• Middle East conflict. Developments dampened sentiment. Oil prices spiked & equities slipped back. USD firmer. AUD & NZD lost some ground.

• Volatility. Geopolitical tensions can generate more bursts of volatility. This adds to the economic uncertainty stemming from various US policies.

• Event Radar. AU jobs report (Thurs) is due. China data out today. In the US retail sales & Fed meeting in focus. BoJ & BoE also on the schedule.

Global Trends

Developments in the Middle East rattled markets on Friday, and with Israel and Iran continuing to trade blows over the weekend investor nervousness is likely to continue for a while yet. That said, outside of the spike higher in the oil price (brent crude rose ~7% and has increased another ~3% so far this morning), the other market moves have (so far) been somewhat restrained. The major European and US stockmakets fell ~0.4-1.8% on Friday and in bonds yields edged up ~4-8bps across respective curves on the back of higher energy price induced inflation risks. In FX, oil price sensitive currencies like CAD and NOK outperformed, as did the USD as some knee-jerk ‘safe-haven’ demand kicked in. However, the moves weren’t overly pronounced. The USD gained ~0.5-0.6% versus the EUR, JPY and GBP, while NZD (now ~$0.6010) declined ~1% and the AUD (now ~$0.6481) shed ~0.8% compared to where it was trading this time on Friday.

The G7 leaders’ summit is getting underway in Canada and will continue until Tuesday. The Israel/Iran situation will dominate the agenda but there should also be other important topics such as trade, defence spending, and the Russia/Ukraine war being discussed. The Israel/Iran conflict has scope to generate more headline driven volatility across markets, which itself may lead to more of a rebound in the beleaguered USD, in our opinion. As could the upcoming macro event calendar. This week the Bank of Japan (Tues), US Fed (Thurs morning AEST), and Bank of England (Thurs night AEST) meet. Datawise, the China activity figures for May are due (today 12pm AEST), as are US retail sales (Tues night AEST).

As outlined last week, the USD index has lost quite a bit of ground since President Trump’s mid-January inauguration and is below where our ‘fair value’ model suggests it should be. In our view, this implies a lot of negatives might already be baked into the USD. We think signs US consumer spending is holding up and/or no strong signals that the US Fed is close to easing policy, coupled with worries about the situation in the Middle East can generate more of a short-term turnaround in the USD.

Trans-Tasman Zone

The negative developments in the Middle East have dampened risk sentiment and generated a bit of USD strength (see above). This has exerted some downward pressure on the NZD (now ~$0.6010) and AUD (now ~$0.6481). The AUD has also weakened on a few of the major cross-rates, though outside of the declines versus the CAD (-0.9%) and CNH (-0.6%) the other moves have been modest with falls of 0.2-0.3% recorded against the EUR, JPY, and GBP. By contrast AUD/NZD has nudged up a touch, though at ~1.0785 it remains in the lower half of its 1-year range.

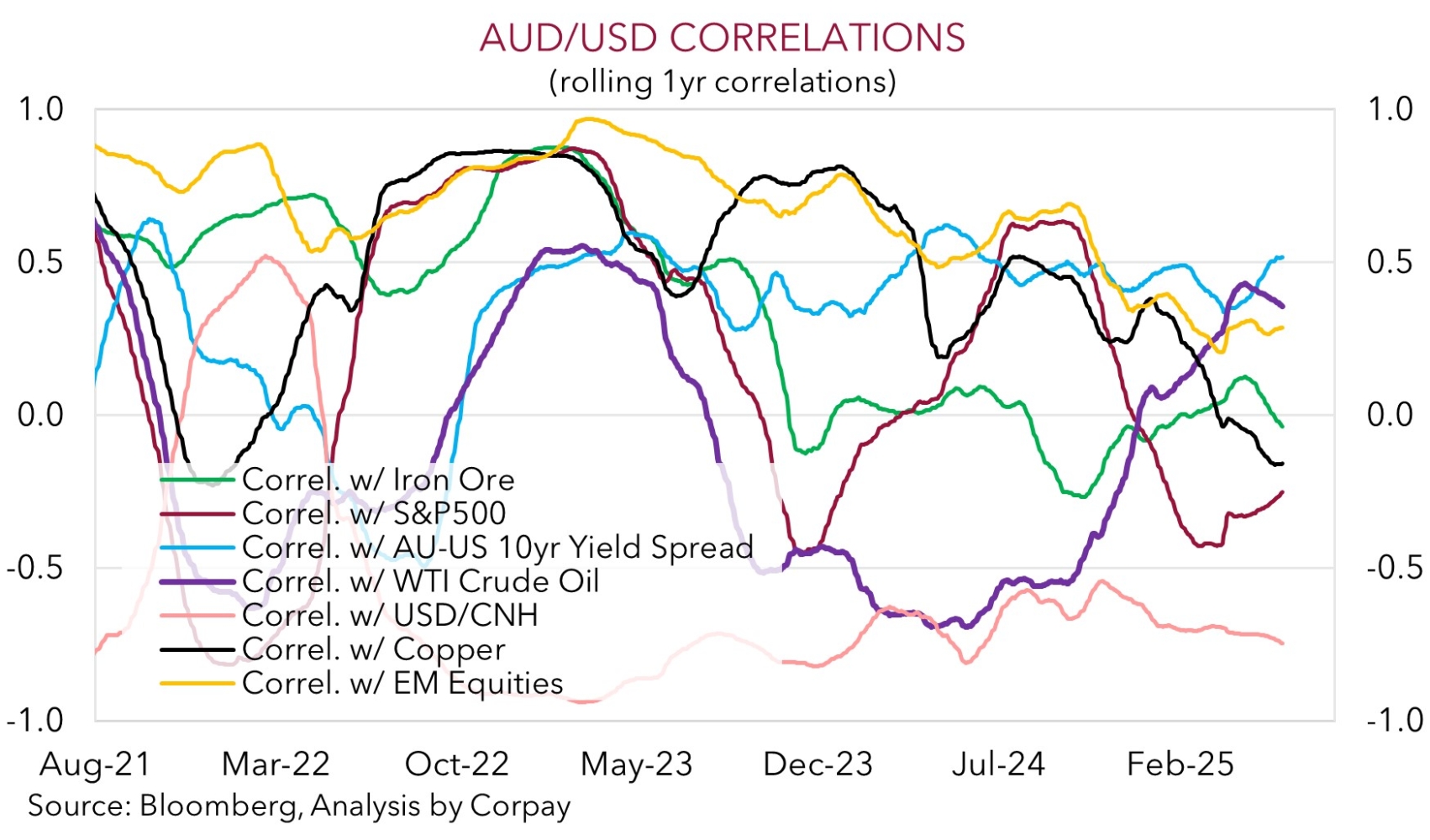

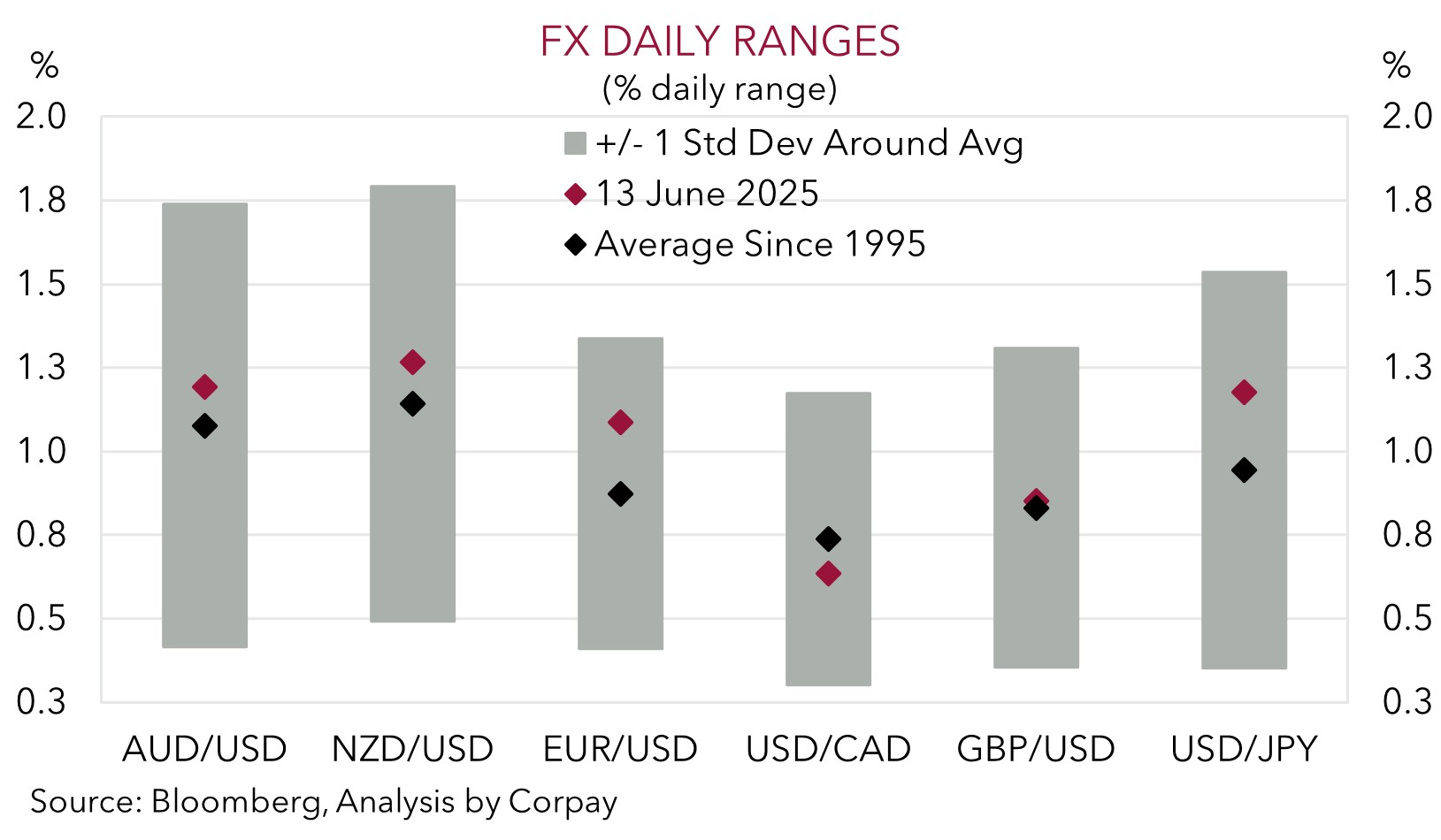

As discussed above, despite the negative headlines outside of the oil price spike the net moves in other major asset markets have been rather restrained. Indeed, as our chart above illustrates the intra-day ranges in the AUD and NZD on Friday were broadly inline with their respective long-run averages. It should be remembered that cyclical currencies such as the AUD and NZD are inherently volatile and are sensitive to swings in risk sentiment/global geopolitical events (see our AUD correlation chart below). However, this may have been somewhat forgotten given the AUD has only traded above its long-run average daily range ~1/3 of the time in the past 2-years.

As flagged last week, after snapping back aggressively due to the weaker USD, we thought the risks resided with the AUD and NZD slipping back over the near-term. This remains the case. In addition to the prospect for more Israel/Iran induced market wobbles and in turn ‘safe-haven’ USD demand, we believe there is the potential for macro forces to shift a bit in the USD’s favour. We think the beaten down USD may recoup lost ground if the US data (such as retail sales on Tues night AEST) surprises and/or the US Fed (Thurs morning AEST) leans against ‘dovish’ expectations looking for a rate cut over the next few meetings. At the same time, after a strong result in April payback in the volatile Australian jobs report in May is possible (Thurs AEST), while global and trade headwinds might also see the China activity data underwhelm (today 12pm AEST). In our judgement, this type of combination could take a little more heat out of the AUD over the short-run.