• Holding on. Some volatility but net changes in US equities & bond yields were modest overnight. USD index a bit firmer but AUD holds its ground.

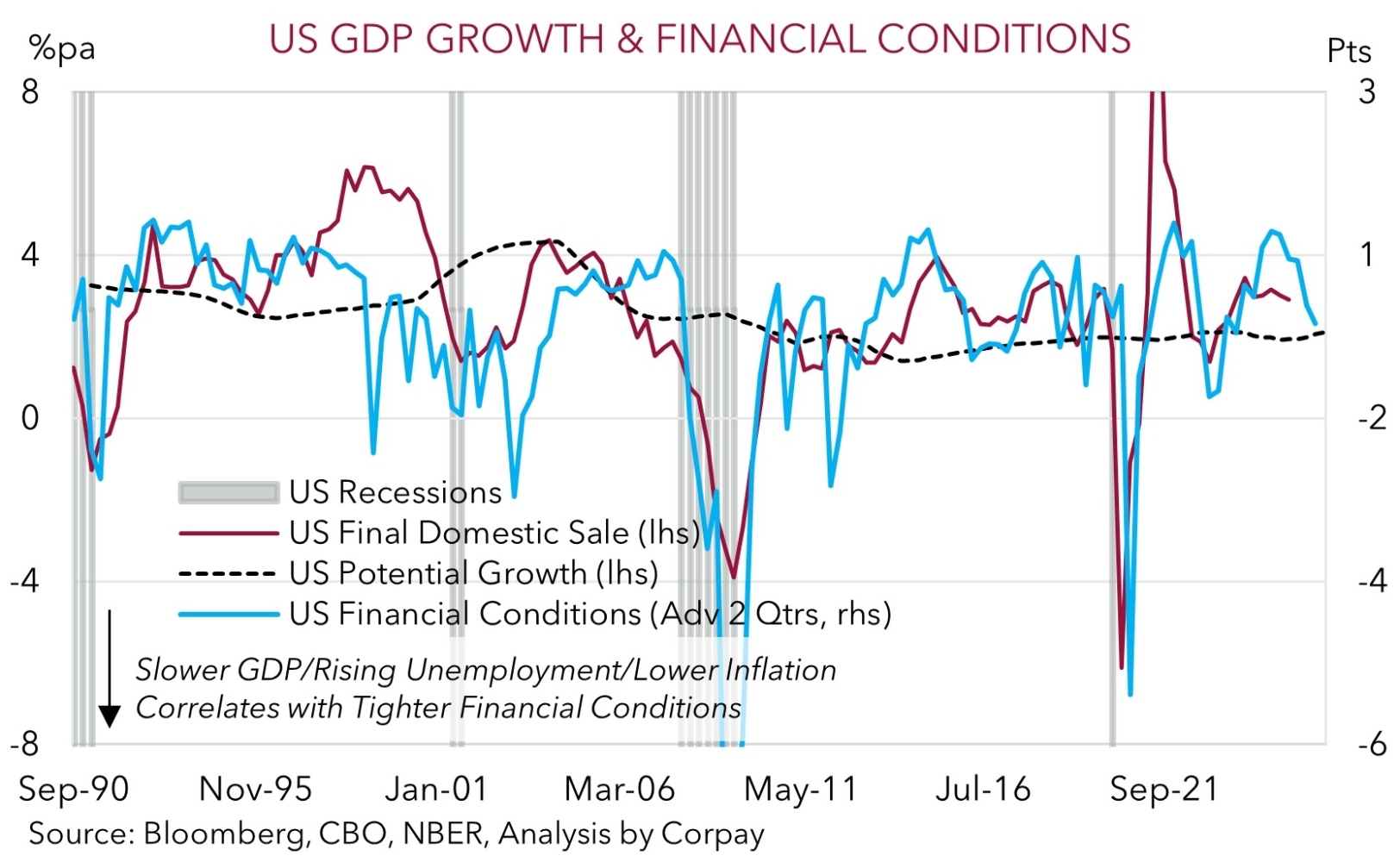

• US GDP. A large jump in imports ahead of tariffs meant US GDP contracted in Q1. Forward indicators point to slower US domestic growth over 2025.

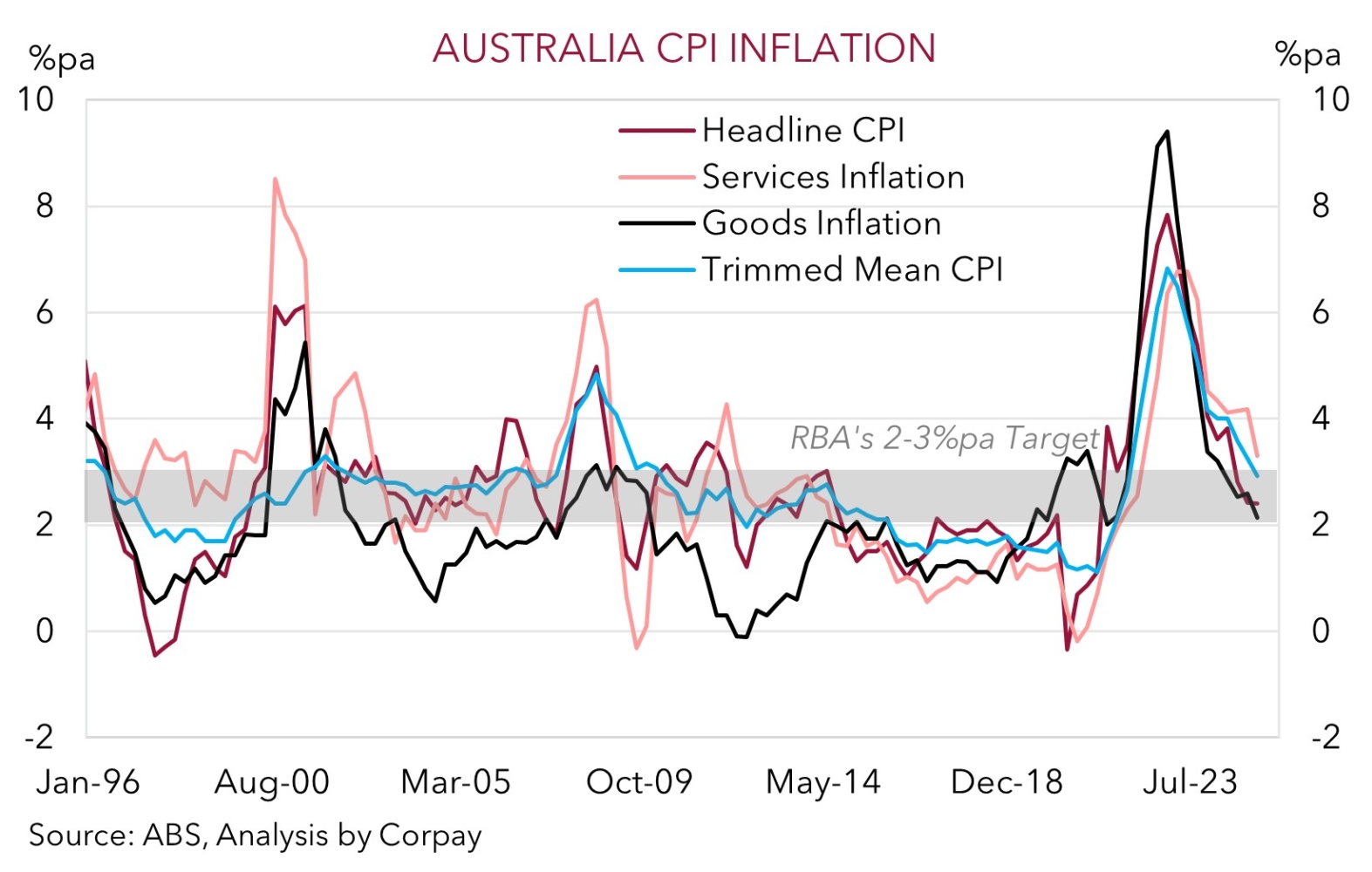

• AU CPI. Q1 inflation a little higher than consensus but inline with RBA’s thinking. Underlying trends point to further RBA interest rate relief in May.

Global Trends

Despite a deluge of global economic data, particularly out of the US, and a few intra-session bursts of volatility the net overnight market moves have been modest. After falling by more than 2% in early trade on the back of lingering growth worries the US stockmarket clawed its way back to end the session in slightly positive territory (S&P500 +0.2%). Remarkably, the rebound that has come through over the past couple of weeks meant that the S&P500 only shed ~0.8% in April after being down as much as 13.8% towards the start of the month as the tariff panic kicked into gear.

Elsewhere, the US 2yr yield drifted lower (-5bps to ~3.60%) as traders factored in more potential policy easing by the US Fed and the benchmark 10yr rate consolidated (now ~4.16%). In FX, the USD index ticked higher with EUR extending its pullback (now ~$1.1330), GBP weakening (now ~$1.3327), and USD/JPY nudging higher ahead of today’s Bank of Japan meeting where no policy change is anticipated (now ~143). NZD also tread water (now ~$0.5935), and although the AUD (now ~$0.6405) was whipped around a bit over the past 24hrs it is a little higher than where it was tracking this time yesterday with yesterday’s positive Q1 Australian CPI surprise helping it outperform.

In terms of the US data the topline result for Q1 GDP undershot predictions with the economy contracting at a 0.3% annualised pace. This is the first outright fall in US GDP since the start of 2022. However, a closer look at the details shows that a surge in imports (and hence drag from net exports) as firms front-run tariffs was a key reason. Private demand was still solid with sales to domestic purchasers running around their recent average rate. That said, as our chart shows, the tightening in US financial conditions coupled with uncertainty and higher prices stemming from the trade policies points to a stepdown in US domestic momentum over coming quarters. This also raises risks for the US jobs market which already looks to be losing steam. ADP employment grew by just 62,000 in April, the smallest gain since last July.

Based on the signal from regional Fed surveys the ISM manufacturing index should show more negative effects from the recent upheaval (12am AEST). The US jobs report (released Fri night AEST) may also show conditions are loosening. That said, for markets the important thing isn’t if something is good or bad but rather if it is better or worse than expected. As such we believe the beaten up USD, which is hovering below our model estimates, might extend its recovery in the near-term, particularly against the EUR and/or JPY if the BoJ pushes back on the prospect of further interest rate hikes later this year.

Trans-Tasman Zone

The domestic and global data flow over the past 24hrs has generated a bit of intra-session volatility in the NZD and AUD. But on balance, the NZD is little changed from where it was tracking this time yesterday (now ~$0.5935), while the AUD is a bit higher (now ~$0.6405). The AUD’s outperformance on the crosses has provided a helping hand with the AUD strengthening by ~0.8-0.9% versus the EUR, JPY, and GBP and recording more modest gains against the NZD (+0.2%) and CNH (+0.3%).

Supporting the AUD has been a paring back of outsized near-term RBA rate cut expectations. Odds of an outsized 50bp move on 20 May were whittled down further after the Q1 Australian CPI came in hotter than predicted. Headline inflation rose 0.9% in Q1 with the annual run-rate holding at 2.4%pa. Core inflation (i.e. the trimmed mean) increased 0.7% in Q1, though favourable base-effects meant that annual growth still moderated to 2.9%pa. This is the slowest pace of core inflation since late-2021, with services price pressures easing to levels last seen in mid-2022.

While the data came in a touch higher than the market was penciling in, it was broadly as per the RBA’s February outlook. In our mind, this should mean that the RBA follows through with another 25bp interest rate cut in May as it continues to steer the economy along the ‘narrow path’. That said, the ongoing resilience in the Australian labour market and still elevated level of activity across the economy points to a gradual/modest recalibration lower in interest rates over the period ahead rather than quick-fire and sizeable moves. We think a further adjustment in near-term RBA interest rate cut expectations may give the AUD support versus currencies such as the EUR, NZD, and CNH. This can also help AUD/USD hold its ground if we are right and the beleaguered USD does edge a little higher over the short-run (see above).