Selling pressure is easing across global financial markets after volatility expectations intensified during yesterday’s session, triggering classic risk-off dynamics and lifting the dollar to its best daily performance in weeks. Benchmark ten-year Treasury yields are down 4 basis points to 4.10 percent, the greenback is paring its advance against a basket of its most-traded rivals, and North American equity futures are setting up for modest losses at the open.

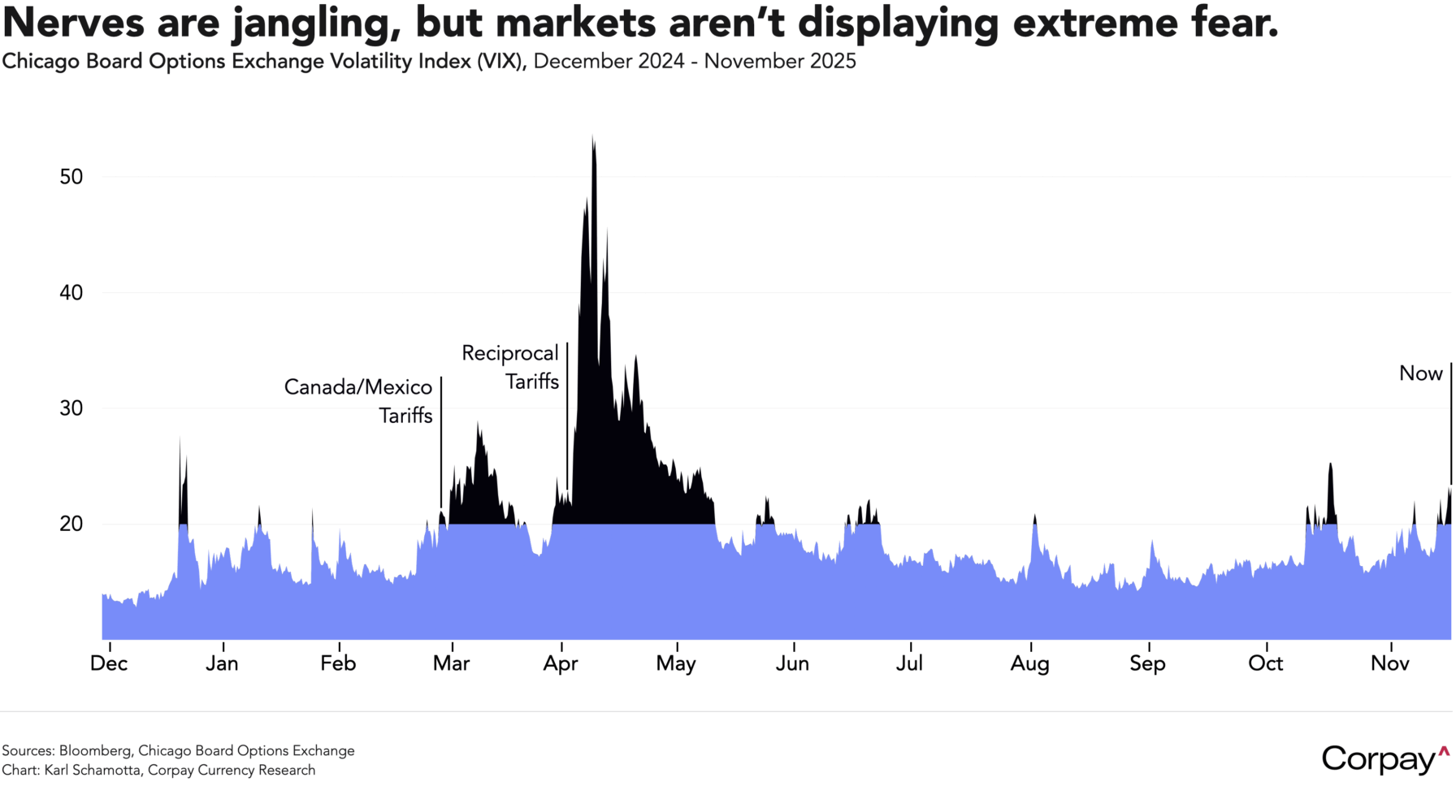

The VIX index—often referred to as Wall Street’s “fear gauge” is trading at levels consistent with growing nervousness, but hasn’t yet climbed to the heights typical of an extreme selloff. Wary investors are trimming risk ahead of tomorrow’s earnings reports from consumer spending bellwether Walmart and artificial intelligence behemoth Nvidia, and a steady stream of hawkish statements from Fed officials is taking its toll on overall market sentiment, but conviction remains low and we’re not yet seeing the signs of a wider downgrade in global growth expectations.

The Japanese yen looks uncharacteristically weak, given the worsening risk backdrop. Tensions with Beijing over newly installed Prime Minister Sanae Takaichi’s support for Taiwan, worries about the scale of the government’s planned stimulus, and corporate vulnerabilities tied to the US technology boom are eroding the currency’s traditional safe-haven appeal, muting its response to negative headlines. This may present tactical opportunities for hedgers, but the effect is unlikely to persist if markets lurch lower again—Japan’s enormous net international investment position and its central role in funding global carry trades still make the yen, alongside the Swiss franc, the principal counterweight in the global currency risk pendulum.

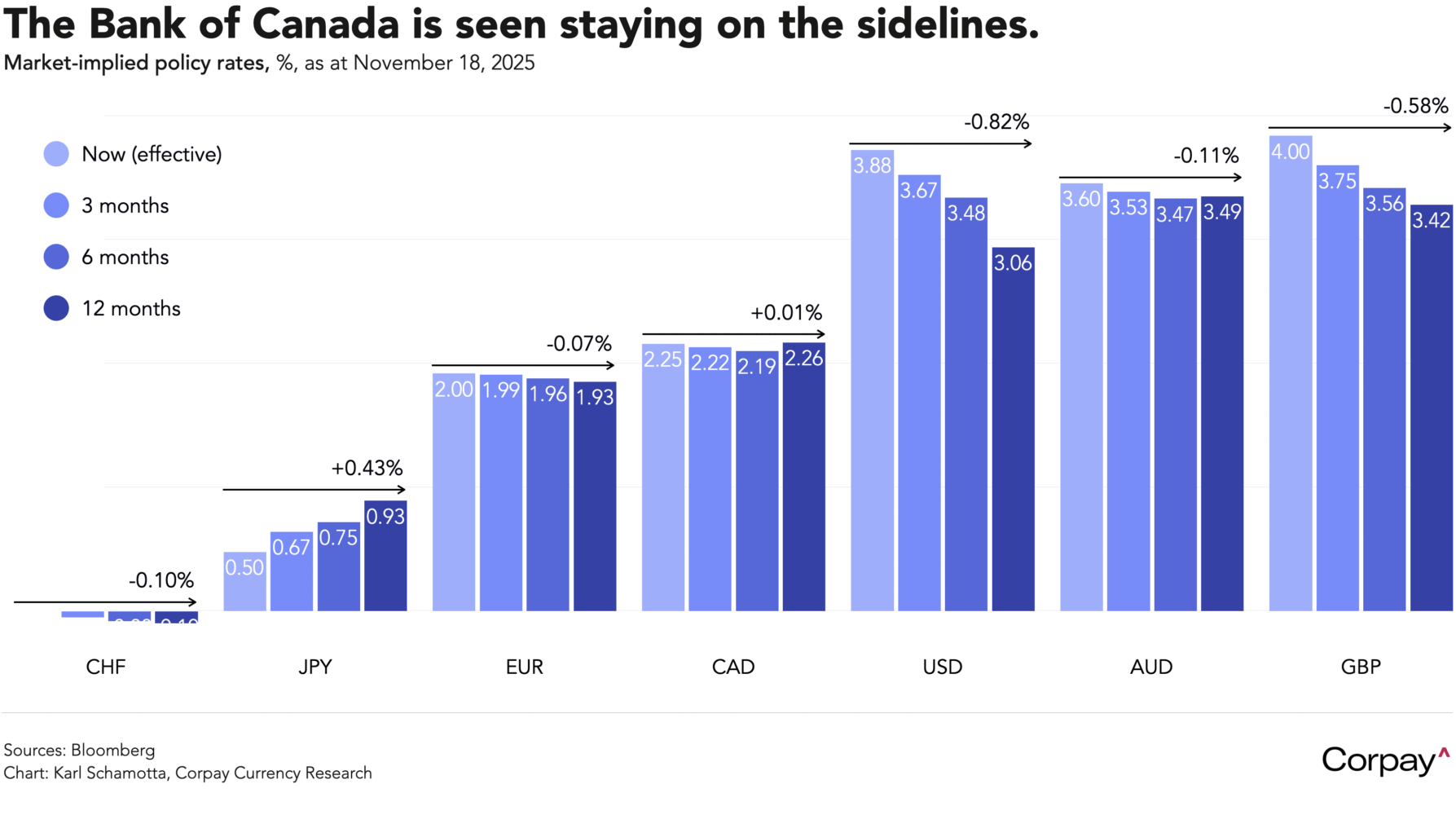

The Canadian dollar remains firmly rangebound as traders brace for a long period of inactivity from the Bank of Canada ahead. The exchange rate barely budged after yesterday’s consumer price report—which showed inflation decelerating a little less than expected in October—and exhibited no response to the passage of Mark Carney’s budget later in the day, suggesting that neither development had any impact on cross-currency rate differentials. To wit, swaps traders are putting just 5 percent odds on a rate cut at the Bank’s December meeting—essentially unchanged from Friday’s 6 percent—and expect Canadian policymakers to adjust rates by less than any of their major advanced-economy counterparts over the next year.

We suspect it will take a decisive shift in growth and monetary policy expectations in the US to shake currency markets out of their long malaise. Upcoming data could provide the spark, but it may well be well into the new year before “bullwhip effects” begin to fade and fundamentals fully begin to reflect this year’s policy changes.