Currency markets are trading with a slight risk-off flavour as investors await the release of the delayed September inflation report later this morning. Economists expect headline inflation to accelerate slightly on a year-over-year basis, while the less-volatile core measure holds steady, but there is considerable uncertainty around the extent to which tariff-led price increases have translated into upward pressure on goods costs. The dollar is edging higher against a basket of its major peers, ten-year Treasury yields are holding just below the 4 percent threshold, and equity futures are pointing to a stronger open after a series of relatively-positive earnings releases from many of America’s biggest companies.

The Canadian dollar is almost unchanged after President Trump threatened to terminate trade negotiations in a late-night social media post. The president claimed Canada “fraudulently used an advertisement, which is FAKE, featuring Ronald Reagan speaking negatively about Tariffs,” to sway the Supreme Court ahead of its upcoming decision. The television commercial in question—paid for by the province of Ontario—features a lengthy excerpt from a 1987 radio address from the former president, in which he says “trade barriers hurt every American worker and consumer,” and criticises tariffs as an outdated concept designed to deliver “quick political advantage” while putting innovation and jobs at stake.

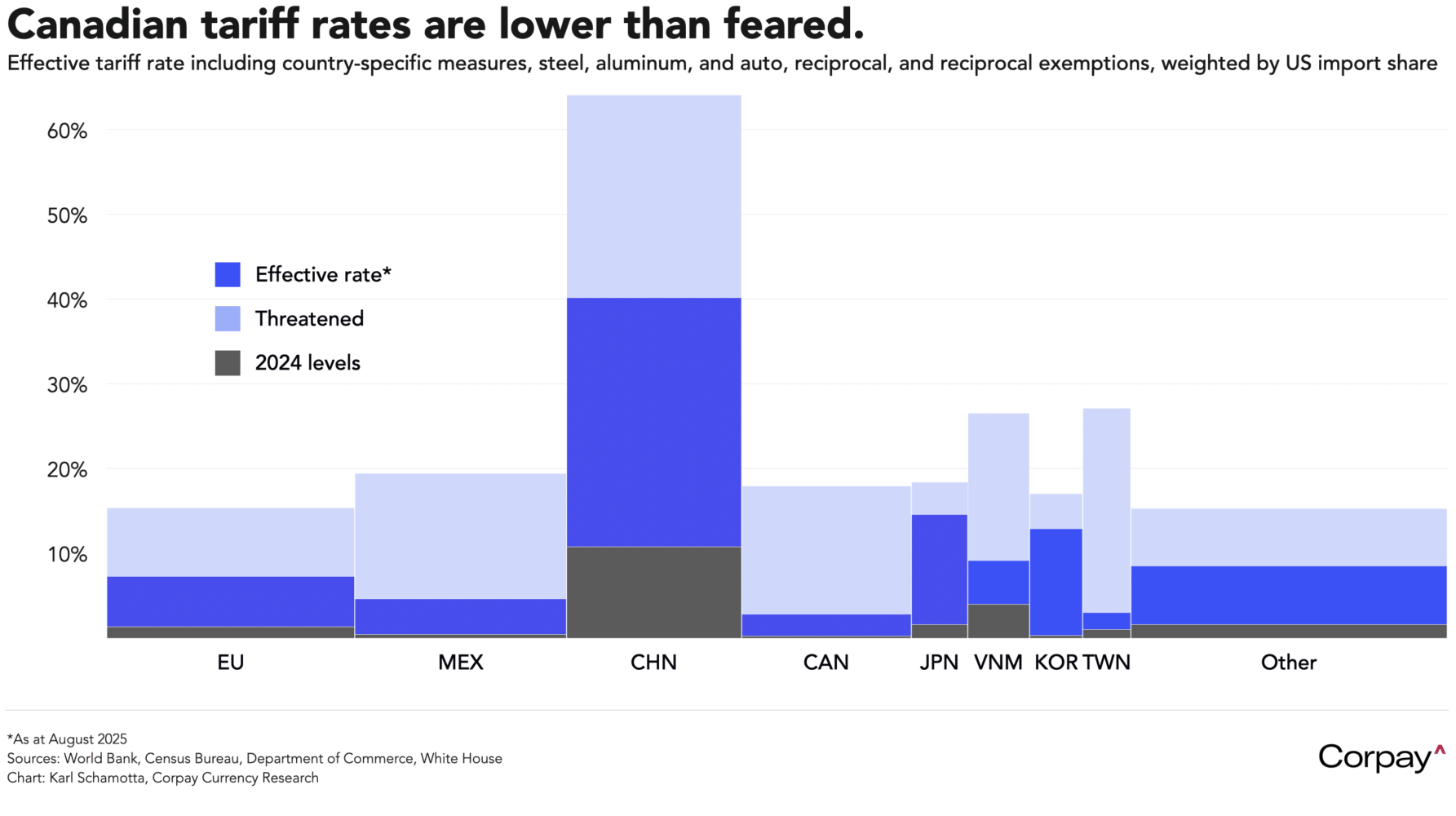

Traders are sticking with the Trump-Always-Chickens-Out playbook, betting that last night’s bombast will ultimately result in some form of compromise, and there is also a growing sense that tariffs at current levels could prove somewhat bearable for America’s largest trading partner. Canadian negotiators would like to see Trump’s 50-percent levies on steel and aluminum rolled back, and are jostling for position ahead of an expected reworking of the US-Mexico-Canada Agreement in the coming months. But the effective tariff rate on overall Canadian products—the duties actually collected and calculated as a weighted average of total merchandise trade—landed at just 2.9 percent in August, far below the president’s threatened levels, and well below the rate applied to imports from many other countries.

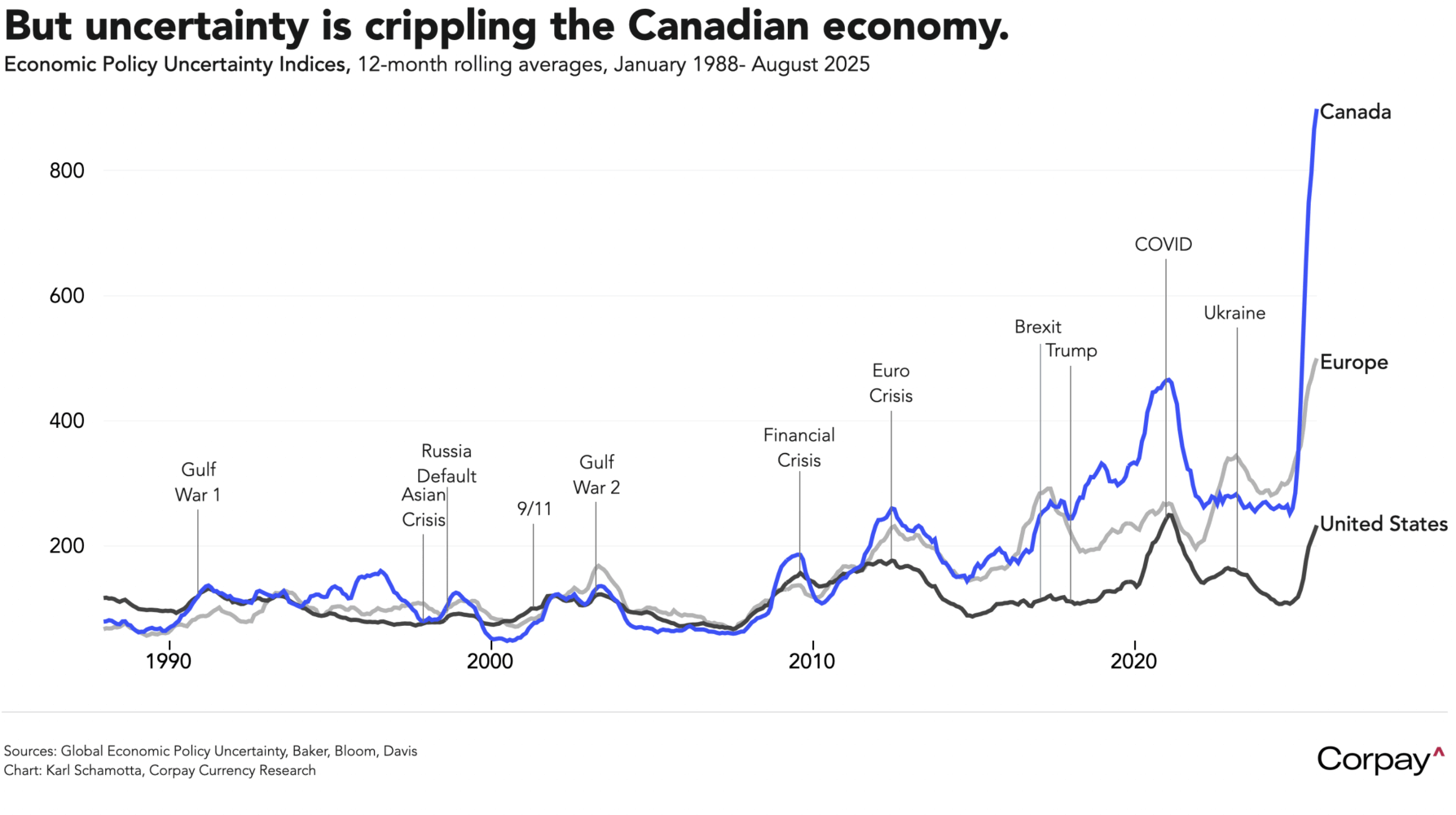

Despite comparatively-favourable trade fundamentals, Canadian economic policy uncertainty is cripplingly high. With the media backdrop remaining unremittingly negative, businesses and consumers are expressing a clear reluctance to hire, invest, and spend, suggesting that the economy will continue to underperform for many months yet. Against this backdrop, we think the odds favour a rate cut from the Bank of Canada at next week’s meeting, and think the loonie will face stiff resistance to upward appreciation for the time being.

Across the pond, the euro is trading on a firmer footing as investors take a more optimistic view on the outlook for the common currency area. Private sector activity expanded by more than expected in October, with S&P Global’s composite purchasing managers index rising to 52.2 from 51.2 in September to reach its highest level in 17 months. In a hopeful sign, new orders jumped by the most in more than two years, and employee headcount climbed after declining in the prior month. The European Central Bank is widely expected to leave benchmark rates unchanged for a third consecutive meeting next week, and overnight index swaps suggest that markets see policy remaining unchanged over the next year as Germany’s fiscal stimulus push offsets continued drag from US tariffs. We remain of the view that the current trading range in the euro-dollar pair will hold until something changes on the US side.