• He said, Xi Said. Confusion about whether US/China are in tariff talks. US equities consolidated overnight, while US yields & USD lost ground.

• AUD rebound. AUD bounced back strongly the past few weeks. At ~$0.6430 it is near levels last traded in early-December. AU Q1 CPI due tomorrow.

• Event Radar. In addition to AU CPI, BoJ meets this week, China PMIs are out, as is US GDP & the US jobs report. More tariff headlines also likely.

Global Trends

Tariff related headlines have seen sentiment wax and wane at the start of the week, particularly with limited economic data released. In terms of the US trade tariffs there is still no clarity on whether talks with China are occurring. Over the weekend US President Trump indicated he had spoken to President Xi. However, this was denied by China with officials stating point blank that “China and the US are not engaged in any consultation or negotiation on tariffs”. And while US Treasury Secretary Bessent outlined his thoughts that it’s up to China to “de-escalate” things because of the unbalanced trade relationship, policymakers in China look to be settling in for the long haul. Chinese officials reiterated their plan to support the economy in the face of external challenges and stressed they are “fully confident” in reaching their 2025 ~5% GDP growth target.

While ‘peak tariff’ may have been reached, the economic impact of the duties is only just starting to emerge, and hence more bursts of market volatility should be anticipated over coming months. Various forward looking US business and consumer sentiment gauges have deteriorated recently as the prospect of higher prices and weaker demand come through. The Dallas Fed manufacturing index, released overnight, was the latest to show a sizeable drop with the topline index slumping to its lowest level since May 2020 due to the macro uncertainty.

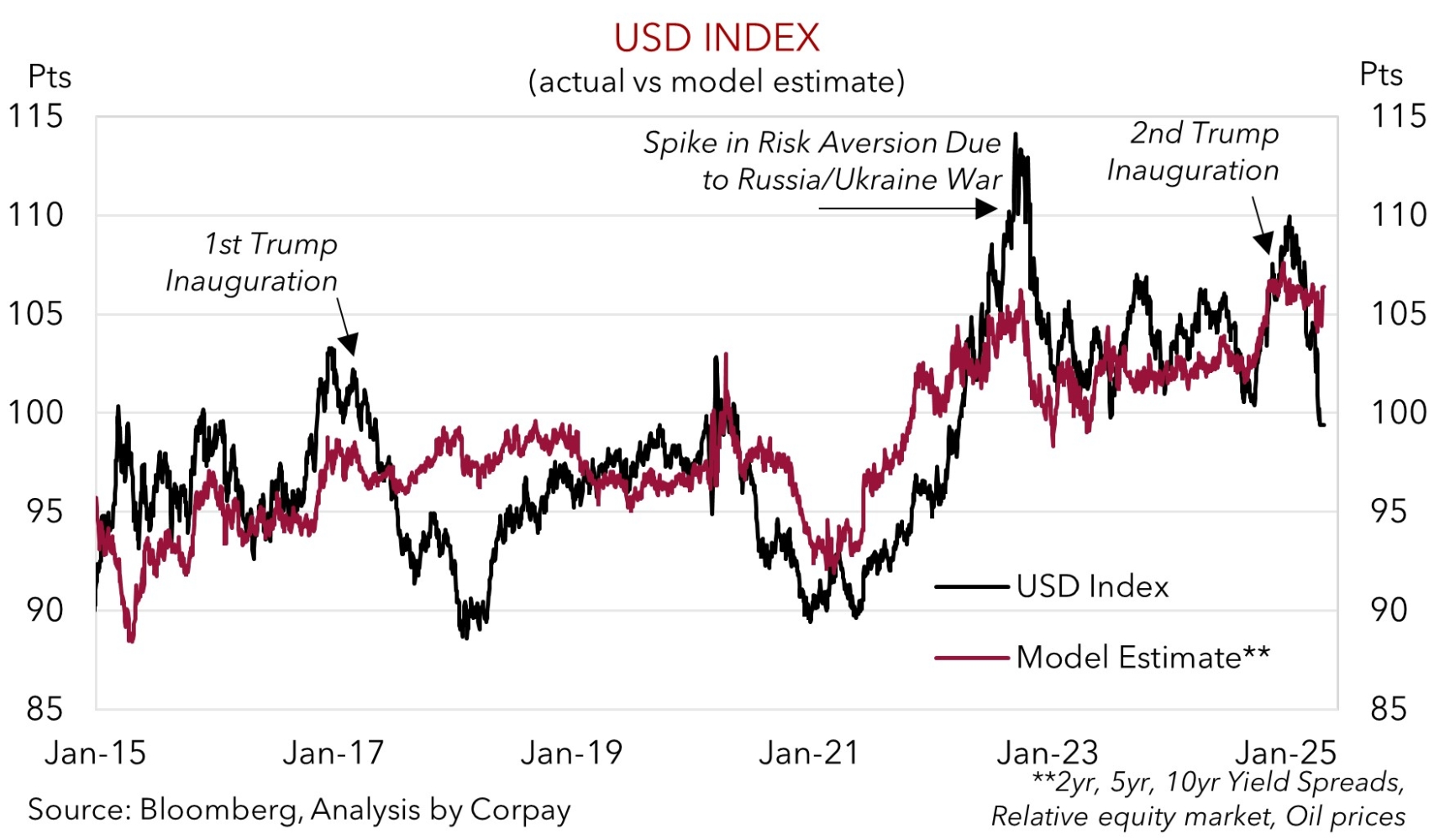

After bouncing back strongly last week the S&P500 and tech-focused NASDAQ consolidated overnight. By contrast, US bond yields drifted lower with 2yr rates shedding ~6bps (now ~3.69%) and 10yr rates slipping back ~3bps (now ~4.21%). The USD unwound some of last weeks’ partial rebound with EUR pushing up towards ~$1.1420 and USD/JPY dipping to ~142.20. GBP (now ~$1.3440) also appreciated to the top of its cyclical range, while NZD (now ~$0.5980) and AUD (now ~$0.6430) ticked higher over the past 24hrs.

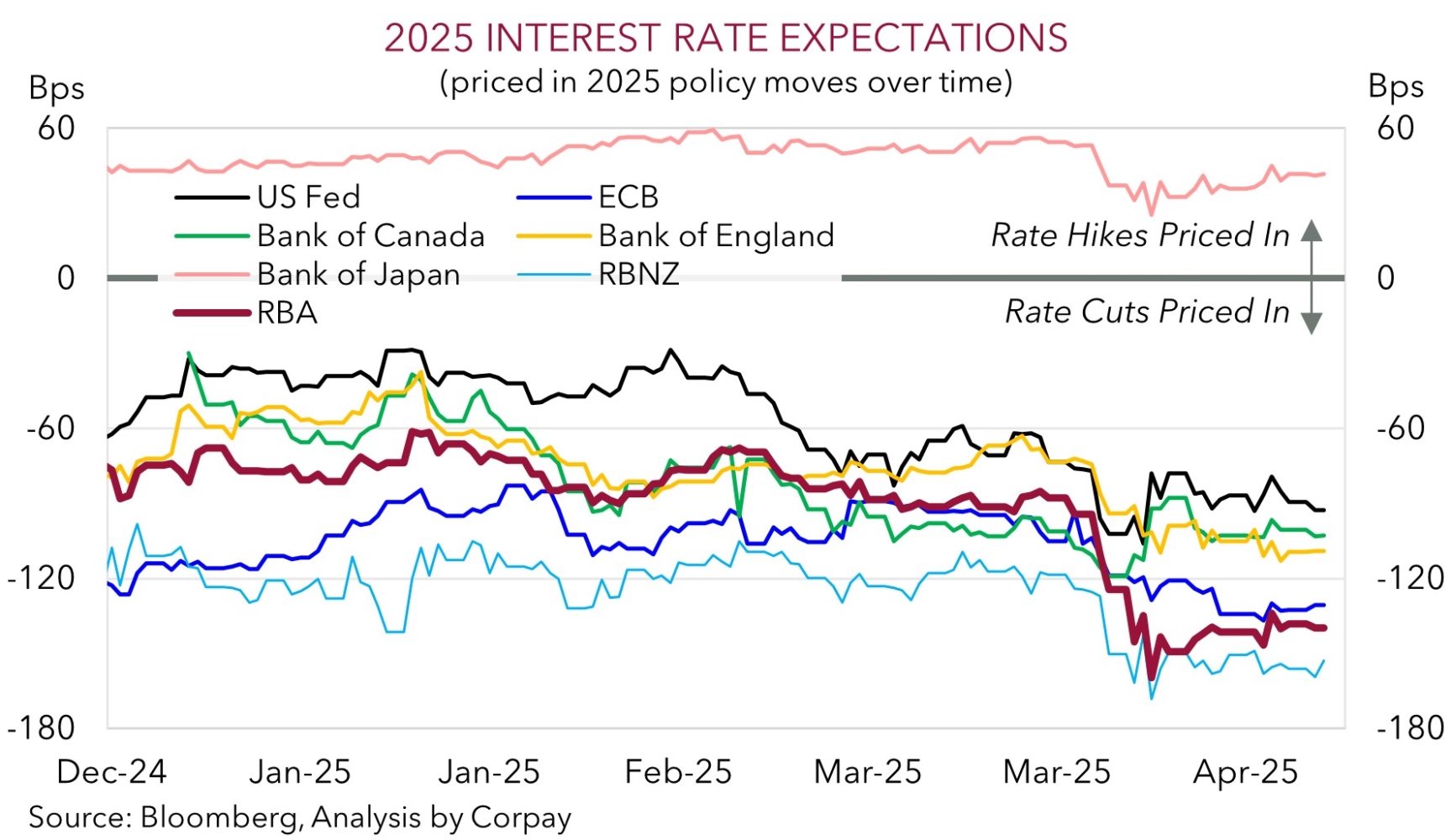

The economic calendar heats up this week. The Bank of Japan meets (Thurs), though no change in interest rates is anticipated. In the US Q1 GDP (Thurs night AEST) and various US employment stats, including the monthly non-farm payrolls report (Fri night AEST), are due. While we believe medium-term US growth and labour market risks have risen, direct tariff impacts shouldn’t show up for a while yet. Hence, there is a chance the incoming top tier US data exceeds rather downbeat expectations. If realised, this could give the beleaguered USD, which is already tracking below our model estimates, a bit of short-term support, particularly against the EUR and/or JPY if the BoJ also pushes back on the prospect of further interest rate hikes later this year because of global developments.

Trans-Tasman Zone

The renewed USD weakness at the start of the new week on the back of lower US bond yields and ongoing US economic concerns (see above) has given the NZD and AUD support overnight. At ~$0.5980 the NZD is tracking towards the upper end of its 6-month range while the AUD (now ~$0.6430) is hovering near levels last traded in early-December. By contrast, the AUD has been more mixed on the major crosses. AUD/EUR (now ~0.5630) has bounced back a little over the past few weeks but it remains towards the lower end of its multi-year range. AUD/JPY (now ~91.37) and AUD/GBP (now ~0.4785) have also lost a bit of recaptured ground over the past 24hrs. Elsewhere, the AUD has edged up by ~0.2-0.4% versus the NZD, CAD, and CNH with AUD/CNH approaching its 1-year average.

Locally, the Q1 CPI report (released Weds) is in focus this week. The quarterly inflation data covers a wider range of consumer prices than the monthly series, particularly on services, and hence it is more closely monitored by RBA policymakers. We think the Q1 Australian CPI should show a further moderation in headline and core inflation pressures with the trimmed mean projected to slow to ~2.8%pa. In our view, this type of result should see the RBA deliver more interest rate relief when it meets on 20 May. However, we think the domestic backdrop, particularly the resilient jobs market, points to a 25bp interest rate reduction rather than a larger move. Odds of an outsized 50bp rate cut being delivered in May have declined but still look somewhat elevated (now deemed a ~17% chance).

In our judgement, a paring back of ‘excessive’ near-term RBA interest rate cut expectations may give the AUD support versus currencies such as the EUR, GBP, NZD, and CNH. However, in terms of AUD/USD it is a more mixed outlook depending on the time horizon. As discussed above, after falling back sharply over recent weeks we think that in the short-term the risks appear to reside with the USD rebounding a bit if the incoming US GDP (Thurs night AEST) and/or jobs data (Fri night AEST) exceeds downbeat predictions. This could take some of the heat out of the AUD. However, over the medium-term, we remain of the opinion that the US’ growth challenges stemming from the lingering uncertainty and higher tariff-induced prices should see the USD trend lower and the AUD push higher.