• Hold the line. US equities ticked up on Friday, as did the USD. EUR & GBP eased back at the end of last week, as did the AUD & NZD.

• Tariff news. US’ reciprocal tariffs set to be unveiled on 2 April. What form they will take is still unknown. Uncertainty may generate more volatility.

• Event radar. In AU the Budget & monthly CPI are due this week. Globally, PMIs are released. In the US the PCE deflator is out on Friday night.

Global Trends

It was an uneventful end to the trading week on Friday with no major data releases or fresh geopolitical news to really move the dial. After a few bursts of intra-session volatility over prior days the US S&P500 eked out a small gain (+0.1%), while bond yields consolidated with the benchmark US 10yr rate hovering just below its 1-year average (now ~4.25%). In FX, the USD index ticked up for the 3rd straight day with EUR (now ~$1.0815) and GBP (now ~$1.2895) giving back some ground following their recent strong runs, and USD/JPY (now ~149.35) nudged up a fraction. Elsewhere, USD/SGD is tracking just north of its 200-day moving average (~1.3340), while the NZD (now ~$0.5740) and AUD (now ~$0.6270) drifted lower. The AUD is back near levels it was tracking at in mid-March.

The global business PMIs for March are released today with markets keen to see whether there is a further shift in growth momentum towards Europe (8pm AEDT) and away from the US (12:45am AEDT). If the PMIs show a further narrowing in growth differentials, we expect the USD to come under a bit of short-term pressure. However, with the announcement of the US ‘reciprocal’ tariffs fast approaching we doubt the moves will be overly pronounced. President Trump has labelled 2 April the US’ “Liberation Day”, and as it comes closer into view, we believe market nervousness could return. There is still a lot of uncertainty about what the US might impose on its trading partners. Weekend reports suggest the measures may be more targeted than what past rhetoric suggested with some countries/regions potentially excluded, although the smaller group of nations that account for the bulk of the US’ foreign trade are still set to be slugged with higher tariffs.

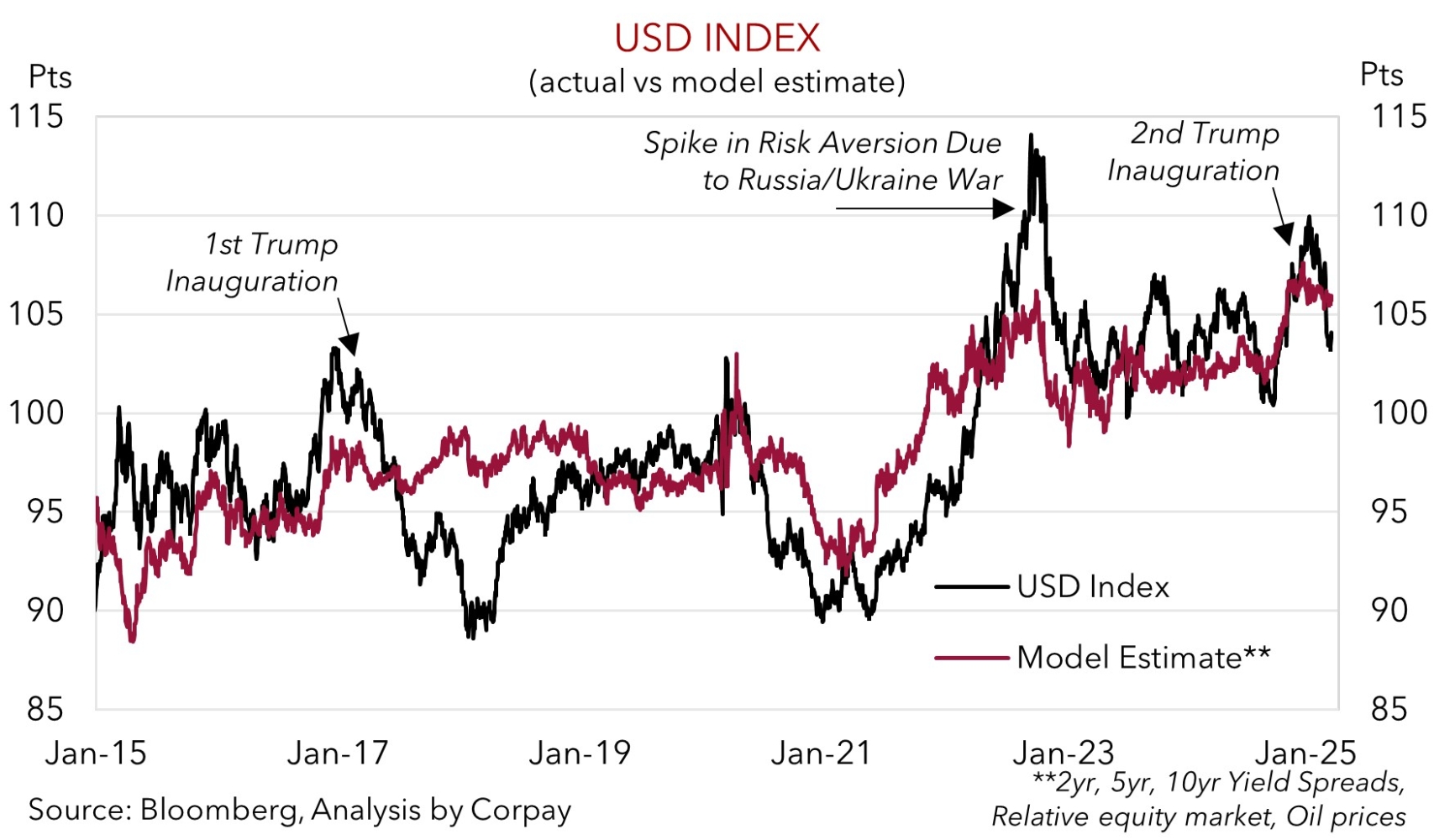

The situation remains fluid. In this type of environment more bouts of market volatility should be anticipated, and if they raise questions about global growth the USD typically benefits. Indeed, as our chart shows, the USD index is currently trading below where our fundamental model indicates it should be. This largely reflects the strength in the EUR which has been underpinned by the optimism regarding the Eurozone’s longer-term growth outlook due to the prospect for greater fiscal spending across the region. We feel too much good news has been priced into the EUR by markets too quickly. At best these more positive economic tailwinds will probably only start to boost Eurozone growth towards the back end of this year. Additionally, in the short-term, the EU is still facing substantial tariff risks. The US imports ~20% of its goods from the EU (more than Mexico, Canada, and China). The EU also has high VAT/GST rates which the Trump administration might incorporate in its “reciprocal” tariff calculations. Announcements of sizeable tariffs on the EU in early-April could exert downward pressure on the EUR, in our view, and this in turn would be USD supportive.

Trans-Tasman Zone

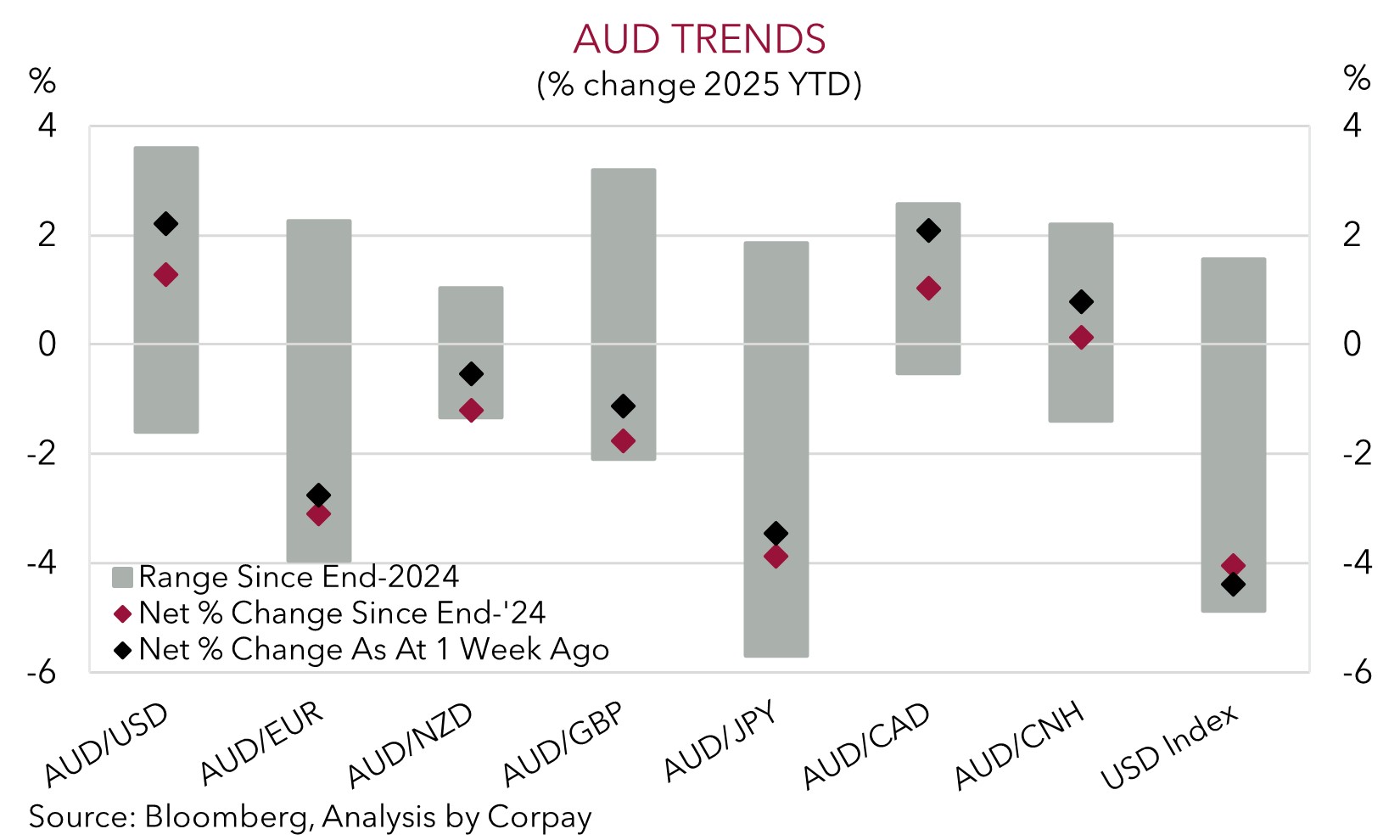

The extension of the USD’s rebound over the back end of last week has kept the AUD and NZD on the backfoot (see above). The AUD (now ~$0.6270) and NZD (now ~$0.5740) both weakened last week to levels traded in mid-March. The AUD also ticked down a little on most of the major crosses with the AUD shedding ~0.1-0.4% versus the EUR, JPY, NZD, CAD, and CNH relative to where it was tracking at this time on Friday. Last week’s surprisingly soft Australian employment data might still be weighing on people’s minds.

This week in Australia the pre-election Federal Budget is handed down (Tues 7:30pm AEDT) and the monthly CPI indicator for February is due (Weds). In terms of the budget, we don’t anticipate any outlook-shifting announcements. Over the weekend the government confirmed power bill relief for households and small businesses will be extended until the end of 2025. This will artificially hold down headline inflation for longer than was the case, though when these measures end there will be a mechanical jump up in the CPI. In our view any other policy initiatives will be reserved for the Federal election campaign that must officially begin within three weeks of Budget day. In terms of the CPI data, more information about services prices will be included in this release. On net, we believe push-pull forces should see headline inflation hold steady at 2.5%pa. The full Q1 CPI report, due 26 April, will be the key release for the RBA when it comes to gauging the inflation pulse. In our judgement, the RBA should hold steady in early April with the 20 May gathering the next ‘live’ meeting for another rate cut.

On balance, as we have outlined before, more bouts of AUD volatility should be anticipated as 2 April approaches. This is when the US will make its broader ‘reciprocal’ tariff announcements. Lingering uncertainty and concerns about global growth may see the USD recoup some lost ground in the near-term, which in turn can keep the AUD under a little pressure. That said, we don’t expect further falls in the AUD to be overly large or long-lasting. Over the medium-term we continue to believe there is more upside than downside potential for the AUD. A decent amount of negativity still looks baked in with the AUD ~4 cents below our ‘fair value’ models. The AUD has also not traded much below where it is over the past decade (AUD has only closed below $0.63 ~3% of the time since 2015). Structural dynamics that supported the AUD at these low levels remain (i.e. Australia’s improved capital flow trends and higher terms of trade). And as mentioned previously, we also think any tariff induced export headwinds in China should be offset via measures aimed at boosting commodity-intensive infrastructure investment. This is AUD supportive given this is where Australia’s key exports are plugged into.