• US support. More tariff headlines. Sentiment improved with US equities & the USD rising. Bond yields declined. AUD & NZD slipped back.

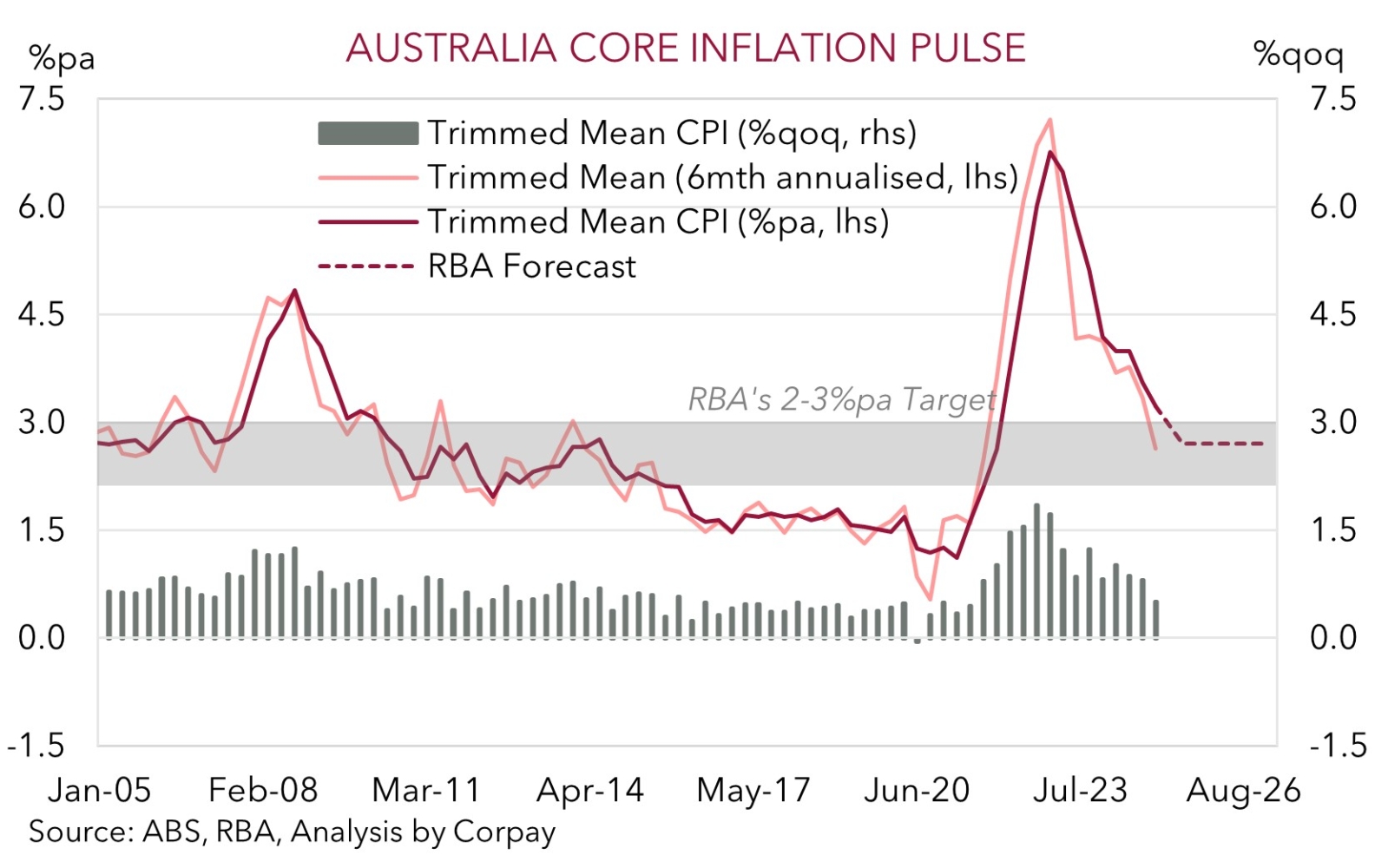

• AU inflation. Q1 CPI out today. Expected to show a further moderation in inflation supporting the case for another RBA rate cut in May.

• US data. US Q1 GDP due tonight. Leading indicators point to a step down in growth. Will it be as bad as feared? Outcomes vs expectations matter.

Global Trends

US tariff related headlines continue to generate market gyrations with the overnight newsflow somewhat supporting demand for US financial assets. US equities rose with the S&P500 (+0.6%) recording its 6th straight gain (though the index remains ~9.5% from its February peak). US bond yields declined with rates falling ~4bps across the curve. And the USD index ticked up with EUR and GBP shedding ~0.3% and USD/JPY nudging a fraction higher (+0.2% to ~142.30). The NZD (-0.8% to ~$0.5930) and AUD (-0.7% to ~$0.6385) underperformed over the past 24hrs.

In terms of tariff developments the US Administration unveiled a few measures to lessen the impact on the auto industry such as ensuring import duties won’t be stacked (i.e. other tariffs on things like steel and aluminium aren’t charged on top of auto tariffs), while automakers will also be eligible for a partial tariff reimbursement on parts. Elsewhere, US Commerce Secretary Lutnick stated a trade deal with an unnamed country had been reached. That said, it hasn’t all been one-way. Media reports indicated trade discussions between the EU and US aren’t going well, and China is showing no signs of blinking first with its Foreign Ministry releasing a social media video that included the message “bowing to a bully is like drinking poison to quench thirst”.

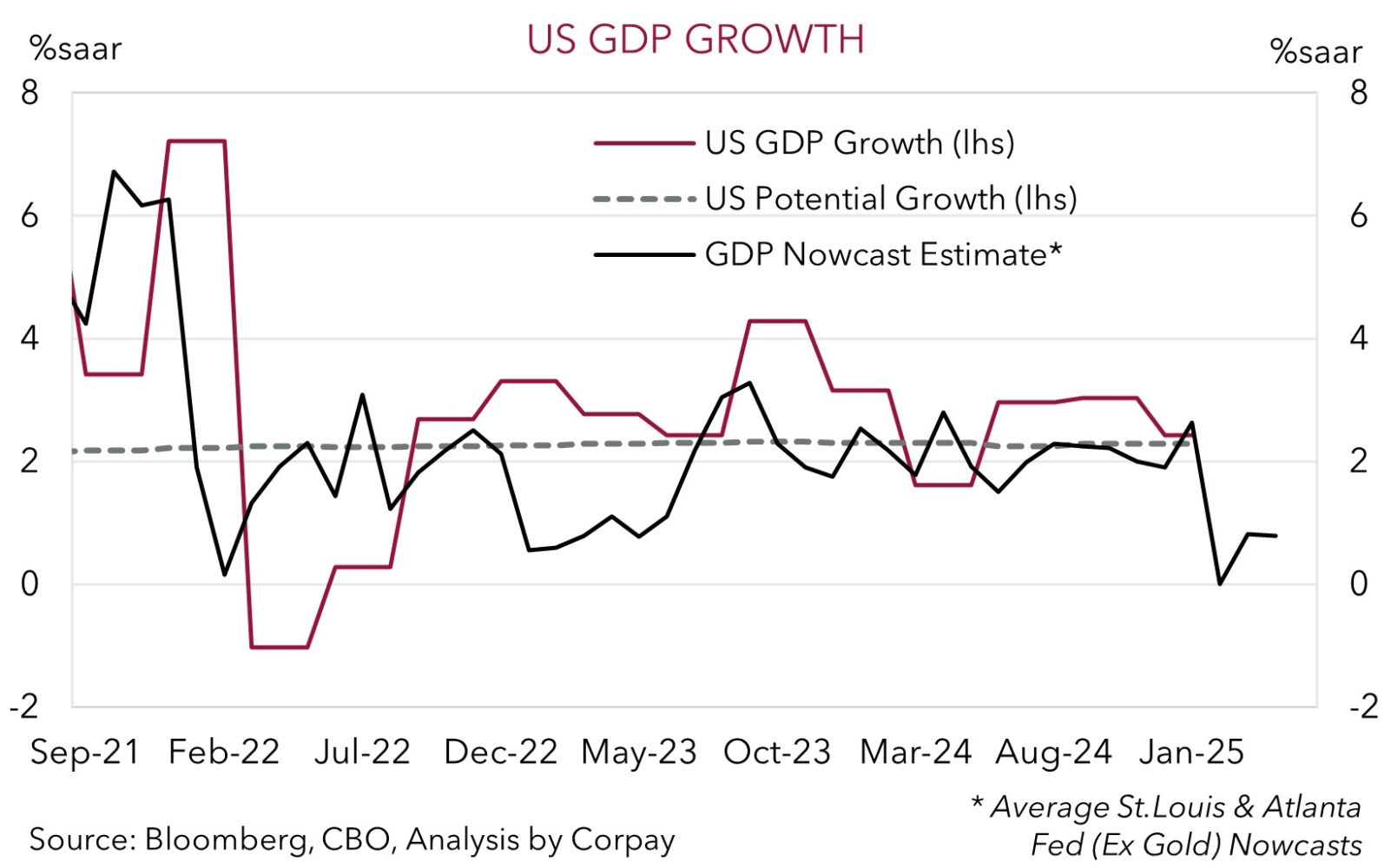

Data wise, the early impacts of heightened policy uncertainty and tariffs continue to show up in the US figures. US consumer confidence dropped to its lowest level since May 2020 because of pessimism about the outlook, the number of job openings (a gauge of labour demand) fell more than anticipated, and the US trade deficit blew out in March to ~US$162bn. Import into the US jumped substantially in Q1 as importers tried to front-run tariff increases. That said, this and an inventory drawdown will mechanically detract from Q1 US GDP. The US GDP report is released tonight (10:30pm AEST) and various ‘nowcast’ models are pointing to a meaningful stepdown in growth with some chance the drag from ‘net exports’ meant the US economy ‘contracted’ in Q1.

While we think medium-term US growth and labour market risks have risen on the back of the US’ policy steps, in the short-term there is a possibility the incoming top-tier US data (or the underlying detail within the reports) isn’t as grim as predicted. For markets the important thing isn’t if something is good or bad but rather if it is better or worse than expected. If realised, we believe this may give the USD, which is tracking below our model estimates, a bit more near-term support, particularly against the EUR and/or JPY if the BoJ also pushes back on the prospect of further interest rate hikes later this year because of global developments at tomorrow’s meeting.

Trans-Tasman Zone

The uptick in the USD overnight on the back of some improved sentiment about the trade outlook on reports a deal with an unnamed nation had been reached and measures to ease the impact of auto tariffs dragged on the NZD and AUD (see above). That said, this only puts the AUD (now ~$0.6385) back broadly inline with where it started the week while the NZD (now ~$0.5930) is around this week’s low point. The AUD also lost ground on the crosses with falls of ~0.4-0.6% recorded against the EUR, JPY, and GBP over the past 24hrs, while there were larger moves against the CAD (-0.8%) and CNH (-0.9%).

During todays Asian session there are couple of data releases that can generate AUD volatility. Locally, Q1 CPI inflation is released (11:30am AEST) and in China the business PMIs are out (also 11:30am AEST). The quarterly inflation data covers a wider range of consumer prices than the volatile monthly series, particularly on services, and hence it is more closely watched by the RBA. We think the Q1 Australian CPI should show a further moderation in headline and core inflation with the important trimmed mean projected to slow to ~2.8%pa. In our opinion, this type of outcome should see the RBA deliver further interest rate relief when it meets on 20 May. However, we think the broader domestic backdrop, particularly the resilient jobs market, points to a 25bp interest rate reduction rather than a bigger move. Odds of an outsized 50bp rate cut being delivered by the RBA in May have declined but markets are still assigning it a ~12% chance.

In our view, a paring back of larger near-term RBA interest rate cut expectations might give the AUD support versus currencies such as the EUR, GBP, NZD, and CNH. However, offsetting this could be signs growth momentum in China is slowing with the PMIs forecast to decline in April. In terms of AUD/USD it is also a mixed outlook depending on the time horizon. As discussed yesterday and above, after falling sharply over recent weeks we think that in the short-term the risks reside with the USD bouncing back a little more if the US GDP (10:30pm AEST) and/or jobs data (Fri night AEST) exceed downbeat expectations. This could take some of the heat out of the AUD. However, over the medium-term, we remain of the opinion that the US’ growth challenges stemming from lingering uncertainty and higher tariff-induced prices should see the USD trend lower (and push the AUD higher).