• Tariff news. Reports the Trump Administration might implement tariffs month-by-month calmed some market nerves. USD eased helping AUD & NZD tick up.

• Stepping back. But moves were modest compared to recent trends. AUD & NZD remain near the bottom of their respective multi-year ranges.

• Event radar. UK & US CPI released tonight. Several Fed members speaking. AU employment tomorrow. US retail sales & China data also due this week.

Global Trends

It has been a turbulent start to 2025, though a sense of calm somewhat returned yesterday after media reports suggested the incoming Trump Administration might implement trade tariffs on a month-by-month basis to boost negotiating leverage and avoid an inflation spike rather than impose them in one fell swoop. Time will tell if this comes through with the US Presidential Inauguration next week and Trump’s overnight comments that an “External Revenue Service” could be created to collect duties a sign tariffs are a cornerstone of his policy platform.

In broad strokes many of the late-2024 market trends have continued over the past few weeks with some consolidation occurring overnight. The major equity markets have remained on the backfoot (the US S&P500 is 1.1% lower year-to-date after falling ~2.5% in December), long-end bond yields have pushed higher (the benchmark US 10yr rate is up at ~4.79%, the top-end of the range occupied since November 2023 and ~119bps above its mid-September low), and despite softening a touch over the past 24hrs the USD’s broad-based upswing has extended with currencies like the EUR, CAD, NZD, AUD, CNH, and SGD touching fresh multi-year lows recently. GBP, which has shed ~2.5% so far in January, has also been undermined by renewed concerns about the financing of the UK’s troublesome external imbalance.

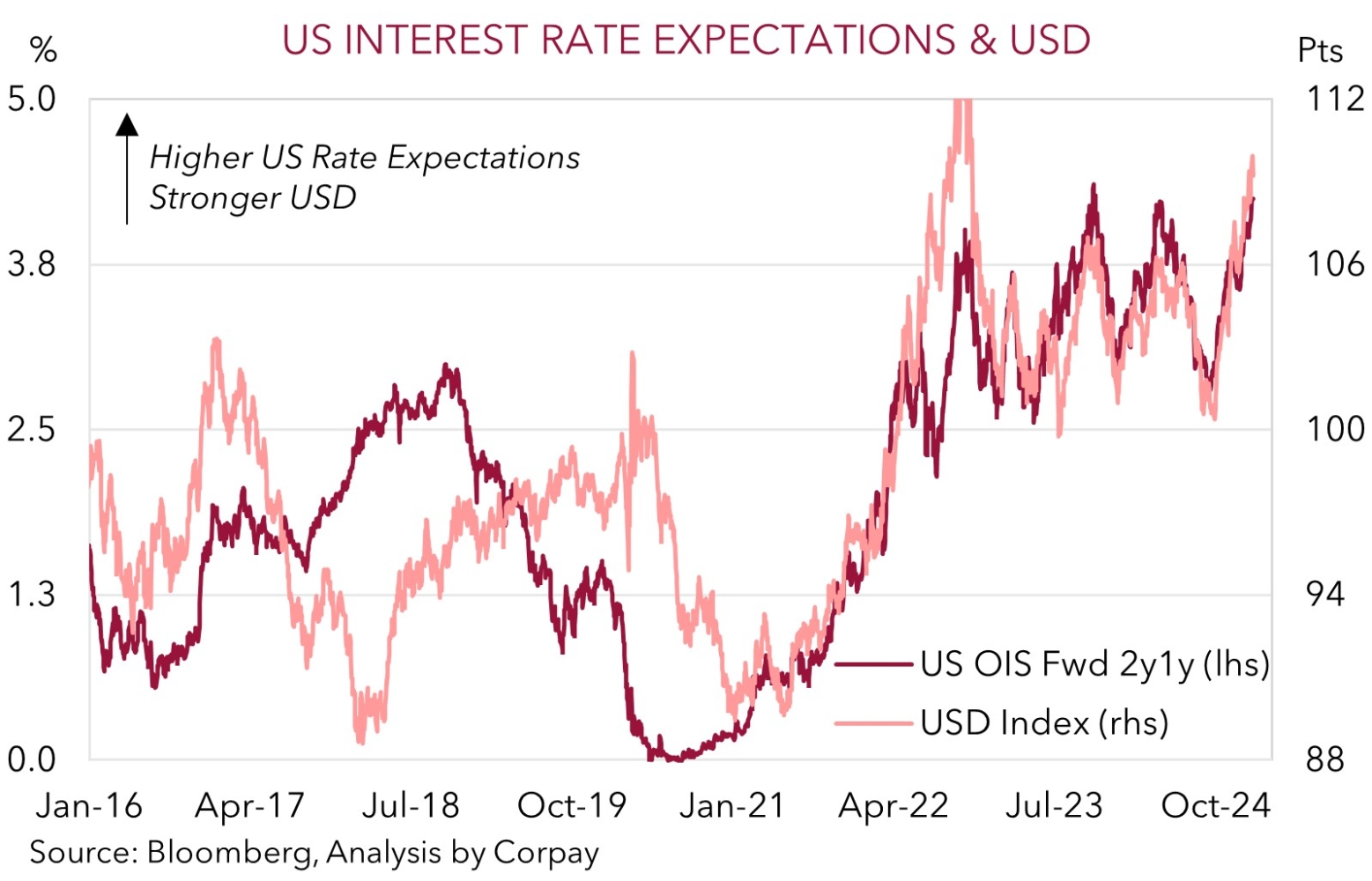

On net a run of positive US economic data, particularly last weeks stellar US jobs report where non-farm payrolls blitzed consensus forecasts and the unemployment rate dipped, has seen markets continue to pare back US Fed rate cut expectations. This has had a cascading impact across asset markets like equities and the USD (see chart below). The US Fed is now assumed to be on hold over H1 2025 with only one 25bp rate reduction factored in this year. By contrast, the ECB is expected to lower rates by another ~85bps in 2025, ~100bps worth of additional easing is anticipated by the RBNZ, and the RBA is predicted to kick off a relatively modest rates recalibration (~63bps of cuts by end-2025).

Macro wise, UK (6pm AEDT) and US (12:30am AEDT) CPI inflation for December are due tonight, with the US Fed’s Barkin (1:20am AEDT), Kashkari (2am AEDT), Williams (3am AEDT) and Goolsbee (4am AEDT) also set to hit the wires. US retail sales are scheduled for release later this week. In our view, risks to the US inflation/spending metrics appear tilted to the upside. Strong holiday demand could have boosted prices for petrol, air fares and accommodation, and rents may have rebounded. We think more signs US inflation is holding up might see markets further water down US Fed rate cut expectations, which if realised, can generate more USD support.

Trans-Tasman Zone

Yesterday’s media reports that the incoming Trump Administration could implement trade tariffs in a measured month-by-month process has helped stabilise risk sentiment (see above). The slight drag on the USD over the past 24hrs has seen the beleaguered AUD (now ~$0.6189) and NZD (now ~$0.5601) tick up a little after their torrid late-2024 spells spilled over into early-2025. That said, despite its modest revival the AUD remains down near multi-year lows, with the NZD around levels last traded in Q4 2022.

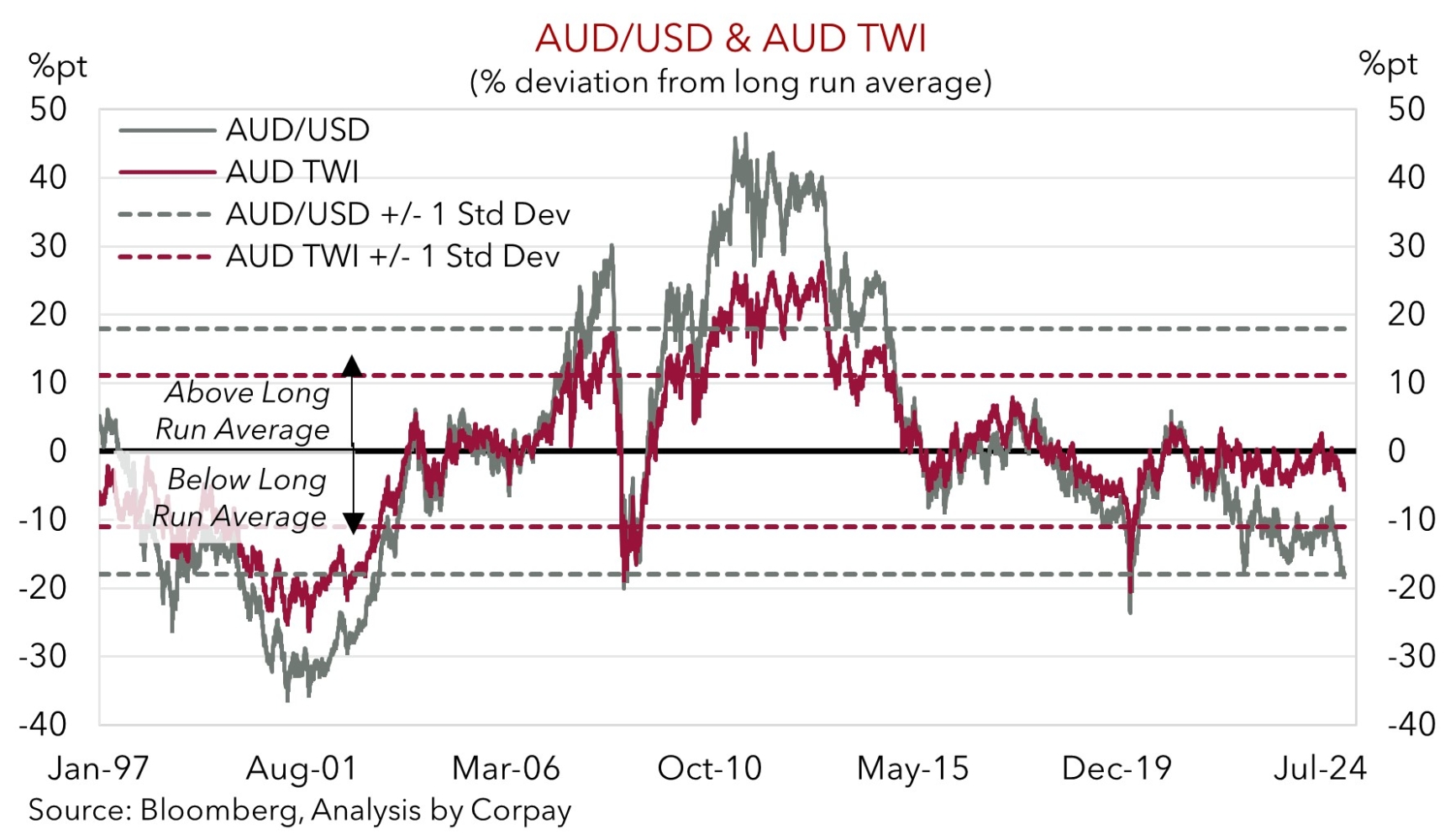

As our chart shows, AUD/USD is now ~2-standard deviations below its long-run average, something that hasn’t happened that often in the post-GFC era. On our figuring, AUD/USD has only been sub ~$0.62 in ~1% of trading days since 2015 and the bulk of this very small pool occurred during bouts of acute market stress such as the start of COVID. If you dig deeper the USD’s upswing has been in the drivers seat. The AUD Trade Weighted Index (which is the more impactful gauge for local growth and inflation) isn’t as stretched. Cross-rates like AUD/EUR (now ~0.6005), AUD/GBP (now ~0.5070), and AUD/JPY (now ~97.74) are now a bit higher than where they ended last year, while others such as AUD/NZD (now ~1.1050) and AUD/CNH (now ~4.5462) are little changed year-to-date.

Despite already being at low levels and a lot of ‘bad news’ seemingly factored in we believe that near-term downside risks for the NZD and AUD remain, and a definitive gradual turnaround may take time to develop. As mentioned above, US CPI is due tonight (12:30am AEDT) and we feel the data could show disinflation trends are stalling. If realised this might see markets further reduce their US Fed rate cut expectations and support the USD.

The local data can also create AUD headwinds. The latest read on the Australian jobs market is due Thursday. Employment growth in November was stronger than anticipated because a larger than normal share of people started jobs that they had already signed up to with the October school holidays likely to have delayed start dates. We believe there might be a bit of payback in December (note, employment also declined in December in 2022 and 2023). In our opinion, risks look skewed to another soft December report. This type of result may reinforce the markets RBA rate cut bets which were kicked along recently by the step down in core inflation in the monthly CPI indicator series. A 25bp RBA rate cut on 18 February is now ~70% priced in, with a full reduction discounted by April.