• Pressure points. US equities hit another record high, while the USD remains under pressure. AUD has risen to the top of its multi-month range.

• USD trends. USD index ~10.5% below where it started the year. Worst performance over the first half of a year since the early-70s.

• Macro events. Eurozone CPI & ECB conference in focus tonight. Various US jobs indicators due over next few days. US ISM also released tonight.

Global Trends

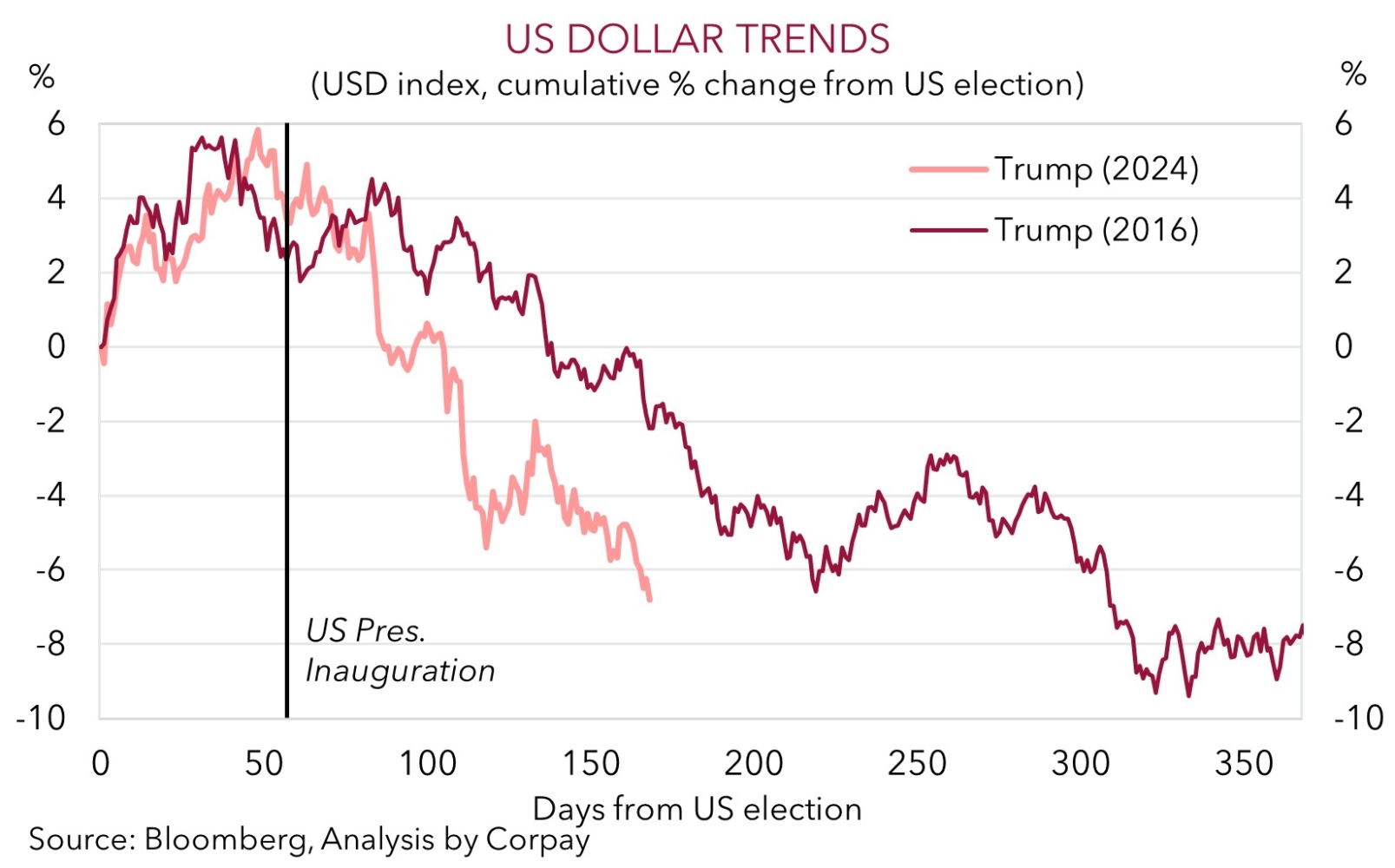

Risk sentiment ended the month, and volatile quarter, on positive footing with the US S&P500 (+0.5%) hitting a fresh record high and cyclical currencies like the AUD and NZD outperforming. More broadly, the USD has lost more ground as fundamental forces continue to exert downward pressure on the currency. The USD Index, which is following a similar path to the first year of President Trump’s first term (see chart below), is now ~10.5% below where it started 2025. This has been the USD’s worst performance over the first half of a year since the early-1970s. EUR (the major USD alternative) has extended its upswing (now ~$1.1785) to be at levels last traded in Q3 2021, and USD/JPY (the second most traded currency pair) has slipped under ~144. USD/SGD (now ~1.2712) is at the bottom of its cyclical range, NZD (now ~$0.6095) touched its highest point since mid-October, and the AUD (now ~$0.6582) is at a multi-month peak.

Signs of progress on trade negotiations and the outlook for looser US monetary policy has underpinned risk appetite, with the USD tracking the decline in US bond yields. The benchmark US 10yr rate shed another ~5bps and this has pushed yields below their 1-year average. Markets are assigning a ~20% chance the US Fed restarts its rate cutting cycle at the end of July with 4 reductions baked in by next April due to the challenges the US economy is facing. On the trade-front, Canadian policymakers rescinded the digital services tax to defuse US trade threats while there were also reports the EU is prepared to accept a deal that includes a universal 10% tariff on most exports to the US, though this is on the condition some products are exempted. More trade-related headlines are likely over the period ahead with the 9 July end of the US’ ‘90-day pause’ fast approaching.

Tonight, Eurozone Inflation (7pm AEST) and the ECB’s annual conference are focal points. The central banker panel, which includes US Fed Chair Powell, is the marquee event (11:30pm AEST). The US ISM survey and JOLTS job openings figures are also out (both 12am AEST). Beyond that, the monthly US jobs report is on the horizon (Thurs night AEST). As outlined before, we think heightened policy uncertainty and loss of momentum across business surveys and underlying activity suggests the US jobs market is cooling. If realised, we believe this could reinforce expectations looking for US Fed interest rate cuts over the next year and this may further undermine the USD.

Trans-Tasman Zone

Upbeat risk sentiment at the end of the month/quarter and sluggish USD has supported the NZD and AUD (see above). As did yesterday’s modest uptick in the China business PMIs which suggests growth momentum is showing signs of life. The NZD (now ~$0.6095) hit its highest level since mid-October while the AUD (now ~$0.6582) is tracking at the top of the range it has occupied since mid-November. The backdrop has also helped the AUD outperform on the cross-rates with gains of ~0.2-0.6% recorded against the EUR, JPY, GBP, and CNH over the past 24hrs. AUD/CNH (now ~4.7120) has ticked back above its 1-year average, yet AUD/EUR (now ~0.5585) and AUD/GBP (now ~0.4793) continue to languish in the bottom half of their respective 1-month ranges.

The Australian data calendar is light on this week with retail sales (Weds) and household spending (Fri) due. In our opinion, indications household consumption improved in May may temper enthusiasm about how many interest rate cuts the RBA might deliver over the next year. Markets are assigning a ~95% chance the RBA lowers the cash rate on 8 July with close to 4 interest rate cuts factored in by May 2026. We think inflation trends point to further RBA interest rate relief being delivered over coming months, but barring a sustained negative shock, we don’t see the RBA being more aggressive than what is discounted. This is important as markets are driven by outcomes compared to expectations.

Moreover, as mentioned previously, when it comes to FX (and the AUD), it should be remembered that local matters typically play second fiddle to USD developments. Australia (and the AUD) are ‘price takers’ of what happens in the US. Fundamentally, we believe the mix of fading US economic strength, outlook for US Fed rate cuts over late-2025/2026, and reduced investor demand for US financial assets given the volatile policy backdrop and lofty valuations should see the USD steadily depreciate over the medium-term. This, combined with moves by authorities in China to mitigate tariff-related headwinds via commodity-intensive infrastructure investment, and/or still solid momentum in the Australian economy could see the AUD grind even higher over the next few quarters, in our opinion.