AEST) and US Fed decision (Thurs morning AEST) are focal points. In Australia the volatile monthly jobs report is out (Thurs), and in NZ Q2 GDP is released (Thurs). In our view, the China data should show positive, albeit not spectacular, momentum, US consumer spending may have softened, while the Australian jobs market could show conditions remain solid. As our chart shows, the RBA’s active decision not to raise interest rates as aggressively as other nations to maintain positive labour market conditions has been paying off. Australian unemployment is still below average and hasn’t started to rapidly climb higher as it has elsewhere. This should also mean that the RBA continues to lag its global peers during the interest rate cutting phase. This policy divergence is a longer-term positive for the AUD, in our opinion.

Shorter-term, the outcome of the US Fed meeting will drive markets this week. As discussed above, we believe a 25bp rate cut by the US Fed is the most likely outcome, with the committee also set to indicate more moves are in the pipeline. However, with markets already factoring that in the USD might bounce back as the Fed struggles to be more ‘dovish’ than what is now baked in. That said, we don’t think short-term rebounds in the USD/pull-backs in the AUD should be overly large or last too long. Over the medium term (i.e. next ~3-12 months) we believe the AUD can continue to edge higher. In our view the AUD will be underpinned by a combination of a weaker USD as the US Fed steadily lowers interest rates, signs of improvement in China’s economy as its stimulus push helps counteract tariff headwinds, firmer momentum in Australia’s economy, and ongoing cautious approach from the RBA.