• Vol. shock. Growth concerns after China retaliated to US tariffs saw markets tumble again on Friday. AUD & NZD plunged, as did equities/commodities.

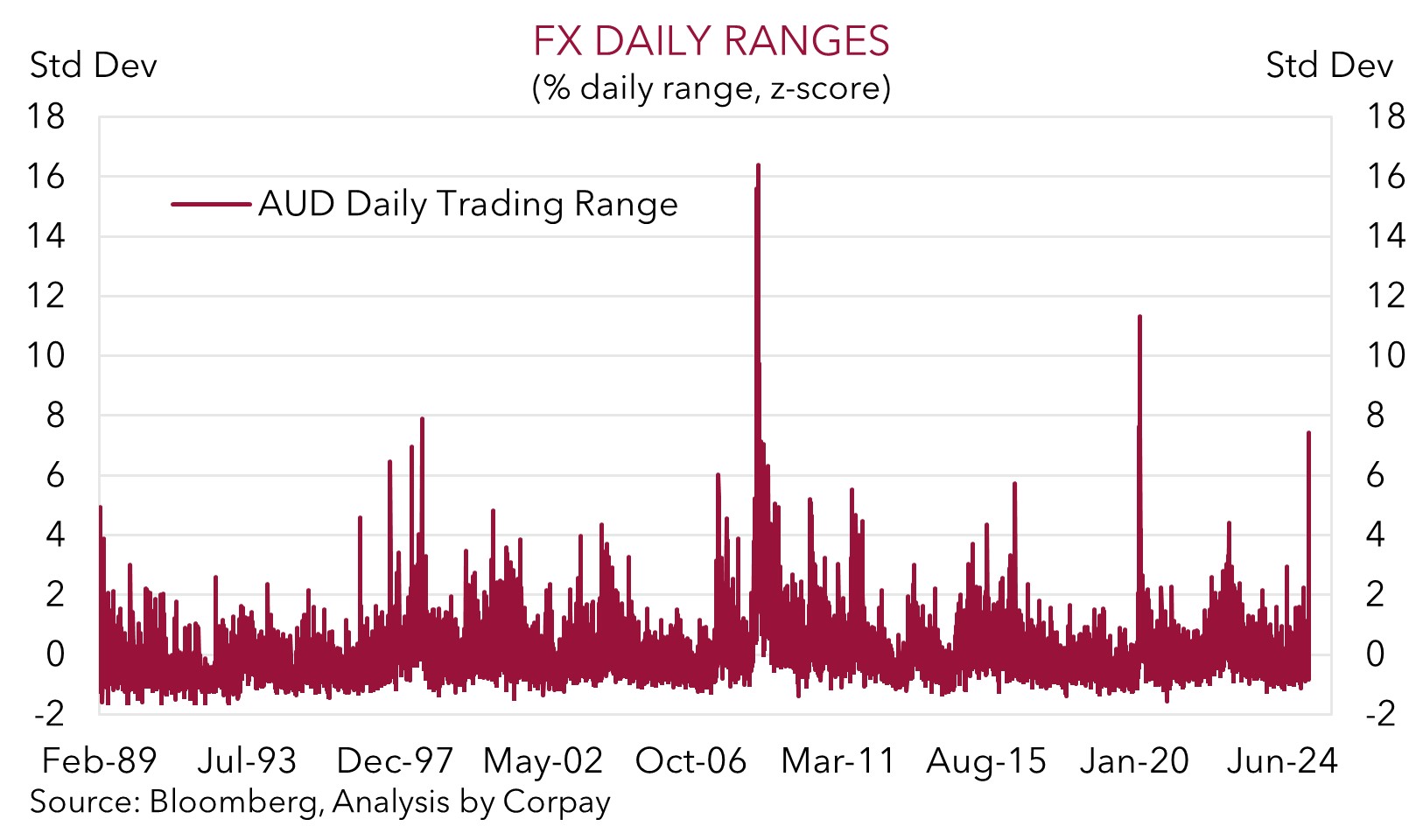

• Extreme moves. The over 10% two-day drop in the S&P500 has only happened a handful of times. AUD’s one-day trading range also historically wide.

• Event Radar. Tariff developments will continue to be in the drivers seat. Data wise, US CPI due this week, RBNZ meets, & RBA Gov. Bullock speaks.

Global Trends

Risk sentiment continues to deteriorate. Asset markets tumbled again on Friday as worries about a tariff induced ‘Trumpcession’ ramped up. Anxiety levels spiked further after China hit back against the US’ by announcing it will impose a 34% levy on US imports (matching the latest ‘reciprocal’ tariffs), restrict rare earth exports (important inputs for consumer electronics, defence, medical equipment), and launch investigations into US companies. According to President Trump China “panicked” and “played it wrong”. The moves diminished hopes for a near-term resolution. Tariff developments were compounded by a better-than-expected US jobs report, and updated inflation comments by Fed Chair Powell that suggested there is limited capacity for policymakers to shift to a more market friendly ‘dovish’ stance. According to Chair Powell the tariffs would result in slower growth and higher inflation, but the rise in prices could be persistent and this is something the central bank needs to guard against.

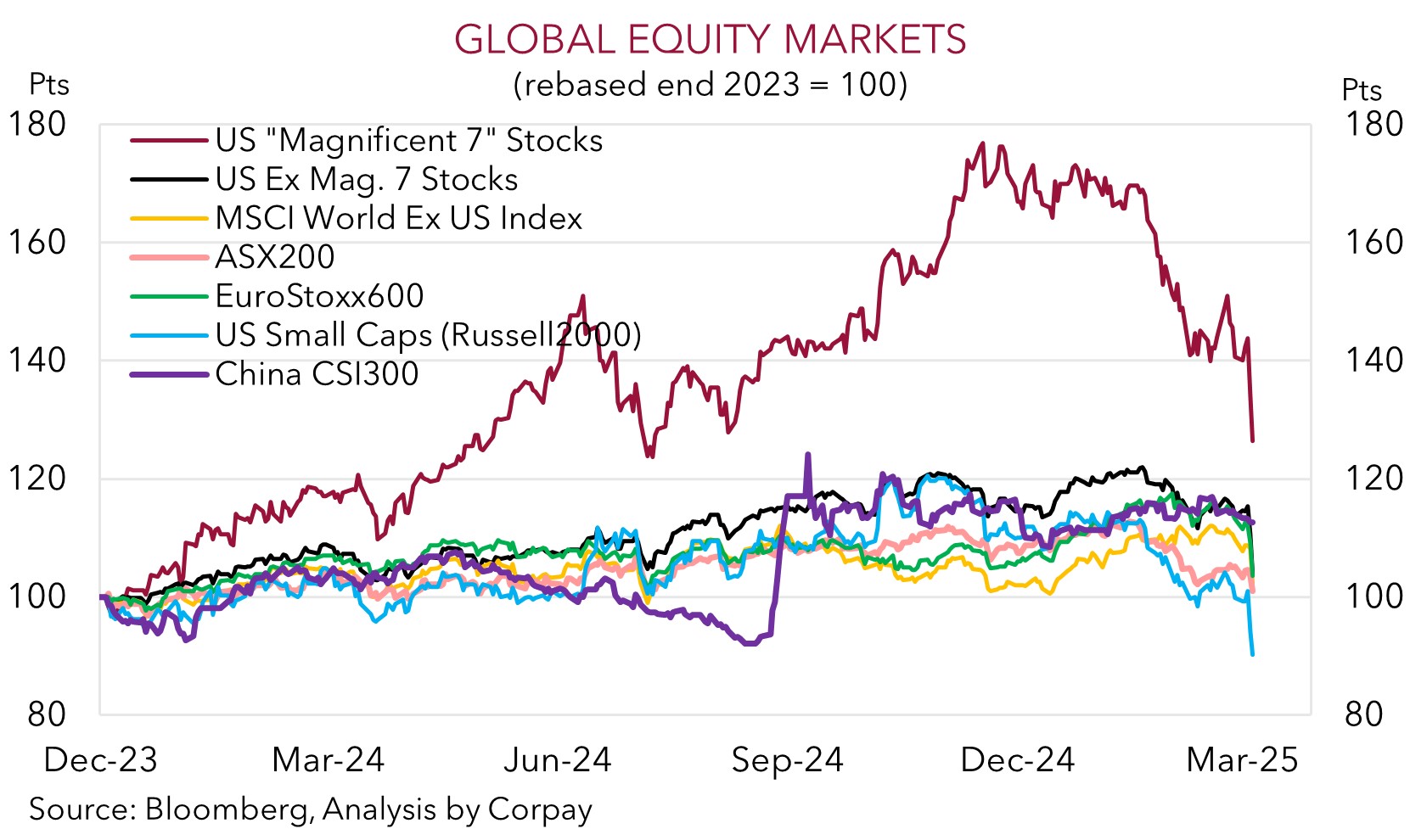

The unease generated a surge in volatility. US equities fell ~6%, with the NASDAQ now ~23% from its post-election record highs. The more than 10% drop in the US S&P500 over Thursday/Friday is extreme as it has only occurred four times in 85 years (the others being the ‘87 crash, GFC, and COVID). As a result, the VIX index jumped to 45.3, the highest closing level since 2020, and while credit spreads aren’t flashing as red as other asset classes the widening does show macro concerns have risen. The growth worries also saw commodity prices fall sharply with WTI crude oil (-6.5%) and copper (-8.8%) nosediving.

In FX, the USD staged a bit of a recovery with EUR losing ground (now ~$1.0920) and GBP weakening (now ~$1.2838). Safe-haven currencies like the JPY held their ground (USD/JPY is now ~145.55, the lower end of its multi-month range). USD/SGD rose ~1% (now ~1.3475), while cyclical currencies such as the NZD and AUD have been in freefall. The NZD (now ~$0.5572) has shed ~3.9%, and the AUD (now ~$0.5998) plunged ~5.2% with broad-based AUD weakness on the crosses also coming through.

US CPI inflation (Thurs night AEST), the RBNZ meeting (Weds), and speeches by a laundry list of central bankers including BoJ Governor Ueda (Weds), RBA Governor Bullock (Thurs), ECB President Lagarde (Thurs), and several US Fed members are scheduled. But this will play second fiddle to trade developments. And with the several key figures in the US Administration doubling down on the tariff strategy over the weekend we doubt the circuit breaker markets are looking for to calm the situation is close. Sentiment and momentum are overpowering fundamentals. This points to heightened market volatility persisting over the near-term. This is typically an environment that favours the USD and safe-haven currencies like the JPY over growth-linked ones such as the AUD and NZD.

Trans-Tasman Zone

Heightened concerns about global growth following China’s decision to retaliate against US tariffs saw the bout of risk aversion escalate on Friday (see above). The worries about growth generated a ‘vol. shock’ across various asset classes with US equities, energy prices and industrial metals all enduring heavy falls. The NZD (now ~$0.5572) has lost ~3.9% to be down near cyclical lows, while the AUD (now ~$0.5998) has plunged more than 5% from where it was tracking this time on Friday and is at levels last traded during the dark days of COVID. The AUD has also depreciated sharply on the crosses. AUD/EUR (-4.1%) is at a multi-year low (now ~0.5494), as is AUD/GBP (-3.3% to ~0.4672) and AUD/CNH (-4.9% to ~4.3840). AUD/JPY (-5.5% to ~87.30) is back at levels last traded in 2023.

As discussed above, some of the swings seen in various asset markets have been extreme. The moves in the AUD fall into this bucket. In percentage terms, this has been the largest one-day slide in AUD/USD since the GFC, with the daily trading range more than 7 standard deviations bigger than normal. On our figuring, since 1989, the AUD’s daily range has only been wider 14 times.

Things are clearly unfolding more negatively than the broader market were anticipating, hence the outsized moves as expectations about the economic landscape have had to be adjusted abruptly. We believe the AUD has been unduly beaten up given the limited direct trade exposure Australia has with the US (only ~4% of exports are sent to the US), China’s background steps to counteract trade headwinds by stimulating domestic activity (this is where Australia key exports are plugged into), and the better relative footing of the Australian economy. Indeed, the AUD is screening “cheap” compared to many fundamentals (it is now ~6% below the average of our suite of ‘fair value’ models even after accounting for Friday’s substantial asset market moves).

Locally, RBA Governor Bullock speaks this week (Thurs), while in NZ the RBNZ is expected to cut interest rates by another 25bps (Weds). That said, in the short-term, as mentioned above, we think sentiment/momentum might continue to override underlying fundamentals. Equity futures are pointing to more heavy falls in markets at the start of the new week. This suggests things could get worse before they get better, and until a ‘circuit breaker’ is found, the downward pressure on the AUD (and NZD) may persist, in our view. Although we do feel more intermittent two-way price swings are probable, rather than just relentless AUD selling. The AUD is tracking in ‘rarefied air’ that has previously seen exporter demand perk up. Since 2015, the AUD has only closed below ~$0.60 in 7 trading days.